The United States’ 50 percent tariff on Indian imports takes effect. A new trifecta forms in the East. India’s diamond industry freezes.

If you have any questions about India, fill out this form or reach out to Shreyas at [email protected]

Macro

India saved an estimated $17 billion since 2022 by ramping up imports of discounted Russian oil, but new U.S. tariffs of up to 50 percent—which could slash Indian exports by more than 40 percent ($37 billion) this fiscal year—now threaten to wipe out those gains.

Tata Steel CEO T.V. Narendran said the U.S. tariff hike will barely affect India’s steel sector, though it could hit Tata Steel’s European operations and weigh more heavily on industries like textiles and gems and jewelery.

Equities

Indian equity markets closed today.

Alts

Indian steel producers are urging the government to raise low-ash metallurgical coke import quotas nearly sevenfold to 9.3 million metric tons, citing a critical supply crunch that threatens expansion plans. Currently capped at 1.4 million metric tons through December, the industry is seeking the bulk of additional imports from Indonesia, followed by Japan and Poland, as domestic output struggles to meet rising demand.

Air India Express, the low-cost subsidiary of Air India, has become the fourth Indian airline to join the International Air Transport Association, which represents 350 carriers handling 80% of global air traffic.

Policy

India has opened all gates of major dams in its Kashmir region after heavy monsoon rains, releasing around 200,000 cusecs of water and warning Pakistan of potential downstream flooding. Pakistani authorities, already grappling with severe monsoon damage that has displaced over 167,000 people and killed 802, have issued alerts for three rivers and mobilized the army for evacuation and relief efforts.

EU Trade Commissioner Maros Sefcovic is expected to visit India next month to review FTA talks with Commerce Minister Piyush Goyal as the 13th negotiation round concludes ahead of a year-end deadline.

Former Zillow exec targets $1.3T

The top companies target big markets. Like Nvidia growing ~200% in 2024 on AI’s $214B tailwind. That’s why the same VCs behind Uber and Venmo also backed Pacaso. Created by a former Zillow exec, Pacaso’s co-ownership tech transforms a $1.3 trillion market. With $110M+ in gross profit to date, Pacaso just reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Reach out to [email protected] to reach our audience and see your advertisement here.

1. Tariffs Take Effect as Scheduled

U.S. President Trump on April 2

The 50 percent tariffs on nearly all Indian imports kicked in this morning, as the White House had scheduled. It is among the highest tariffs imposed on the imports of all countries, composed of a 25 percent “reciprocal tariffs” announced as part of April 2nd’s “Liberation Day” tariffs and another 25 percent “secondary tariff” for continuing to import Russian oil.

The move comes after five failed rounds of negotiations and threatens to upend nearly 55 percent of India’s $87 billion in exports to the U.S., hitting key sectors like textiles, gems, leather, and chemicals. Exporter groups warn as many as 2 million jobs could be at risk, while competitors such as Vietnam and Bangladesh stand to benefit.

India has rejected Washington’s claim that it is financing Moscow’s war, calling it a double standard given U.S. and European trade ties with Russia. Officials in New Delhi say they will continue sourcing energy where it best serves national interests, while simultaneously exploring ways to cushion the blow. Plans under discussion include financial support, loan moratoriums for exporters, and redirecting trade toward the U.K., Australia, and the UAE, where agreements already exist.

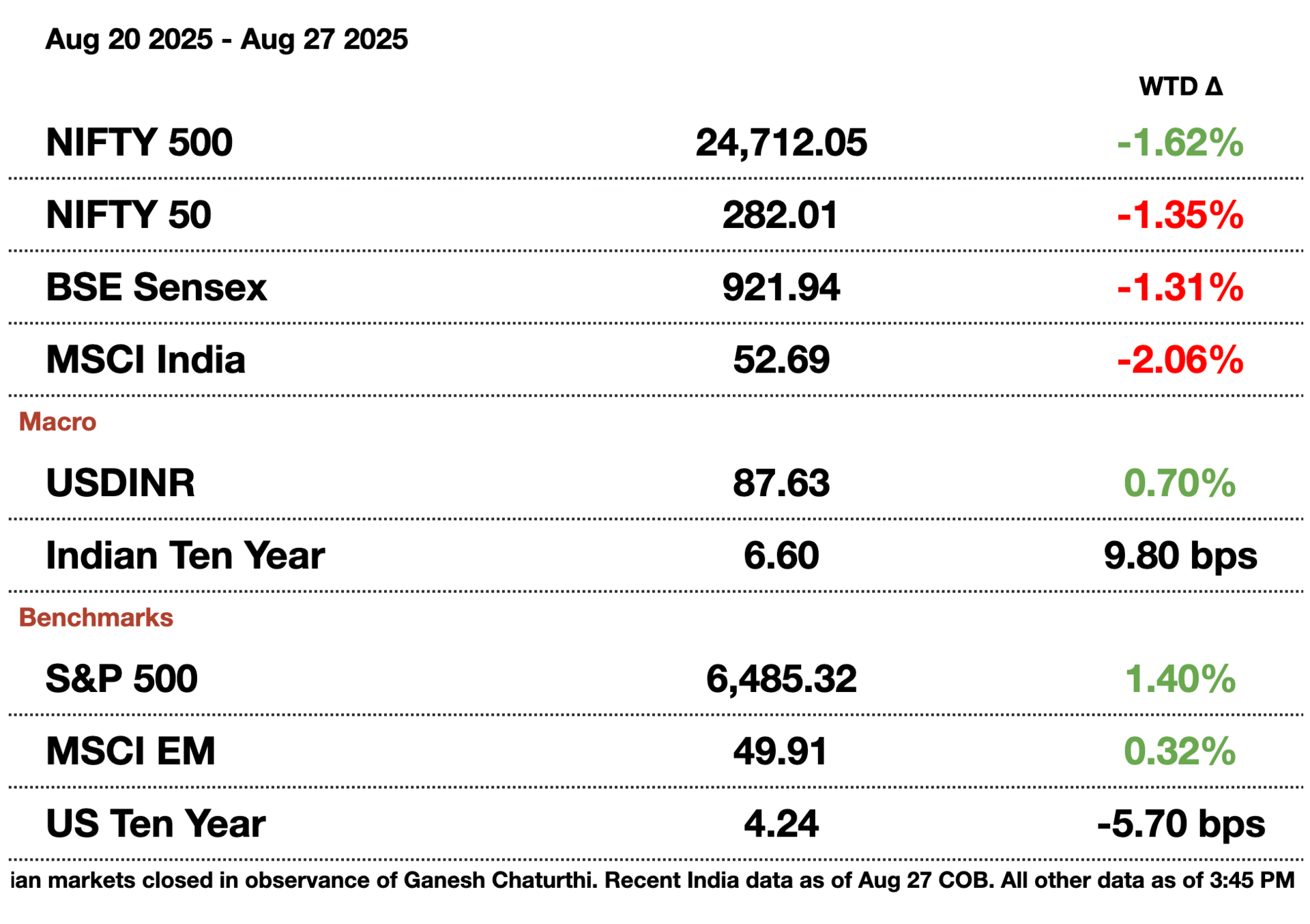

Markets are unhappy. Indian equities saw their steepest drop in three months, and the rupee has been on a five-day losing streak. Analysts caution that the tariffs could dent India’s positioning as a manufacturing alternative to China, particularly in electronics and smartphones. Still, they note that India’s diversified export base, resilient domestic demand, and stable corporate earnings could help absorb the shock.

With two-way trade at $129 billion and a U.S. deficit of nearly $46 billion, both sides have much at stake. For now, India is bracing for short-term pain while betting its long-term growth story remains intact.

2. A New Trifecta

World leaders at 2024 BRICS Summit

China’s Xi Jinping will invite India’s Modi and Russia’s Putin to Tianjin, China for a meeting to show solidarity with nations heavily sanctioned by the United States. The move is part of Xi’s invitation to 20 world leaders to the Shanghai Cooperation Organization (SCO) summit, set to be the largest gathering since the group’s founding in 2001.

This will be Modi’s first visit to China in seven years, a strong signal to the world about his shifting allegiances and a desire to warm ties with the nation after a 2020 border dispute shut down diplomacy between the two countries.

Analysts suggest India and China could announce incremental steps—troop withdrawals, easing of trade and visa rules, and new areas of cooperation like climate and people-to-people engagement. Modi’s priority, officials say, is maintaining momentum in this détente, particularly as tariff disputes with Washington intensify.

Putin plans to secure high-level platforms despite ongoing Western isolation. He is expected to remain in China for a World War Two military parade, extending a rare trip abroad.

Still, questions linger over the SCO’s effectiveness. Originally a Eurasian security bloc, it has expanded to 10 members and 16 observers, with ambitions ranging from counterterrorism to economic integration. Yet its implementation remains “fuzzy,” as one analyst put it—dogged by India-Pakistan frictions and disagreements on global conflicts.

For Xi, it likely doesn’t matter. As one observer noted: “This summit is about optics, really powerful optics.”

3. India’s Diamond Industry Freezes

Surat Diamond Bourse

Unveiled in 2023, the Surat Diamond Bourse became the world’s largest office complex, located in Gujarat, India. Larger than even the Pentagon, it was designed to showcase India’s growing role in global trade—particularly in diamonds, which account for nearly a fifth of the country’s exports and make India the world’s largest diamond exporter.

Yet, today, nine towers stand largely empty. Of more than 4,700 offices sold, fewer than 250 are in use, as exporters rethink expansion plans amid one of the industry’s toughest downturns in decades.

India’s diamond exports, worth $28.5 billion annually, have plunged to a 20-year low on weak Chinese demand. The 50 percent tariff on all Indian imports threatens to make Indian diamonds completely uncompetitive in the world’s largest consumer market for diamonds, the United States.

Some larger firms are exploring a shift to Botswana, which faces a lower 15 percent U.S. tariff, while American buyers are already diversifying toward Israel, Belgium, and Africa. Industry groups warn that 150,000–200,000 Indian jobs could be at risk.

At what should be peak season, demand has collapsed. The slowdown has rippled through Surat, where 80 percent of the world’s rough diamonds are cut and polished.

How would you rate today's newsletter?

See you tomorrow.

Written by Eshaan Chanda & Yash Tibrewal. Edited by Shreyas Sinha.

Sponsor the next newsletter to reach tens of thousands of U.S.-based business-savvy professionals. Reach out to [email protected].

Could your business use expert insights to power growth in India? Reach out to [email protected] for a free introductory call.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.