Welcome to Samosa Capital’s evening briefing — the best way to stay up-to-date on India’s financial markets. Here’s what’s in today’s newsletter:

Airlines are pushing for a single nationwide tax code,

Vedanta isn’t fully divesting anymore,

And, economists project the RBI to cut rates in February.

Finally, we’ll close with Gupshup, a round-up of the most important headlines.

If you have feedback on our newsletter or just want to chat about India, always feel free to reach out to me. You can also share criticism about the newsletter anonymously here.

—Shreyas, [email protected]

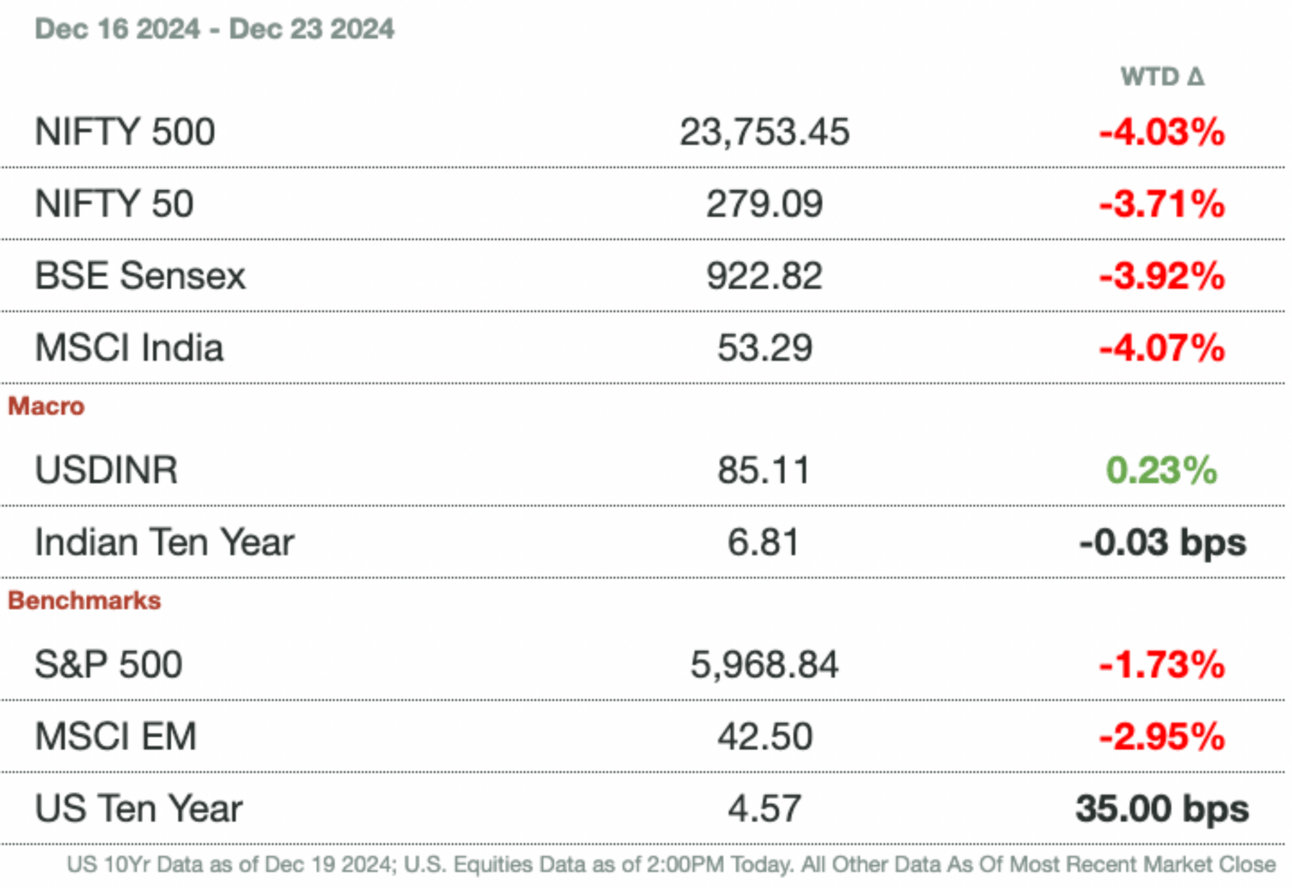

Market Update

Live Event

Seats are running out for our upcoming “Future of India” expert panel and networking event on Wednesday, February 12, 2025, in New York City. Buy now here, or earn a free ticket by sharing Samosa Capital with three friends.

Airlines Push For Unified GST Across the Country

An Indian government panel has rejected an airline industry proposal to include aviation turbine fuel (ATF) under the unified Goods and Services Tax (GST). This decision was made after a meeting of the Goods and Services Tax (GST) Council, chaired by Finance Minister Nirmala Sitharaman and composed of federal and state government officials.

Who cares? India Inc. has frequently criticized the federal government for failing to streamline regulatory hurdles between states and establish a unified single-tax, single-regulatory framework across the country. Currently, state governments determine how aviation turbine fuel (ATF) is taxed. Airlines have been pushing for its inclusion in the GST regime to standardize taxation nationwide. However, state authorities have resisted, fearing a loss of revenue. As Finance Minister Nirmala Sitharaman explained, "States do not want ATF to be brought under GST, just like petrol and diesel."

BTW: Before you criticize India for not having a unified tax code, adding to regulatory hurdles of domestic businesses, note that the U.S. also has state-level ATF and jet fuel taxes.

The tax panel set an 18 percent GST on sales of used vehicles by registered sellers, excluding direct individual sales. Plans to reduce taxes on life and health insurance premiums were delayed for further discussion, aimed at boosting insurance uptake.

Vedanta Backs Out of Fully Divesting

Vedanta, an Indian mining conglomerate, has revised its demerger plan, now deciding to retain its base metals business within the parent company.

Specfiically: Vedanta has opted against creating a separate listed entity for its base metals business, contrary to its initial plan. Instead, it will proceed with the demerger of five other businesses, adhering to the previously set share entitlement ratio. Lenders believe retaining the base metals unit within Vedanta will better unlock value and optimize debt allocation.

Why: Vedanta's stock has surged over 87 percent in 2024, with analysts maintaining a broadly positive outlook. The company is exploring options to restart its copper operations in Tamil Nadu while aiming to complete the demerger process by January 2025. For the quarter ended September 2024, Vedanta reported a profit of $659 million (₹56 billion), a significant turnaround from a loss in the same period last year.

So what? The emphasis on retaining the base metals business within the parent company highlights how Indian conglomerates are prioritizing balance sheet strength and efficient capital use in a high-interest rate environment. This approach signals a shift towards financial prudence in an economy with tightening liquidity conditions.

Chart of the Day

Finally, A Gosh Darn Rate Cut?

Economists anticipate the RBI will cut interest rates for the first time in February, following its decision to maintain the benchmark rate at 6.5 percent during the December meeting. Bond yields began the week slightly lower, influenced by RBI minutes signaling a potential February rate cut. Achala Jethmalani, an economist at RBL Bank, told Bloomberg she expects the February cut, citing rising concerns about economic growth. Similarly, Aditya Vyas, chief economist at STCI Primary Dealer, expressed the same outlook in an interview with The Economic Times.

Stressed out: In case you needed a reminder, India's GDP growth slowed to 5.4 percent in the July-September quarter of the 2024-25 fiscal year, marking a seven-quarter low and falling short of the RBI's projected 7 percent. Yet, inflation clocked in at 5.4 percent in November, beyond the RBI’s 4 percent target but within its 2 percent tolerance range. Expect RBI staffers to get a few more gray hairs in the coming months.

Gupshup

Macro

QState oil refiners struggle to hold enough Russian crude supply due to dropping cargo shipments. Executives from Indian Oil Corp, Bharat Petroleum, and Hindustan Petroleum said they were unable to procure the 6 million spot barrels they sought. Spot barrels reflect shipments for the current or very next month. The two likely explanations are (1) the Rosneft-Reliance deal which will soak up lots of production (2) Moscow limiting sales to favor long-term production contracts which can be more lucrative.

The Middle East's share of Indian oil imports is at a 9-month high. India imported 2.28 million barrels per day in November which is 10 percent higher than October and composes 48 percent of all energy imports. Russian oil imports have now fallen to 1.52 million barrels per day amid difficulty getting spot arrangements.

Banks are lobbying the RBI to switch the repo rate from MIBOR to SORR. MIBOR is the current swap rate and is based on uncollateralized trades that are liable to market collusion. Similarly, the US used LIBOR until market collusion was found causing a switch. SORR would be based on market transactions which, according to the bank consortium, would lead to better price discovery. Additionally, market transaction volume for uncollateralized agreements has fallen since LIBOR was switched to SOFR in the US.

Various bank economists expect the first interest rate cut in February. It’s starting to become a consensus pick in terms of timing since it will be the first meeting with 5 new MPC members plus an extra 3 months' worth of data to back up any rate changes. The RBI is expected to pay close attention to the winter harvest numbers plus how growth continues to evolve after a disappointing 5.4 percent quarter.

Poor weather is expected to reduce sugar production to 27 million metric tons and kill export hopes. Weather analysts now predict that sugar production will fall from 32 million tons in 2023; the larger issue is that annual consumption is 29 million tons which would require imports to be placed. Excessive droughts in the summer reduced the sugarcane yields.

The rupee's slip has been exacerbated by importers and a weak yuan. Strong dollar bids from importers have risen due to end-of-month payments even with state bank dollar sales. The weak yuan is another indicator of dollar strength over Asian currencies which has led to momentum still swinging against the rupee.

Equities

SEBI ends a 10,000 percent rally for Bharat Global Developers over fake revenue disclosure. The company was announcing forays into defense, aerospace, and agriculture using fake disclosures about high-marquee orders from companies like Reliance, Tata, and McCain India Agro. SEBI fully halted trading in the company after finding $31.7 million (₹2.7 billion) of insider selling as soon as the IPO lock-up period ended.

Global funds are shifting holdings from EM to US SMID (small and mid) caps in droves. Elara Capital data shows that last month alone had $78 billion (₹6.6 trillion) worth of US equity inflows. Historically, a shift to American SMIDs has spelled worse Indian returns since US SMIDs are a high-return substitute for Indian holdings.

Alts

Indian aviation is expected to grow through more airports and planes. Domestic air traffic is expected to rise to 170 million passengers by March 2025. To handle greater capacity, 2 new airports in Mumbai and Delhi are going to ease congestion. Airlines have also invested in hundreds of new aircraft from Boeing and Airbus as well to become more competitive internationally.

The NTPC inks a pact to set up more green hydrogen plants in Odisha. NTPC is working with GRIDCO (a national energy grid management organization) and CRUT (a public transportation agency) to create clean fueling systems and hydrogen buses.

The JNPA is collaborating with Swiss TIL to invest $2.4 billion (₹200 billion) in Vadhavan ports. The ports are being developed by a joint venture called VPPL, in which JNPA has a 74 percent stake. The Vadhavan project is meant to transform the Maharashtrian port into a world-class facility for exports and imports off of the west side of India.

Policy

The US FDA is restricting 11 Viatris drugs made in India. The FDA served a warning to Viatris regarding a facility in Indore. Viatris has immediately implemented a remediation plan, though specifics have not been released.

Bangladesh requests former PM Hasina be returned from Delhi for judicial processes. Ties between India and Bangladesh have become fraught since the Bangladesh government was overthrown and Hasina found refuge in India. New Delhi has reiterated that Hasina came to India for safety reasons but interim PM Yunus is adamant that Hasina must be returned to Bangladesh to be tried for her crimes in order for India-Bangladesh relations to resume normalcy.

See you Wednesday.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.