Trump threatens “secondary sanctions” on Russian oil buyers like India. Jane Street ban causes derivative market to experience a sharp decline. India’s state-run Oil and Natural Gas Corporation looks to expand in Gujarat.

If you have any questions about India, fill out this form or reach out to Shreyas at [email protected]

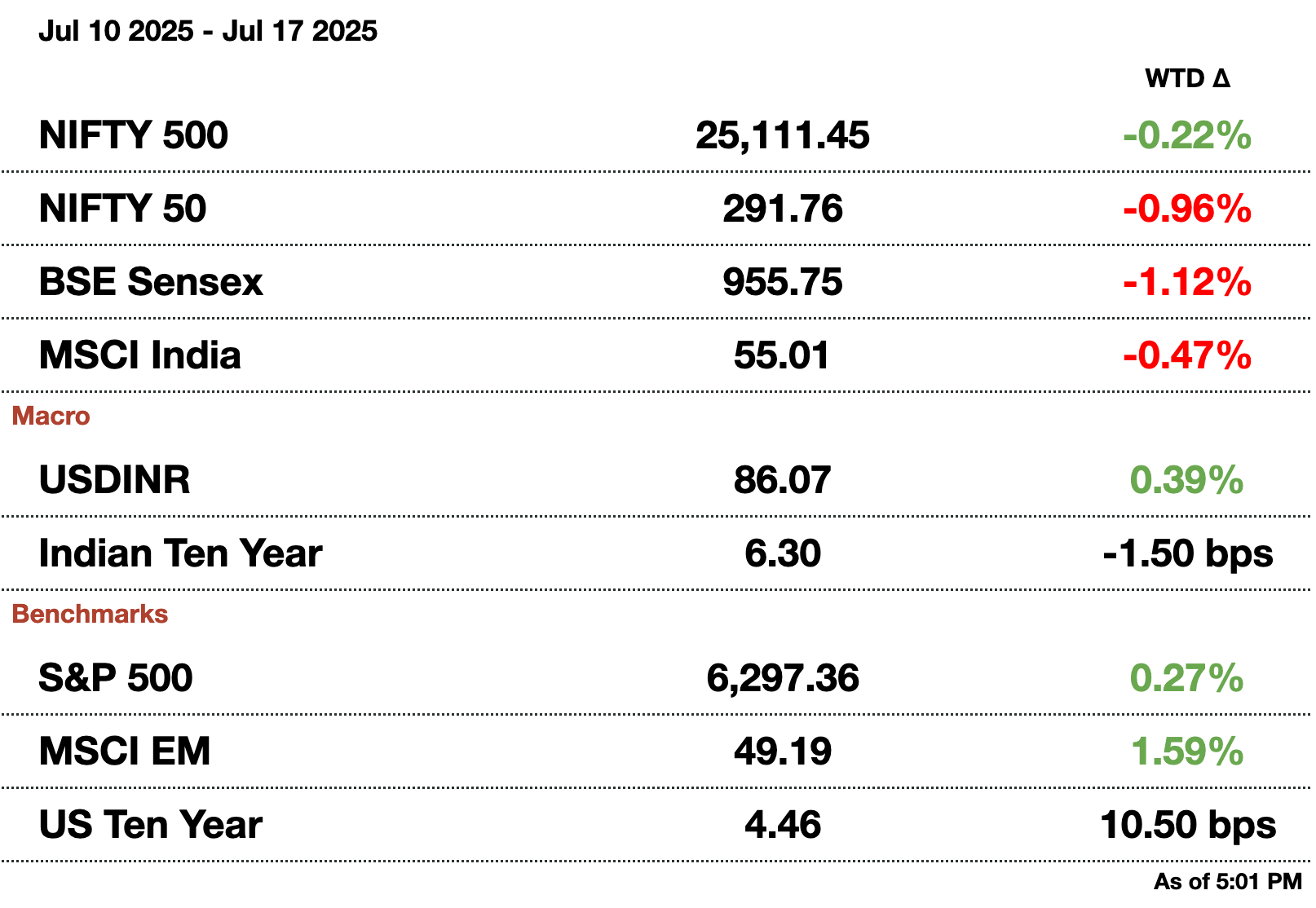

Macro

Indian software exporters remain the worst performers, with the Nifty IT index lagging for three straight quarters due to weak earnings. Despite broader market optimism, the sector’s sluggish results have deepened concerns, though technical indicators suggest downside may be limited.

Emerging Asia bonds are gaining appeal as U.S. tariffs shift production to local markets, helping contain inflation. Subdued price pressures and attractive real yields are drawing investors to regional government debt.

The Indian rupee slipped to a three-week low, breaching the 86 mark against the U.S. dollar due to a stronger dollar globally. However, export dollar sales and foreign inflows helped limit further losses.

Equities

WeWork India has begun marketing a $407 million (₹35 billion) IPO, aiming to launch in August. The offering includes share sales by Embassy Buildcon and 1 Ariel Way Tenant amid rising demand for flexible office space.

Axis Bank reported a nearly 4 percent drop in quarterly profit as bad loans surged to $953 million (₹82 billion) following a one-time benchmarking exercise. The rise in slippages was mainly due to issues in its unsecured retail lending, particularly credit overdrafts.

DLF has launched its premium residential project "Westpark" in Mumbai and is considering nearly 20 partnership proposals as it returns to the city after over a decade. The development involves redeveloping a slum area, a common strategy in Mumbai's land-scarce real estate market.

Shoppers Stop narrowed its quarterly loss to $1.83 million (₹157.4 million) as strong demand for luxury watches, perfumes, and apparel boosted sales. Premium products accounted for 67 percent of revenue, reflecting continued spending by affluent consumers.

Alts

Adani Enterprises will receive $1.3 billion (₹108.7 billion) from selling its remaining stake in AWL Agri Business to partner Wilmar and other investors. The move aligns with Adani’s strategy to focus on core infrastructure sectors like renewables and airports.

A cockpit recording from Air India Flight 171 shows the junior pilot questioning the captain about switching off the fuel supply just before the fatal crash. Investigators are probing whether it was a system failure or human error.

Policy

U.S. solar makers have filed trade petitions against India, Indonesia, and Laos, alleging Chinese-owned firms are dumping solar products. The case could lead to new tariffs and further disrupt the global solar supply chain.

The Quad nations (the US, Australia, Japan, and India) met in New Delhi to discuss strengthening and securing undersea communication cables amid rising sabotage and cyberattack threats. Submarine cables, vital for global internet traffic, are a key area of regional cooperation.

1. Is India Prepared to Maintain Oil Security Amid Possible Russian Oil Sanctions?

India’s Oil Minister Hardeep Singh Puri said the country is fully prepared to handle potential U.S. secondary sanctions on Russian oil, citing India’s broad supplier base and growing domestic production efforts. His comments came after President Trump threatened sanctions against nations continuing trade with Russia if a peace deal with Ukraine is not reached within 50 days.

India currently sources about 35 percent of its crude oil from Russia, the largest share among all suppliers, but Puri emphasized that India now buys oil from 40 countries, up from 27 before the Ukraine war. Newer suppliers like Guyana and expanded imports from Brazil and Canada are expected to bolster India’s energy resilience.

Indian Oil Corp echoed this confidence, noting that India could revert to its pre-war import model where Russian crude made up less than 2 percent of supplies. Private refiners like Reliance and Nayara currently handle nearly half of India’s Russian crude imports.

With energy security a strategic priority, India has also ramped up domestic exploration and output. Officials reaffirmed that sourcing decisions are guided by market realities, not geopolitics, cautioning against “double standards” from the West.

While secondary sanctions could raise short-term costs, India’s diversified energy strategy is expected to cushion any potential disruption, underlining its pragmatism in navigating a volatile global energy landscape.

2. Jane Street Ban Causes Deritivate Market to Falter

India’s equity derivatives market has experienced a sharp decline in activity following the July 4 ban on U.S.-based trading giant Jane Street by the Securities and Exchange Board of India (SEBI). Weekly index options turnover on the NSE dropped 36 percent in the past two weeks, with similar declines on the BSE. Jane Street, a key liquidity provider, was accused of manipulating index levels through derivatives trading.

Market participants say the drop is not solely due to Jane Street’s exit but also reflects a broader lull in volatility. India’s volatility index has hovered near its lowest point in over a year, further dragging down options volumes. Analysts warn that without new market makers or a rise in volatility, turnover may not recover soon.

Amid this disruption, SEBI is pushing structural reforms to improve market quality. In a speech this week, SEBI official Ananth Narayan highlighted the regulator’s intent to extend the tenure of derivatives contracts and reduce the dominance of short-term trading. He pointed to research showing that 91 percent of individual traders lost money in F&O trading in FY25, underscoring the need for longer-term, capital-formation-driven products.

These developments signal a critical shift for Indian markets, with regulators aiming to reduce speculation and strengthen institutional depth, changes that could reshape India’s fast-growing but risk-heavy derivatives landscape.

3. India’s ONGC Eyes Major Oil Refinery Expansion in Gujurat

India’s state-run Oil and Natural Gas Corporation (ONGC) is conducting a pre-feasibility study for a large refinery project in Jamnagar, Gujarat, with a proposed capacity of 200,000–240,000 barrels per day, according to a company source. The move aligns with India’s broader strategy to position itself as a global refining and energy hub, amid growing domestic demand and shifting geopolitical energy dynamics.

The proposed project would significantly bolster ONGC’s downstream footprint, which has traditionally been smaller compared to private refiners like Reliance Industries, whose massive Jamnagar complex is already among the world’s largest. If greenlit, the new refinery could complement India's ambitions to expand refining capacity and enhance energy security as it navigates supply uncertainties, such as potential sanctions on Russian crude.

India is the world’s third-largest oil consumer, and expanding domestic refining infrastructure is key to managing import dependency and supporting industrial growth. ONGC’s plan also comes amid increasing upstream activity, including a recent pact with BP for drilling stratigraphic wells, an effort to boost domestic exploration and production.

The proposed Gujarat refinery would strengthen India’s refining corridor on the west coast and enhance its ability to serve both domestic and export markets, particularly as the country adapts to volatile global energy flows and evolving trade dynamics.

How would you rate today's daily briefing?

See you tomorrow.

Written by Eshaan Chanda & Yash Tibrewal. Edited by Shreyas Sinha.

Sponsor the next newsletter to reach tens of thousands of U.S.-based business-savvy professionals. Reach out to [email protected].

Could your business use expert insights to power growth in India? Reach out to [email protected] for a free introductory call.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.