State governments have taken on record levels of debt, today we discuss what this means for India’s bond market.

We’ll be off tomorrow for Christmas!🎄

If you have any questions about India, fill out this form or reach out to Shreyas at [email protected]

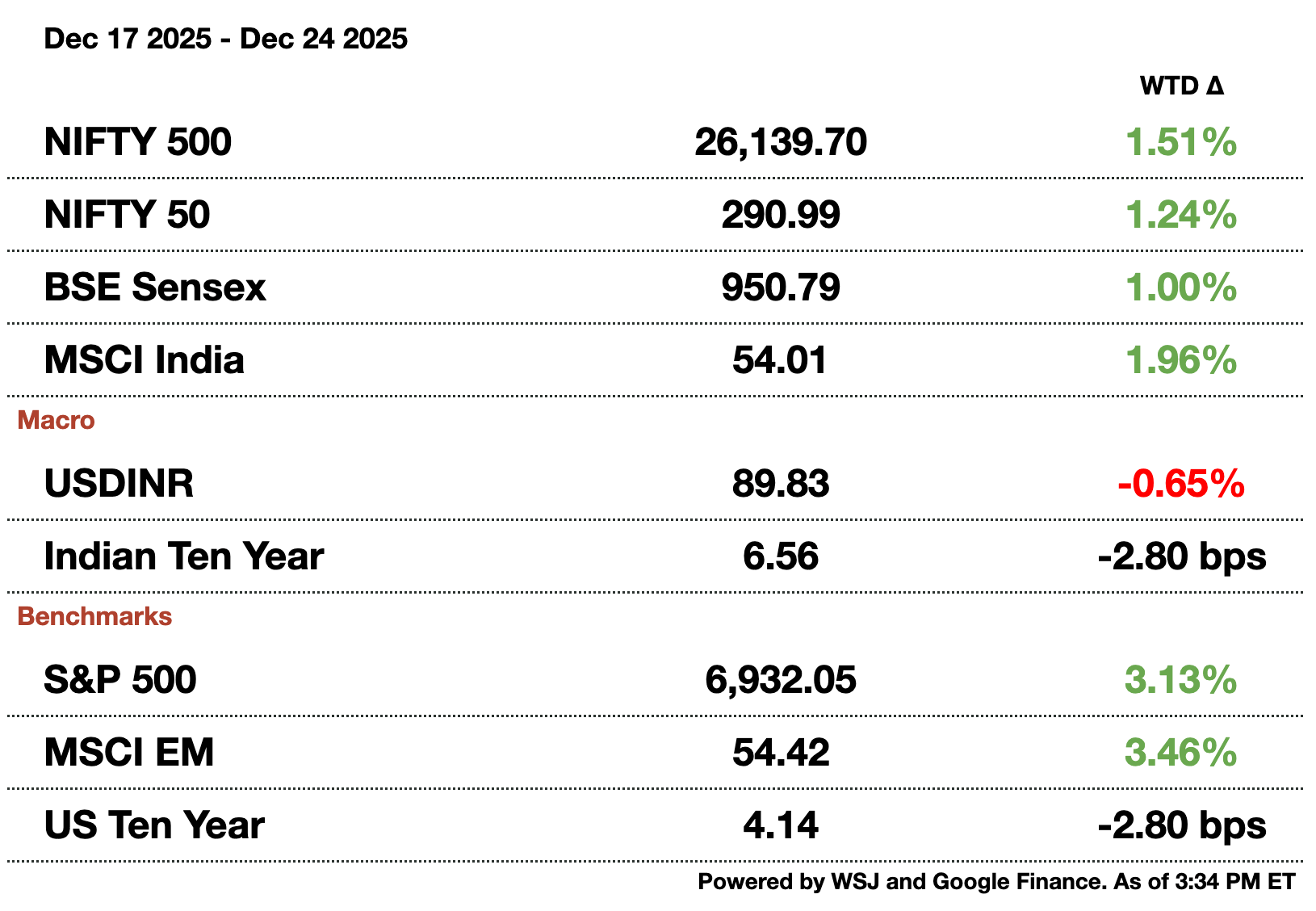

Macro

The RBI carried out further FX swaps, in an unknown currency amount, to reduce lending rates. The bank bought dollars from regional banks and sold rupees in order to cool lending rates to 5.80 percent from 6.99 percent. The interest rise was due to the RBI buying rupees, restricting lending, to strengthen the currency.

India's largest refiner, Reliance, is importing Russian crude again for its 660,000 barrels per day Jamnagar refinery. Reliance had stopped Russian imports on October 22, but the wide discount was too enticing. This will likely lead to India’s 800,000 barrels import prediction to be massively understated.

Bonds are rallying on the RBI's $22 billion (₹2 trillion) bond purchase and $10 billion (₹890 billion) FX swap plan.The 10-year fell to 6.54 percent amid the ‘shock-and-awe’ plan. The goal is to push rates down to 6.50 percent and further, though this offsets rupee boosting swaps completed earlier in the month.

Equities

Tata's Jaguar plans to add 5 new EV options and 1 million chargers to India by 2030. Tata launched a new brand (Avinya) and SUV to pursue this goal. Tata’s share in the EV market has dropped from 59 percent to 35 percent, with their revenue share of the total market being just 17 percent.

Alts

Toy manufacturers like Micro Plastics Pvt. show how tariffs affect Indian manufacturing. It had signed contracts with Hasbro and Mattel but has since then lost existing and new contracts; the company is sitting on $35 million (₹3.1 billion) of manufactured toys it cannot export.

Haier is selling 49 percent of its Indian unit to Bharti and Warburg Pincus.The deal was done for about $2 billion (₹178 billion). The move is to help navigate regulatory hurdles while deepening local sourcing, manufacturing, and selling. Revenue in South Asia grew 25 percent y-o-y for the company.

Policy

Protesters on climate are focused on Aravalli hills due to court orders allowing mining. The Supreme Court defined the hills as only landforms taller than 300 feet. This technicality allows for mining and other biodegradation at any level below that which would impede prior conservation projects in the region.

A US Judge just upheld Trump's $100,000 (₹8.9 million) H1-B fee. Another change to keep in mind is Homeland Security’s new weighted selection procedure rather than a random lottery. The actions should curb wage arbitrage and protect American workers, but will cost firms more while increasing uncertainty for foreign students and current employees.

Start investing right from your phone

Jumping into the stock market might seem intimidating with all its ups and downs, but it’s actually easier than you think. Today’s online brokerages make it simple to buy and trade stocks, ETFs, and options right from your phone or laptop. Many even connect you with experts who can guide you along the way, so you don’t have to figure it all out alone. Get started by opening an account from Money’s list of the Best Online Stock Brokers and start investing with confidence today.

Reach out to [email protected] to reach our audience and see your advertisement here.

State Govts’ Debt Up to Record Levels

India’s government bond market is under new pressure due to state government borrowing increasing to record levels. States are projected to borrow $50.6 billion (₹4.5 trillion) in 1Q26, a 60 percent jump q-o-q and a pace which would lead to a record issuance for the fiscal year ending in March 2026. The aggressive borrowing creates another problem for the RBI which will have to combat higher interest rates (even with rate cuts).

States are selling more debt due to slowing tax revenue and higher state spending; the combination has led to borrowing to be 20 percent higher this FY compared with 2024. The higher supply is not being met with equal demand either. Investors are reluctant to commit capital at low yields, forcing states to offer higher yields to clear auctions which is lifting borrowing costs across the broader bond market. Shorter-term traders are following suit by also asking for higher yields. .

Nationally, India’s 10 year government bond yield climbed to a nine month high of 6.68 percent after states announced a larger than expected bond sale. Major state issuers like Power Finance Corp are now canceling their own offerings which could even hamper large infra projects from being completed. Yields on state development loans have risen sharply in recent months, widening spreads over federal debt and weakening the transmission of monetary policy.

This dynamic is also undermining the RBI’s easing efforts. Despite 125 basis points of rate cuts and large liquidity injections this year, the benchmark 10 year yield has fallen only modestly, while yields on top rated corporate bonds have actually risen. Heavy issuance of longer-tenored state debt is absorbing investor capacity and crowding out private borrowers, pushing up funding costs for banks and companies. State bonds are relatively illiquid, discouraging foreign investors and global banks, while domestic institutions face exposure limits. With a narrow buyer base, spreads are likely to remain under pressure.

Looking ahead, gross state borrowing could rise to as much as $151.7 billion (₹13.5 trillion) next FY, potentially exceeding federal net borrowing once central bank bond purchases are adjusted for.

How helpful was today's newsletter?

See you tomorrow.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Sponsor the next newsletter to reach tens of thousands of U.S.-based business-savvy professionals. Reach out to [email protected].

Could your business use expert insights to power growth in India? Reach out to [email protected] for a free introductory call.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.