Today, we discuss how the RBI’s forecasting model faces growing scrutiny for repeatedly overestimating price pressures, and what this means for the future of India’s interest rates and economic growth.

If you have any questions about India, fill out this form or reach out to Shreyas at [email protected]

Macro

7.7 million barrels of Russian crude are racing to reach India before sanctions hit on the 21st. New US sanctions will impact the tankers being used at the end of the week though they are already on the way to India. Most are going to Reliance or Nayara, though whether they are allowed to discharge their cargo after the 21st is still under question.

Textiles have managed to withstand tariffs. Strategic partnerships with US companies and cost cutting has helped cushion the blow. Lower cotton prices have kept spinners’ margins intact while other firms are eating tariff costs; winning back lost orders is far more difficult than a quarter or two of higher costs.

Ethanol prices could be lifted to help sugar mills absorb higher cane costs.The other motives are to ensure timely payments to sugar farmers and curb sugar supply which is currently in surplus. Sugar prices have risen a few rupees per hundred kilograms since 2022 though ethanol prices have remained flat.

Equities

Amazon's More Retail IPO will pave the way for future quick-commerce IPOs, including Reliance Retail. This is the first major supermarket listing since DMart and Vishal Mega Mart years ago. Confidence from investors would help buoy the otherwise battered commerce sector in the stock market.

Wall Street has shifted to being bullish on India based on a macro view. IPO momentum signals rising risk-on appetite while banks and lenders are saying investors should overlook the EM underperformance compared to peers. A rise in earnings and GDP growth should also fuel stocks to rise in 2026.

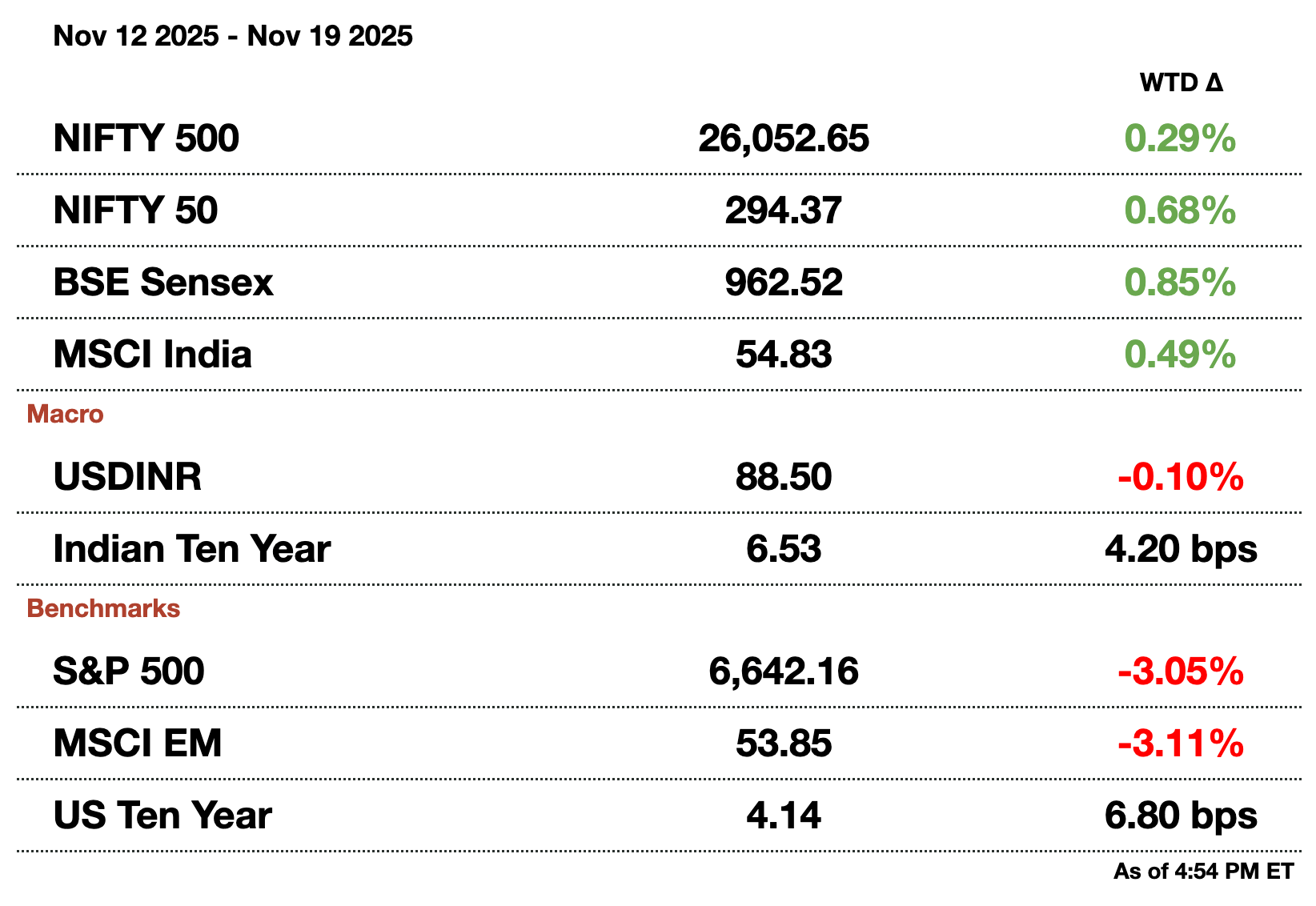

Nifty and S&P performance, normally coupled, are starting to diverge showing Indian financial independence.For a while now, both markets have moved in lockstep due to US news dominating both countries. Over the last few weeks, Indian stocks have started outperforming while the S&P is declining, showing an idiosyncratic story starting to form around India.

Alts

VW has slashed EV development costs in India from $1 billion (₹88.6 billion) to $700 million (₹62 billion). The company also wants to boost its tiny 2 percent market share by finding a local partner to share costs and risk. Other issues for VW include tighter carbon-emission standards for Indian autos in 2027, which could necessitate more imports from the EU.

Jefferies is hiring a Mizuho banker to lead its private credit business in India. Emerging market deals from private lenders are on course for a record year due to political pressure. Modi has demanded a huge infrastructure financing push with $9 billion (₹797.4 billion) worth of deals being done in 1H25.

Offshore investors are using options to bet on a rupee rally. At least 2 US banks and 1 UK bank (unnamed) have heightened their options to be long rupee. Traders expect the rally to last anywhere from 1 to 3 months based on option tenors used for trading.

Creditors to Jaiprakash Associates are backing Adani's $1.5 billion (₹153 billion) takeover plan.The bankrupt infrastructure group prefers Adani to Vedanta’s bid even though Vedanta bid higher due to Adani’s higher upfront cash payments. Jaiprakash was once one of India’s largest infra construction businesses but is now wrapped in one of the country’s largest ever bankruptcies.

Policy

Air India is lobbying to use China's military air zone in Xinjiang to shorten routes. The ban over Pakistani airspace has led to higher costs by 29 percent especially with long haul routes to Europe, Canada, and the US. The Pakistani airspace closure has cost it $455 million (₹40.3 billion); it is unsure how much the Indian government will parlay with the Chinese given India-China direct flights only resumed a few weeks ago.

Nara Lokesh, a Modi ally, is securing multinational investments in Andhra Pradesh.His proximity to Modi allows him to remove bureaucratic bottlenecks and he claims he has secured $120 billion (₹10.6 trillion) in commitments over the last 16 months. Lokesh’s main slogan has been “Speed of Doing Business” has worked with securing tax abatements for Google and infra project approval for Adani.

But what can you actually DO about the proclaimed ‘AI bubble’? Billionaires know an alternative…

Sure, if you held your stocks since the dotcom bubble, you would’ve been up—eventually. But three years after the dot-com bust the S&P 500 was still far down from its peak. So, how else can you invest when almost every market is tied to stocks?

Lo and behold, billionaires have an alternative way to diversify: allocate to a physical asset class that outpaced the S&P by 15% from 1995 to 2025, with almost no correlation to equities. It’s part of a massive global market, long leveraged by the ultra-wealthy (Bezos, Gates, Rockefellers etc).

Contemporary and post-war art.

Masterworks lets you invest in multimillion-dollar artworks featuring legends like Banksy, Basquiat, and Picasso—without needing millions. Over 70,000 members have together invested more than $1.2 billion across over 500 artworks. So far, 23 sales have delivered net annualized returns like 17.6%, 17.8%, and 21.5%.*

Want access?

Investing involves risk. Past performance not indicative of future returns. Reg A disclosures at masterworks.com/cd

Samosa Capital does not endorse the perspective on U.S. equity markets displayed by Masterworks’ ad.

Reach out to [email protected] to reach our audience and see your advertisement here.

Reserve Bank of India

The RBI Keeps Overestimating Inflation

India’s inflation debate has taken a sharp turn this year as the RBI’s forecasting model faces growing scrutiny for repeatedly overestimating price pressures. The projection errors have been unusually large: a 0.7 percent miss in Q1 (the widest in nearly six years) followed by smaller but still significant gaps of 0.2 and 0.1 points in the next two quarters. With October inflation collapsing to just 0.25 percent, economists now expect another sizable miss in the current quarter, rendering the RBI’s October projection of 2.6 percent for FY25 outdated in a matter of weeks. Most bank economists expect inflation at just 2.0 to 2.2 percent, a historic low for an economy whose formal target is 4 percent.

These repeated misses matter because they have shaped monetary policy in a more hawkish direction than the economy may have required. Most often, central bank forecasts reflect policy intent but persistent misses damage credibility and lead to the wrong policy. Governor Malhotra cut rates by 50 basis points in June, but also shifted the stance to “neutral”, a move interpreted as limiting the scope for further easing. Since then, despite inflation steadily falling, the RBI has kept rates unchanged even as India absorbed a 50 percent tariff shock from the United States. Economists warn that when forecasts overshoot for several quarters, real interest rates rise unintentionally, tightening policy even when growth is softening.

Much of the forecasting error stems from food. A strong monsoon, sharp improvements in supply-chain management, and an unusually large drop in vegetable and grain prices drove food inflation to –5.02 percent in October which is now the steepest contraction on record. Given food’s 46 percent weight in the CPI basket, even moderate swings can move headline inflation by entire percentage points. Governor Malhotra himself highlighted that food-price volatility has historically shifted headline inflation by around 3 points per year. But this year’s collapse has surprised nearly every forecaster, since core inflation (excludes food and energy) remained stable even as the headline plunged.

The RBI has attempted to modernize its framework. Its 2023 upgrade to the Quarterly Projection Model 2.0 integrated fiscal-monetary dynamics, domestic fuel-pricing mechanisms, capital flows, exchange-rate channels, and the effects of central bank intervention. The model is undergoing further refinement, with Malhotra emphasizing improvements in nowcasting and real-time measurement. But structural issues remain: the CPI basket itself is more than a decade old and no longer reflects contemporary spending patterns. The Ministry of Statistics will release an updated basket next year, which should reduce some of the model’s systematic biases.

GDP projections have also been inconsistent, with growth undershooting the RBI’s July-September forecast (5.4 percent vs. 7 percent) and overshooting in April-June (7.8 percent vs. 6.5 percent). These swings highlight the difficulty of modeling a rapidly evolving, supply-driven emerging market economy in a year dominated by volatile food prices and external shocks.

The central bank’s latest forecast sees inflation averaging 1.8 percent this quarter compared to Deutsche Bank seeing 0.7 percent. While the RBI expects inflation to climb back toward 4.5 percent by mid-2025, the central bank missed opportunities to ease in August and October when inflation was already showing structural softness. If inflation remains anchored below target into December, the conversation will shift from questioning the model to questioning whether monetary policy itself has become unintentionally restrictive at a critical moment for India’s growth cycle.

How helpful was today's newsletter?

See you tomorrow.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Sponsor the next newsletter to reach tens of thousands of U.S.-based business-savvy professionals. Reach out to [email protected].

Could your business use expert insights to power growth in India? Reach out to [email protected] for a free introductory call.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.