Good afternoon,

India crossed Japan to become the world’s fourth-largest economy, something that has been much celebrated. Others have derided this, pointing out India’s GDP-per-capita is lower than Japan’s. However, an even deeper dive reveals a much weirder story.

Then, we close with Gupshup, a round-up of the most important headlines.

Have a question you want us to answer? Fill out this form and you could be featured in our newsletter.

—Shreyas, [email protected]

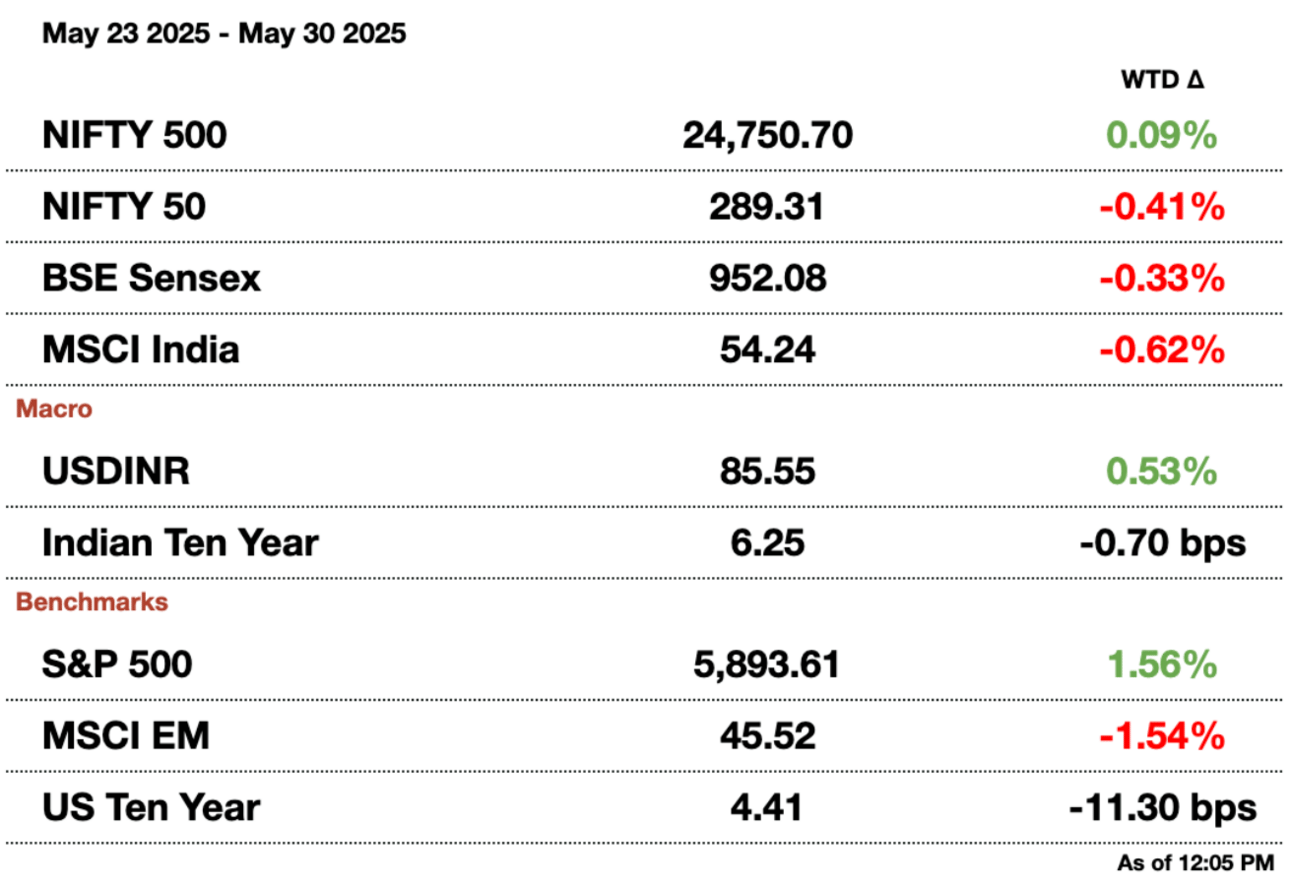

Market Update.

India Passes Japan to Become 4th Largest Economy.

India’s economy continues to stun, with Q4 of the last fiscal year seeing growth of 7.4 percent, leading to FY24-25 seeing 6.5 percent for the year. The growth continues a post-pandemic trend of hyperbolic growth, which spells opportunity for global and domestic investors. In fact, IMF projections now have India’s nominal GDP at $4.187 trillion (₹358 trillion), which just passes Japan’s estimate, which sparked premature celebration of India becoming the globe’s 4th largest economy.

But, the super weird thing is... China crossed $4 trillion (₹342 trillion) in GDP back in 2010, when per capita GDP was roughly $3,500 (₹299,250) and PPP was double that. More simply, when China crossed the $4 trillion GDP mark, Chinese people were relatively far wealthier than Indians today living in a $4.2 trillion economy. Even as India catches up in the macro, it is not keeping up in the micro. How is this possible?

Symbolic strength: Firstly, some celebration is warranted; in 2000, the GDP was 10 percent of its current size for a billion citizens. There is proof that the last 25 years of economic reform and financial management have led to benefits for the country.

Still, passing Japan in GDP doesn’t reflect larger on-the-ground quality of life differences. GDP per capita comes in at $2,880 (₹246,240), which ranks 134th in the world and is barely one-tenth of Japan’s. When controlling for purchasing-power-parity (PPP, which adjusts GDP by strength of currency and costs) puts India at around $12,000 (₹1 million), India ranks 119th in the world.

Population Dividend: As we have written about extensively, India’s growth phenomenon can be attributed to the “population dividend,” a term popularized by former Reserve Bank of India Governor Raghuram Rajan. The nation has the largest population of working-age humans, and the increase in the size of this group has done more to drive up GDP than technological advancement and improvements in quality of life. Cementing this point further is that neighboring Bangladesh has seen its GDP per capita rise 6.5 times since 2000, while India’s has only risen 5.4 times, despite starting from near identical economic metrics. The comparisons prove that “4th largest economy” is a laurel resting on aggregate size alone.

Wealth Inequality: The top 1 percent of Indians own over 40 percent of the national wealth. If one subtracts the top 1 percent’s share (roughly $1.56 trillion) from the $3.9 trillion total, the remaining per-capita GDP across 99 percent of the population plummets to around $1,670 (₹142,785). Remove the top 5 percent, commanding 62 percent of wealth, and per-capita income collapses to roughly $1,100 (₹94,050). Those starkly lower figures align more closely with the realities faced by hundreds of millions of Indians living on informal or agrarian wages. It is for precisely this reason that India’s government continues to distribute subsidized food rations to roughly 800 million citizens.

The future is here but unequally distributed: High-GDP-growth sectors in IT services, finance, e-commerce, and other capital-intensive industries employ only a fraction of the workforce but generate outsized value added. Services now account for over 55 percent of GDP while employing fewer than 30 percent of workers. In contrast, agriculture employs roughly 50 percent of the workforce but contributes only 17–18 percent to GDP. Manufacturing, despite government pushes like “Make in India,” hovers around 15 percent of output, further limiting its ability to soak up labor. While India wants to become a manufacturing giant, excess regulation for foreign approval and a lack of move-in-ready factories make “Make in India” and other PLIs a factor in name alone.

Within those service sectors, too, wage growth has lagged behind gains in corporate profitability. A middling real wage growth of 2–3 percent annually means urban consumption remains muted, even as corporate fortunes balloon. Profits grew at around 5+ percent in 2024, a year with squeezed margins and revenue.

Not a unique story: The United States has a per-capita GDP above $89,000 (₹7.6 million), with some 38 million Americans living below the country’s poverty line and medical insolvencies. In such contexts, GDP becomes a blunt metric: it measures aggregate activity, and doesn’t control for cost-of-living.

Still... India must also invest in human capital — schools, skills training, and public health — to ensure its demographic dividend does not become a demographic liability. An economy is only as strong as the capacity of its people to participate in and benefit from growth. Unless India embraces an agenda of inclusive development by improving life expectancy, literacy, and per-capita consumption, the promise of “4th largest economy” risks becoming a symbolic victory.

Want to reach our audience?

Email [email protected] to sponsor the next newsletter.

The key to a $1.3T opportunity

A new real estate trend called co-ownership is revolutionizing a $1.3T market. Leading it? Pacaso. Led by former Zillow execs, they already have $110M+ in gross profits with 41% growth last year. They even reserved the Nasdaq ticker PCSO. But the real opportunity’s now. Until 5/29, you can invest for just $2.80/share.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals. Under Regulation A+, a company has the ability to change its share price by up to 20%, without requalifying the offering with the SEC.

Gupshup.

Macro

India’s economy likely grew 6.7 percent y-o-y in Q1 2025, up from 6.2 percent the previous quarter, driven by stronger rural consumption and increased government spending, a Reuters poll showed. Despite cautious private investment amid global uncertainty, India remains relatively well-positioned. Official GDP data is due Friday.

Emerging-market bonds from India, Indonesia, Brazil, and South Africa are poised to outperform lower-yielding peers, as a weaker U.S. dollar offsets the impact of rising Treasury yields. The currency boost is helping investors maintain returns, especially in unhedged, high-yield EM debt, according to Goldman Sachs and PineBridge.

Equities

Ola Electric’s stock fell nearly 10 percent after quarterly losses more than doubled and revenue plunged 62 percent year-on-year. Founder Bhavish Aggarwal blamed weak demand, operational delays, and rising competition, while analysts remain skeptical about the company’s turnaround.

Indian auto stocks are outperforming the broader market on hopes of a domestic demand rebound, aided by monsoons, lower rates, and tax cuts. The Nifty Auto Index rose 4.6 percent in May, more than twice the Nifty 50’s gain.

India’s government has asked Baba Ramdev’s Patanjali Ayurved to explain suspicious transactions flagged by economic intelligence officials. The company is also under investigation for possible fund diversion and corporate governance lapses.

India’s Apollo Hospitals plans to add 4,300 beds over the next 3-4 years and expects mid-teen revenue growth in FY26. Currently, it operates about 9,458 beds nationwide, and the first phase to add around 2,000 beds is underway, including new hospitals and expansions of existing ones.

Mumbai’s Adani-run airport changed payment terms, prompting IndiGo and Air India to lobby officials against it. The airlines warn that the move could set a bad precedent. Mumbai is India’s busiest airport and part of Adani’s growing airport portfolio.

India’s top EV makers, Tata Motors and Mahindra, are pushing the government to block hybrids from official fleets, arguing that promoting hybrids alongside electric vehicles (EVs) will slow EV adoption and hurt investments. They want incentives to be limited to fully electric models, opposing a pollution body’s advisory to include hybrids.

Indian beauty retailer Nykaa’s Q4 profit nearly tripled year-on-year to $2.4 million (₹202.8 million), driven by strong demand for premium brands among urban consumers. Its total revenue rose almost 24 percent, with over 92 percent coming from beauty products.

Alts

Jump Trading’s India unit has hired Javed Akhtar, a longtime IMC executive, to head its technology operations. His hiring reflects high-frequency trading firms’ focus on infrastructure amid surging derivatives volumes and tighter regulatory scrutiny.

Adani and Emaar have called off discussions over the sale of Emaar’s Indian real estate unit after failing to agree on valuation terms. The potential $1.4 billion (₹120 billion) deal would have expanded Adani’s property footprint in India, though talks could resume later.

Indian private equity firm Multiples Alternative Asset Management has secured about $58.5 million (₹5 billion) in private debt from HSBC and Nomura to support its acquisition of a controlling stake in QBurst Software Services. The debt is structured as non-convertible debentures with a five-year term and an 11.4 percent coupon.

DBS Group has paused plans to form an insurance partnership in India and Taiwan after initial bids fell short of its valuation expectations. While work on the deal is on hold, DBS may revisit the opportunity in the future.

Policy

India is broadening defense ties beyond the US by working with the UK, France, and Japan to develop fighter jet engines for its new twin-engine fighters. This effort aims to secure supply chains and boost domestic defense production.

India is urging the US to scrap the 10 percent baseline tariffs imposed in April, citing recent court rulings against Trump’s trade policies, Bloomberg reports. It also wants to lower the local content threshold for origin rules from 60 percent to 35 percent. A US trade team will visit New Delhi next week, but India’s tone has toughened amid legal setbacks for Trump and growing geopolitical tensions.

India will exempt Saudi Arabia’s sovereign wealth fund from some foreign investment rules to boost capital flows and strengthen ties. Current limits cap sovereign investments at 10 percent per company, restricting Saudi Arabia’s Public Investment Fund from investing more in India.

India’s federal finance ministry has requested relaxations in the Reserve Bank of India’s new gold loan rules. The ministry’s financial services department urged the central bank to ensure that small gold loan borrowers are not adversely affected, according to a post on the ministry’s official social media account.

See you Monday.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.