Today’s deep dives: Eli Lilly announced plans to invest $1 billion in India. India has launched real-time foreign exchange settlement operations at GIFT City. The World Bank has downgraded its forecast for South Asia’s economic growth from 6.6 to 5.8 percent, and its mostly because of India.

We want to talk to you! Just respond to this email and we’ll set up a time to learn more about how Samosa Capital can be more helpful in your work.

If you have any questions about India, fill out this form or reach out to Shreyas at [email protected]

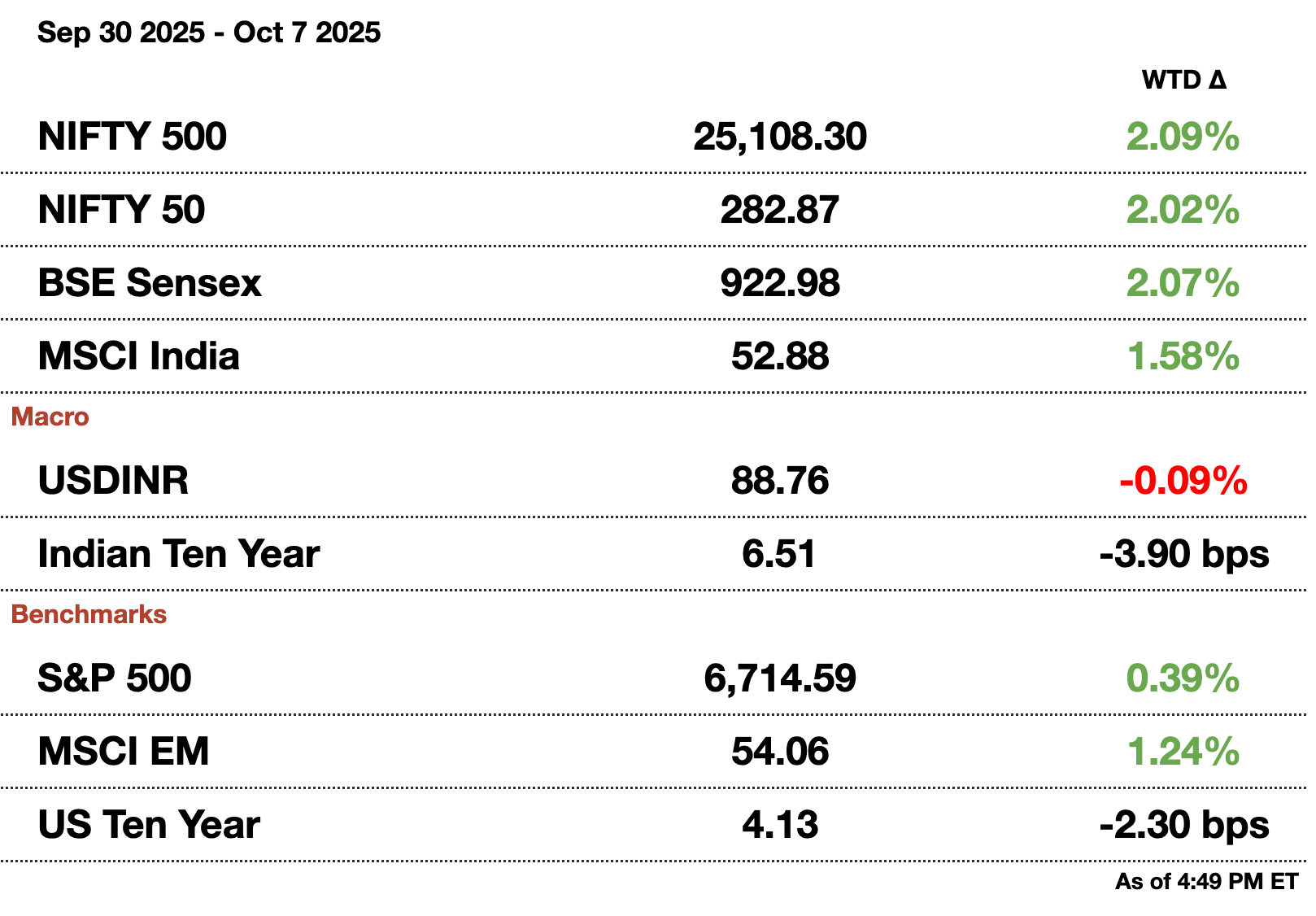

Macro

Nayara Energy resumes fuel sales to Brazil and Turkey for the first time since 2022. The company is distancing itself from more established markets due to sanctions but started using its shadow fleet again last week.

Ray Dalio's OceanX is launching deep sea research missions in the Indian Ocean. Deep sea conservation is the goal, and Dalio’s company will survey mountains starting from Singapore and down. The study is being partly supported by Singapore, contributing $4.6 million (₹404.8 million).

Ken Griffin is concerned about the rush to gold.The trade on gold has been led by de-dollarization especially with the US seeing fiscal and monetary stimulus. The stimulus is akin to recessionary measures which has propped markets up but has led to a currency flight.

Equities

LG Electronics initial $1.3 billion (₹114.4 billion) share sale was fully booked, an indicator of great depth. The offering was subscribed by 104 percent with most of the demand coming from wealthy individual investors and the portion reserved for employees was also fully subscribed.

Traders are eyeing a breakout in Vodafone Idea due to regulatory relief. The hearing on AGR was delayed to Oct 13, while the government explores a one-time settlement for $22.5 billion (₹2 trillion). The proposal includes knocking off interest and some of the principal charges.

The benchmark stock index broke past the 25,000 mark reversing an eight week slide. This signals newfound bullish momentum as traders bet on strong corporate earnings, government support, and IPOs.

Jefferies enlists former HDFC head to enter the $900 billion (₹80.1 trillion) mutual fund industry.Inflows have averaged $3 billion (₹267 billion) since April due to monthly investment plans. Jefferies has grown its revenue, but is still new to asset management and seeking to grow its share in the world’s fastest stock market.

Alts

Authorities are probing a cough syrup manufacturer following the death of 14 children. Sresan Pharma is the manufacturer in Tamil Nadu and their brand Coldrif was found to have excess diethylene glycol causing the deaths. The company will likely face civil and criminal action, on top of losing their license to operate.

Cricket stars Ben Stokes and Jofra Archer led a seed round for a startup helping UK patients get medical treatment in India. Medical Travel Company will get $4.5 million (₹396 million) to grow in the UK and scale operations in India. More than 500,000 UK citizens travel overseas for medical treatment.

Adani Green gets $250 million (₹22 billion) from global lenders for 5 years at 8.2 percent. 4 banks are extending the credit which will be used to refinance and cut the existing leverage ratio. This follows an equity injection of $1.1 billion (₹96.8 billion) from the Adani family in July.

Adani's Navi Mumbai Airport will start commercial flights in December.The ribbon cutting will be this month and IndiGo, Air India, and Akasa have already agreed to launch flights. The first phase of the airport has required $2.3 billion (₹200 billion) in Adani investments.

Policy

Bihar will lead polls next month for 74 million voters in a test of Modi's popularity. The 74 million voters are primarily 18-29, a group that Modi has struggled more with. The Congress Party has also accused Modi of manipulating electoral rolls and misusing voting machines. A victory would take pressure off from both the opposition and a group that Modi has struggled to win.

Where to Invest $100,000 According to Experts

Investors face a dilemma. Headlines everywhere say tariffs and AI hype are distorting public markets.

Now, the S&P is trading at over 30x earnings—a level historically linked to crashes.

And the Fed is lowering rates, potentially adding fuel to the fire.

Bloomberg asked where experts would personally invest $100,000 for their September edition. One surprising answer? Art.

It’s what billionaires like Bezos, Gates, and the Rockefellers have used to diversify for decades.

Why?

Contemporary art prices have appreciated 11.2% annually on average

…And with one of the lowest correlations to stocks of any major asset class (Masterworks data, 1995-2024).

Ultra-high net worth collectors (>$50M) allocated 25% of their portfolios to art on average. (UBS, 2024)

Thanks to the world’s premiere art investing platform, now anyone can access works by legends like Banksy, Basquiat, and Picasso—without needing millions. Want in? Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

Reach out to [email protected] to reach our audience and see your advertisement here.

1. Eli Lilly’s Manufacturing Push Grows in India

Eli Lilly announced plans to invest over $1 billion (₹88.7 billion) in India over the next few years to expand its contract manufacturing capabilities and strengthen its global production network. The US-based pharmaceutical giant will establish a new manufacturing and quality center in Hyderabad, which will oversee and provide technical support for its contract manufacturing operations in the country. Recruitment for the new facility, including engineers, chemists, scientists, and managers, will begin soon.

The move reflects Lilly’s growing confidence in India as a key hub for global capability building. The investment also follows the company’s recent launch of its blockbuster diabetes drug, Mounjaro, in India, though specific details on the new manufacturing projects have not been disclosed.

Lilly’s expansion comes against the backdrop of Trump’s new 100 percent tariff on imported branded or patented drugs, a policy that has spurred many global pharmaceutical companies to increase domestic and alternative overseas production. While these tariffs are not expected to affect India immediately since most US exports are generics the move highlights the strategic advantage of building regional supply resilience.

Globally, Eli Lilly has pledged more than $55 billion (₹4.8 trillion) in investments over the past five years to expand manufacturing and ensure supply chain security. The company’s latest initiative underscores India’s growing importance as a destination for high-value pharmaceutical investment, leveraging the country’s skilled scientific workforce to support global drug production and distribution. At the same time, Lilly still has not ramped investment at the same pace in India which likely reflects the low revenue market.

2. Real-Time FX Settlement Launches at GIFT City

GIFT City, India

India has launched real-time foreign exchange settlement operations at GIFT City, a major step toward transforming the financial hub into a global center for capital and trade. The system, inaugurated by Finance Minister Sitharaman, will allow instantaneous settlement of foreign currency transactions within the International Financial Services Center, significantly reducing settlement times from several hours to just four to five seconds. This opens the center for both retail traders/tourists but also huge investors.

Sitharaman said the new system will enhance liquidity management, operational efficiency, and regulatory compliance, aligning GIFT City with international financial centers such as Hong Kong, Tokyo, and Manila, which already offer localized foreign currency settlement infrastructure.

Standard Chartered has been appointed as the designated settlement bank, managing US dollar transactions through its network of over 50 member institutions within GIFT City.

The initiative is part of Modi’s broader vision to position GIFT City as a world-class financial hub that can compete with Dubai and Hong Kong. The zone provides tax incentives and regulatory flexibility to attract global investors and financial institutions. According to Supriyo Bhattacharjee, chief general manager at the International Financial Services Centres Authority, real-time settlement has been a long-standing demand among market participants and will strengthen GIFT City’s competitiveness in global finance.

Sitharaman also highlighted ongoing government efforts to bolster India’s Global Capability Centers—which have evolved from cost-saving units to hubs for engineering, research, and innovation—reinforcing India’s growing role in high-value global financial and technological services.

3. South Asia Is Projected to Grow Slower Due to India

The World Bank has downgraded its forecast for South Asia’s economic growth from 6.6 to 5.8 percent, all based on escalating trade tensions with India. Excluding periods of global recession, this marks South Asia’s slowest growth in 25 years.

While the World Bank noted that the region “remains the fastest-growing in the world,” it cautioned that its economic potential could be undermined by trade disruptions, financial fragilities, and geopolitical uncertainty.

The downgrade was led by a weaker outlook for India, which accounts for over 75 percent of South Asia’s GDP. The US administration’s 50 percent tariffs on Indian exports—covering more than 75 percent of shipments to the US—are expected to hit labor-intensive sectors such as textiles and jewelry, and curb export earnings.

As a result, India’s GDP growth for the fiscal year ending March 2026 is now seen at 6.3 percent, slightly below the RBI’s 6.8 percent projection and the World Bank’s prior estimate of 6.5 percent.

The report also highlights a confluence of regional headwinds, including foreign exchange strains and social unrest in Nepal; high debt repayment risks in the Maldives, amid low reserves; and persistent political uncertainty in Bangladesh. The only bright spot for India is the lack of an idiosyncratic regional headwind in the country.

The World Bank also flagged AI-driven labor disruptions and financial sector weaknesses as emerging threats that could compound the region’s slowdown. Johannes Zutt, Vice President for South Asia, said that South Asia has “enormous economic potential, but countries need to proactively address risks to growth.” The primary risk, of course, is still tariffs particularly on India.

How helpful was today's newsletter?

See you tomorrow.

Written by Eshaan Chanda & Yash Tibrewal. Edited by Shreyas Sinha.

Sponsor the next newsletter to reach tens of thousands of U.S.-based business-savvy professionals. Reach out to [email protected].

Could your business use expert insights to power growth in India? Reach out to [email protected] for a free introductory call.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.