Today, we explain how India’s economy is getting a noticeable push this year, thanks to a mix of tax cuts and interest-rate reductions.

If you have any questions about India, fill out this form or reach out to Shreyas at [email protected]

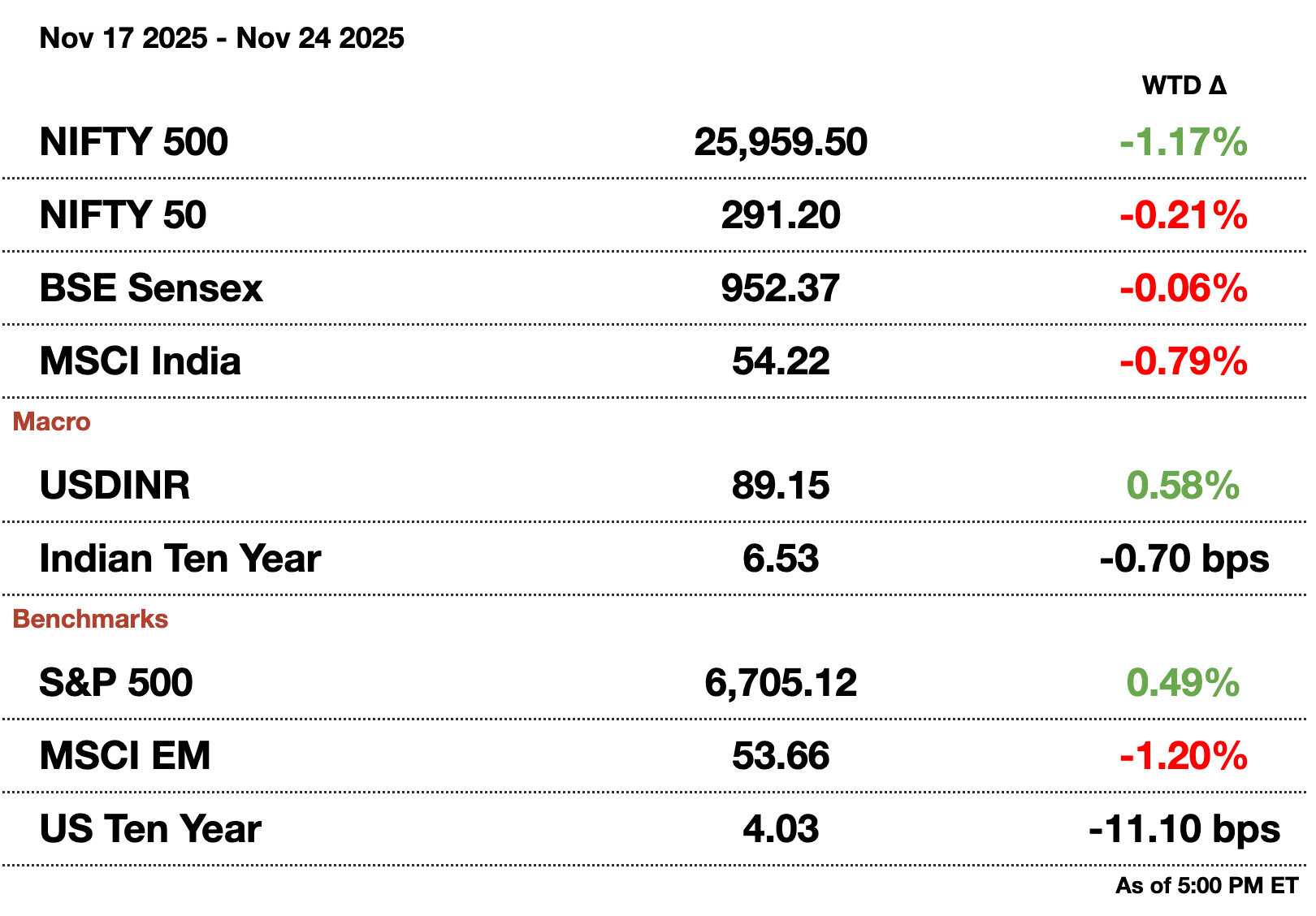

Macro

India’s Supreme Court has agreed to drop all criminal charges against fugitive brothers Nitin and Chetan Sandesara if they pay $570 million of the $1.6 billion they allegedly owe in a major bank-fraud case, according to a newly posted court order. The ruling could encourage other accused economic offenders to seek similar deals, since the brothers, who fled India in 2017 on Albanian passports and deny wrongdoing, would have all proceedings quashed once payment is made.

India’s solar panel exports fell from $134 million in August to $80 million in September, their lowest this year, after the U.S. kept a 50 percent tariff on Indian modules and increased import scrutiny. Manufacturers are now pushing excess supply into the domestic market, raising oversupply concerns as installations trail the 44–45 GW a year needed for 2030 targets.

The Reserve Bank of India sold a net $7.91 billion in September to support the rupee, which had fallen to 88.80, with total sales of $10.11 billion against $2.2 billion in purchases. Ongoing trade tensions with the U.S. and higher gold and silver imports contributed to currency pressure, pushing the rupee to a record low of 89.49 by November 21.

Equities

India’s benchmark indexes fell, with the Nifty 50 down 0.42 percent and the Sensex down 0.39 percent , as broad profit-taking offset gains in IT stocks. Expectations of a U.S. Federal Reserve rate cut helped cushion losses, while small- and mid-cap stocks dropped 0.9 percent and 0.3 percent, respectively.

Alts

India’s finished steel imports fell 34 percent year-on-year to 3.8 million tons in April–October, even as India remained a net importer and South Korea led with 1.4 million tons shipped in. Weak domestic demand and high supply kept prices subdued, while India’s finished steel exports rose 25 percent to 3.5 million tons over the same period.

Policy

India’s sugar mills are unlikely to ship the full 1.5 million-ton export quota after global sugar prices fell below domestic rates, leaving Indian offers at about $450 per ton, roughly $25 above London futures. With mills avoiding unprofitable deals, exports may end up near 800,000 tons, a shortfall that could help support global prices as buyers in Asia and Africa ramp up demand early next year.

India’s central bank governor said there is still room for more interest rate cuts, noting that October’s macro data, including record-low inflation of 0.25 percent, has not reduced the space for easing after the 100 bps already cut in early 2025. He added that the rupee’s slide to 89.49 is in line with its typical 3–3.5 percent annual depreciation, though the timing of any further rate cut is up to the MPC.

Canada and India have agreed to restart negotiations on an economic agreement aimed at doubling bilateral trade to $50 billion by 2030 after talks stalled two years ago. The move follows recent high-level meetings and signals thawing relations, with both countries also reaffirming civil nuclear cooperation and long-term commercial ties.

Here’s an un-boring way to invest that billionaires have quietly leveraged for decades

If you have enough money that you think about buckets for your capital…

Ever invest in something you know will have low returns—just for the sake of diversifying?

CDs… Bonds… REITs… :(

Sure, these “boring” investments have some merits. But you probably overlooked one historically exclusive asset class:

It’s been famously leveraged by billionaires like Bezos and Gates, but just never been widely accessible until now.

It outpaced the S&P 500 (!) overall WITH low correlation to stocks, 1995 to 2025.*

It’s not private equity or real estate. Surprisingly, it’s postwar and contemporary art.

And since 2019, over 70,000 people have started investing in SHARES of artworks featuring legends like Banksy, Basquiat, and Picasso through a platform called Masterworks.

23 exits to date

$1,245,000,000+ invested

Annualized net returns like 17.6%, 17.8%, and 21.5%

My subscribers can SKIP their waitlist and invest in blue-chip art.

Investing involves risk. Past performance not indicative of future returns. Reg A disclosures at masterworks.com/cd

Reach out to [email protected] to reach our audience and see your advertisement here.

RBI Projects India Will Boost Investment, Growth

India’s economy is getting a noticeable push this year, thanks to a mix of tax cuts and interest-rate reductions that New Delhi hopes will jolt private investment back to life. In its latest monthly bulletin, the Reserve Bank of India said the combination is already showing up in the data, with October flashing early signs of stronger momentum even as the global economy stays wobbly.

This isn’t the first time India has tried to lean on domestic demand when the world turns shaky. Historically, during slowdowns, from the 2008 crisis to the 2019 pre-COVID slump, the government has often turned to consumption-focused measures to keep growth from stalling. This year’s move fits that pattern: in September, taxes were slashed on a wide basket of consumer goods, from everyday essentials like soap to entry-level cars.

The RBI has played its part too, trimming policy rates by a full percentage point so far in 2025. Rate cuts usually work with a lag, but the central bank says high-frequency indicators, things like manufacturing output, services activity, and the usual festive-season surge, are already pointing upward. India’s GST overhaul from a few years ago, once criticized for its messy rollout, is now being credited for smoothing inter-state commerce enough to give both factories and service businesses a bit more lift.

One of the most striking data points is inflation. Headline CPI dropped to just 0.3 percent in October, down from 1.4 percent in September, far below the RBI’s 4 percent target and among the lowest levels India has seen. The fall is partly due to the tax cuts feeding directly into lower retail prices, but also because of a favorable base effect from last year’s higher prints. With inflation this soft, the door is open for more rate cuts, something RBI governor Sanjay Malhotra hinted at ahead of next week’s policy meeting.

Despite all the global uncertainty, trade tensions, tariff swings, and the usual geopolitical noise, the RBI says India remains relatively insulated. For now, it’s sticking with its full-year growth projection of 6.8 percent for FY26, betting that domestic spending can outrun whatever the world throws at it.

How helpful was today's newsletter?

See you tomorrow.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Sponsor the next newsletter to reach tens of thousands of U.S.-based business-savvy professionals. Reach out to [email protected].

Could your business use expert insights to power growth in India? Reach out to [email protected] for a free introductory call.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.