Good afternoon,

Welcome to the best way to stay up-to-date on India’s financial markets. Today, we’re discussing

India’s currency rally may be nearing its end,

India hits a 12-year high in housing sales,

and India’s armed forces face a readiness crisis.

Then, we close with Gupshup, a round-up of the most important headlines.

Have a question you want us to answer? Fill out this form and you could be featured in our newsletter.

—Shreyas, [email protected]

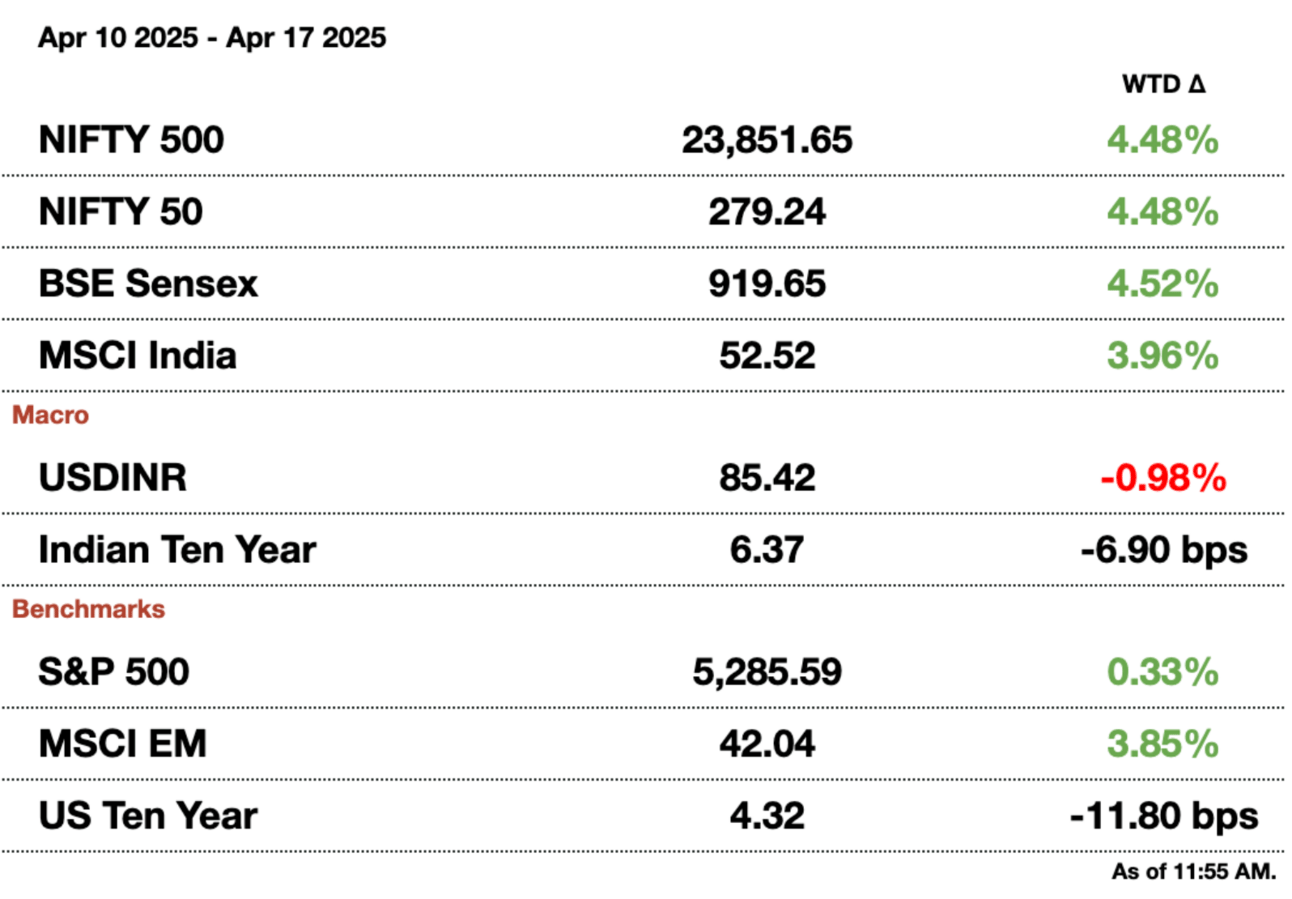

Market Update.

The Rupee’s Gains Could be Short-Lived.

India’s currency rally may be nearing its end as fresh depreciation pressures build on the rupee, driven largely by a loosening yuan. In recent weeks, Beijing’s willingness to allow the yuan to slide has put competitive pressure on Asia’s export-linked currencies.

The 120‑day correlation between the onshore yuan and the rupee has climbed to its highest since May 2023, while the 30‑day link between one‑month non‑deliverable forwards stands at a striking 0.66. The high correlations make it so the rupee and yuan will likely move in tandem now and in the future.

So far this month, the yuan has slipped about 0.6 percent — the sharpest Asian decline after the rupiah — while the rupee has only drifted 0.1 percent lower. But as China reroutes exports to counter US tariffs, fears of dumped goods flooding Indian markets are mounting. Given that India’s largest trade deficit is with China, any surge in cheap imports could weigh further on the rupee by widening the current‑account gap.

Maybe this is good? The RBI has already signaled its tolerance for two‑way currency movements in recent months, intervening only if volatility becomes excessive. Governor Malhotra reiterated this new regime after cutting rates to bolster growth, though this adds downward pressure on the rupee. Against this backdrop, the RBI appears willing to let the rupee depreciate modestly if regional peers do the same. Since the yuan is an anchor currency for Asian exports, a controlled rupee dip could help preserve India’s competitiveness without triggering disruptive swings.

Redevelopment Projects Are At an All-Time High.

In the heart of South Mumbai, entire neighborhoods are caught up in a redevelopment frenzy that has few parallels in the city’s history. Sixty-year-old apartment blocks—once humble chawls or modest middle-class buildings—are suddenly goldmines, with developers dangling gleaming new towers in exchange for worn‑out flats. Powered by a 12‑year high in housing sales and prices up 6–8 percent citywide, this rush has seen over 700 private redevelopment agreements inked in just five years, with thousands more in the pipeline.

What’s the downside? The issue is who is renovating. New firms entering the space have been skirting safety requirements, which led to a Bandra condo building nearly collapsing, causing a two-year build to become a four-year fiasco. Residents in the building were promised 85 percent more living space, which was a huge draw.

The cause: Rules have been relaxed to allow taller towers and higher floor‑space ratios to utilize floors more wholly, incentivizing builders to redevelop rather than build on new land. Those extra square meters aren’t just perks for incumbent owners; they’re the commodity that funds the profit‑making units sold to outsiders. No surprise, then, that 28 developers vied for the chance to rebuild the 50‑year‑old Surya Apartments in Breach Candy, each pitching 60–80 percent additional space for 120 flat owners.

But beneath the surface gleam, risks abound. When cycles turn, “too‑good‑to‑be‑true” offers — some touting 100 percent extra FSR — can collapse under their own weight. Delays, cost overruns, financing hiccups, and infrastructure bottlenecks can undermine even the strongest contract. Savvy societies now arm themselves with teams of lawyers, project managers, and accountants, demanding bank guarantees and penalties against lagging developers.

While all the rebuilds like these redevelopments and Adani’s Dharavi overhaul could fix the chronic housing shortfall, there is still major execution risk seen with a few past project failures in the city.

India’s Military is Still Underprepared.

India’s decision to buy 26 Rafale marine fighters from France may plug a glaring gap on its aircraft carriers, but it does little to disguise a deeper crisis of readiness across the armed forces. The $7.4 billion (₹640 billion) deal shores up the navy’s need for modern jets, replacing half‑retired Russian MiG‑29Ks, but it also lays bare how short‑sighted planning and constrained budgets have left India’s military perilously understrength.

The Indian Air Force, once proud of maintaining 42 to 45 squadrons of 18 aircraft each, today struggles to field barely 32 squadrons, many under‑manned and composed of aging MiG‑21s slated for retirement this year. Unless New Delhi commits to long‑term force expansion, analysts warn the IAF could dwindle to just 25 squadrons by 2030 — well below the level needed to “balance” China, let alone respond to new threats along the Himalayan frontier or an upgraded Pakistan Air Force.

Local misses and underinvestment: Defence outlays have fallen to multi‑decade lows as a share of GDP, squeezed by populist spending on pensions and fiscal conservatism elsewhere. Meanwhile, India’s only indigenous fighter‑jet maker, Hindustan Aeronautics, repeatedly misses delivery schedules and performance benchmarks, leaving the IAF to rely on last‑minute government‑to‑government buys like the 2016 Rafale air‑force deal that sidestepped India’s own tender process.

That hurried approach breeds risk. Emergency purchases sacrifice technology transfers and local assembly, undermining India’s goal of building a domestic defense industry. They also erode transparency: lengthy, structured tenders give way to opaque, high‑pressure negotiations led by ministers rather than technocrats, stifling strategic debate. Piecing together ad‑hoc solutions won’t suffice. India needs a clear, multi‑decade roadmap that balances foreign acquisitions with indigenous development, secures technology transfer, and links procurement to realistic threat assessments.

Message from our sponsor.

What Top Execs Read Before the Market Opens

The Daily Upside was founded by investment professionals to arm decision-makers with market intelligence that goes deeper than headlines. No filler. Just concise, trusted insights on business trends, deal flow, and economic shifts—read by leaders at top firms across finance, tech, and beyond.

Reach out to [email protected] to sponsor the next newsletter!

Gupshup.

Macro

Credit demand is expected to soar with rates coming down. The Nifty Bank index has led the market recently due to banks making more loans. Analysts also expect tariff-related shocks to be capped to the downside in India, given the muted market response at 26 percent before they were rolled off.

RBI skips 14-day cash operation again, which could represent a more flexible approach. In the past, the RBI did 2-week operations to manage cash in the economy, but has been using smaller 3 or 5-day operations intermittently. Doing so could lead to a flexible permanent shift — the initial results show bank lending rates matching the policy rate much better than in the past.

Equities

Infosys is forecasting slowing sales growth due to sluggish IT spending. Their guidance includes revenue flat or up 3 percent in FY26, lower than the 6.3 percent street prediction. Net income fell 12 percent to $817.4 million (₹70.3 billion) for the fourth quarter, and shares are down nearly 25 percent y-t-d. This comes as the $280 billion (₹24.1 trillion) IT industry grapples with slowing projects, with India’s largest export being tech services.

Gensol Engineering stock sank after the RBI banned the firm's founders from securities markets. SEBI ordered a forensic audit as well due to the founders buying $30,600 (₹2.1 million) golf sets. The stock has slid over 70 percent since credit agencies also marked it down to default.

Alts

Adani is selling ownership of Australian port terminals to his Adani Ports company for $2.4 billion (₹206.4 billion). Adani Ports is going to issue preferred shares to Adani’s special entity, which has now given the family a 20 percent return over the last decade since they first bought the ports. This represents the fourth international port asset that Adani Group now owns.

Tata gets a $990 million (₹85.1 billion) loan to build Britain's largest battery-making facility. 15 banks hopped in the deal for the 2-year bridge loan, which has been priced at a slight spread over SONIA — the UK’s benchmark rate. Foreign currency loans for Indian firms have risen by 23 percent y-t-d to $6.6 billion (₹567.6 billion).

IDFC First Bank is raising $877 million (₹75.4 billion) from Warburg Pincus and Abu Dhabi's Investment Authority. The deal is going through preferred shares, which will pay an undisclosed dividend; both entities were cited, saying that they believe the Indian banking sector is undervalued.

Kenya seeks bids for $245 million (₹21.1 billion) power lines after Adani's exit. The country canceled deals with the power unit due to the US indictment, but still needs to develop electric services by 2029.

Policy

India and China are going to resume the Kailash pilgrimage this year as ties improve. The mountain is sacred to Hindus and Buddhists alike; the resumption comes amid talks to restore flights, visas, and discussions on trade and investment.

U.S. agencies are looking into TCS amid claims that the company favored H-1Bs over American employees. There have been complaints filed since the end of 2023, primarily by non South-Asian workers over the age of 40. TCS denies all allegations, calling them baseless, though there have been similar claims from former TCS employees in the UK. The case is very similar to Cognizant’s from 2003 to 2012 for similar allegations.

See you Friday.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.