Today, we dive into how Y Combinator — the world’s most prestigious start-up accelerator — seemingly doesn’t want India’s founders anymore.

If you have any questions about India, fill out this form or reach out to Shreyas at [email protected]

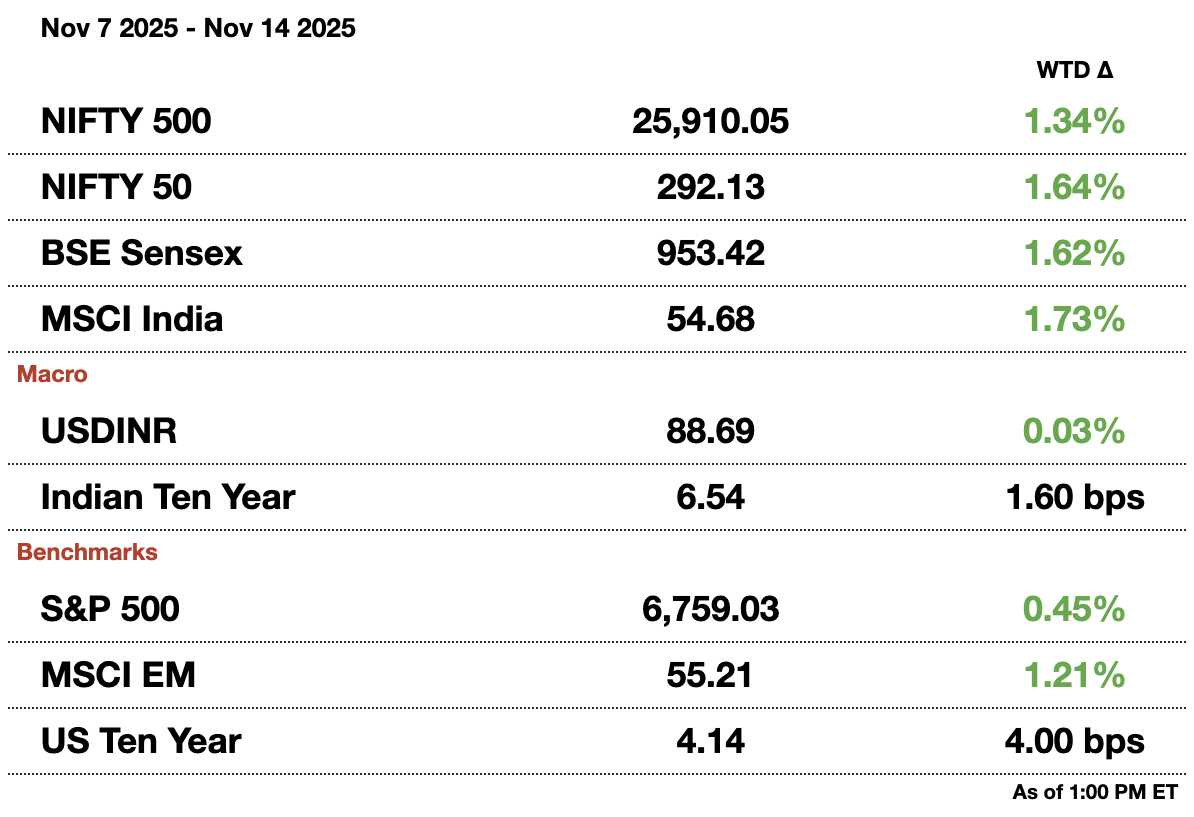

Macro

Modi provides a $5 billion (₹445 billion) relief package for exporters through loan programs. There are $2.3 billion (₹204.7 billion) worth of collateral free loans and the rest is in a six-year loan program.

Citigroup sees the rupee rebounding to 87 based on a US FTA.While news of a trade deal is widespread, the actual reaction should propel the rupee upwards. Citi is expressing the trade with 3 month options bullish on the rupee.

Equities

Jubilant (Domino's Indian operator) posts a 54 percent profit growth y-o-y, from surging sales. Same-store-sales grew 9.1 percent leading to revenue from operations rising 20 percent to $272.1 million (₹23.4 billion). Jubilant believes sales will continue to grow from GST cuts.

Tata Motors sees HSD demand growth from tax cuts and infrastructure boosts.First half sales grew by 3 percent in H1 y-o-y but it expects far larger growth as the year continues. There was a quarterly loss of $11.6 million (₹1 billion) due to a one-time impairment charge.

Alts

Mahindra Mahindra enters into a JV with Canadian brand Manulife. For Manulife, the investment helps them enter one of the fastest growing insurance markets projected to be worth $25.2 billion (₹25 trillion). This extends an existing 5 year partnership with both companies spending over $400 million (₹35.6 billion).

ReNew is investing $9.3 billion (₹820 billion) in Andhra Pradesh for green projects.They are setting up a 6 GW ingot-wafer plant, a 2 GW pumped hydro project, and another 5 GW of hybrid projects.

Policy

SEBI wants to ease lock-up requirements for existing stakeholders in IPO. Current lock-up requirements are considered cumbersome since the standard is 6 months. The disclosure time would remain the same, but existing shareholders could exit faster.

Where to Invest $100,000 According to Experts

Investors face a dilemma. Headlines everywhere say tariffs and AI hype are distorting public markets.

Now, the S&P is trading at over 30x earnings—a level historically linked to crashes.

And the Fed is lowering rates, potentially adding fuel to the fire.

Bloomberg asked where experts would personally invest $100,000 for their September edition. One surprising answer? Art.

It’s what billionaires like Bezos, Gates, and the Rockefellers have used to diversify for decades.

Why?

Contemporary art prices have appreciated 11.2% annually on average

…And with one of the lowest correlations to stocks of any major asset class (Masterworks data, 1995-2024).

Ultra-high net worth collectors (>$50M) allocated 25% of their portfolios to art on average. (UBS, 2024)

Thanks to the world’s premiere art investing platform, now anyone can access works by legends like Banksy, Basquiat, and Picasso—without needing millions. Want in? Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

Reach out to [email protected] to reach our audience and see your advertisement here.

Y Combinator Doesn’t Want India’s founders Anymore

Y Combinator doesn’t want India’s founders anymore, or at least that’s what the numbers suggest. YC is one of the most prestigious startup incubators and, in 2021, 66 Indian startups made it into YC’s batches. By 2023, the number was down to 12. In 2025: 1. The accelerator that once served as the launchpad for India’s most promising early-stage founders (from Meesho to Clear) now looks like it’s quietly retreating from the world’s third-largest startup ecosystem.

Founders in Bengaluru and Delhi used to scramble to incorporate Delaware entities, fly to Mountain View, and chase the network effect of Silicon Valley capital. Now that pipeline is drying up. YC’s India exposure has shrunk, and so has its willingness to deal with the legal and logistical headache of foreign teams. The deeper structural shift is the lack of YC need for Indian founders.

India’s funding ecosystem has matured faster than almost any in the world. Even as global venture activity slowed, Indian startups raised roughly $8.2 billion (₹729.8 billion) in 2024, keeping the country firmly in the top three for global startup funding, behind only the U.S. and China. Homegrown funds like Peak XV (formerly Sequoia India), Nexus, Accel India, and Lightspeed, have the firepower to anchor Series A and B rounds locally. Meanwhile, “reverse-flipping”, startups moving their parent entities back from Delaware or Singapore to India, has become a dominant trend.

The visa issue, though, has sharpened the divide. Many founders who did make it into YC have been blocked by U.S. immigration policy. The team behind Giga (a startup that reportedly outperformed Anthropic’s Claude on LLM benchmarks) was denied U.S. visas twice. Rising visa fees, more frequent denials, and increased bureaucratic scrutiny have made it prohibitively difficult for international founders to live or work in the U.S. The current administration’s stance signals even tighter restrictions on skilled-worker visas like H-1B. That means fewer founders setting up U.S. entities, fewer cross-border teams, and more innovation staying in India.

The accelerator now favors startups that can quickly scale in AI, dev tools, and hard tech, areas that require deep ties to U.S. infrastructure and capital. Indian teams, by contrast, tend to excel in fintech, logistics, and SaaS. These are domains where distribution and regulation matter more than access to GPU clusters. Combine that with YC’s requirement for U.S. incorporation, and the math stops making sense for many Indian founders. The upside of staying local now outweighs the brand equity of a three-month stint in San Francisco. Founders can now scale to IPO or unicorn status without ever leaving the subcontinent.

How helpful was today's newsletter?

See you tomorrow.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Sponsor the next newsletter to reach tens of thousands of U.S.-based business-savvy professionals. Reach out to [email protected].

Could your business use expert insights to power growth in India? Reach out to [email protected] for a free introductory call.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.