Good morning,

Welcome to the best way to stay up-to-date on India’s financial markets. Here’s what’s in today’s newsletter:

India’s National Commodity and Derivatives Exchange allows for the trading of weather derivatives (and, how they work and why Indian businesses need them),

Why India’s tax cuts will fail to jumpstart economic growth,

and, India plans to boost American LNG imports ahead of Trump-Modi meeting (and what this means for U.S.-India trade relations).

Finally, we’ll close with Gupshup, a round-up of the most important headlines.

Have a question you want us to answer? Fill out this form and you could be featured in our newsletter.

—Shreyas, [email protected]

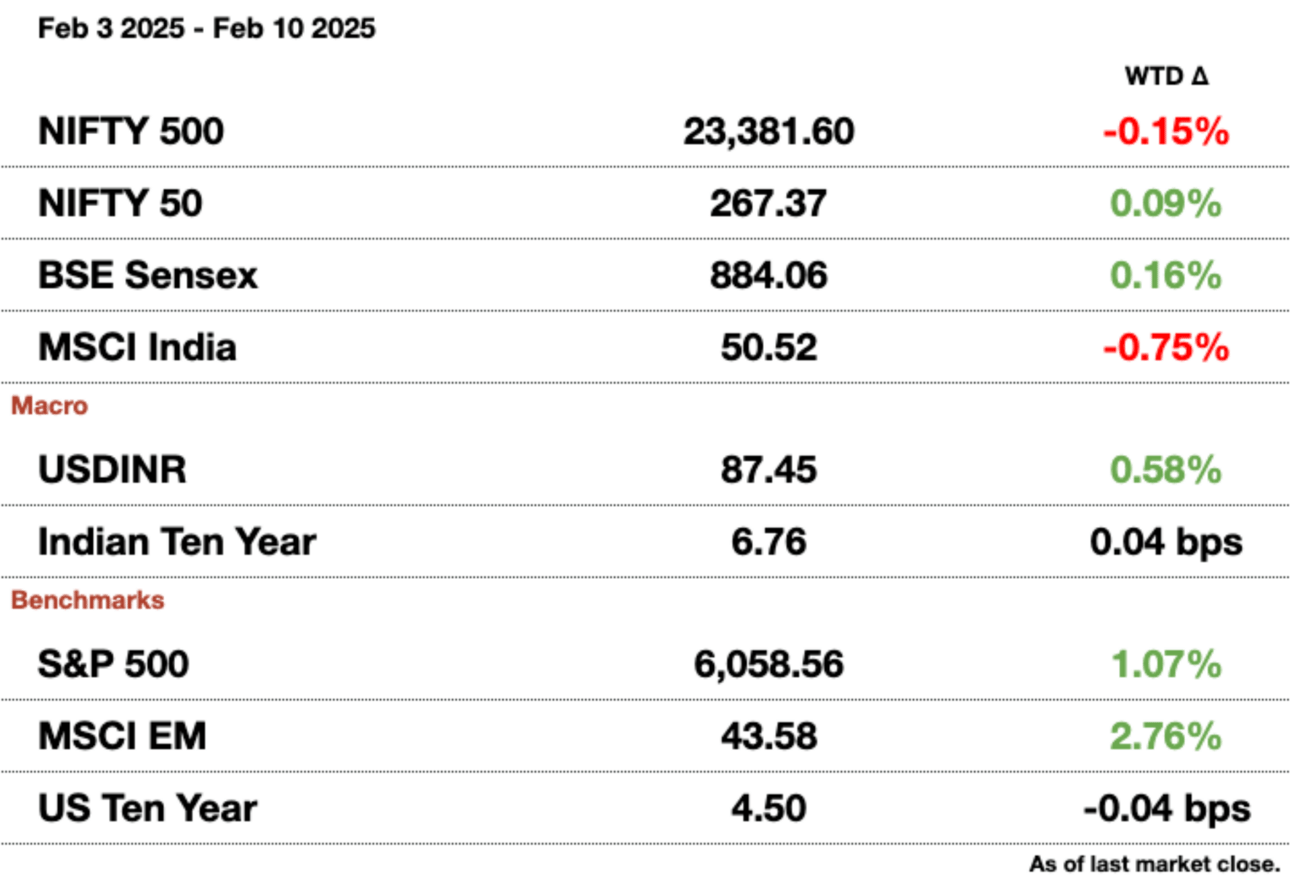

Market Update.

THIS WEDNESDAY: Expert Panel & Networking Event in New York City

Attend our upcoming “Future of India” expert panel and networking event on Wednesday, February 12, 2025, in New York City.

Our keynote speaker is Dr. Viral Acharya, who served as the deputy governor of the Reserve Bank of India, during which he oversaw India’s monetary policy, financial markets, and the central bank’s research. Buy tickets here.

India Launches Weather Derivatives.

India’s National Commodity and Derivatives Exchange is set to introduce the nation’s first weather derivatives, designed to manage risks from unpredictable rainfall using an index developed by IIT Bombay. With agriculture making up 16 percent of the country’s GDP—compared to a global average of 4.1 percent—the government recently approved weather derivatives for trading to help safeguard farmers and businesses from climate-related uncertainties. This launch coincides with stricter oversight on derivatives trading, as regulators work to curb speculation in commodity markets.

Unlike traditional financial derivatives that are based on stocks or commodities, weather derivatives are tied to measurable weather conditions recorded at specific locations over a set period. India’s weather derivative will function on a rainfall index using data sourced from the India Meteorological Department.

How it works: A weather derivative contract is based on a chosen weather index (e.g., temperature or rainfall) and a predefined threshold, with payouts triggered if actual weather conditions deviate beyond the agreed range. At expiration, official weather data is compared to the contract terms, and payments are made accordingly, helping businesses hedge against risks like extreme temperatures or insufficient rainfall. For example, A utility company expecting high electricity demand in summer might buy a Cooling Degree Day (CDD) derivative to hedge against extreme heat. If temperatures exceed a set threshold, triggering higher air-conditioning usage and increased power generation costs, the derivative pays out to offset these expenses. This helps the company stabilize revenue and manage financial risk from unpredictable weather.

Why Indian businesses want weather (specifically, rainfall) derivatives: India’s agricultural economy is highly volatile given its dependence on the monsoon season. Around 50% of India's farmland lacks irrigation, making rainfall crucial for crop yields. A good monsoon boosts agricultural output, rural incomes, and demand for goods, leading to higher GDP growth. Conversely, deficient rainfall can reduce crop production, raise food inflation, and slow down economic growth. Studies suggest that a drought year can lower GDP growth by 1-2 percentage points, while a strong monsoon can add a similar boost. The impact also extends beyond farming to sectors like food processing, rural consumption, and employment.

Global market for weather derivatives is exploding: Weather products like these have been available to trade over the counter in the U.S. and other countries since 1997 and have become increasingly popular as corporations seek to protect from risks linked to the elements. The global weather derivatives market is expected to be around $25 billion in notional value. Globally, interest in weather-related financial instruments is rising, with CME Group reporting a 260 percent jump in trading activity last year and China rolling out temperature-based options.

India’s Tax Cuts Expected to Fail to Boost Economic Growth.

India’s recent record tax cuts, amounting to $12 billion, are expected to boost FY26 (fiscal year ending March 2026) GDP by just 10-20 basis points, according to an analysis by Motilal Oswal.

Wait, what? The cuts are supposed to boost consumer spending to jumpstart the slowing Indian economy, as Samosa Capital wrote last week. However, while tax reductions put more money in the hands of individuals, much of the additional income is expected to go toward debt reduction rather than increased discretionary spending. Household debt has surged significantly in the last 10 years, rising from 35 percent of income going towards debt servicing to around 52 percent today. With high debt levels, many consumers are prioritizing repayments over increased consumption, dampening the expected stimulus effect on demand.

Infrastructure’s influence. Unlike previous years, where infrastructure spending grew at a robust 30 percent annually between FY21 and FY24, the latest budget increases infrastructure allocations by only 10 percent. Reduced fiscal expenditure on critical sectors such as roads, ports, and railways— previously major growth drivers—will limit economic expansion.

Although tax cuts typically encourage consumption, the current economic environment presents challenges. Consumers remain cautious due to elevated debt levels, and the government’s restrained fiscal push means that the private sector alone may not be able to drive significant economic acceleration.

GDP growth is projected to be 6.7 percent for FY26.

Message from our Sponsor

The gold standard of business news

Morning Brew is transforming the way working professionals consume business news.

They skip the jargon and lengthy stories, and instead serve up the news impacting your life and career with a hint of wit and humor. This way, you’ll actually enjoy reading the news—and the information sticks.

Best part? Morning Brew’s newsletter is completely free. Sign up in just 10 seconds and if you realize that you prefer long, dense, and boring business news—you can always go back to it.

India Boosts American LNG Imports Ahead of Trump-Modi Meeting.

India’s largest liquefied natural gas (LNG) importers Indian Oil, Bharat Petroleum, and Gail India are in talks with US suppliers to secure additional long-term fuel purchases. The move comes ahead of Modi’s scheduled meeting with Trump in Washington this week.

India’s Oil Secretary, Pankaj Jain, confirmed that discussions are ongoing, with LNG taking precedence over crude oil in current negotiations. The talks may also extend beyond supply contracts, as some Indian firms are reportedly open to acquiring stakes in U.S. LNG projects. Among the key suppliers, Cheniere Energy and other American firms with LNG export capabilities are involved in these negotiations. According to sources familiar with the matter, Gail is also considering investing in a US-based LNG project.

These discussions align with broader efforts to strengthen US-India trade ties. Indian buyers are under government pressure to finalize deals that could foster smoother diplomatic relations with the Trump administration, although companies remain focused on securing favorable pricing and contract terms.

Other countries at the table: The timing of these talks is crucial, as Modi’s upcoming visit to Washington is expected to cover various trade, defense, and energy-related issues. India appears to be following the lead of Japan, where Prime Minister Shigeru Ishiba recently pledged to increase LNG imports from the US to address trade imbalances. Other economies, including Taiwan, Japan, South Korea, and the European Union, are also considering increased LNG purchases to mitigate potential tariff pressures and reduce trade surpluses with the world’s largest economy.

Some fundamental reasoning: The US currently leads global LNG exports, while India’s demand for cleaner-burning fuel is expected to rise steadily throughout the decade. As the country transitions away from more polluting energy sources, securing long-term LNG supply agreements will be crucial for meeting its growing industrial and power sector needs. While India has intensified discussions with US suppliers since Trump’s re-election last year, it remains uncertain how many deals will materialize in the near term. Given the current limited availability of spare US LNG supply, any new contracts will likely take effect later in the decade.

India is also in talks with the U.S. to purchase and co-produce Stryker combat vehicles and finalize a fighter jet engine deal. The discussions come amid efforts to strengthen defense ties and avoid trade tensions, with Modi also considering tariff cuts to boost American exports.

Gupshup.

Macro

India braces for $4 billion (₹350.2 billion) in IPO lockups on Monday. The expiries could impact upcoming IPOs amid concerns over economic slowdown and weak earnings growth, adding pressure to an already struggling stock market.

Indian investors remain skeptical about the effectiveness of the 25 bps rate cut evidenced by the muted reaction of the stock market. With limited room for further stimulus and global uncertainties weighing on the economy, a swift recovery appears unlikely.

Equities

India expects stable deliveries of GE-powered fighter jets next fiscal years after delays of nearly 12 months. India’s own Hindustan Aeronautics Ltd would have the capacity to hand over 16 to 24 aircraft in the fiscal year after the GE engines are delivered.

Alts

India opened its largest air show with a focus on expanding defense manufacturing and exports. India, the world’s largest arms importer, continues to stress the importance of military modernization to counter China’s advancements.

Policy

PM Modi plans to discuss trade, defense, and energy cooperation with President Trump in their upcoming meeting in Washington on Feb. 12. These discussions may also lead to tariff reductions, defense purchases, and nuclear investment.

Modi's Bharatiya Janata Party won the Delhi state elections after 27 years, securing 48 of 70 seats and defeating Arvind Kejriwal's Aam Aadmi Party (AAP). The victory strengthens Modi after last year's national election setback, while AAP, which ruled for a decade, vows to be a constructive opposition.

India's forex policy aims to maintain stability without hurting market efficiency. RBI governor Sanjay Malhotra advises investors to look at long-term rates, not day-to-day volatility.

See you Tuesday.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.