Welcome to Samosa Capital’s daily briefing — the best way to stay up-to-date on India’s financial markets. Here’s what’s in today’s newsletter:

Gov’t to cut stakes in five state-owned banks,

What fixed income funds are doing to trade on expected monetary policy changes,

and, the world’s largest human gathering is taking place.

Finally, we’ll close with Gupshup, a round-up of the most important headlines.

Have a question you want us to answer? Fill out this form and you could be featured in our newsletter.

—Shreyas, [email protected]

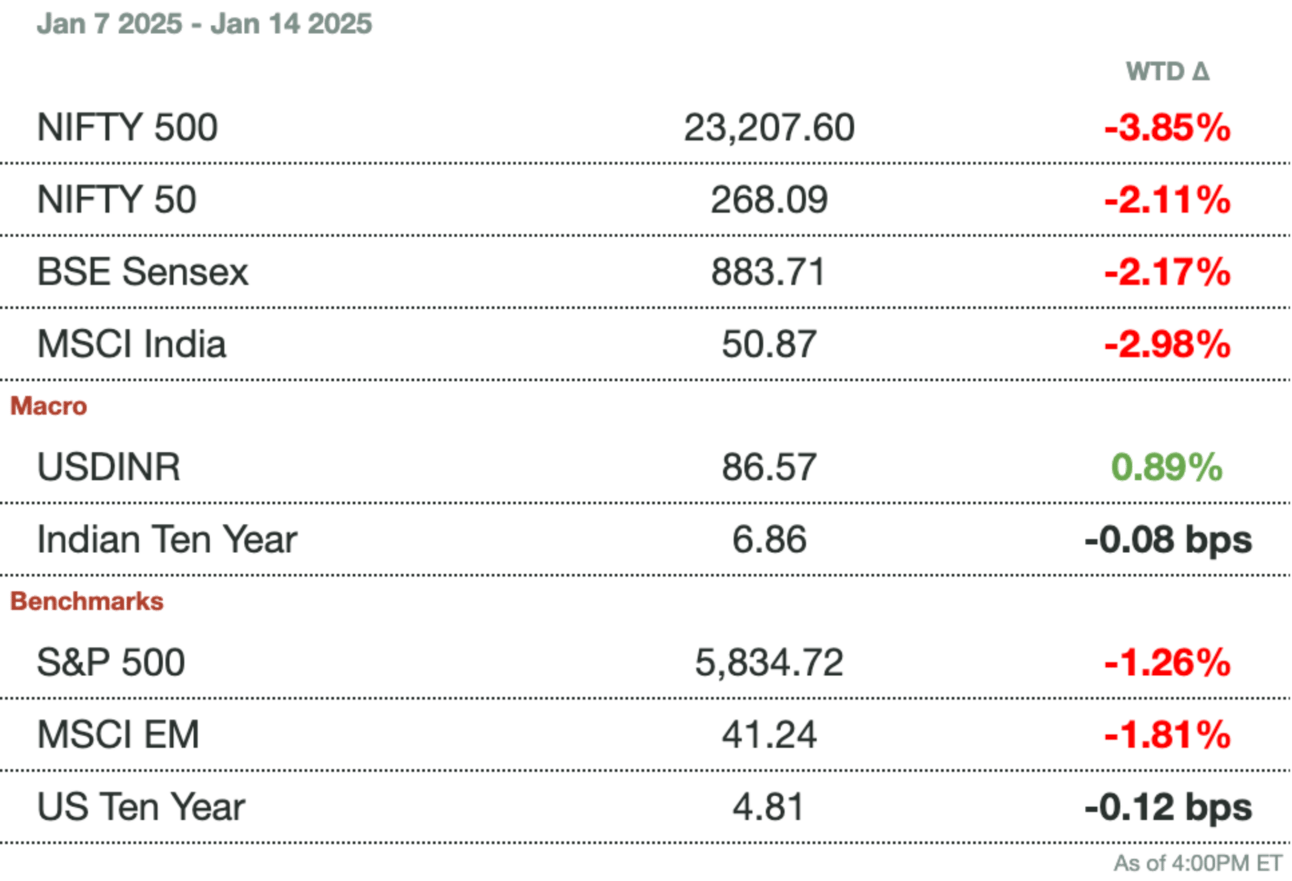

Market Update

Overall, markets shifted upwards after a massive Monday selloff, closing up 0.53 percent.

Live Event

Seats are running out for our upcoming “Future of India” expert panel and networking event on Wednesday, February 12, 2025, in New York City. Buy now here, or earn a free ticket by sharing Samosa Capital with three friends.

Gov’t to Cut Stakes in 5 State Banks

India’s government is exploring the possibility of reducing its ownership in five state-run banks — UCO Bank, Central Bank of India, Indian Overseas Bank, Bank of Maharashtra, and Punjab & Sind Bank — through stake sales or allowing the lenders to sell shares to large investors. The goal is to bring government holdings in these banks below 75 percent and help them comply with public float norms, a senior government official said.

A few different options are: The Department of Investment and Public Asset Management could either sell government stakes directly or permit the banks to raise capital from institutional investors. These moves are expected to increase market liquidity and enhance the ability of these banks to lend, which could bolster economic activity amid slowing growth.

Market view: The announcement led to a surge in the shares of these banks. UCO Bank and Indian Overseas Bank both saw their stocks jump 20 percent, marking their biggest daily gains since 2003 and 2009, respectively. The broader Nifty State-Owned Banks Index has outperformed its private sector counterpart, rising nearly 4 percent over the last year compared to a 3.6 percent decline in the Nifty Private Bank Index.

Despite the positive sentiment, the valuations of these banks remain high relative to larger peers. The price-to-book ratios for the five banks range between 1.43 and 3.62, higher than the State Bank of India’s 1.44, potentially limiting the attractiveness of these stocks for some investors. This overvaluation is likely due to the safety factor of having government guarantees.

Fixed Income Funds are Planning Trades

India’s fixed-income fund managers are positioning themselves for anticipated monetary policy easing by the Reserve Bank of India in 2025. The outlook for rate cuts, coupled with expectations of liquidity injections, is shaping their investment strategies across various segments of the debt market.

RBI Governor Sanjay Malhotra is expected to prioritize injecting liquidity into the banking system, which is currently facing a deficit of approximately $23 billion (₹2 trillion). Measures such as open market bond purchases, foreign exchange swaps, and reductions in banks’ cash reserve ratio are on the table, with fund managers predicting rate cuts to follow.

Top Trades

Money Markets and Shorter-Maturity Corporate Debt

Tight liquidity conditions have pushed yields higher on short-term instruments, making them attractive. ICICI Prudential Asset Management is focusing on top-rated corporate bonds with maturities of two to three years, leveraging the steep yield curve inversion (when long-term rates fall below short-term).

Sovereign Bonds and Duration Trades

Bandhan Asset and Tata Mutual Fund are bullish on long-tenor sovereign debt, citing favorable demand-supply dynamics and prospects for open-market bond purchases. Tata expects 10-year bond yields to drop in Q1 2025, making longer-dated bond strategies lucrative.

Barbell Strategies

Edelweiss Asset Management employs a barbell approach, balancing between benchmark 10-year bonds and long-end yields to capitalize on expected policy easing and short-term rate declines.

Riskier Credit

Aditya Birla Sun Life AMC sees opportunities in lower-rated bonds, predicting widening spreads on AA-rated and below notes as corporate bond supply increases. These instruments are expected to offer attractive yield premiums amid slower bank lending.

What is Maha Kumbh?

TLDR: Maha Kumbh Mela or the Great Pitcher Festival is a 6-week festival attended by 400 million Hindus as a large pilgrimage. While Kumbh Mela is celebrated every 12 years, the Maha Kumbh Mela is celebrated every 144 yeras. The event is the largest human gathering in history.

The economics are crazy: The government spends around $900 million (₹77.9 billion) to create makeshift housing, utilities, and safety features. Returns are projected to be a staggering $24 billion (₹2.1 trillion) assuming each attendee spends approximately $58 (₹5,000). In just a few weeks, India will add a whole percentage point to its annual GDP growth.

Investment in the festival is at an all-time high due to safety considerations. A temporary city spanning 10,000 acres has been set up with 50,000 security personnel, a bevy of drones in the air and water, and $15 million (₹1.3 billion) worth of fire safety equipment.

Gupshup

Macro

India's central bank plans to manage foreign exchange reserves cautiously, using interventions only to ease market volatility amid global headwinds, sources said. The Reserve Bank of India aims to avoid heavy interventions to defend specific currency levels, emphasizing a measured approach.

India's wholesale inflation rose to 2.37 percent year-on-year in December, up from 1.89 percent in November, aligning with market expectations. While food and manufacturing prices saw modest increases, retail inflation eased to a four-month low of 5.22 percent, intensifying calls for a rate cut by the Reserve Bank of India.

AM Green has teamed up with DP World to develop infrastructure for exporting 1 million tons per year of green ammonia and methanol, focusing on markets in the EU, Far East, and UAE. The partnership also includes building port facilities and refueling stations in India, Dubai, and Southeast Asia as part of India's renewable energy push.

Traders say the Indian central bank intervened heavily before the local spot market opened, selling dollars to support the rupee amid strong demand tied to non-deliverable forwards. As a result, the rupee saw slight gains, though dollar demand is expected to limit significant improvements.

Equities

Indian equity benchmarks rebounded on Tuesday, with the Nifty 50 gaining 0.39 percent and the Sensex rising 0.22 percent, driven by financial and metal stocks. Despite recent market pressure, small and mid-cap stocks posted notable recoveries of around 2 percent and 2.5 percent, respectively.

Hyundai and Kia's slow electric vehicle rollout in India, coupled with increased sales of gasoline SUVs, is hindering their decarbonization efforts, Greenpeace said. Despite progress in emissions reductions elsewhere, their vehicle emissions have risen in India, the world’s third-largest auto market.

Industry data revealed that India's car sales growth slowed to 4.2 percent in 2024, the lowest in four years, as high inflation dampened demand. While overall sales reached a record 4.27 million units, small car sales fell 14.4 percent, with SUVs and larger cars driving modest growth.

Shoppers Stop reported a 41 percent jump in third-quarter profit, driven by festive demand for premium items like watches and perfumes. Revenue rose 11 percent to ₹13.79 billion, with luxury products contributing 64 percent of sales amid steady consumer interest despite inflation.

HCLTech shares plummeted nearly 10 percent, marking their worst session since 2015, after missing Q3 revenue expectations and providing a modest revenue growth outlook. Despite a strong 31 percent stock gain in 2024, the disappointing results led to multiple brokerage downgrades.

Alts

Pixxel, an Indian space startup, is set to launch three hyperspectral imaging satellites on January 14, marking the country's first private satellite network. With plans to expand its fleet to 24 satellites, the company aims to capture a share of the $19 billion satellite imaging market by 2029.

Policy

India's central bank has assigned Deputy Governor M. Rajeshwar Rao to oversee monetary policy and economic research as Michael Patra's term ends on Jan. 15. Rao will also join the monetary policy committee, starting with the February meeting, until a successor for Patra is named.

China and India are turning to Middle Eastern and African crude supplies as U.S. sanctions tighten on Russian oil, driving up global oil prices and spot market demand. Analysts predict short-term disruptions to Russian exports, but shadow fleet tankers may help Russia adapt to the restrictions.

See you Wednesday.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.