Indian equity markets are set for another surge of public listings, as per JPMorgan. U.S. President Donald Trump’s sweeping overhaul of the H-1B visa program is set to ripple across India’s economy. India’s banking system liquidity has tightened sharply in recent days.

If you have any questions about India, fill out this form or reach out to Shreyas at [email protected]

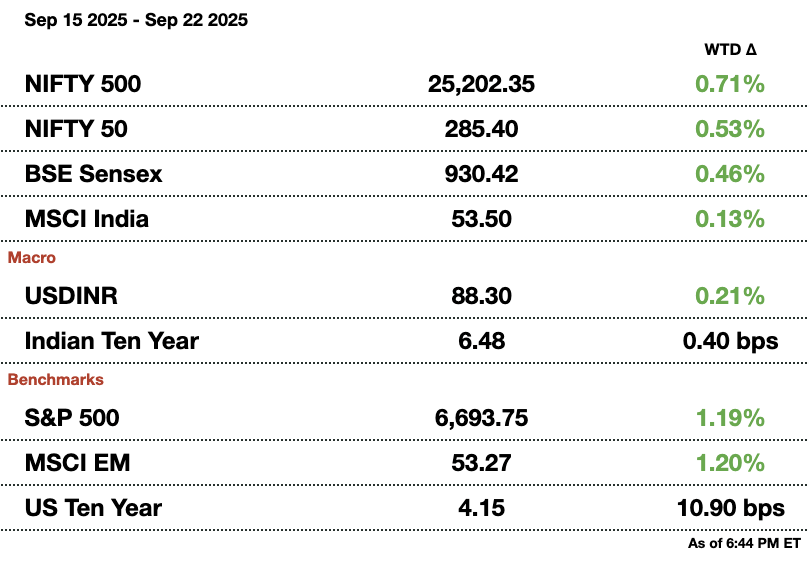

Macro

Wall Street banks are expected to expand Indian support hubs after Trump imposed a $100,000 (₹8.8 million) fee on new H-1B visas, making offshoring more attractive. With Citigroup, JPMorgan, and Goldman Sachs already employing tens of thousands locally, reliance on India may accelerate.

Student arrivals to the US dropped 19 percent in August to a four-year low, with Asian students down 24 percent, including a 45 percent plunge from India, as Trump’s visa hurdles bite. The decline threatens billions in university revenues and US competitiveness.

JPMorgan sees India as a “bright spot” in the global economy, citing strong domestic growth and limited export reliance despite tariff hikes and H-1B visa issues. The bank has expanded its India headcount by 20 percent in two years and leads IPO advisory.

India’s infrastructure output rose 6.3 percent year-on-year in August, driven by higher steel, coal, and cement production, government data showed. The index, accounting for 40 percent of industrial output, accelerated from a revised 3.7 percent growth in July.

Equities

Adani Group plans to cut leverage through 2030 and will avoid issuing dollar bonds until 2027, focusing instead on domestic and private placements. Despite targeting debt reduction, the group will press ahead with $15–20 billion (₹1.3-1.8 trillion) annual capex, balancing growth with financial discipline.

Walmart-backed PhonePe cut its annual losses to $195 million (₹17.2 billion) in FY25 from $226 billion (₹19.96 billion) a year earlier, a regulatory filing showed. The fintech giant, with 600 million users and 310 million daily transactions, is preparing for an IPO.

IndusInd Bank appointed Viral Damania as its new chief financial officer effective September 22, following recent leadership changes after a $230 million (₹20.3 billion) accounts hit. The move comes weeks after veteran banker Rajiv Anand took charge as CEO for three years.

Alts

Knowledge Realty Trust, India’s largest REIT backed by Blackstone and Sattva, plans its first-ever rupee bond sale, aiming to raise $181 million (₹16 billion) via a 3-year note at 7.2 percent. The move highlights growing REIT popularity in India’s commercial real estate boom.

GQG Partners sold about 1 percent of Adani Power in a $250 million (₹22 billion) deal, locking in nearly 100 percent gains since 2023. The partial exit came as SEBI dismissed some Hindenburg allegations, boosting Adani stocks by almost $20 billion and lifting investor sentiment.

India’s renewable energy minister Pralhad Joshi said the federal government is urging states to boost clean energy purchases, as many utilities delay amid hopes of cheaper prices. A second round of talks with state governments will be held soon.

Policy

India’s Chief Economic Adviser said the government’s FY26 second-half borrowing plan remains unchanged at $77 billion (₹6.8 trillion). Total borrowing for the year is set at $167 billion (₹14.82 trillion), with confidence in meeting the fiscal deficit target.

U.S. Secretary of State Marco Rubio emphasized the importance of U.S.-India ties after President Trump’s $100,000 (₹8.8 million) H-1B visa fee rattled Indian tech firms. Meeting India’s Foreign Minister Jaishankar, Rubio reaffirmed cooperation on a free and open Indo-Pacific through the Quad.

India will sell minority stakes in about six state-run firms, Divestment Secretary Arunish Chawla said, without naming them. Reuters earlier reported plans to offload shares in public sector banks, including UCO Bank and Bank of Maharashtra.

India’s pension regulator plans to expand investment avenues for private funds to boost subscriber returns, chairperson S. Ramann said. Options under consideration include gold and silver ETFs, venture capital, private credit, and alternative investment funds, alongside easing bond valuation rules.

1. JPMorgan Sees India Building on Record IPO Momentum

Indian equity markets are set for another surge of public listings, with JPMorgan Chase projecting that IPO volumes could surpass last year’s record as companies and private equity firms look to unlock value.

India raised nearly $21 billion (₹1.9 trillion) through IPOs in 2024, marking its strongest year ever, with Hyundai Motor India’s blockbuster debut and two other billion-dollar offerings leading the charge. According to Anu Aiyengar, global head of advisory and M&A at JPMorgan, the pipeline remains robust, and activity “could be much higher” going forward.

“India is the busiest market for us on IPO preparation right now,” Aiyengar said during the bank’s annual India conference in Mumbai. She highlighted that the deepening investor base and strong retail participation provide tailwinds for sustained issuance.

The pickup in activity comes despite macro headwinds from U.S. tariffs and new visa restrictions. Domestically, confidence in corporate earnings and reforms is helping keep investor appetite strong. With household savings shifting steadily from gold and property into financial assets, equity demand is broadening beyond major metros.

Aiyengar added that M&A volumes are also expected to climb as firms seek scale in artificial intelligence, technology, and supply chains. “If you can work through these headwinds and have higher certainty, there is upside to those volumes,” she said.

For global and domestic investors alike, India’s capital markets appear positioned to extend their role as a key financing hub for Asia’s fastest-growing major economy.

2. Trump’s H-1B Fee Hike Poses Risk to India’s Remittances and Rupee

Trump and Modi in 2019

U.S. President Donald Trump’s sweeping overhaul of the H-1B visa program is set to ripple across India’s economy, threatening remittance flows, pressuring the rupee, and complicating the outlook for the country’s $280 billion (₹24.7 trillion) IT services industry.

The new policy mandates a $100,000 (₹8.8 million) application fee for H-1B visas, a move aimed at curbing heavy reliance on the program. India is particularly vulnerable: nearly 70 percent of H-1B visa holders in the U.S. are Indian, many employed by IT giants such as Tata Consultancy Services Ltd. and Infosys Ltd. Analysts warn that higher costs and fewer visas could slow the deployment of Indian engineers overseas, forcing firms to recalibrate business models.

Remittances are a key concern. Citigroup economists estimate that the U.S. accounts for almost 28 percent of India’s annual inflows, around $35 billion (₹3.1 trillion). A decline in visa approvals could trim hundreds of millions in yearly transfers, JPMorgan cautioned, potentially worsening the rupee’s weakness. The currency, already Asia’s worst performer this year, slipped to 88.32 per dollar on Monday, with MUFG Bank forecasting a slide to 89 by March.

Economists also note that while reduced remittances and IT disruption pose risks, U.S. corporations may respond by expanding their “global capability centers” in India, partly offsetting the drag. Still, the fee hike underscores rising friction in U.S.-India ties, already strained by Washington’s tariffs, and adds fresh pressure on New Delhi to boost domestic demand as external drivers falter.

3. India’s Bank Cash Crunch Likely Temporary, Analysts Say

RBI Governor

India’s banking system liquidity has tightened sharply in recent days, but the squeeze is expected to ease soon as government spending and upcoming bond redemptions replenish cash, analysts said Monday.

The surplus liquidity in the system fell to just $794 million (₹70 billion) on September 21, the lowest since March, after nearly $29.5 billion (₹2.6 trillion) moved out on account of income tax and goods and services tax payments. Banking system liquidity, or the excess cash parked with the RBI), influences market interest rates and affects the cost of consumer loans.

“We expect this shortage to be temporary, as a pickup in government spending should help neutralise its impact over the coming week,” said Vivek Kumar, economist at Quanteco Research. He added that scheduled bond redemptions would also release liquidity back into the system.

The RBI typically prefers liquidity surpluses around 1 percent of deposits. Levels had comfortably exceeded that until the recent tax-driven outflows.

Liquidity is also set to improve from October as the phased cut in banks’ cash reserve ratio (CRR) takes effect. The RBI has announced a total 100-basis-point reduction in CRR in four tranches through November, with the next 25-basis-point cut due October 4.

Analysts expect liquidity to rebound to between $23-28 billion (₹2-2.5 trillion) even before the next CRR cut, with banks borrowing only modestly from the RBI’s repo facility, suggesting confidence in near-term conditions.

How helpful was today's newsletter?

See you tomorrow.

Written by Eshaan Chanda & Yash Tibrewal. Edited by Shreyas Sinha.

Sponsor the next newsletter to reach tens of thousands of U.S.-based business-savvy professionals. Reach out to [email protected].

Could your business use expert insights to power growth in India? Reach out to [email protected] for a free introductory call.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.