Tata Consultancy Services’ raised $1 billion (₹88.6 billion) from a US PE giant to get ahead on AI. Today, we explain more.

If you have any questions about India, fill out this form or reach out to Shreyas at [email protected]

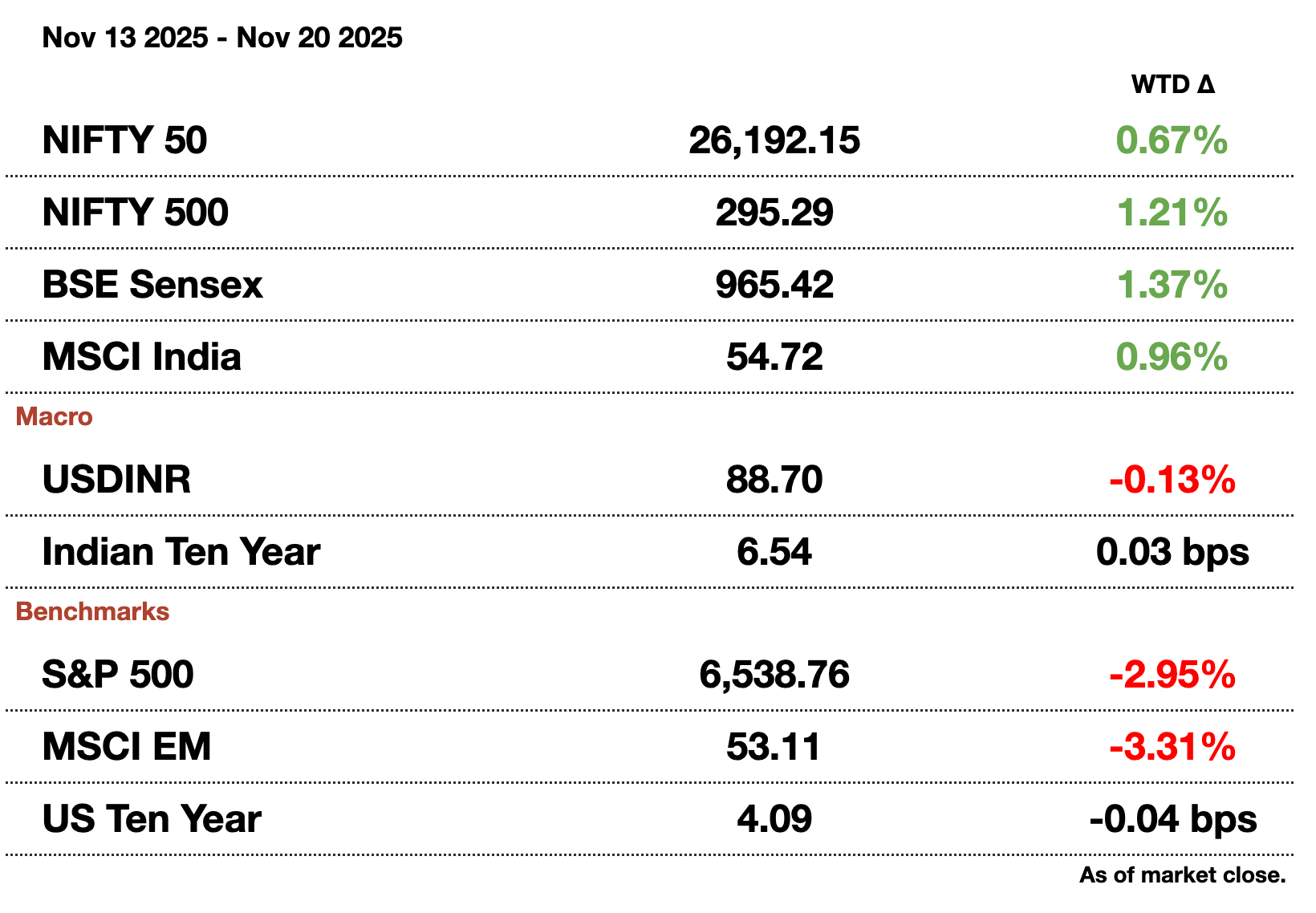

Macro

The RBI is confident on a US trade deal to steady the rupee. Governor Malhotra relayed the idea in a recent speech in Delhi. He also said the RBI has ample reserves of $690 billion (₹61.2 trillion) to keep the rupee steady as well, though he said there is no predefined target for the rupee.

India says its chipmaking capabilities will be on par with other countries by 2032. India has used a $10 billion (₹888 billion) fund to subsidize growth in the industry and attract tech giants.

India is seeking ships for Middle Eastern oil.Roughly a dozen vessels have already been chartered driving freight rates up; the majority are Very Large Crude Carriers though there are some smaller ones as well.

Equities

The NSE hit an all time high at 26,246 after earnings boosted sentiment. This is the highest peak, surpassing its September 2024 high. Overseas investors have returned after a strong earnings season, improved trade talks, and GST cuts. MSCI members are expected to continue this streak by growing earnings at 16 percent next year.

There were $78 billion (₹6.9 trillion) of domestic institutional and retail inflows this year. Indian fund managers reported that they saw India as a defensive stock market due to the limited exposure to AI stocks. Global markets are arguably overstretched valuation wise due to tech stocks.

ICICI Prudential Asset is nearing a $1.1 billion (₹97.5 billion) IPO. Insiders at SEBI signalled that they will grant approval in the coming days. The asset manager is valued at $11 billion (₹976.8 billion) based on deal terms.

IndusInd is pursuing a restructuring to strengthen its balance sheet.The organization will be cleaned up with low performers being fired, though headcount is not being materially affected. The move comes after a $221 million (₹19.6 billion) accounting discrepancy that opened multiple probes.

Alts

Reliance will stop processing Russian oil in Jamnagar, a refinery doing 700,000 barrels per day. The move is to allow for the refinery to keep supplying oil to Europe after new sanctions come into place early 2026. Reliance is currently not buying any Russian oil.

Deutsche Bank is attempting to sell its retail and wealth management business in India. The potential buyers are Emirates NBD, Kotak Mahindra, and Federal Bank. This continues a changing of hands for financial businesses; over $15 billion (₹1.3 trillion) of financials deals have taken place in 2025.

Bajaj Group's alternative investment arm hires a CIO from Kotak. The Indian asset management industry is worth $169 billion (₹15 trillion) and is accelerating. CIO Jitendra Gohil plans on launching more alternative funds in early 2026.

The Muthoot firm is worth over $13 billion (₹1.2 trillion) from rising gold loans.They take gold as collateral; this market has surged 35 percent y-o-y to be worth $151 billion (₹13.4 trillion) this year with competition in the space heating up. Indian households own 34,600 tons worth $3.8 trillion (₹337.4 trillion), more than the central bank holdings of China, the US, Russia, France, Italy, and Germany combined.

Policy

From July to November, India has been forced to reduce its QCOs in durable industries. Everything from textiles to metals has seen non-tariff barriers being reduced to appease Trump. The secondary effect has been supply chain efficiency though the Make in India has been reduced in efficacy.

Someone just spent $236,000,000 on a painting. Here’s why it matters for your wallet.

The WSJ just reported the highest price ever paid for modern art at auction.

While equities, gold, bitcoin hover near highs, the art market is showing signs of early recovery after one of the longest downturns since the 1990s.

Here’s where it gets interesting→

Each investing environment is unique, but after the dot com crash, contemporary and post-war art grew ~24% a year for a decade, and after 2008, it grew ~11% annually for 12 years.*

Overall, the segment has outpaced the S&P by 15 percent with near-zero correlation from 1995 to 2025.

Now, Masterworks lets you invest in shares of artworks featuring legends like Banksy, Basquiat, and Picasso. Since 2019, investors have deployed $1.25 billion across 500+ artworks.

Masterworks has sold 25 works with net annualized returns like 14.6%, 17.6%, and 17.8%.

Shares can sell quickly, but my subscribers skip the waitlist:

*Per Masterworks data. Investing involves risk. Past performance not indicative of future returns. Important Reg A disclosures: masterworks.com/cd

Reach out to [email protected] to reach our audience and see your advertisement here.

Tata Consultancy Services Raises $1 Billion

Tata Consultancy Services’ decision to bring in $1 billion (₹88.6 billion) from US PE giant TPG marks one of the most aggressive moves yet by an Indian IT major to stake a claim in the global AI–infrastructure race. The money will flow into HyperVault, TCS’s newly formed data center platform, as part of a broader investment plan of up to $2 billion (₹180 billion). For TCS, the deal is both a financial and strategic pivot: it reduces the capital load on its balance sheet, offers accelerated scale in a capital-intensive business, and allows India’s largest outsourcer to participate meaningfully in the hyperscale build-out that is reshaping global technology competition.

India is becoming one of the most sought-after destinations for AI compute infrastructure, driven by three pillars: a booming startup economy generating vast data, rising digital consumption from a 1.4-billion-person population, and geopolitical tailwinds that are pushing cloud and AI companies to diversify outside China. Global firms are responding with unprecedented capital commitments. Google recently outlined a $15 billion (₹1.3 trillion) plan for an AI hub in southern India; Amazon has earmarked $12.7 billion (₹1.1 trillion) for cloud infrastructure through 2030; and OpenAI is exploring a 1-gigawatt data center. All of this was unthinkable in India just two years ago. TCS’s move positions an Indian player to compete in a domain currently dominated by hyperscalers and sovereign-backed infrastructure giants.

Governments across the Middle East, East Asia, and the US are pouring trillions into data centers to secure supply of compute. The US this week approved the sale of tens of thousands of Nvidia’s most advanced chips to the UAE’s G42 and Saudi Arabia’s Humain, illustrating how compute access is increasingly a geopolitical asset. Japan and South Korea are planning multi-billion-dollar expansions of their own. In this environment, India risks falling behind unless local firms scale rapidly. TCS’s HyperVault and the decision to share ownership with a deep-pocketed investor like TPG reflects that urgency.

TPG’s stake, expected to end between 27.5 percent and 49 percent, also continues a pattern of collaboration with the Tata Group following earlier deals in electric vehicles and Tata Technologies. For TCS, the structure creates a hybrid: majority control with third-party capital to accelerate build-out. For TPG, the bet offers exposure to a country where demand for compute is likely to outstrip supply for years. TCS’s target of building 1.2 gigawatts of capacity positions HyperVault as one of the largest domestic AI-centered infrastructure plays and one of the few with both financing and execution capability from day one.

The larger significance is that India is no longer treating data centers as simple real-estate or IT-services extensions. They have become strategic national assets by determining who controls AI development, where datasets reside, and how fast India can absorb the next wave of industrial automation. The TCS–TPG deal signals that India’s private sector intends to compete directly in this space, not merely serve global hyperscalers. It is an inflection point: the first time an Indian IT major is raising external capital at scale to build AI compute domestically. And with global firms committing billions and compute demand exploding, this may be the opening phase of India’s own AI-infrastructure supercycle.

How helpful was today's newsletter?

See you tomorrow.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Sponsor the next newsletter to reach tens of thousands of U.S.-based business-savvy professionals. Reach out to [email protected].

Could your business use expert insights to power growth in India? Reach out to [email protected] for a free introductory call.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.