In partnership with

Shares of Ambani’s Reliance Industries experienced a 5 percent selloff today, erasing more than $10 billion (₹901.2 billion) in value. Today, we explain what happened.

If you have any questions about India, fill out this form or reach out to Shreyas at [email protected]

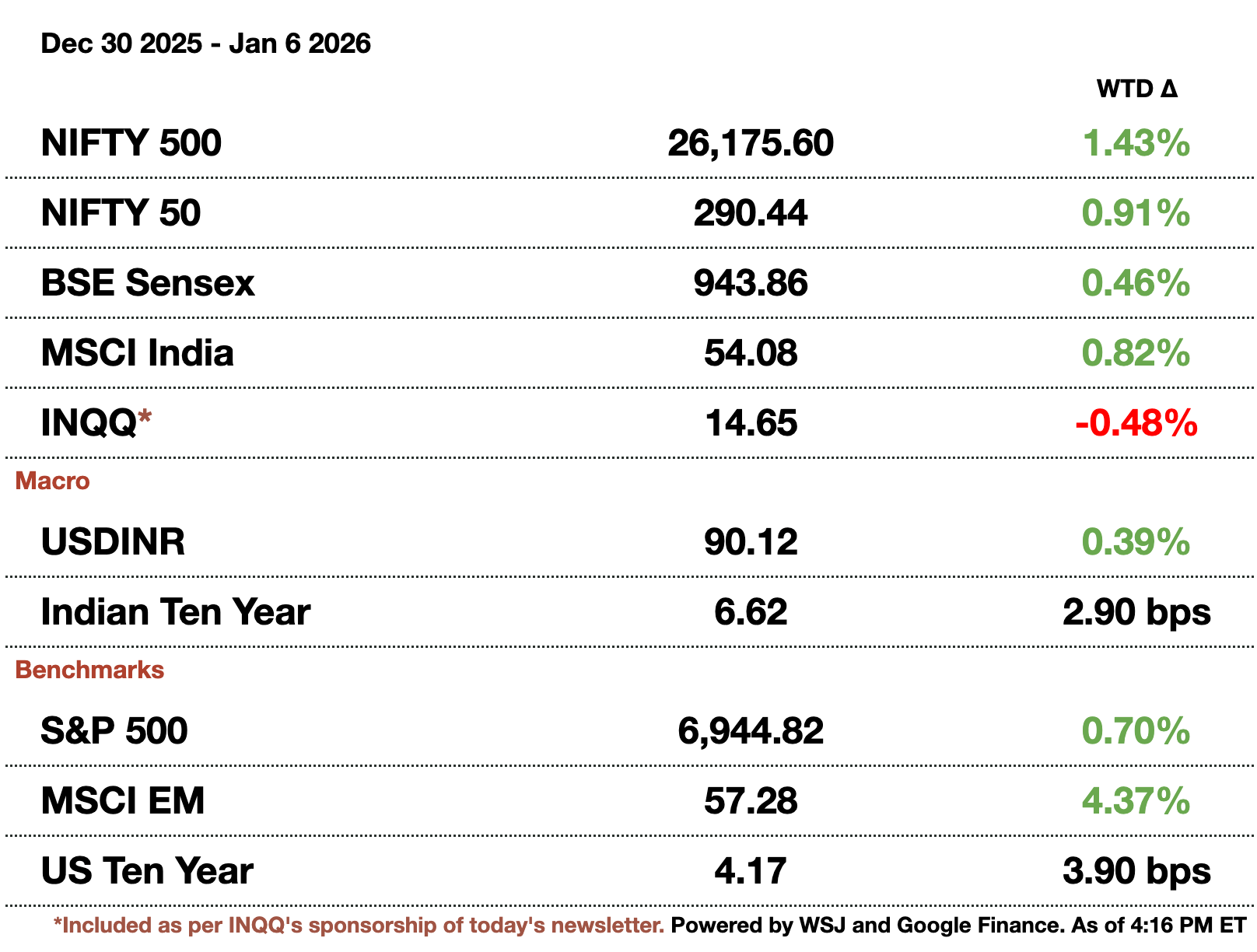

Macro

Zespri, a New Zealand kiwi exporter, is betting on Indian growers to fuel more demand. Zespri execs are helping Indian growers expand their yields since both nations have different harvest seasons; introducing more Indians to the fruit should boost demand. The FTA signed a few weeks ago is making agricultural trade more streamlined.

11 outbreaks of bird flu were reported on firms in south Kerala last month. The outbreaks resulted in 54,000 bird deaths (mostly ducks). Avian flu caused the rise of poultry and egg prices over the last few years due to supply shocks.

Indian states are likely to borrow a record $55.5 billion (₹5 trillion) in 1Q25.Demand for bonds has weakened causing higher yields. Traders are expecting longer tenors as well.

Equities

Banks like HDFC, Kotak Mahindra, and Bank of Baroda logged improved loan growth last month. While credit had slowed by 9.9 percent y-o-y by the end of 1H25, credit ended the year up 11.4 percent y-o-y for 2025. Secured gold loans and vehicle financing are the two biggest year-end drivers.

Coal India is struggling to export its oversupply with shipments down 5 percent.The move to even sell seemed desperate, and usual importers like Nepal and Bhutan are relying more on hydropower now. Coal India is also branching into cleaner energy production with solar.

Alts

Wealth management assets will hit $2.3 trillion (₹207.2 trillion) by 2029 compared to $1 trillion (₹90.1 trillion) in 2024. India minted a new billionaire every 6 weeks in 2025 due to startups. That list, plus growing wealth in Tier 2 and 3 cities, is giving new life to the industry.

Bangladesh's interim government banned IPL broadcasts after the IPL forced a team to drop a Bangladeshi player.The country is also refusing to play its matches in the next world tournament hosted in India later next month.

Policy

Trump's imperial view towards Venezuela and Greenland is of little benefit to India. Bilateral trade is mostly unaffected between Venezuela and India with it being only about $340 million (₹2.6 billion) of oil imports. Any gains from the US taking it over will be long-realized due to US demands being filled first.

SEBI is proposing a new $2.8 million (₹250 million) net worth requirement for merchant banks managing public offerings, fund raises, or lead managers.It added that the requirement would double to $5.6 million (₹500 million) by 2028.

Invest in India's Tech Wave — The India Internet ETF (INQQ)

Eternal. NYKAA. Groww. Lenskart. Swiggy. Gain exposure to the “new age” technology leaders driving India's rise on the global stage -- all in a single trade. The India Internet ETF (NYSE: INQQ) allows investors to access a basket of innovative companies contributing to the future of the world’s most populous country.

From e-commerce to fintech to travel, the INQQ ETF taps into India’s rapidly expanding digital landscape and seeks to deliver a targeted way to participate in potential long-term growth. Invest with the INQQ ETF.

Reach out to [email protected] to reach our audience and see your advertisement here.

Oil tanker in India

Reliance’s Massive 5 Percent Selloff Explained

Shares of Ambani’s Reliance Industries experienced a 5 percent selloff today, erasing more than $10 billion (₹901.2 billion) in value. The large move was unusual for India’s largest company and happened right after Reliance touched an 18-month high. While an explanation is hard to find, the most likely culprit is due to US-Venezuela and renewed tension on oil imports.

Trump, after taking Venezuela, said that India could see higher-than-50 percent tariffs if Russian crude imports continue. Unfortunately for Reliance, they just resumed importing Urals again this month after taking a month hiatus to comply with the government lowering Russian imports. If Reliance does stop importing crude, refining margins will plummet and input costs would skyrocket since they currently use hundreds of thousands of barrels per day at multi-dollar discounts from Russia.

There are a number of smaller reasons as well. Competition in Indian retail has been ramping up and profitability is being pressured in a segment that accounts for roughly half of Reliance’s valuation. There is also a higher probability of any potential US-India trade deal being delayed. Trump is increasingly focused on Greenland, Cuba, and Venezuela while refusing to let India straddle potential alliances with the US or Russia.

Given that there have been fewer than a dozen days since the pandemic first started where Reliance fell 5 percent or more, the selloff is a clear indicator of how investors are unwilling to tolerate global risk affecting India in 2026. 2025 saw a record $18 billion (₹1.6 trillion) of foreign money leave Indian equities due to global, systemic risk alone. While this strong of a reaction will likely be a one-off, investors are likely in for a market bracing for further tests. December quarterly earnings will bring volatility as analysts are split over most companies’ performances. The federal budget in February also usually leads to a slight decline with the MSCI India index averaging a 1 percent decline preceding it due to uncertainty.

How helpful was today's newsletter?

See you tomorrow.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Sponsor the next newsletter to reach tens of thousands of U.S.-based business-savvy professionals. Reach out to [email protected].

Could your business use expert insights to power growth in India? Reach out to [email protected] for a free introductory call.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.