Good afternoon,

Welcome to the best way to stay up-to-date on India’s financial markets. Here’s what’s in today’s newsletter:

Indian-made exports see shrinking profit margins and slower growth,

Cerberus Capital says India’s private credit market is attractive,

and India’s service sector hit a 10-month high.

Then, we close with Gupshup, a round-up of the most important headlines.

Have a question you want us to answer? Fill out this form, and you could be featured in our newsletter.

—Shreyas, [email protected]

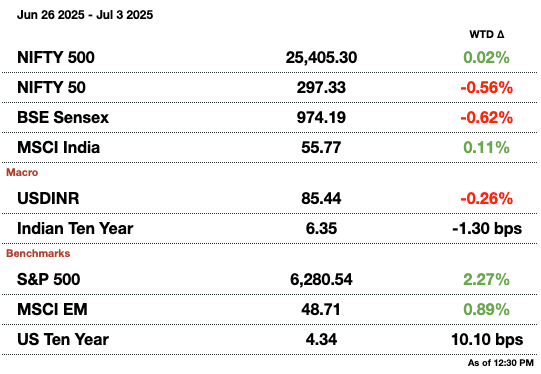

Market Update.

“Make in India” Has a Profit Problem.

India’s electronics manufacturing story, once central to the “Make in India” push to rival China, is losing its shine as shrinking profit margins and slower growth sour investor sentiment. After years of triple-digit gains, leading contract manufacturers like Dixon Technologies and Kaynes Technology have tumbled more than 15 percent this year, sharply underperforming broader market indices.

The reversal marks a critical turning point for India’s bid to cement its place in global supply chains. With ambitious capacity expansions underway, investors are questioning whether domestic and export demand can keep up with the sector’s rapid scaling. Soaring valuations and fierce competition are adding to the pressure, just as production-linked incentive schemes, a key policy driver behind India’s manufacturing build-out, approach expiry.

Wall Street firms are turning more cautious. Jefferies this week reaffirmed its underperform rating on Dixon, calling its risk-reward “stretched,” while Morgan Stanley downgraded the stock to a sell. For the broader sector, stocks that once traded on hopes of India becoming the next big manufacturing hub now face scrutiny as earnings growth moderates and margins compress.

The shift highlights a broader macro reality: while India’s manufacturing ambitions remain intact, sustaining investor confidence will depend on more than incentives alone. Companies will need to prove they can convert topline growth into sustainable profits, or risk seeing the once-booming ‘Make in India’ trade continue to unwind.

The Growth of Indian Private Credit.

India’s emerging private credit market is gaining traction, with large global investors warming to bigger deals as local companies seek fresh capital with relatively conservative balance sheets. Cerberus Capital Management, which anchored Shapoorji Pallonji Group’s record $3.4 billion (₹290.5 billion) financing, says India’s low leverage ratios are proving a major draw at a time when Asia’s share of global private credit remains underweight.

“Even three years ago, seeing multiple Indian deals larger than $100 million (₹8.5 billion) would’ve been unthinkable,” said Indranil Ghosh, Cerberus’ Asia special situations head. But that’s changing fast: KKR and Greenko Energy Holdings have closed large private financings this year, while homegrown players like Motilal Oswal and Kotak are raising billions for new local credit funds targeting high returns.

With an average loan-to-value ratio around 40 percent, well below levels in much of Asia and developed markets, India’s private borrowers offer investors greater downside protection, boosting confidence as they tap bigger capital pools. The government’s own National Investment & Infrastructure Fund is also stepping up, seeking as much as $2 billion (₹170.9 billion) with backing from Abu Dhabi’s sovereign wealth fund.

Still, challenges remain. While corporate governance has improved, India’s slow insolvency resolution process is a sticking point for global allocators wary of drawn-out recoveries when deals turn sour. As India’s macro environment stays resilient and tariffs push more supply chains its way, the country’s maturing private credit market could become a more meaningful pillar in its broader financial system, if structural bottlenecks are tackled.

India’s Service Sector Hits 10-Month High.

India’s services sector posted its strongest expansion in ten months in June, reinforcing the country’s position as a bright spot for domestic demand amid a challenging global backdrop. The HSBC India Services PMI climbed to 60.4, up from 58.8 in May, as robust new business flows and resilient household spending lifted overall activity well above the 50-point mark that separates growth from contraction.

The sustained strength in the services economy, from retail to IT and hospitality, was supported by solid gains in both domestic and export orders. Panelists cited steady demand from key overseas markets, including Asia, the Middle East, and the US, even as the pace of export growth moderated slightly from May’s levels.

Cooling input cost pressures offered further support, with input inflation easing to a 10-month low. Firms maintained pricing power, though output price inflation edged lower and remained in line with long-term averages. Employment growth, while positive, slowed from May’s record pace as companies balanced hiring with productivity gains.

The latest reading lifts the HSBC India Composite PMI, which tracks both services and manufacturing, to a robust 61.0, the fastest expansion in over a year. Yet, despite strong near-term momentum, the outlook softened, with business confidence for the year ahead dipping to its lowest level in more than two years, highlighting lingering caution as firms navigate a still-uncertain global demand cycle.

Message from our sponsor.

CorridorX connects US startups with top-tier tech providers in India and other markets, offering Global Capability Centers (GCCs)—traditionally built for Fortune 500s—now available to high-growth startups. We build lean, high-performing technical pods (4-5 engineers, product engineers, designers, and AI experts) that integrate seamlessly with your in-house team. Whether you're scaling fast, building globally, or reducing overhead, CorridorX provides flexible, fast solutions tailored to your needs. Our curated network of trusted delivery partners ensures world-class engineering, product, AI, and design capabilities. Ready to scale your startup? Learn more at corridorx.io

Reach out to [email protected] to see your ad here.

Gupshup.

Macro

India may allow imports of some processed GM animal-feed products like soybean meal from the US as part of a trade deal, even though it still bans GM corn and soybean imports for food to protect local farmers. Talks aim to finalize an agreement before US tariffs rise on July 9.

The ADB and UN Green Climate Fund will launch a $200 million (₹17.1 billion) facility to boost emerging clean tech in India, like 24/7 renewables and electric mobility. The program aims to mobilize $2.9 billion (₹247.8 billion) over 10 years to help smaller developers scale up amid high entry costs.

The Indian rupee hit a one-month high at 85.20, supported by foreign inflows,short-covering, and optimism over a potential U.S.-India trade deal ahead of the July 9 deadline. Dollar sales from foreign banks and regional trade sentiment also boosted the currency, which closed 0.4 percent stronger at 85.31.

Equities

Reliance Industries will spin off its consumer goods brands into a new subsidiary, New Reliance Consumer Products, to sharpen its focus on its retail arm ahead of a planned IPO. The move aims to attract separate investors for its growing FMCG business, including brands like Campa Cola and Tira Beauty.

Indian domestic institutional investors have bought over $40 billion (₹3.4 trillion) of stocks so far in 2025, closing in on last year’s record, even as global investors pulled out $8 billion (₹683.5 billion) from Indian equities.

Small investors in India have pumped nearly $42 billion (₹3.6 trillion) into equities so far in 2025, with mutual funds driven by retail SIPs fueling most of the buying, offsetting global outflows and showing strong local confidence in domestic stocks.

India’s top e-commerce stocks like Swiggy and Eternal have outperformed peers as investors bet on their quick-commerce lead and path to profitability, with the market expected to hit $100 billion (₹8.5 trillion) by 2030 despite new competition from Amazon and Flipkart. Established players are now focusing on monetization and margin improvements after rapid expansion.

India’s Meesho has confidentially filed to raise about $497 million (₹42.5 billion) via an IPO, aiming for a September-October listing as it looks to compete more aggressively with Amazon and Flipkart in the country’s booming e-commerce market.

Indian stocks slipped on Thursday as profit booking in heavyweight financials outweighed optimism around a possible US trade deal, with the Nifty 50 and Sensex both easing about 0.2 percent after recent strong gains. Analysts say the broader trend stays positive, but stretched valuations mean earnings and trade progress will be key for further upside.

Marico expects its quarterly revenue to grow by a low-twenties percentage, supported by steady rural demand, though margins remain under pressure due to high input costs. The company sees pressures easing later this year and forecasts modest profit growth for the quarter.

India’s ONGC has signed a deal with Japan’s Mitsui OSK to build and operate two large ethane carriersto supply feedstock for its OPaL unit’s cracker facility. The agreement, aimed at importing 800,000 tons of ethane per year from 2028, still needs ONGC board approval.

Alts

Tata Group is reportedly in talks to buy out ICICI Venture, Kuwait Investment Authority, and Oman Investment Authority’s stakes in Resurgent Power, aiming to fully own the Singapore-based firm valued at around $2.1 billion (₹179.4 billion), including debt. Resurgent Power holds major stakes in Prayagraj Power and other transmission assets in northern India.

Kerala’s tourism campaign has turned a stranded UK F-35 jet into an unexpected mascot, using a viral AI image of the fighter jet surrounded by coconut trees to humorously promote the state’s beaches and backwaters after the aircraft made an emergency landing last month.

Carlyle Group plans to sell up to a 10 percent stake in India’s Piramal Pharma through block deals, which could fetch about $305 million (₹26 billion), Moneycontrol reported. Carlyle, which held an 18 percent stake as of March, first invested in the company in 2020.

India’s Shapoorji Pallonji & Co is in talks to raise about $300 million (₹25.6 billion) through a share-backed loan to refinance debt, with Afcons Infrastructure shares and real estate assets likely as collateral, sources said. The company aims to replace a loan from HDFC Bank, targeting borrowing costs around 15 percent.

Policy

India’s defence acquisition council has cleared the start of procurement for arms and military gear worth $12.3 billion (₹1.1 trillion), including armoured vehicles, electronic warfare systems, and surface-to-air missiles, the defence ministry said on Thursday.

U.S. and Indian negotiators are working to finalize a tariff-cutting trade deal before Trump’s July 9 deadline, but talks remain stuck on U.S. demands for access to India’s farm and dairy markets, sources said. This push follows Trump’s fresh trade agreement with Vietnam to lower tariffs on its exports.

See you Friday.

Written by Eshaan Chanda & Yash Tibrewal. Edited by Shreyas Sinha.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.