The United States may cut tariffs on India. India’s pension regulator signals support to channel savings into investing in infrastructure. SEBI clears Adani of some Hindenburg allegations.

If you have any questions about India, fill out this form or reach out to Shreyas at [email protected]

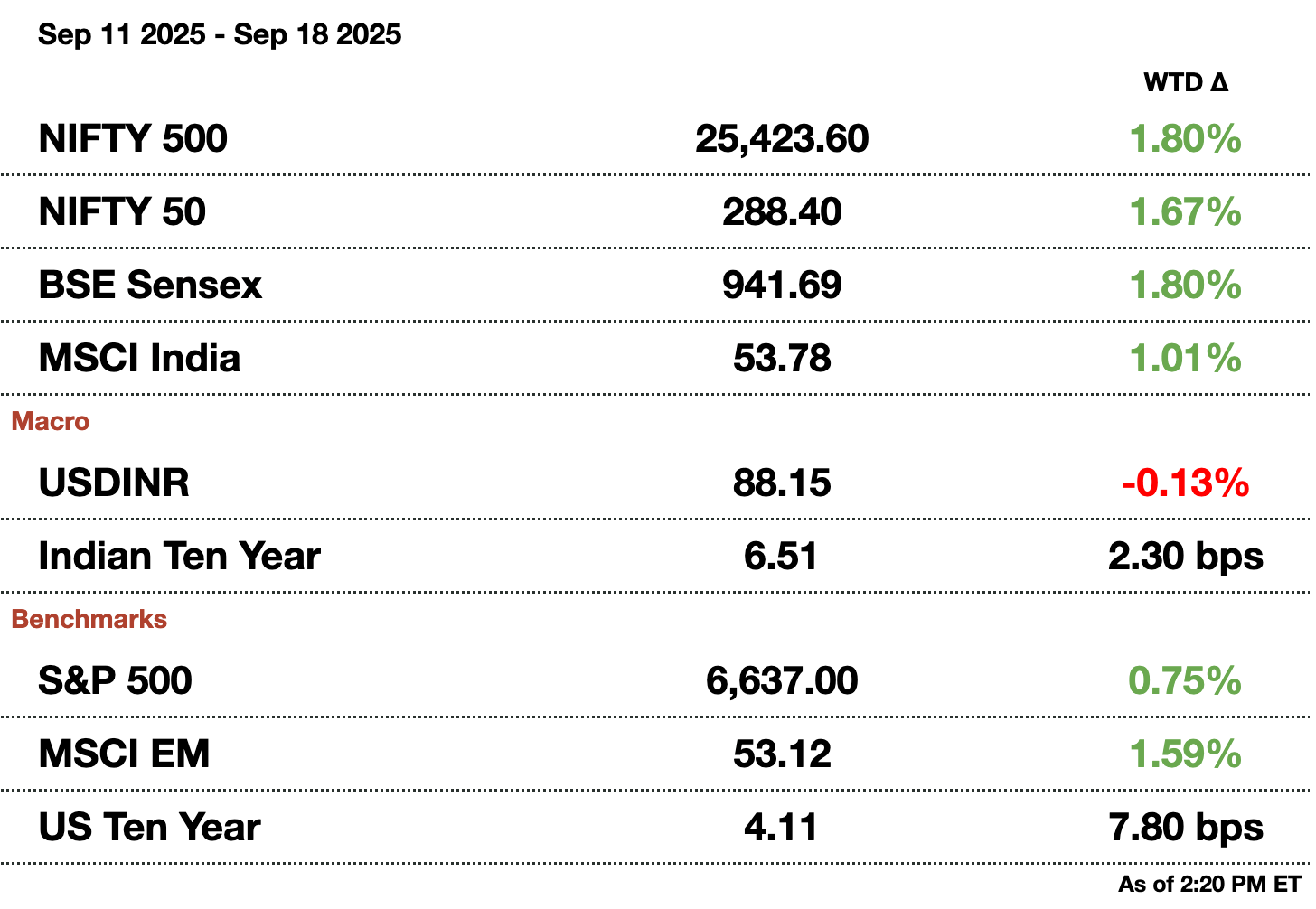

Macro

The Fed’s rate cut is boosting sentiment in India, with Asian fund managers turning overweight on Indian equities after months of caution. HSBC sees shares as undervalued, citing potential tariff relief and stronger consumption, though shadow lenders face mounting credit risks.

Equities

Pine Labs, backed by PayPal and Mastercard, plans to raise up to $700 million (₹61.7 billion) in an IPO slated for late October. The share sale includes a fresh issue worth $294.8 million (₹26 billion) and secondary sales by founders and investors.

India’s top used-car unicorns, CARS24, CarDekho, and Spinny, are slimming down by cutting jobs and exiting non-core ventures to prepare for IPOs over the next 12–18 months. Together, they aim to raise over $1 billion, capitalizing on booming domestic investor appetite.

Gokaldas Exports, a major Indian garment maker heavily reliant on U.S. sales, plans to shift focus toward the EU and UK while expanding production in Africa to cushion the impact of Trump’s new tariffs, which threaten margins.

Alts

The U.S. embassy in New Delhi said visas for several Indian business executives were revoked over links to trafficking fentanyl precursors, chemicals used to make the deadly drug. It added that India is cooperating closely with U.S. authorities on drug control.

Kerala is on alert after reporting 69 cases and 19 deaths from primary amoebic meningoencephalitis (PAM) this year, caused by the “brain-eating” amoeba Naegleria fowleri. Authorities note cases are isolated, complicating tracing efforts, unlike last year’s clusters.

Indian edtech firm upGrad is expanding across Asia and the Middle East, partnering with universities in Dubai, Malaysia, Singapore, and beyond, as U.S. and UK campuses lose appeal due to visa restrictions, costs, and weaker job prospects for Indian students.

Policy

EU chief Ursula von der Leyen said the bloc must strike trade deals with partners like India to cut reliance on the US amid rising tariffs. She added that PM Modi assured her of India’s commitment to sealing a deal this year.

Families of four passengers killed in the June 12 Air India crash have sued Boeing and Honeywell, alleging faulty fuel cutoff switches caused the tragedy. The FAA has disputed this, saying the switches likely did not trigger the accident that killed 260.

1. U.S. May Cut Tariffs on India

Trump and Modi in 2019

The United States may soon roll back punitive import tariffs on Indian goods and reduce reciprocal duties, a move that could mark a significant thaw in bilateral trade ties, India’s Chief Economic Adviser V. Anantha Nageswaran said on Thursday.

“My personal confidence is that in the next couple of months, if not earlier, we will see a resolution to at least the extra penal tariff of 25 percent,” Nageswaran said at an event in Kolkata. He added that the reciprocal tariff rate could also fall from the current 25 percent to between 10 percent and 15 percent.

The comments follow “positive” and “forward-looking” trade talks in New Delhi earlier this week, which raised hopes of a breakthrough after Trump imposed a punitive 25 percent levy on India in late August. The additional tariff doubled overall duties on Indian goods to 50 percent, part of Washington’s broader effort to pressure New Delhi over its continued purchases of Russian oil.

Trump and Modi also spoke by phone on Tuesday, with Trump describing it as a “wonderful call” and thanking Modi for help in efforts to end the war in Ukraine. Neither leader disclosed specifics, but the tone suggested easing tensions after months of strain.

Indian equities responded positively to the prospect of tariff relief. The benchmark Nifty 50 index hit a one-week high on Thursday, closing at its strongest level since July 9.

2. India Pension Regulator Signals Support for Infrastructure

India’s pension regulator is preparing to channel more long-term savings into the country’s infrastructure buildout, following the launch of a new government credit enhancement program designed to boost investor appetite for project bonds.

The initiative, announced Thursday, will allow the National Bank for Financing Infrastructure and Development (Nabfid) to provide guarantees of up to 20 percent on infrastructure bonds. By improving credit ratings and lowering borrowing costs, the program aims to attract large institutional investors such as pension funds and life insurers, which typically allocate only to higher-rated securities.

“We will certainly want to make sure there is a smooth flow of money to infrastructure bonds or infrastructure projects if Nabfid provides a credit enhancement guarantee,” Sivasubramanian Ramann, chairman of the Pension Fund Regulatory and Development Authority, told Bloomberg.

Infrastructure investment remains central to Prime Minister Narendra Modi’s economic strategy, but a substantial funding gap persists. According to Crisil Intelligence, India’s infrastructure will require more than ₹25 trillion ($284 billion) of debt financing over the next four years, with about one-quarter expected to come from bond markets.

While government outlays on infrastructure have expanded nearly 600 percent over the past decade, corporate bond issuance from the sector has lagged. Policymakers hope credit enhancement will change that dynamic, drawing stable, long-term capital into projects spanning roads, ports, and energy.

3. SEBI Clears Adani of Some Hindenburg Allegations

Gautam Adani, founder and chairman of Adani Group

India’s securities regulator has cleared the Adani Group and its founder Gautam Adani of some of the impropriety claims raised by U.S. short seller Hindenburg Research in early 2023, offering the ports-to-power conglomerate a partial reprieve.

The SEBI said in two orders on Thursday that there was no evidence the group used related-party transactions to route funds into its listed companies. The regulator found that dealings involving Adicorp Enterprises, Milestone Tradelinks, and Rehvar Infrastructure did not meet the definition of related-party transactions under its rules.

The finding validates Adani’s consistent denials of wrongdoing, though SEBI emphasized that other allegations remain under regulatory scrutiny. Hindenburg’s explosive report, which accused Adani of large-scale fraud and stock manipulation, triggered a historic $150 billion wipeout in the group’s market capitalization and stalled its debt-driven expansion.

Adani’s companies have regained some ground, with a current market capitalization above $150 billion (₹13.2 trillion), still well below the $235 billion (₹20.7 trillion) valuation before the report. The Supreme Court last year backed SEBI’s closure of its broader probe, reducing immediate legal risk.

However, Adani continues to face international challenges. The U.S. Department of Justice has indicted him in a $250 million (₹22 billion) bribery case, with efforts to resolve the matter reportedly stalled.

How helpful was today's newsletter?

See you tomorrow.

Written by Eshaan Chanda & Yash Tibrewal. Edited by Shreyas Sinha.

Sponsor the next newsletter to reach tens of thousands of U.S.-based business-savvy professionals. Reach out to [email protected].

Could your business use expert insights to power growth in India? Reach out to [email protected] for a free introductory call.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.