Good evening,

Welcome to the best way to stay up-to-date on India’s financial markets. Here’s what’s in today’s newsletter:

India’s Finance Minister arrives in D.C. as U.S. VP JD Vance lands in New Delhi for bilateral trade negotiations,

Adani is doubling down on India’s data‐center boom, pledging an additional $10 billion,

and Indian stocks powered ahead for a fifth consecutive session on Monday.

Then, we close with Gupshup, a round-up of the most important headlines.

Have a question you want us to answer? Fill out this form and you could be featured in our newsletter.

—Shreyas, [email protected]

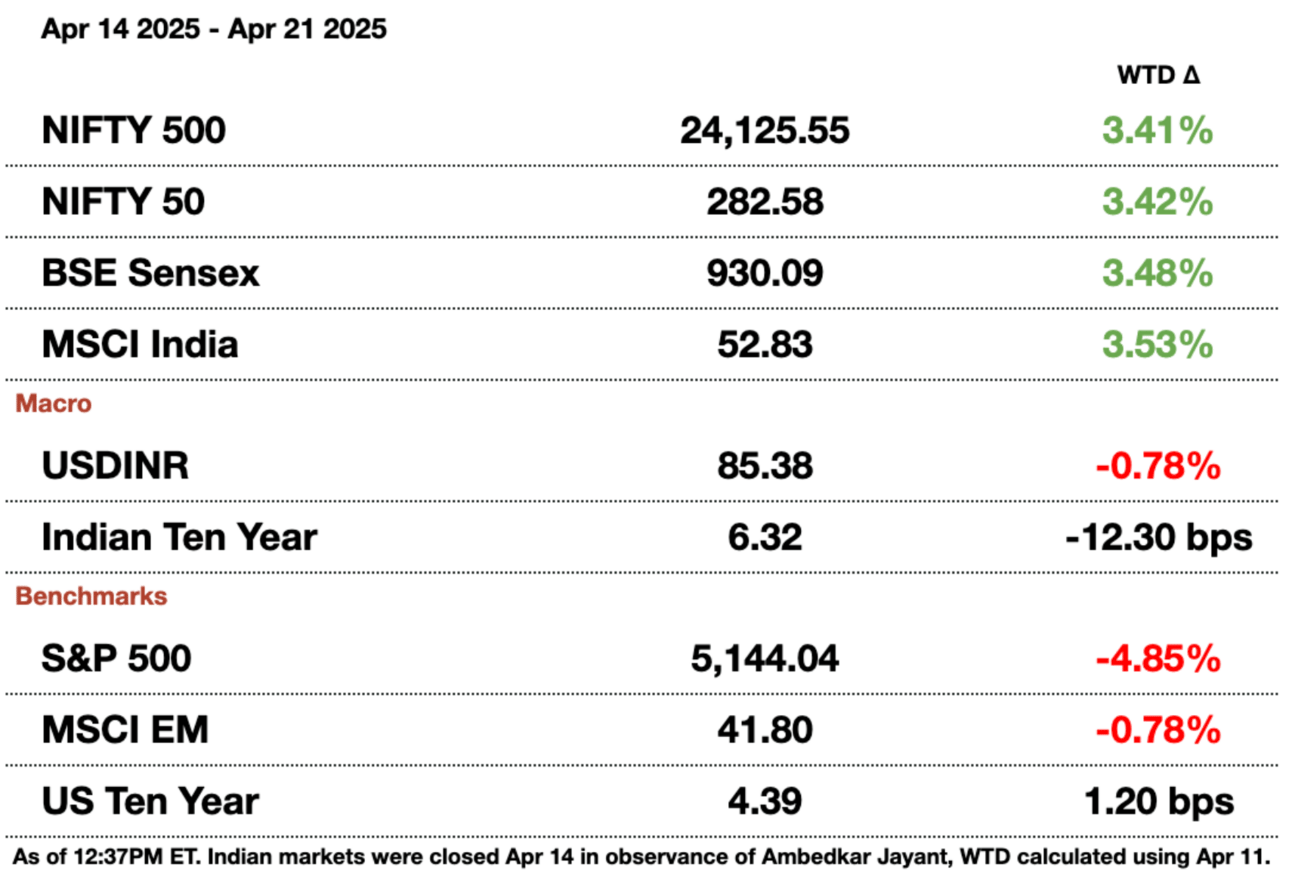

Market Update.

Trade Negotiations Continue.

Finance Minister Sitharaman arrives in Washington this week not merely as a delegate to the IMF–World Bank Spring Meetings but as a frontline negotiator to finalize a bilateral trade pact with the US. Her meeting with Treasury Secretary Scott Bessent comes amid a 90‑day reprieve on Trump‑imposed tariffs. Both countries are trying to use the window to define the broad strokes of a trade agreement that can then be sealed by autumn. With reciprocal duties poised to climb from 10 percent to 26 percent once the pause expires, virtual meetings are now being rolled back in favor of high-profile ones like this.

Posters put-up in New Delhi in honor of Vance’s 4-day India visit

Two-way street: Simultaneously, the diplomatic choreography extends in reverse: US Vice President JD Vance is visiting New Delhi, poised to meet Modi just as Sitharaman holds court in Washington. This two‑way shuttle diplomacy underscores what both capitals describe as a “special relationship” — one that now seeks to deepen defense ties even as it cements economic bonds. For Modi’s government, the calculus is simple: trade liberalization and greater US market access not only cushion India from global headwinds but also bolster strategic alignment in a region roiled by uncertainty.

Past Indian actions: Over the past months, New Delhi has slashed import duties on some 8,500 industrial items, opening its markets to American bourbon, Harley‑Davidson motorcycles, and high‑end machinery. A dedicated trade help desk now fields real‑time queries from exporters navigating shifting levies, while India’s chief negotiator prepares to travel to Washington for face‑to‑face talks. These moves underscore a shift from reactive tariff tussles to proactive deal‑making, which also reflects the urgency reflected in Sitharaman’s pledge to the Indian diaspora: “the keenness with which we are engaging” should yield the first tranche of a deal by year’s end.

Yet beneath the optimism lies a tempered assessment of India’s near‑term prospects. While the RBI pegs GDP growth at a healthy 6.5 percent for the new fiscal year, Morgan Stanley and Goldman Sachs have trimmed forecasts to roughly 6.1 percent, citing softer external demand in a world unsettled by tariff shocks. Sitharaman herself acknowledged that the current uncertainty is some of the highest that India has had to face. At the same time, she pointed to a decade of reforms that have fortified India’s resilience.

As negotiators refine tariff carve‑outs and lock in commitments on energy and defense purchases, the trend is looking fairly positive for a trade agreement. Keep in mind, a successful trade pact would not only avert a punitive rate hike on Indian exports but also signal to global investors that New Delhi is open for business at the highest levels.

Adani is Pushing for Data Center Growth.

Adani is doubling down on India’s data‐center boom, pledging an additional $10 billion (₹853.8 billion) to build massive server farms even as global giants hit the brakes. Insiders say the conglomerate has zeroed in on Andhra Pradesh, Maharashtra, Gujarat, and Tamil Nadu for two new facilities — each 1 gigawatt in capacity — with land acquisition already underway. The long-term vision is a sprawling 10 GW portfolio capable of powering the next wave of AI applications and offshore business services.

AdaniConneX data center in Chennai, India

Diverging global and local views: Adani’s aggressive move comes on the heels of Reliance Industries’ own 1 GW announcement in Jamnagar and follows his firm’s earlier promise to invest $5.9 billion (₹500 billion) in Maharashtra’s data‑center infrastructure. Foreign companies like Microsoft, Amazon, and Alibaba are cautious due to overcapacity and cooling AI demand, but Indian companies are betting that demand will far outstrip supply in the world’s most populous nation. After all, global capability centers leased a record 77 million square feet of office space here last year, and the largest operating data centers in India today still fall below the 1 GW mark.

This bet is more than just a real estate play. Adani’s push targets government‑to‑government contracts, a nod to the strategic importance of on‑shore data sovereignty even as multinational firms debate their cloud road maps. It also reflects a broader return to expansion after the group weathered the Hindenburg report and a Department of Justice probe. Through its 50:50 JV with EdgeConnex, the group already runs facilities in Chennai and Hyderabad and is breaking ground in Mumbai and Pune.

Indian Stocks are Power Ahead.

Indian stocks powered ahead for a fifth consecutive session on Monday, cementing their status as a relative safe haven amid Trump’s escalating trade war. The Nifty 50 climbed 1.2 percent by the close — its biggest five-day gain since 2021 — buoyed by stronger-than-expected weekend earnings from HDFC and ICICI Bank. Their robust results sent the banking sub-index to a fresh record, underscoring solid corporate fundamentals even as global markets waver.

The good: What sets India apart is its large, predominantly domestically driven economy and modest exposure to US trade, which has allowed local equities to shrug off tariff‑induced angst. Following Trump’s April 2 announcement of reciprocal levies, the Nifty was the first major Asian index to erase all such losses. That resilience attracted more than $1 billion (₹85.4 billion) in net foreign inflows last week, helping to trim this year’s outflows to about $15.5 billion (₹1.3 trillion). At the same time, domestic institutions and retail investors have piled back in, underpinning a recovery from the nine‑month low hit last month.

Looking ahead, investors are pinning their hopes on a bountiful monsoon season, critical for agricultural growth, and further rate cuts by the RBI, which has already signaled an accommodative stance. Valuation multiples, too, have eased from September’s peaks, tempting both foreign and local funds to redeploy. Foreign institutions are more likely to invest at favorable prices since they can actually realize some type of value now. Add India’s limited trade-war exposure, and suddenly Indian equities look like a bargain.

Some headwinds remain. Pharma exports and commodity‑linked sectors could yet feel the pinch from broader tariff pressures, and the Nifty still sits more than 7 percent below its all‑time highs. For now, though, India’s markets are riding a wave of confidence driven by strong bank earnings, policy support, and healthy inflows, one that looks set to carry them further unless global shocks intensify.

Gupshup.

Macro

Emerging market currencies like the rupee are gaining due to Trump contemplating firing Fed Chair Powell. Uncertainty with the Fed is causing the dollar to weaken against lots of emerging currencies, with the rupee gaining 1.1 percent over the past week. An EM currency basket gained 0.8 percent over the past week.

Gold hit another record high with global trade war concerns and Fed volatility. Risk with trade has made gold a safe haven and an inflation hedge to protect investors’ holdings. Banks are also buying more gold as a hedge against the dollar losing its reserve status in favor of other currencies like BRICs, the euro, or the yen. This will likely hurt the jewelry industry in India, however, since refining and selling gold make up a huge part of jewelry.

Starting in May, India is going to start releasing monthly unemployment in lieu of quarterly. May’s release will still cover January to March, but going forward, there will be a 1-month lag to each data point, similar to the US system. This is to increase transparency and frequency.

Equities

India's banking gauge hit a record high on low tariff exposure. The Nifty Bank Index gained 1.9 percent today, pushing past September’s record highs. Banks in India do almost no international lending and still have robust fundamentals with significant capital adequacy ratios, good additional provisions, and accelerating growth provisions among rate cuts.

HCL Q4 is likely to see sequential revenue decline due to demand falloff. Guidance expects net profit to rise 8 percent over this year due to cost savings. Revenue on the year is still up 5 percent as well, with the slowdown only coming as the year was ending, starting in September.

Bharat Heavy Electrical, a state-run engineering and manufacturing major, reported a 19 percent rise in y-o-y revenue. They also had their highest-ever order inflow at $10.8 billion (₹925.3 billion). The gains have been led by power and machinery to help develop infrastructure.

Alts

Corporate and local bonds are seeing higher inflows than even US Treasuries. Local currency bonds in India and peer countries have more room to see lower rates and are protected against movements in the dollar, which keeps weakening. For macro investors, playing India’s local bonds gives access to betting on the currency, monetary policy, yield curves, and duration.

Policy

Vance is visiting New Delhi to meet with Modi. He was first greeted by Tech Minister Ashwini Vaishnaw; the goal of Vance’s visit is to deepen the India-US Comprehensive Global Strategic Partnership. Vance’s visit is also a view of softer diplomacy between the two countries since the 2025 relationship has been tumultuous with trade wars.

Musk has revived a plan to meet Modi after speaking with him last week. A trip this year would be pivotal for his companies since Tesla, Starlink, and X have been floundering recently due to his increased politicization. While Musk’s appeal in the US is waning, his influence in India is growing: Tesla is opening showrooms in Mumbai, and Starlink is inking deals with Reliance and Airtel.

Modi is set to visit Saudi Arabia next week to strengthen ties. Trade between the two countries is at $43 billion (₹3.7 trillion) currently, with exports being automobiles, cereals, petrochemicals, and petroleum products. The visit is also timely, with Modi supporting the Waqf bill to take over Muslim property in India.

See you Tuesday.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.