Hello. What’s India’s largest conglomerate, Tata Group, been up to? We’ll investigate and then close with Gupshup, a round-up of the most important headlines you can’t miss.

BTW: India is home to the world’s largest statue, about twice the height of the Statue of Liberty. Do you know which one it is? (Answer at bottom)

Markets

Read here for an appendix on the above.

What’s Next for Tata Group?

Tata Group, India’s largest conglomerate, operates 29 publicly listed companies that serve over 150 countries. Based in Mumbai, the $403 billion company operates a consulting service, an airline, hotels and luxury brands, steel plans, electricity production, one of the country’s largest automobile companies, just to name a few.

Background Founded in 1868 by Jamshedji Tata, the son of Persian refugees, the conglomerate began as an export-trading firm in Mumbai during the British Raj rule. Today, the company is led by Chairman Emeritus Ratan Tata, who took the helm in 1991 and grew the company through massive acquisitions during India’s liberalization. Tata Sons, a limited holding group, is the principal owner of Tata Group, owning roughly 66 percent of its shares, and the chairman of Tata Sons is typically the chairman of Tata Group.

Jamshedji Tata

Today, Tata Group accounts for 5 percent of India’s total GDP.

Airline Tata Group’s most notable recent venture is its 2022 acquisition of India’s second-largest airline, Air India. The Indian government sold its state-run airline to Tata Group in an effort to privatize the industry and with hopes that corporate leadership could resolve growth issues and inefficiencies, the company was facing.

Since the acquisition, the conglomerate has launched an ambitious plan to revive the struggling airline. Recently, Air India placed an order for 470 new planes from Airbus and Boeing, marking the largest fleet expansion in aviation history. This move aims to modernize Air India's aging fleet and improve its services after years of operational and financial struggles under government ownership.

Air India, which had accumulated over $8 billion in debt, was privatized after multiple failed attempts by the Indian government. Tata Group emerged as the successful bidder, offering $2.4 billion (₹18,000 crore) and reclaiming the airline it originally founded in 1932 as Tata Airlines. India had nationalized the airline in 1953.

Tata’s plan includes integrating Air India with its other aviation ventures, Vistara, AIX Connect, and AirAsia India, to create a stronger, consolidated carrier. Tata Group has forced Vistara and AirAsia India to merge with Air India, and the entire fleet will operate under the Air India banner. The merger with Vistara, in particular, is expected to boost Tata’s presence in both domestic and international markets.

Tata’s ambitious push has increased competition in the space, with India’s largest airline, IndiGo, ordering 1,000 aircraft. IndiGo is a privately owned budget airline serving 62 percent of the domestic market.

Earlier this summer, hundreds of employees from Air India and Vistara went on strike canceling 175 flights due to new human resources policies put in by Tata from 2022.

An Air India plane

Expansionary Tata Group has been aggressively expanding across various sectors in recent years. In 2024, Tata Consultancy Services broadened its presence in Latin America, the Middle East, Africa, and Asia. Since 2023, Tata has invested heavily in high-tech manufacturing, including a $11 billion semiconductor facility, becoming the first Indian firm in Apple’s iPhone supply chain. The conglomerate has also acquired major global brands like Corus Steel, Land Rover, Jaguar, and Tetley since the early 2000s, making it a significant player in European markets.

Recently, Tata bought out minority investors in Tata Play, a satellite television company, aiming to grow the entertainment unit before its anticipated $1 billion IPO.

Tata stays true to its growth-by-acquisition strategy that has served it well for over 150 years. Its venture fund, expected to exceed $120 billion in coming years, has reportedly had an interest in industrial robotics and electric vehicles and may seek strategic acquisitions in the space over the next few years.

Board Changes Tata Sons have been having issues with the board since 2019: the board removed chairman Cyrus Mistry in 2016 but it was found that the board and predecessor Ratan Tata had been oppressive. This led to a slowdown in growth and, at this time, delayed the process of finding partners for Land Rover/Jaguar. Tata Sons is now seeing board members Bhaskar Bhat and Ralf Speth step down, plus various executives as FY24 winds down, though Bhat will stay on until Air India-Vistara closes down.

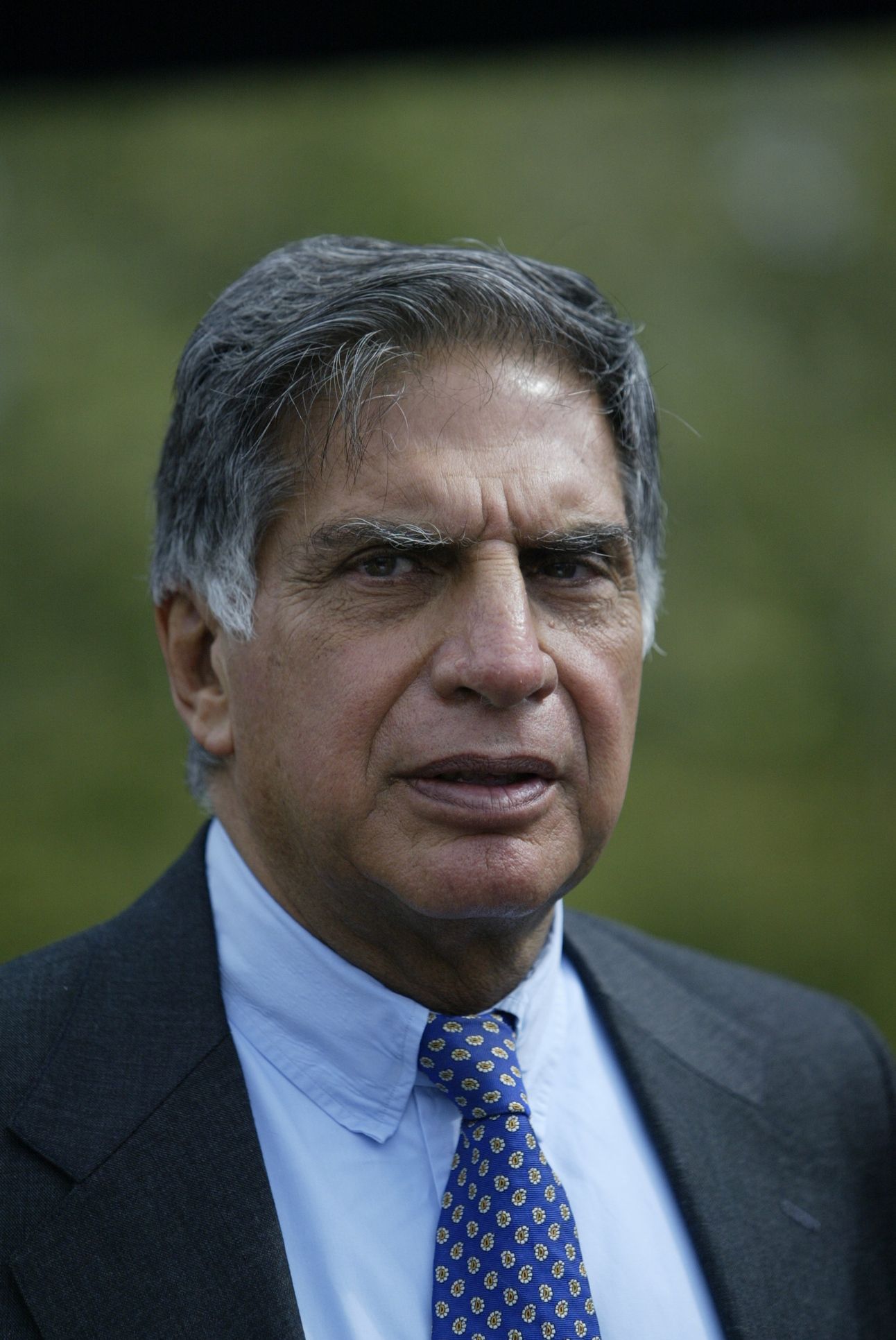

Ratan Tata, chairman emeritus of Tata Group

Macro

India eases registration for foreigners purchasing debt (BBG)

India will constitute 10% of JPM’s foreign credit index, up from 3% right now

August net inflow was $2.8B, the most since JPM first announced the debt inclusion

Smaller countries beating India in manufacturing, according to World Bank (BBG)

Trade in goods and services share in GDP has been dropping due to costs like tariffs, non-tariff barriers, and a lack of concrete trade pacts; Tiger countries like Vietnam and Thailand are leading

India’s deposit crunch seems similar to China’s past (BBG)

The central bank is similarly reining in inflation through money growth but this puts a hurdle on credit and investment

The government is also taxing savers aggressively while bankers do not pay savers enough

Equities

Zomato and Jio eye Nifty50 inclusion (BBG)

Odds for both companies rose after regulators approved rules for F&O eligibility

Nuvama Wealth Management expects both to be added to the derivatives segment

Alts

Oil and Natural Gas Corp. may set up a refinery in Uttar Pradesh (BBG)

ONGC is looking to set up a 9 million ton per year refinery in Prayagraj due to India’s surging petroleum consumption and development

ONGC is looking to partner with Bharat Petroleum as Bharat owns the land, expediting the process

India’s National Bank for Financing Infrastructure and Development is disbursing $17B in INR loans (BBG)

NaBFID is looking to finance various long-term projects with infra plays growing in India

Currently, 3.4% of GDP goes to infrastructure but NaBFID professionals believe 5-6% is required

Politics

India has an infra-spending gap of 4% plus small business funding (BBG)

The RBI’s deputy governor Michael Patra says that the infra-spending gap is 4% of GDP and private businesses will have to step into the center fold to achieve Indian growth

The country also needs over $2T for small, medium, and micro company funding, not just from banks

Oh, and the world’s tallest statue is the Statue of Unity, a 597-foot sculpture of Sardar Vallabhbhai Patel, an Indian freedom fighter and activist who served as the first Deputy Prime Minister.

Statue of Unity, Gujarat, India

See you next week.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

1 USD = 83.90 Indian Rupee