The RBI names a new governor in charge of regulation. Air India gets a six-year loan. European banks are closer to market making in India.

If you have any questions about India, fill out this form or reach out to Shreyas at [email protected]

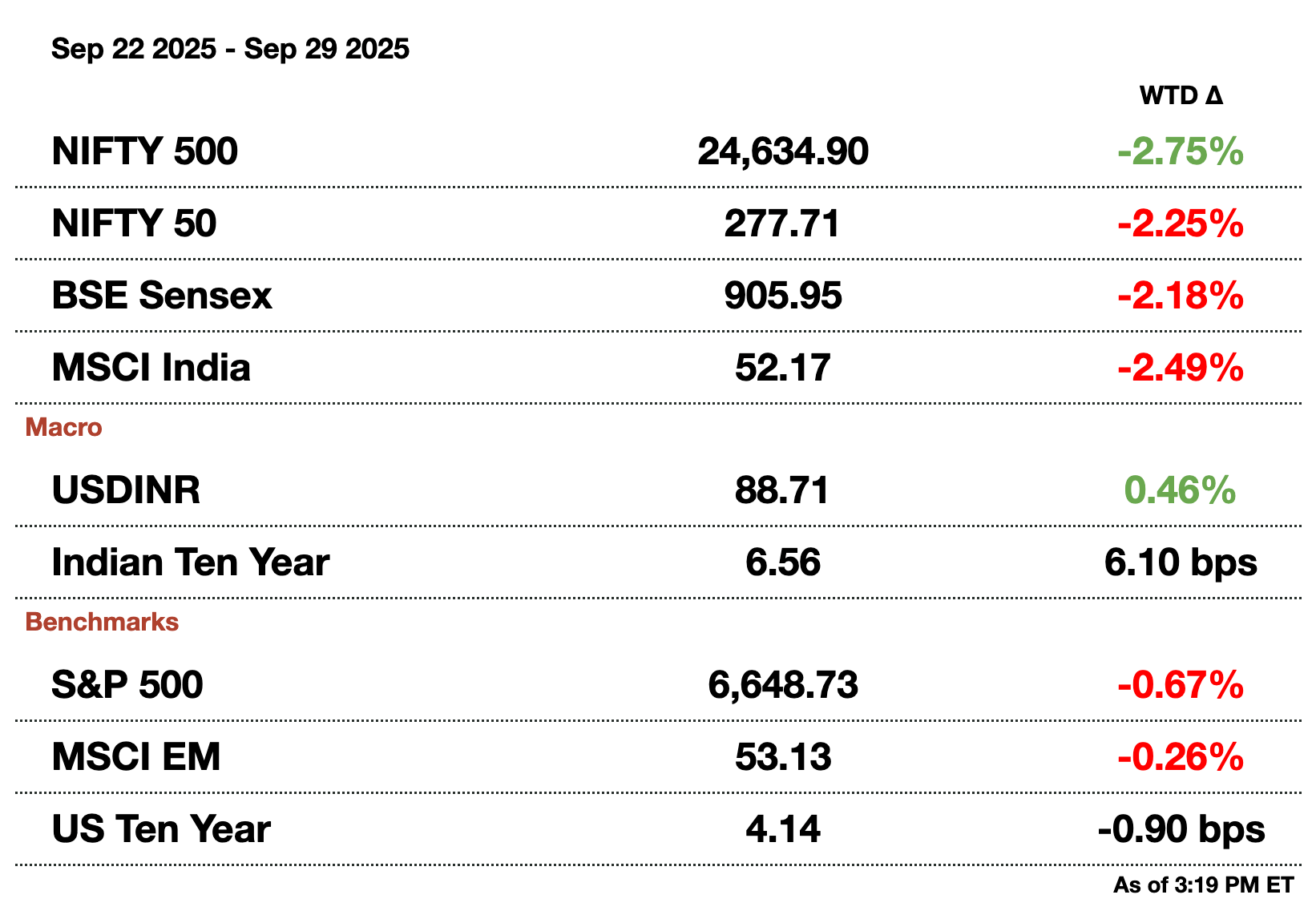

Macro

The IT sector continues declining with analysts seeing a near-term trough. There needs to be a demand upswing which likely will not present itself until 2026 with a pickup in discretionary spending and better deal conversion.

Financials show more relative stability due to strong underlying performance. Banks have strong balance sheets, high quality assets, and great operating efficiency. Healthy capital levels and conservative provisioning standards have led to banks improving from their 2024 risks.

Bond traders are pinning their hopes on a dovish RBI to revive a lackluster bond market.A cut is expected to nudge 10-year yields 30 basis points lower while dovish sentiment would lead to a 10 basis point reduction. No action risks a major selloff. Rising global uncertainty with tariffs and H1Bs have also led to trader optimism of policy support.

Equities

Tata Group loses $75 billion (₹6.5 trillion) in market cap following visa curbs and cyberattacks. The conglomerate faces a cyberattack at Jaguar, an Air India crash, and visa curbs impacting its technology business in the US. Tata serves as a barometer for the overall Indian market which has traded down in the last few months, mostly on geopolitical tension.

Tata Capital's IPO seeks $1.7 billion (₹146.2 billion) for India's largest 2025 listing. The company would be valued at $16 billion (₹1.4 trillion) even with current strains in the shadow banking industry. The RBI had instructed shadow lenders to list by the end of September, but Tata asked for an extension to handle an IPO of such size.

HDFC (India's largest private lender) is banned from onboarding new clients in Dubai due to regulatory lapses.The bank offered services to local clients who were not actually onboarded in Dubai. HDFC’s statement says that Dubai is not material to its growth and is already working on remedial procedures.

Alts

India announced a $454 million (₹40.3 billion) cross-border train with Bhutan for travel and goods. The two countries have already built up road connectivity with more checkpoints and immigration stops, but the train will expedite trade. The project is expected to take 4 years until completion with the rail line running 90 kilometers for now.

ArcelorMittal may get a $491 million (₹42.2 billion) bid for its South African steel mills. IDC is a leading financial institution debating the bid which would end a 2 year saga of Arcelor shutting down its steel mills which affected nearly 100,000 people who were employed in the steel supply chain. Arcelor is expected to accept a bid of that size.

Nayara Energy has clawed back sales even after heavy US sanctions. Rosneft (a Russian oil company) has minority ownership of Nayara which caused the sanctions. Indian government support has led to the company recovering such as multiple lenders facilitating rupee payments and state-owned companies buying more oil from Nayara.

Indian miner Vedanta is debating a dollar bond sale to repay private debt. Although the amount is unknown, sources say the facility would be for 7 years with investor calls being done in Asia, Europe, and the US. The firm is going to refinance debt taken out in 2023 at 18 percent.

Kedaara Capital raises $300 million (₹25.8 billion) for a continuation fund.The private equity fund is transferring partial stakes in Lenskart and Care Health Insurance to the vehicle. The deal continues a global trend of extending stakes due to a weaker exit environment.

Policy

Vijay, an actor turned politician in Tamil Nadu, had a massive event turn into a stampede. 38 people died when the crowd suddenly started surging forward. The opposition party to Vijay blames him for not taking more police precaution even while knowing that the crowd would span nearly ten thousand people.

1. The RBI Names a New Governor for Regulation

The government has named Shirish Chandra Murmu, a career central banker, as one of the RBI’s deputy governors for a three-year term beginning October 9. He succeeds M. Rajeshwar Rao, whose tenure ends October 8. Rao has overseen regulation, enforcement, and risk monitoring, and briefly represented the RBI on the MPC earlier this year before Poonam Gupta assumed that role. Murmu is likely to oversee further regulation as India’s financial industry expands.

Murmu currently serves as an executive director in the Department of Supervision, where he has been closely involved in regulatory oversight. While his exact portfolio will be finalized after he assumes office, his appointment is expected to maintain continuity in supervision and regulatory functions at a time when the central bank faces challenges ranging from financial stability risks to oversight of fast-growing fintechs.

The appointment, announced by a federal selection panel, ensures a smooth leadership transition at the RBI without altering the MPC’s composition since Gupta remains the sole deputy governor on the policy-setting body. Murmu will join a four-member deputy governor bench alongside Gupta, T. Rabi Sankar, and Swaminathan Janakiraman.

Strategically, the move underscores the government’s preference for continuity and experience in regulatory leadership at a time when Indian banking is navigating global interest rate volatility, the rise of digital lending, and heightened scrutiny of non-bank financial intermediaries. Murmu’s supervisory background suggests the RBI will maintain its strong focus on enforcement and systemic risk monitoring as it balances stability with financial innovation.

2. Air India Refinances in a Landmark Deal

Air India has secured a six-year, $215 million (₹18.5 billion) loan from Bank of India and Standard Chartered to refinance short-term debt tied to the acquisition of six Boeing 777 aircraft. The facility, priced at about 168 basis points over SOFR, was raised through GIFT City, underscoring both the airline’s balance sheet strategy and the growing relevance of India’s international financial hub.

The transaction reflects Air India’s push to strengthen its capital structure under Tata Group ownership by rolling near-term liabilities into longer-dated, competitively priced funding. While fundraising talks initially slowed after a major crash in June, the successful close of this loan highlights recovering lender appetite and continued support for Air India’s expansion strategy.

The deal also carries broader significance for India’s financial ecosystem. It marks the first time Bank of India has acted as a mandated lead arranger in a GIFT City loan, signaling that Indian lenders are beginning to take on more prominent roles in cross-border structured financing. Alongside Standard Chartered’s participation, the arrangement points to sustained international interest in Indian aviation exposure despite operational and safety challenges.

For GIFT City, the transaction is another step toward establishing itself as a competitive alternative to offshore hubs like Singapore and Dubai. For Air India, it secures more predictable financing for its widebody fleet, ensuring stability as the carrier ramps up operations and repositions itself in the global aviation market.

3. European Banks Are Closer to Market Making in India

The European Central Bank is in talks with major lenders on easing capital charges tied to trading through India’s Clearing Corp. of India (CCIL), as regulators seek to defuse a standoff that has complicated billions of dollars in bond and derivatives trades. The discussions follow the European Securities and Markets Authority’s (ESMA) 2022 decision to strip CCIL and other Indian clearing houses of recognition for failing to comply with stricter EU oversight requirements.

The loss of recognition triggered costly capital penalties for European banks active in India’s debt and swaps markets (mostly Deutsche Bank, BNP Paribas, Credit Agricole, and Societe Generale) since using non-recognized clearing houses makes exposures riskier in regulatory terms. Banks have warned that the added charges undermine their role as market-makers in Indian government bonds and derivatives.

To mitigate the impact, some institutions have floated routing trades through Indian banks to sidestep direct exposure to CCIL, though this workaround risks fragmenting liquidity and increasing operational complexity. Regulators in France and Germany have already extended temporary allowances for their domestic lenders while urging them to explore alternatives with Indian counterparts.

At the core of the dispute is a clash of regulatory philosophies. EU rules require ESMA to establish cooperation agreements granting it access to foreign clearing house data and the ability to shape risk frameworks. The RBI, however, has resisted what it views as interference in its supervisory autonomy.

For now, the ECB is exploring whether a temporary fix can ease pressures on European banks without undermining EU standards, but officials caution that no resolution is guaranteed. A joint approach between European and Indian regulators remains the ultimate goal, though political sensitivities over regulatory sovereignty make a swift breakthrough unlikely.

The outcome carries broader implications: India’s ambition to deepen its bond market and attract more global participation depends on clearing infrastructure remaining accessible, while European banks’ ability to intermediate that flow rests on regulatory compromises yet to be struck.

How helpful was today's newsletter?

See you tomorrow.

Written by Eshaan Chanda & Yash Tibrewal. Edited by Shreyas Sinha.

Sponsor the next newsletter to reach tens of thousands of U.S.-based business-savvy professionals. Reach out to [email protected].

Could your business use expert insights to power growth in India? Reach out to [email protected] for a free introductory call.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.