Hello. India’s unemployment rate is at a moderately low 4.7% — so then why is unemployment the largest concern among the country’s voters, with a Reuters survey finding most economists agree it is the most pressing challenge facing the country? We’ll discuss India’s structural unemployment crisis, along with why the fear of volatility is rising in Indian equity markets, and close with Gupshup, a round-up of the most important headlines from the week.

Also, Adam Sandler was the highest-paid U.S. actor of 2023, raking in $73 million. Who was the highest-paid Indian actor? (Answer at bottom)

Share your feedback on this newsletter here.

Markets

Equities | Last Close | 1 Week | YTD |

|---|---|---|---|

NFTY | 275.86 | 1.79% | 5.85% |

FLIN | 38.83 | 1.94% | 11.42% |

MSCI EM | 1082.98 | -1.72% | 6.55% |

SP500 | 5304.72 | -0.06% | 11.85% |

MSCI India | 54.07 | 1.79% | 11.10% |

Other | Last Close | 1 Week | YTD |

|---|---|---|---|

USDINR | 83.102 | -0.23% | -0.10% |

EURINR | 90.335 | -0.16% | -1.96% |

Gold | 2357.5 | -1.17% | 13.70% |

Coal (Spot) | 142.8 | -0.14% | 8.26% |

Indian 10YR | 6.998 | -9.70bps | -18.00bps |

U.S. 10YR | 4.46 | 8.50bps | 52.40bps |

Quick Appendix: NFTY is a weighted average of the largest 50 companies listed in the National Stock Exchange of India by market capitalization. FLIN, or Franklin TSE India ETF, tracks large and mid-cap companies, weighted by market cap, to give international investors exposure to Indian markets. MSCI EM is an index that captures large and mid-cap companies across 24 emerging market countries and covers 85% of the free float-adjusted market capitalization in each country. SP500 is the index of the 500 largest companies listed in U.S. stock exchanges by market cap. MSCI India is an index that covers 85% of the Indian equity universe.

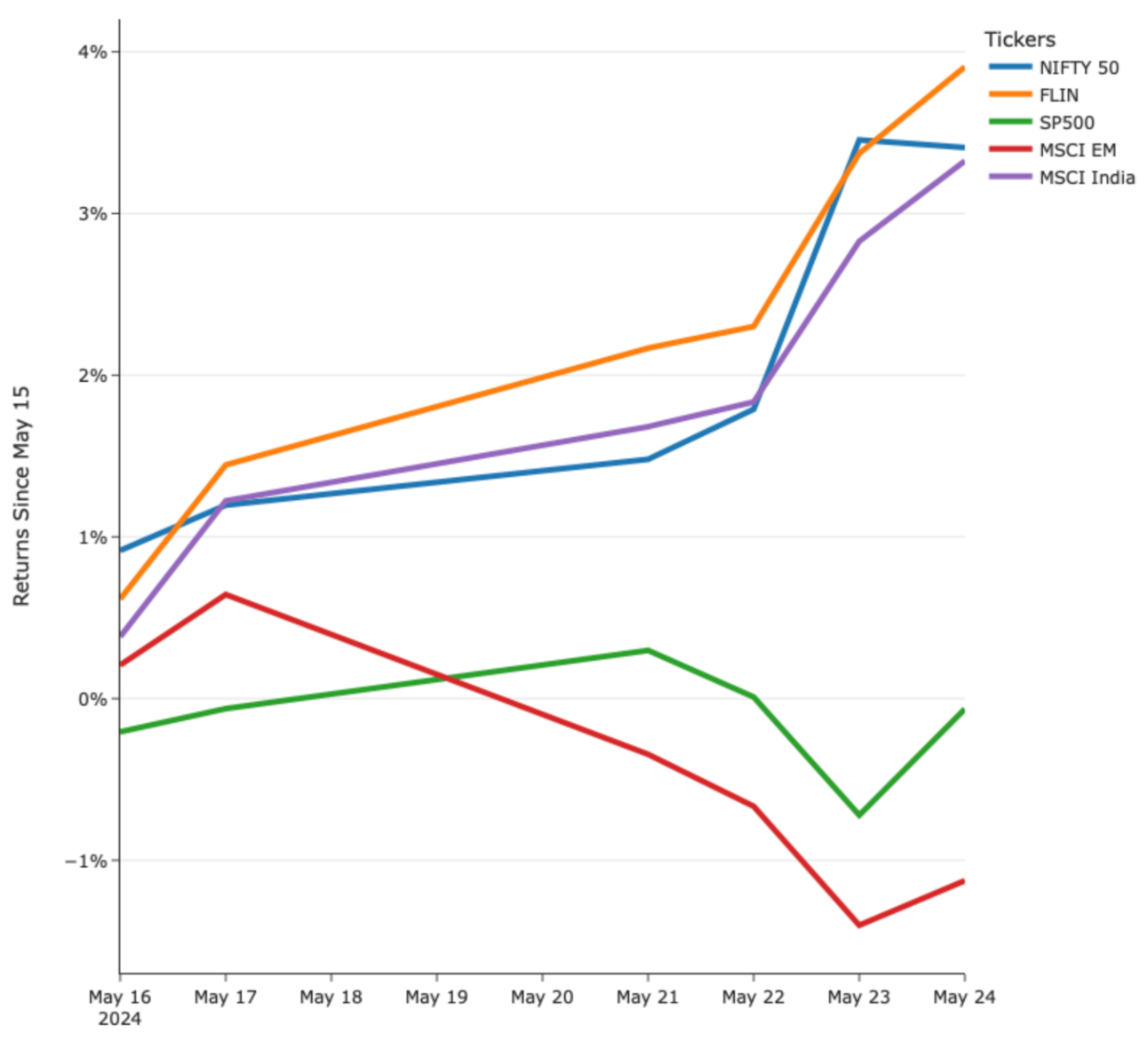

India’s “Fear Index” Inches Upward

The Indian VIX, a popular “fear gauge,” which measures expected future volatility similar to the standard VIX, rose over 100% to 20.36 until May 13th. High CPI prints in the United States causing the Federal Reserve to maintain “higher-for-longer” rates have made EM investment less attractive as yields on safer U.S. treasuries and credit remain high.

Additionally, Prime Minister Modi’s promise to turn India into a developed country by 2047 hinges on 400 seats in the Lok Sabha, but lower-than-expected voter turnout makes the spending frenzy less likely.

Over the last five quarters, Nifty50 stocks have reported 12% growth in net profit; while this would be unprecedented for many economies in the neighborhood, it is considered too slow for Indian investors used to and expecting high growth.

Still, most analysts at banks, such as Mitsubishi UFG, view any potential BJP victory (almost a certainty) as something that should balance markets.

Unemployment Is Largest Concern for India, Economists and Voters Say

One of India’s top universities where one-third of graduates could not find jobs

A Reuters survey of economists found the majority to say that the biggest challenges for the Indian government post-election will be addressing unemployment. This is matched with sentiment on the ground: a CSDS-Lokniti survey found the largest concern for voters is unemployment, with 29% saying it was their foremost voting issue.

While India enjoys a moderately low unemployment rate of 4.7% in 2023, significantly lower than 8% a decade ago, half of India’s working-age population is out of work, as seen in the country’s starkly low labor force participation rate of 51%. For context, China has a 76% participation rate, while the United States’ is 62%. Partially driven by India’s inability to get women in the workforce — 25% of India’s women work, while even neighboring Pakistan and Bangladesh have higher labor participation rates from women — India also struggles to employ workers that are too low-skilled for the service economy (think technology and IT) jobs the country’s leaders hope will drive employment growth; India’s literacy rate is 74% compared to China’s 97%.

However, India also struggles to attract high-paying jobs for its fast-growing educated populace. India’s premier technology universities located in major metro hubs, called IITs, graduate some of the most talented youth of the country. Still, over 1 of 3 IIT graduates were unable to find a job in 2024.

Another telling sign of India’s employment crisis is that low-paying civil service jobs (called “peons”), which require no more than an elementary school education, often receive millions of applications from those far too qualified. When the northern Indian state Uttar Pradesh posted a job for 368 peon jobs; 2.3 million applied, including thousands of PhD holders. In another case, hundreds of doctors and lawyers were interviewed for a peon job in the northwestern Indian state of Rajasthan.

This is largely driven by what experts call a decade of “jobless growth.” In an interview with Fareed Zakaria GPS, former RBI chair Raghuram Rajan said that India’s economy is driven by a “population dividend.” India’s GDP growth, which still lags behind other countries’ peaks like China, Taiwan, and South Korea at 10%, is far more attributable to a fast-growing population than it is to wealth creation. India’s GDP per capita has grown more slowly than Thailand, Indonesia, or Bangladesh since 1970.

Macro

Gold on Track for Further Correction as Rate Cut Odds Dwindle (ET)

Gold, which Indians stockpiled $1.3 trillion of their individual wealth into in 2020, is down 3% from an intra-week high of over 2,400

High rates make gold less attractive as an inflation hedge when investors can receive a risk-free 5% yield on U.S. Treasuries

The Federal Reserve’s “higher-for-longer” stance on rates hurts gold prices

India Meteorological Department predicts June-September rain season will be 106% of long-term average (BBG)

Such reports are bullish for India’s high agriculture-dependent economy

BlackRock analysis finds that as the working-age population grows, so does the country’s share-price valuations (BBG)

India and Indonesia's populations are set to grow by 5.08% and 4.41% by 2030, respectively, compared to China’s -0.71% and G7’s 0.86% for the same period

Google (NASDAQ: GOOG) to Manufacture New Pixel 8 in Tamil Nadu Foxconn Facility (BBC)

U.S. and Indian leaders hope this signifies a move away from dependency on China as a manufacturing hub

Equities

Adani Energy (NSE: ADANIENSOL) Gets Board Approval to Raise Up to $1.5 Billion (BBG)

It still needs approval from others, including shareholders

Five of ten billionaire Gautam Adani’s publicly traded firms have climbed to pre-Hindenburg levels

Reliance Industries (NSE: RELIANCE), Owned by Billionaire Mukesh Ambani, Enters Africa Market (BBG)

Radisys Corp, a U.S.-based company creating technologies for telecommunication companies in mobile networks, owned by Reliance via its subsidiary Mumbai-based Jio Platforms, inked a deal with Ghana’s ‘Next-Gen InfraCo.” (NGIC) to create Africa’s first 4G and 5G mobile broadband, as per a press release.

Ghana, in West Africa, has given exclusive rights to NGIC to develop 5G services for the country for a decade, with a license valid for 15 years

NGIC will spend $145 million in capex over the next three years

Vedanta Ltd. (NSE: VEDL) is considering a share sale that may raise $1 billion (BBG)

Hyundai plans IPO for its India Unit (Yahoo)

India’s second biggest car manufacturer continues to plan what may be a $2.5-3 billion dollar raise rivaling India’s largest IPO of Life Insurance Corp at $2.5 billion

Kotak Mahindra and Morgan Stanley have joined the bank consortium which already included Citi, JP Morgan, and HSBC in preparation for the June filing

Credit

India’s REC (NSE: RSELTD) is accepting bids of $602 million for its bond issuance (ZAWYA)

REC is a state-run power and energy conglomerate

India’s Long-Duration Bonds Grow in Popularity Worldwide (Business Standard)

Global investors have sold off $1.41 billion worth of Indian government bonds in the last 10 weeks, opting for longer-duration options

The practice of riskier derivative hedging by both sovereign and corporate entities persists, with the issuance of total return swaps (which involve exchanging asset flows for financing costs) continuing to grow

Yields Ease by 25bps for Low-Rated Indian Bond Issuers (Money Control)

Yields on corporate bonds rated AA and below have fallen by 25bps in the last 6 months

Many investors are now jumping in to lock in yields as the RBI’s new investment guidelines, effective April 1, 2024, removes ceiling on corporations looking to hold held-to-maturity assets in their reserves

Politics

India hosts Phase 6 of the seven-part national election on May 25th (LiveMint)

Average voter turnout was 60%, with the highest turnout in West Bengal at 78.27%

Constituencies in Bihar, Haryana, Jharkhand, Odisha, Uttar Pradesh, West Bengal, and Delhi attended polls

Modi’s Campaign Uses Welfare Handouts to Increase Voter Turnout (New York Times)

In a nation where 95% of residents are too poor to file income taxes, Modi’s $142 billion food welfare program and $76 billion in direct cash transfers are a powerful tool for him to convince voters

Consider sharing this newsletter with three friends.

We need your feedback to make this newsletter more useful to people like you. Please let us know what you think here.

Oh, and the highest-earning Bollywood actor of 2023 was Shah Rukh Khan.

See you next week.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

1 USD = 83.12 Indian Rupee