Good evening,

Welcome to the best way to stay up-to-date on India’s financial markets. Here’s what’s in today’s newsletter:

The Indian rupee saw a significant surge on Monday, rising to 85.50 against the U.S. dollar,

India's Nifty 50 index has bounced back from earlier losses this year, thanks to foreign investors buying stocks,

and India is set to hold its first-ever naval drills with several African nations this April, aiming to counter China.

Then, we close with Gupshup, a round-up of the most important headlines.

Have a question you want us to answer? Fill out this form and you could be featured in our newsletter.

—Shreyas, [email protected]

Market Update.

Rupee Wipes All Losses of 2025.

The Indian rupee saw a significant surge on Monday, rising to 85.50 against the U.S. dollar, erasing its losses for the year and marking levels last seen at the end of 2024. By the close of trading, the currency had strengthened 0.4 percent, settling at 85.64, a nine-day streak of gains. This rally was largely driven by persistent dollar sales from foreign banks and favorable inflows into Indian assets.

A notable contributor to the rupee's recent strength is the flow of dollars related to inter-company borrowings and the repatriation of corporate profits, which are common in March, the final month of India's financial year. Additionally, over $3 billion flowed into Indian bonds in March, boosting the rupee's position. Foreign buying of Indian stocks in recent sessions has further supported the currency.

In particular, a Mumbai-based trader noted that foreign banks were dominant sellers of the U.S. dollar, with little intervention from the Reserve Bank of India. This surprising shift also prompted exporters to sell dollars, adding to the momentum.

The Indian rupee’s performance has outpaced other Asian currencies this month, gaining 2.1 percent so far. Meanwhile, the benchmark Nifty 50 index also rebounded, gaining nearly 1.5 percent on Monday and recovering its 2025 losses. As India’s economy continues to benefit from strong foreign investment and an improving macroeconomic outlook, the rupee’s upward trend could persist, especially with expectations of further foreign capital inflows.

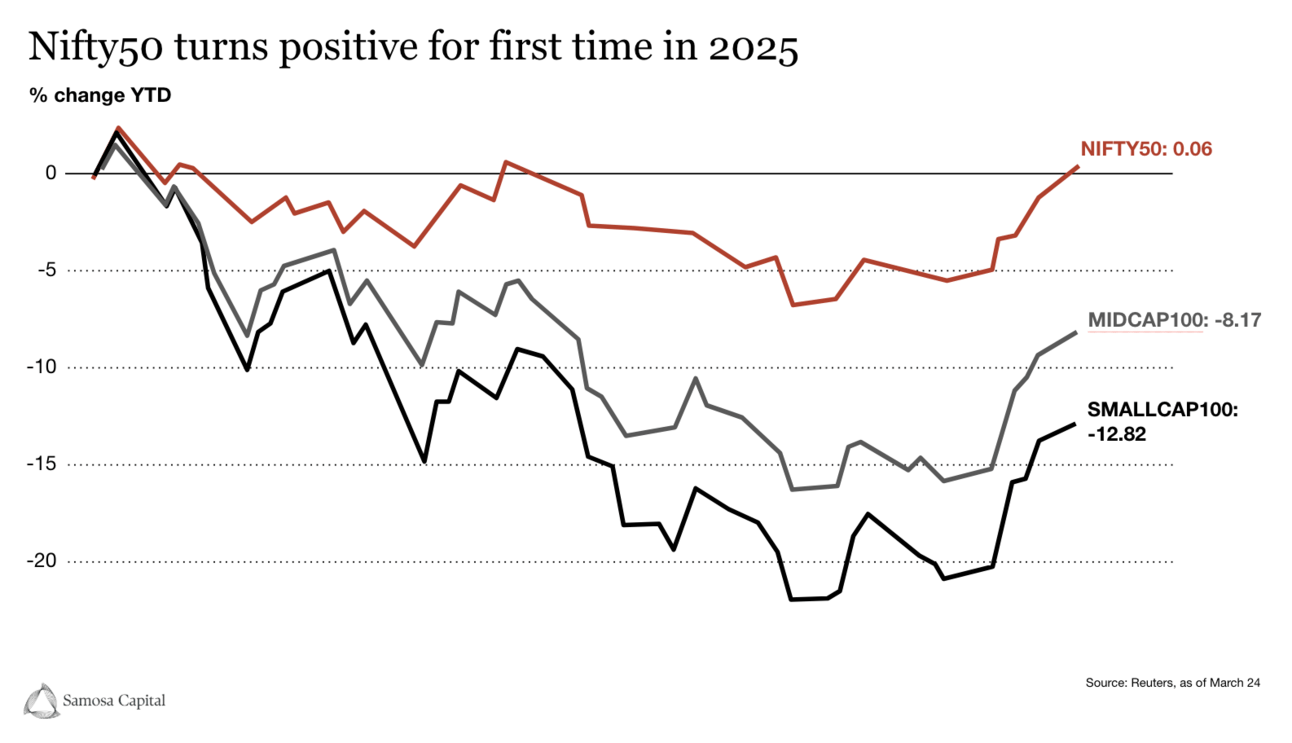

Nifty50 Turns Positive For 2025.

India's Nifty 50 index has bounced back from earlier losses this year, thanks to foreign investors buying stocks and people taking advantage of lower prices ahead of the earnings season. On March 24, the Nifty 50 went up by 1.32 percent, closing at 23,658.35, while the Sensex rose 1.4 percent to 77,984.38. Although both indexes have made some recovery, they are still about 10 percent below their highest levels from last September.

Positive news about inflation and industrial production has helped improve investor confidence. Experts believe that the market has now overcome its recent struggles, suggesting that the worst may be over. Foreign investors, who had been selling stocks for months, have started buying again, especially in the financial sector. Stocks like Kotak Mahindra Bank jumped 4.7 percent after a leadership change.

However, with the market rising quickly, some investors are getting cautious. The volatility index, which measures market uncertainty, spiked to its highest level since January. This has led some investors to protect themselves from potential risks of a market drop.

All sectors of the market saw gains, and smaller stocks also performed well, with small-cap and mid-cap indexes rising 1.1 percent and 1.3 percent, respectively. Big stocks like Reliance and HDFC Bank gained 2 percent and 1.7 percent, respectively. As the market continues to climb, experts warn that there could still be some risk of a pullback.

India Begins Naval Drills With African Nations To Counter China.

India is set to hold its first-ever naval drills with several African nations this April, aiming to counter China’s growing influence in the Indian Ocean. Ten countries will join the exercise, including Kenya, South Africa, Tanzania, Mozambique, and Madagascar. The drills will feature live fire exercises, as India steps up its presence in a region where China’s military and financial footprint has been expanding rapidly.

Historically, India and African nations have shared ties mainly through trade, but they’ve rarely collaborated militarily. This exercise marks a shift in that dynamic, as New Delhi seeks to assert itself as a key player in Africa's security landscape. For decades, Africa has largely been influenced by Western powers, but China’s growing presence has shaken things up. China has been heavily investing in Africa, from infrastructure projects to military bases, notably around the Horn of Africa.

India’s interest in strengthening ties with Africa isn't just about countering China, though. The Indian Ocean, with crucial shipping lanes running through countries like Mozambique and Madagascar, has always been a key strategic area for India. China’s naval presence in the region has been a growing concern, especially after it began sending warships for anti-piracy missions and securing access to important naval bases.

By holding these drills, India hopes to secure partnerships with African nations that hold strategic maritime positions, helping to curb China’s rapid advances. The move also fits into a broader shift in India’s foreign policy, which has been increasingly focused on strengthening relations with countries beyond its immediate neighborhood. This exercise is just the beginning, with more African nations expected to join in future drills, signaling India’s growing naval presence in the region.

Gupshup.

Macro

India's business growth eased in March as HSBC’s flash India Composite PMI slipped to 58.6 from 58.8 in February, weighed down by weaker services demand despite stronger manufacturing, according to S&P Global. The services PMI fell to 57.7 from 59.0, while manufacturing rose to 57.6, with international demand for both sectors expanding at the slowest pace in three months.

Housing sales in India’s top nine cities dropped 23 percent in the January–March quarter, with high prices and economic concerns dampening buyer confidence. Bengaluru and the National Capital Region were exceptions, seeing a 10 percent rise in sales, while new project launches plummeted by 34 percent across the cities.

The Reserve Bank of India raised the priority sector lending target for urban cooperative banks to 60 percent of adjusted net bank credit and expanded loan limits across sectors under revised guidelines effective April 1. The updated rules broaden coverage to areas like housing, renewable energy, and weaker sections to improve credit flow to critical segments.

The Indian rupee surged to 85.50 on Monday, erasing all its losses for 2025 amid strong dollar inflows from foreign banks and corporate repatriations. A nine-day rally, $3 billion in bond inflows, and renewed foreign interest in Indian equities helped lift the currency from near-record lows seen last month.

India’s central bank drew bids worth over twice the offered amount in its $10 billion, three-year FX swap auction on Monday, setting the cutoff premium at 5.86 rupees. The Reserve Bank of India will inject $10.04 billion worth of rupee liquidity on Wednesday as part of efforts to ease a banking system deficit that stood at ₹2 trillion last week.

India's key manufacturing scheme attracted investments of nearly $19 billion as of November 2024, according to the trade ministry. Despite these investments, the government will not expand the program or extend deadlines, as firms have only met 90 percent of their production target, with less than $1.7 billion in incentives paid out so far.

India will lift the 20 percent export duty on onions starting April 1, after nearly five months of export restrictions aimed at securing domestic supply. The government stated this decision ensures fair prices for farmers while keeping onions affordable for consumers.

Equities

Mahindra & Mahindra is in talks to acquire Sumitomo’s entire 44 percent stake in SML Isuzu, a deal that could value the Indian truck and bus maker at $236 million (₹20.26 billion), CNBC Awaaz reported Monday. Mahindra may offer between $16.37 (₹1,400) and $17.53 (₹1,500) per share, with its board expected to review the proposal this week.

OpenAI and Meta Platforms are in talks with Reliance Industries about potential AI partnerships in India, with discussions including the distribution of ChatGPT through Reliance Jio and hosting OpenAI models locally. Reliance also explored selling AI models to enterprise clients and building a large data center in Jamnagar to support these efforts.

India’s National Stock Exchange will begin settling trades of its unlisted shares through a designated depository starting Monday, significantly reducing settlement time from months to just days. This change, prompted by the Indian regulator last year, eliminates the need for buyers to seek approval from both the exchange and the market regulator, potentially boosting trade activity ahead of NSE's long-awaited IPO.

Alts

Renewable energy projects in Rajasthan, India’s top solar state, are set to become 8 percent-10 percent more expensive after a rule change requiring stamp duty and registration for land agreements, industry executives told Reuters. The added costs and delays could impact new solar developments, as land expenses already account for nearly 20 percent of total project costs.

Indian refiners plan to reduce their spot tenders for crude oil in the coming months as Russian oil shipments recover from previous disruptions, sources said. After sanctions impacted Russian oil deliveries, refiners turned to the spot market, but with Russian oil now shipped via non-sanctioned vessels, they are scaling back tender issuance.

Policy

A U.S. trade delegation, led by Assistant Trade Representative Brendan Lynch, will visit India from March 25-29 for talks amid concerns over reciprocal tariffs set to begin April 2. Both nations aim to resolve tariff disputes and advance a bilateral trade deal targeting $500 billion in trade by 2030.

India's market regulator SEBI will review its 17-year-old conflict of interest rules and has formed a committee for the task, marking the first major move under new chairman Tuhin Kanta Pandey. SEBI also approved raising the disclosure threshold for foreign portfolio investors to $5.84 billion (₹500 billion rupees) and tightening rules on key appointments at market infrastructure institutions.

See you Tuesday.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.