Good afternoon,

Welcome to the best way to stay up-to-date on India’s financial markets. Here’s what’s in today’s newsletter:

Monetary Policy Committee member says RBI open to more rate cuts soon,

India is pivoting from rice shortages to surplus management, using a record volume of rice for ethanol production,

and India’s government is pushing back against industry-led legal challenges to its new quality control measures on copper cathode imports.

Then, we close with Gupshup, a round-up of the most important headlines.

Have a question you want us to answer? Fill out this form, and you could be featured in our newsletter.

—Shreyas, [email protected]

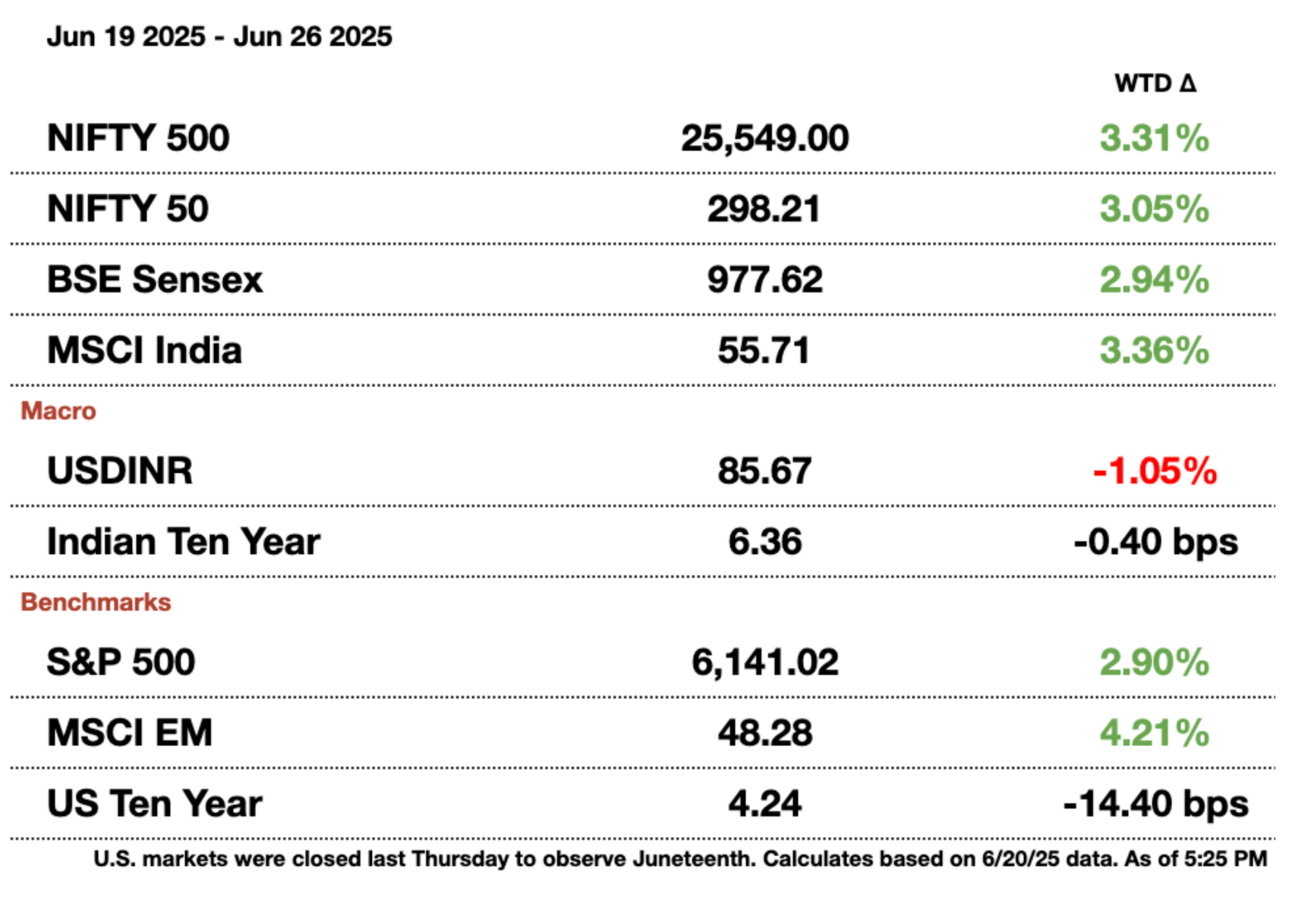

Market Update.

RBI Open to More Rate Cuts.

Despite the Reserve Bank of India’s recent policy pivot signaling a more neutral stance, further interest rate cuts remain a live option, according to Saugata Bhattacharya, a relatively hawkish member of the central bank’s Monetary Policy Committee. His comments suggest that India’s monetary strategy remains flexible in the face of cooling inflation and shifting global macroeconomic dynamics.

Bhattacharya emphasized that the RBI’s June shift from an ‘accommodative’ to ‘neutral’ stance does not rule out further easing. “If inflation allows a further cut in the policy repo rate, so be it,” he said in an interview, pointing to softening food prices, a strong monsoon, and declining edible oil costs as supportive of a benign inflation outlook. He was the lone member to favor a smaller, quarter-point cut in the last policy round, where the RBI surprised markets with a more aggressive rate reduction and liquidity easing.

The remarks align with the RBI’s recent balancing act: while it injected liquidity to spur credit growth, it also announced plans this week to withdraw $11.7 billion (₹1 trillion) via short-term operations to curb excess market liquidity and stabilize short-term rates.

From a macro perspective, Bhattacharya’s comments reflect India’s complex policy challenge, managing a still-fragile recovery while guarding against inflation flare-ups and capital outflows. He called attention to the difficulty of managing liquidity due to variables like currency in circulation, global capital flows, and the government’s cash position.

India’s FY26 growth forecast of 6.5 percent remains intact, but Bhattacharya warned that structural metrics like potential output need reassessment. “We are far from overheating,” he said, noting that subdued core inflation gives the RBI room to act. His comments reinforce the view that India’s monetary policy path remains contingent on incoming data, especially global trade dynamics and inflation trends.

India’s Rice Glut Powers Ethanol Surge.

India is pivoting from rice shortages to surplus management, using a record volume of rice for ethanol production in a move that highlights the country’s shifting food and energy priorities. This marks a strategic response to burgeoning stockpiles and supports India’s ambitious target of blending 20 percent ethanol into gasoline by 2025–26.

After poor monsoons in recent years forced New Delhi to restrict rice exports, this year’s ample rainfall has yielded a bumper harvest, creating inventory headaches for policymakers. As of June 1, the Food Corporation of India (FCI) held a record 59.5 million metric tons of rice—more than four times the government’s buffer norm for July. In response, the government has allocated 5.2 million tons of FCI rice for ethanol production in the current marketing year—up from just 3,000 tons last year and equivalent to nearly 9 percent of global rice exports.

This shift is also easing pressure on alternative ethanol feedstocks such as corn, which saw record-high prices and imports last year. India’s grain-based distilleries, which rotate between corn, rice, and damaged grains, now have a reliable fallback as sugarcane output falters due to drought.

The ethanol strategy not only relieves FCI’s bulging silos but aligns with broader energy security goals. As the world’s third-largest oil importer, India views ethanol blending as a critical step toward reducing fossil fuel dependence. The country hit a 19.8 percent ethanol blend last month—nearly meeting its target a year ahead of schedule.

Still, challenges remain. Ethanol makers say margins are tight unless rice prices fall or ethanol procurement rates rise. With another bumper crop expected in October, the government may need to ramp up rice-to-ethanol conversion further.

The policy underscores how India’s macro strategy is evolving—from food security to resource optimization, blending agriculture with energy resilience.

India Defends Copper Import Curbs.

India’s government is pushing back against industry-led legal challenges to its new quality control measures on copper cathode imports, arguing in court that the regulations are essential for consumer safety and do not restrict foreign competition. The defense comes amid growing scrutiny from trade associations who argue the curbs could lead to monopolistic practices and supply shortages.

In a 160-page legal filing, the Ministry of Mines stated that 10 foreign producers, mostly from Japan, along with Malaysia and Austria, have already secured compliance certification under the new Quality Control Order (QCO). The government asserted that concerns raised by the Bombay Metal Exchange and Bombay Non-Ferrous Metals Association are "misconceived and unfounded," and it urged the court to dismiss the challenge.

From a macroeconomic lens, the dispute highlights India’s increasing reliance on refined copper as it accelerates infrastructure development, renewable energy deployment, and electric vehicle production. With copper demand projected to double by 2030, securing both quality and supply chain resilience has become a strategic priority. Copper was designated a "critical mineral" by India in 2023.

Imports have surged since the 2018 shutdown of Vedanta’s Sterlite Copper smelter, making India the world’s second-largest copper importer. The current import structure is heavily reliant on Japan, followed by Tanzania and Mozambique. The government’s position aims to balance safety standards with supply diversification, and ensure long-term price stability.

With domestic copper output still lagging demand, led by Hindalco, Vedanta, Adani, and Hindustan Copper, the QCO is also part of a broader effort to develop domestic refining capacity and attract foreign investment. While the legal process continues, the case signals India’s intent to exert more regulatory oversight over key resource imports in line with its critical minerals strategy.

Want to sponsor our next newsletter?

Reach out to [email protected] to see your ad here.

Gupshup.

Macro

An Indian trade delegation is in Washington to negotiate an interim deal ahead of a July 9 deadline, when higher U.S. tariffs are set to take effect. Talks remain tense as both sides clash over issues like genetically modified crops and reciprocal tariff concessions.

The Indian rupee climbed to a two-week high, buoyed by a weakening U.S. dollar amid concerns over the Federal Reserve’s future independence. Market fears that a Trump-appointed Fed chair might align more closely with political interests have intensified pressure on the dollar, boosting Asian currencies.

The Reserve Bank of India’s holdings of government bonds reached a record high of about $173.55 billion (₹14.9 trillion) by March-end, driven by aggressive debt purchases. However, analysts expect the central bank to reduce its bond holdings in the coming months.

Equities

State Bank of India has picked six banks, including Citi and HSBC, to manage a $3 billion (₹256.8 billion) share sale. The move comes as bank valuations near record highs, prompting several Indian lenders to tap capital markets.

PayPal-backed Pine Labs has filed for a $303 million (₹26 billion) IPO in India, aiming to capitalize on the country's booming fintech sector. The proceeds will be used to repay debt and expand operations in Singapore, Malaysia, and the UAE, as Indian markets see renewed interest in tech listings.

Indian tech stocks are poised to extend gains as improving earnings prospects and technical indicators support continued momentum. Analysts note that software exporters are outperforming the broader market, with the Nifty IT Index rebounding from key support levels ahead of June-quarter results.

Shares of Multi Commodity Exchange of India hit a record high after UBS raised its price target, projecting over 20 percent upside. The upgrade reflects confidence in MCX's volume growth driven by commodity price volatility and upcoming product launches like electricity derivatives.

Indian fintech firm Pine Labs is targeting a valuation of up to $6 billion (₹513.6 billion) in its IPO, which could raise about $1 billion (₹86.5 billion). The company plans to use the proceeds to expand overseas, invest in technology, and reduce debt, while existing investors like PayPal and Mastercard will also sell shares.

Alts

Vodafone Idea is seeking about $2.9 billion (₹248.2 billion) in loans to upgrade its network and stem subscriber losses to rivals. The State Bank of India is expected to lead the lending consortium, with the funds helping support capital expenditure amid talks of potential government relief.

India’s newly licensed shipping finance firm, Sagarmala Finance Corp., is seeking to raise up to $467 million (₹40 billion) to address a funding gap in the maritime sector. The state-owned lender plans to support smaller operators and projects overlooked by banks, aligning with the government’s 2047 maritime expansion goals.

India’s monsoon rains are expected to cover the entire country within the next three to four days, more than a week earlier than usual. This early arrival boosts prospects for summer crops, as nearly half of India’s farmland relies on monsoon rainfall for irrigation.

Vedanta Resources has secured up to $600 million (₹51.4 billion) in loans from international banks to refinance its debt, aiding its efforts to reduce borrowing costs. The move contributed to credit rating upgrades from agencies like S&P and Moody’s, as the company lowered its net debt in fiscal 2025.

Policy

India refused to endorse a joint defense statement at the China-led SCO summit, citing the absence of language addressing terrorism. The move reflects ongoing tensions with Pakistan and highlights India's push to prioritize counter-terrorism amid growing divisions within the bloc.

India is considering easing fuel efficiency norms for small cars under 1,000 kg, following lobbying by Maruti Suzuki amid declining sales. This move aims to boost small car sales, which have dropped as SUVs gain popularity.

India’s power ministry has proposed a new rule requiring electricity distribution companies to seek regulatory approval within 30 days of signing clean energy deals, aiming to speed up project starts. This move addresses industry concerns over delays that have slowed solar, wind, and other renewable projects as India pushes to nearly triple its clean energy capacity by 2030.

See you Friday.

Written by Eshaan Chanda & Yash Tibrewal. Edited by Shreyas Sinha.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.