Good afternoon,

Welcome to the best way to stay up-to-date on India’s financial markets. Here’s what’s in today’s newsletter:

India’s rural economy may emerge as a crucial support for consumer companies this quarter,

India’s auto industry is bracing for a high-stakes clash with policymakers because of “overly aggressive” carbon emission standards,

and Prime Minister Narendra Modi will place supply security for critical minerals at the heart of his upcoming five-nation tour.

Then, we close with Gupshup, a round-up of the most important headlines.

Have a question you want us to answer? Fill out this form, and you could be featured in our newsletter.

—Shreyas, [email protected]

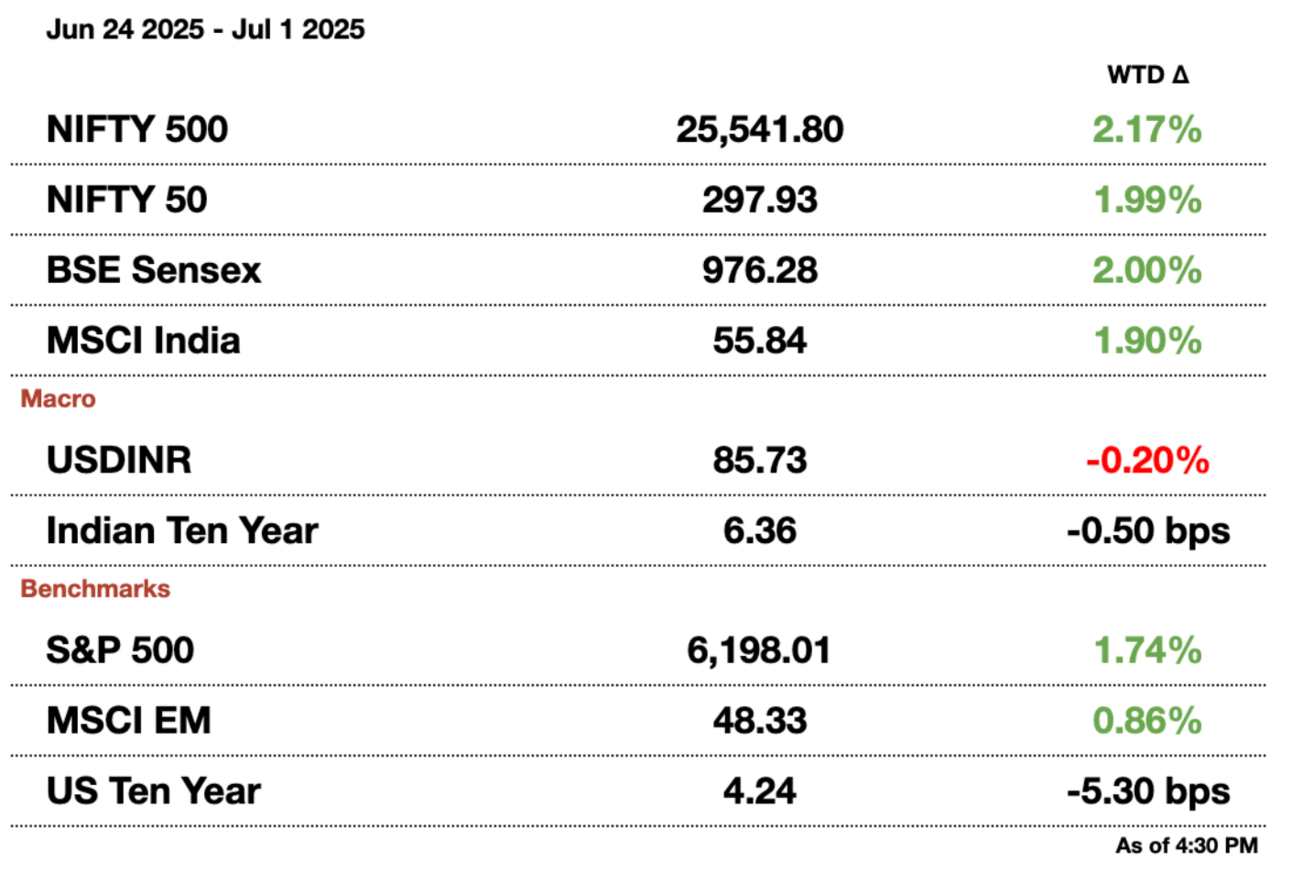

Market Update.

Rural Demand to Lift Indian Consumption.

India’s rural economy may emerge as a crucial support for consumer companies this quarter, offering a bright spot in an otherwise mixed macro landscape. As first-quarter earnings roll in, analysts expect rural markets to cushion the impact of sluggish urban demand and erratic weather patterns that have weighed on sales in recent months.

Nomura forecasts a 6.7 percent year-on-year revenue uptick for consumer staples firms, outpacing the average growth of the past eight quarters, driven largely by resilient rural spending. With food inflation moderating and the early monsoon benefiting farm sentiment, rural households could keep consumption steady even as urban centres grapple with inventory gluts and softer discretionary spending.

This boost comes at a time when other pockets of India’s economy are showing signs of cooling. Passenger vehicle sales are projected to decline by 5 percent in June as auto dealers struggle with excess stock and subdued footfall. Competitive pressures in the paints sector, too, are intensifying, adding to margin worries for manufacturers.

Yet, the rural upturn highlights India’s still-diverse domestic demand base, a key macro pillar as the Reserve Bank of India maintains an accommodative stance to sustain growth. For policymakers, rural consumption remains a vital buffer against external headwinds, underscoring the sector’s role in India’s broader economic resilience as it navigates a patchy global recovery.

Automakers vs. Policymakers.

India’s auto industry is bracing for a high-stakes clash with policymakers as the government moves forward with what automakers are calling “overly aggressive” new carbon emission standards. Under draft plans for the third phase of the Corporate Average Fuel Efficiency norms, India aims to slash passenger vehicle emissions by 33 percent by 2027, more than double its previous target.

Auto manufacturing in India

The Society of Indian Automobile Manufacturers warned that the steep cut could threaten the sustainability of the $137-billion (₹11.7 trillion) industry, which remains a key pillar of India’s manufacturing sector and job market. In a formal note to the power ministry, automakers flagged the risk of billions of rupees in penalties and the potential to stifle future investments.

Automakers are also resisting the government’s proposal to set different standards for smaller, lightweight cars compared to heavier models. Critics argue the split could unfairly benefit players like Maruti Suzuki, which dominates the compact car segment and is investing heavily in hybrids and compressed gas vehicles.

Industry lobby groups are urging the government to provide comparable incentives for hybrids, ethanol-blend cars, and gas-powered models, not just electric vehicles, to smooth the transition toward cleaner transport. Some stakeholders are also pushing for a more gradual 15 percent emissions reduction and a carbon trading mechanism to allow flexibility for firms that exceed targets.

India, one of the world’s biggest emitters, is also exploring a 2040 deadline to phase out sales of petrol and diesel vehicles, a move automakers say risks repeating Europe’s struggles with overly ambitious bans. The outcome of this regulatory battle could define India’s climate strategy in a sector vital for balancing decarbonization with economic growth and consumer affordability.

Critical Minerals to Top Modi’s Five-Nation Tour Agenda.

Prime Minister Narendra Modi will place supply security for critical minerals at the heart of his upcoming five-nation tour, as India looks to diversify away from China’s tightening grip on rare earth exports. The diplomatic swing through Ghana, Namibia, Brazil, Argentina, and Trinidad & Tobago marks a strategic pivot to secure vital inputs for India’s fast-growing industries, from electric vehicles to electronics.

Indian Prime Minister Narendra Modi

“We have achieved good progress in Argentina,” said Dammu Ravi, secretary for economic relations, highlighting new partnerships being explored by state-owned Khanij Bidesh India and NMDC in Africa and Latin America. These regions have emerged as natural partners for India’s resource ambitions amid Beijing’s escalating export restrictions.

With China, the world’s dominant rare earth supplier, increasingly weaponizing its mineral dominance for geopolitical leverage, Indian automakers and clean energy firms are particularly exposed to supply shocks. Coal India Ltd. and Khanij Bidesh already hold concessions in Latin America, but India is now in talks to expand its footprint in Argentina, Peru, and Bolivia.

The push underscores New Delhi’s broader macro strategy: building resilient supply chains and insulating key sectors from external risks. As India intensifies its energy transition and digital manufacturing ambitions, ensuring stable access to critical minerals is set to be a cornerstone of both its trade policy and its economic security doctrine.

Message from our sponsor.

Investment picks returning 200%+

AIR Insiders get weekly expert investment picks and exclusive offers and perks from leading private market investing tools and platforms. So if you’re looking to invest in private markets like real estate, private credit, pre-IPO venture or crypto, the time to join FOR FREE is now.

Email [email protected] to sponsor our next newsletter!

Gupshup.

Macro

India’s factory activity hit a 14-month high in June as booming export orders drove strong output and record hiring, HSBC’s PMI survey showed. Robust international demand, especially from the U.S., offset trade uncertainties ahead of key tariff negotiations.

India’s stock indexes were little changed on Tuesday as financials dipped after a strong run, while investors looked for signs of progress in U.S. trade talks ahead of the July 9 tariff deadline. Broader Asian markets rose on optimism around global negotiations.

The Indian rupee edged higher on Tuesday, supported by a weaker dollar and regional gains, as data showed the RBI’s FX forward book shrank due to maturing near-tenor swaps. The rupee has rebounded about 2.5 percent from its record low, with the central bank managing its dollar positions to steady the currency.

India’s annual monsoon has covered the entire country nine days ahead of schedule, boosting prospects for early planting of key summer crops. The stronger-than-usual rains, vital for half of India’s rain-fed farmland, are expected to support another year of above-average harvests.

U.S. and India are close to finalizing a trade deal to lower tariffs on American imports and help India avoid steep Trump-era levies set to rise next week, Treasury Secretary Scott Bessent said Tuesday. Indian negotiators extended their stay in Washington to resolve sticking points on duties for auto parts, steel, and farm goods before the July 9 deadline.

Equities

Indian auto parts maker Hero Motors has filed for an IPO of up to $140 million (₹12 billion), planning to raise funds to cut debt and expand its Uttar Pradesh facility. Backed by clients like BMW and Ducati, the company aims to strengthen growth despite a recent drop in annual profit.

India’s Apollo Hospitals plans to spin off and list its digital health and pharmacy unit within 18 to 21 months as part of a reorganization. Shareholders will get new shares in the entity, which is expected to generate nearly $3 billion in revenue by March 2027.

India’s antitrust regulator has launched a probe into Asian Paints after Grasim Industries accused it of abusing its market dominance by pressuring dealers into exclusivity. The investigation comes as competition heats up in India’s $8 billion paint market, with Grasim and others challenging the sector leader’s practices.

Alts

A fire and explosion at Sigachi Industries’ chemical plant in Telangana has killed at least 39 people, with dozens more injured, officials said Tuesday. The state government has launched an investigation as rescue teams continue clearing debris at the collapsed facility.

Apollo Global-backed Tenneco Clean Air India has filed for an IPO worth up to $350 million (₹30 billion), with its parent Tenneco Mauritius Holdings planning to sell shares. The auto-parts maker joins India’s booming IPO market as it looks to capitalize on strong investor interest despite a recent dip in revenue.

India’s NSE will launch monthly electricity futures trading from July 14, aiming to help power utilities better manage costs and secure stable prices. The move, following recent regulatory approval, marks a step toward modernizing how India’s energy sector handles demand and price fluctuations.

Policy

India is likely to finalize an interim trade deal with the U.S. as early as this week, the Financial Times reported, citing sources familiar with the negotiations. The move comes as both sides push to resolve key issues ahead of a looming tariff deadline.

India’s ties with the U.S. will be in the spotlight as External Affairs Minister Jaishankar joins his Quad counterparts in Washington for talks hosted by Secretary of State Marco Rubio. While the group aims to strengthen cooperation to counter China, India faces added friction over Trump’s tariff moves and other bilateral trade tensions.

India has extended import curbs on low-ash metallurgical coke for another six months, setting country-specific quotas and capping imports at 1.4 million tons through December. The move aims to boost local sourcing but has raised concerns among major steelmakers who rely on overseas supplies for preferred grades.

India has ended a key subsidy that helped drive its clean energy boom, requiring new solar and wind projects to pay 25 percent of inter-state transmission costs from July. The move could raise green power tariffs and push states like Karnataka to build more local projects, reshaping how renewable energy is developed nationwide.

See you Wednesday.

Written by Eshaan Chanda & Yash Tibrewal. Edited by Shreyas Sinha.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.