Good afternoon,

Welcome to the best way to stay up-to-date on India’s financial markets. Here’s what’s in today’s newsletter:

India’s finance ministry says US-India trade could flip “headwinds into tailwinds,”

India’s markets regulator has barred several former and current top executives of IndusInd Bank from participating in capital markets,

and India has directed online retailers to end “dark patterns,” which mislead consumers into buying products.

Then, we close with Gupshup, a round-up of the most important headlines.

Have a question you want us to answer? Fill out this form, and you could be featured in our newsletter.

—Shreyas, [email protected]

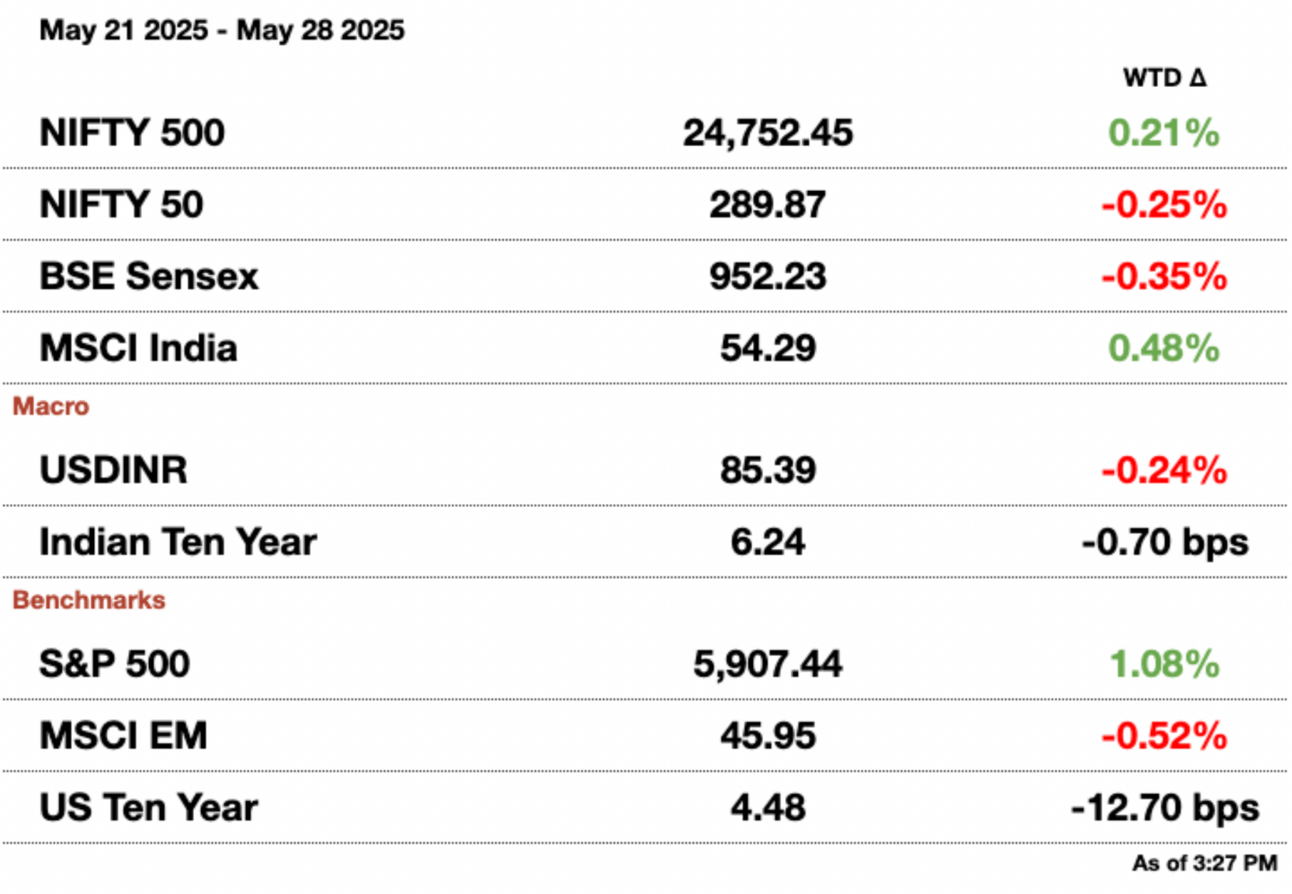

Market Update.

India Sees US Trade Pact as Crucial Hedge Against Global Risks.

India views a potential trade deal with the United States as a key strategic move to shield its economy from rising global uncertainties and to unlock new avenues for export growth, according to the country’s latest monthly economic review released by the finance ministry.

“A successful US-India trade agreement could flip current headwinds into tailwinds,” the finance ministry said on Tuesday, noting that escalating global trade tensions and the potential reintroduction of tariff barriers represent a significant external risk. “The risk of renewed trade barriers remains a key external vulnerability,” the ministry added, referring in particular to the 26 percent tariff that currently applies to Indian exports to the US, a levy that has been temporarily suspended but could return if negotiations falter.

The trade talks, currently structured in three phases, are being expedited, with both sides aiming to finalize an interim deal by July. A comprehensive agreement, however, remains a longer-term goal. The Indian government hopes a near-term pact will solidify bilateral economic relations and provide a framework to address tariff and non-tariff barriers going forward.

India’s Commerce Minister Piyush Goyal recently concluded a four-day visit to Washington, where he met with U.S. Commerce Secretary Howard Lutnick and other senior officials. Goyal described the meetings as “constructive and forward-looking”, emphasizing a mutual commitment to expanding trade and investment flows between the world’s two largest democracies.

India’s Commerce Minister Piyush Goyal

Resilience amid global headwinds: Despite persistent geopolitical tensions, global supply chain disruptions, and volatility in commodity prices, the Indian economy has shown signs of resilience. Economic activity remained robust in April, according to the finance ministry, buoyed by pro-growth fiscal and monetary measures.

Recent initiatives announced in the Union Budget, such as expanded income tax exemptions and infrastructure spending, are expected to strengthen domestic demand. Additionally, the Reserve Bank of India’s surprise 50-basis-point rate cut earlier this month is expected to support credit growth and lower borrowing costs for businesses and consumers.

“The combination of fiscal support and monetary easing is likely to stimulate consumption and investment, potentially lifting GDP growth toward the upper end of the 6.3 percent to 6.8 percent forecast range for the year,” the report said.

Macroeconomic tailwinds: Inflationary pressures, particularly from food prices, are also expected to ease in the coming months. The government cited a healthy crop harvest, strong procurement of food grains, and a forecast for an above-average monsoon as reasons to expect a “benign” food inflation outlook. These developments could offer further relief to households and policymakers, who have struggled to contain inflation in recent years.

The ministry added that India's external sector, including foreign exchange reserves, export performance, and current account dynamics, remains in a stable position, but warned that the global trade environment remains fluid. Securing a durable and mutually beneficial trade agreement with the US, it said, would provide an important buffer against global headwinds while deepening India’s integration into global value chains.

With elections approaching in both the US and India next year, trade diplomacy is expected to intensify, offering both governments a platform to highlight economic cooperation in a volatile global environment.

India Bans Ex-IndusInd CEO, Top Executives in Insider Trading Probe.

India’s markets regulator has barred several former and current top executives of IndusInd Bank, including its former Chief Executive Officer, from participating in capital markets, citing insider trading linked to a major accounting discrepancy.

The Securities and Exchange Board of India (SEBI) said in an interim order that former CEO Sumanth Kathpalia and former Deputy CEO Amit Khurana, along with the bank’s head of treasury, head of global markets, and chief administrative officer, traded shares while in possession of unpublished price-sensitive information. The order alleges they collectively avoided losses of nearly $2.4 million (₹198 million) by selling shares before the disclosure of the financial irregularities.

Former CEO Sumanth Kathpalia

Inside the investigation: The investigation centers around a $234 million (₹20 billion) accounting lapse related to the bank’s derivatives book. SEBI found that members of IndusInd’s senior management were aware of the issue as early as December 2024, months before it was made public on March 10, 2025, a disclosure that triggered a record drop in the bank’s stock.

Kathpalia, who resigned in April, said in his resignation letter that he was stepping down out of “moral responsibility, given the various acts of commission and omission that have been brought to my notice.” The timing of the share trades by insiders in the weeks leading up to the public announcement raised red flags and prompted SEBI’s enforcement action.

SEBI has impounded the avoided losses and has given the individuals named in the order 21 days to respond with their defense. The regulator may issue a final ruling following their submissions.

IndusInd Bank, backed by the billionaire Hinduja brothers, is one of India’s leading private sector lenders. The incident marks one of the most high-profile insider trading cases in India in recent years and underscores the regulator’s heightened scrutiny of corporate governance practices at major financial institutions.

India Tells E-Commerce Firms to Eliminate Deceptive “Dark Patterns”.

India has directed online retailers and shopping platforms to eliminate deceptive design tactics, known as “dark patterns”, that mislead consumers into making unintended purchases or sharing personal information without full awareness.

The government has flagged 13 such practices and issued more than 400 notices to e-commerce firms, Consumer Affairs Minister Pralhad Joshi said Wednesday at a press briefing in New Delhi. He declined to name specific companies but noted that action would be taken if violations persist.

India’s Consumer Affairs Minister Pralhad Joshi

What are “dark patterns”? Dark patterns include tactics like hidden charges, auto-adding products to shopping carts, and using countdown timers to create a false sense of urgency. Officials said these practices often pressure buyers into spending more than intended or giving up personal data involuntarily, eroding consumer trust in digital platforms.

“No consumer should feel trapped in the services or misled into sharing data,” Joshi said. He added that companies must provide transparent opt-out mechanisms, simple cancellation options, and clearer information during the purchasing process.

More than 50 platforms have agreed “in principle” to comply with the government’s new guidelines, according to Nidhi Khare, the ministry’s senior-most official overseeing consumer affairs. Discussions are ongoing to ensure full implementation and monitoring.

The move marks a broader effort by India to strengthen consumer protection in its fast-growing digital economy, where online shopping is surging across both urban and rural markets. Authorities say that as the e-commerce sector expands, regulatory frameworks must evolve to safeguard user rights and maintain fair business practices.

Message from our sponsor.

What Top Execs Read Before the Market Opens

The Daily Upside was founded by investment professionals to arm decision-makers with market intelligence that goes deeper than headlines. No filler. Just concise, trusted insights on business trends, deal flow, and economic shifts—read by leaders at top firms across finance, tech, and beyond.

Gupshup.

Macro

Oil prices inched higher to $65 (₹5,558) with Russian sanctions risk. While OPEC+ supply remains high, US sanctions on Russian oil could boost prices. There is also some risk with OPEC production quotas for 2025 and 2026, with the meeting coming up this week.

US-sanctioned tankers have been used by India for Russian oil, even though the country denies it. Over 1 million barrels of crude were transferred last week by US-sanctioned tankers. Additionally, more sanctioned cargoes are being used in June. Refineries are hiding behind Modi, who said that India only listens to the UN sanctions, though the government as a whole said US-embargoed ships would not be allowed.

Citi recommends buying Indian bonds based on a diverging rates policy with the US. Many different investment banks and asset managers see extended RBI rate cuts while the Fed maintains a hawkish angle. That divergence has caused Indian bonds to continue rallying this year while treasuries have faltered.

Equities

Indian equity markets are expected to open higher on Wednesday, Mutual funds are cropping up to take in more wealthy investor capital. Jio-Blackrock received approval for its business, while South African Sanlam bought a strategic minority interest in Shriram Asset Management. Outside of foreign JVs, domestic firms are also launching public funds focused on sophisticated strategies.

The NSE is now valued at $58 billion (₹4.9 trillion) in private markets ahead of an IPO. That’s up 60 percent y-t-d with high-net-worth investors snapping up private shares in dark pools.

The historical bull and monsoon season for India is commencing yet again. The 4-month rainy season is marked by high gains due to rain boosting rural consumption and lowering food prices. The RBI is also likely to cut interest rates for the 3rd time, boosting the consumption recovery.

All eyes are on tax cuts boosting demand in order to reverse earnings downgrades. Nifty 50 forward earnings have been cut broadly following this past quarter of earnings. Consumption needs to recover to support growth which relies on monsoons and the Budget tax cuts.

Alts

Royal Enfield motorcycles exported 9,000 vehicles before the 25 percent duty. The company is looking for options to move more inventory to Canada, which currently sees imports come in from the US. Enfield is incentivized to keep US exports high due to the demand for mid-sized premium bikes.

Adani Ports is planning a $584 million (₹50 billion) bond issue.This would be Adani’s largest offering in a 15-year package at 7.75 percent. The proceeds would go towards capex and refinancing dollar debt. The deal also goes far to expunge Adani’s US indictment and curry global favor.

Policy

Former RBI Governor Rajan is bearish on the US's foreign student ban. He sees foreign student immigration as a cornerstone for US growth, one that could end if the US keeps the pipeline closed. More than 1.1 million foreign students came to the US, with India making the plurality of the inflow.

See you Thursday.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.