Good afternoon,

Welcome to the best way to stay up-to-date on India’s financial markets. Today, we’re discussing

The Reserve Bank of India will stop daily fund infusions,

the U.S. trade delegation in India has extended its stay in New Delhi,

and India’s coal power output drops sharply.

Then, we close with Gupshup, a round-up of the most important headlines.

Have a question you want us to answer? Fill out this form, and you could be featured in our newsletter.

—Shreyas, [email protected]

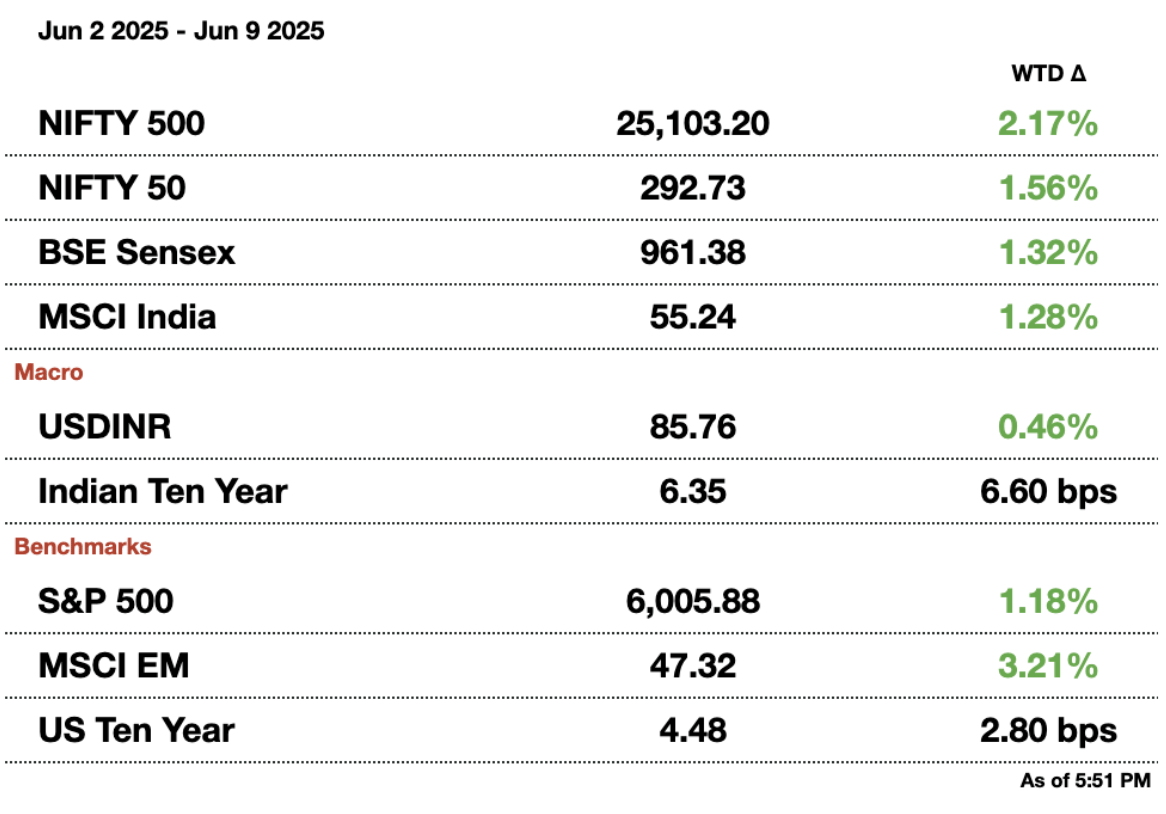

Market Update.

RBI to End Daily Fund Infusions as Policy Stance Shifts to Neutral.

The Reserve Bank of India announced Monday it will cease its daily variable rate repurchase auctions from June 11, marking a notable shift in its approach to liquidity management. The move comes just days after the central bank cut policy rates and introduced a surprise liquidity boost, but also signaled that further easing may be limited by shifting its policy stance from “accommodative” to “neutral.”

Signaling a shift: This change in stance suggests the RBI is now preparing to manage excess liquidity in the financial system more actively, a development that could impact short-term borrowing costs and bond market dynamics.

“In light of the change in policy stance, the move to stop daily fund injections could mean that the central bank may now act to modulate excess funds in the banking system,” analysts say. “That’s a clear risk from the bond market standpoint and some part of the rise in bond yields since the policy may have to do with that risk,” said ICICI’s economist Abhishek Upadhyay.

Indeed, the bond market has reacted. Government bond yields began rising after the RBI’s recent policy announcement, partly due to expectations that the RBI might shift from injecting to withdrawing liquidity.

Liquidity implications: Back in January, the RBI launched daily repo operations as banks faced an unprecedented liquidity deficit of $35 billion (₹3 trillion). The central bank’s consistent fund infusions since then, through a combination of repo operations, open market purchases, and a phased cut in the cash reserve ratio (CRR), helped flip the system from a cash crunch to a cash surplus.

As of June 8, banks were parking $29.2 billion (₹2.5 trillion) in excess funds with the RBI, sharply reversing the liquidity deficit seen earlier in the year.

With the system now flush with cash, participation in daily repos has dwindled. At the same time, banks’ overnight borrowing costs have consistently fallen below the central bank’s policy rate, sometimes by more than 20 basis points, effectively delivering looser monetary conditions than the RBI’s official rate cuts would suggest.

The RBI’s shift away from daily injections signals a desire to bring market rates back in line with policy rates, potentially through absorption tools like reverse repos or term auctions. Analysts say this could reduce the divergence between overnight rates and the official repo rate, and give the RBI more control over the monetary transmission mechanism.

US Trade Delegation Extends India Visit as Deal Talks Gain Pace.

A U.S. trade delegation currently in India has extended its stay beyond the original schedule, signaling growing momentum in negotiations between the two countries ahead of a key July deadline, according to people familiar with the matter.

Why the extension? Originally planned for June 5–6, the meetings have now been extended until at least Tuesday, the delegation stated, requesting anonymity as the discussions are private. Most of the outstanding issues could be resolved within a week, they added, raising hopes for a preliminary trade agreement.

The two sides are working toward a phased trade deal, with an early-stage agreement targeted for completion before July 9, the date when reciprocal tariffs are set to take effect. These tariffs, a legacy of former President Donald Trump’s administration, are currently facing legal scrutiny in U.S. courts, but their implementation deadline remains in place.

Both India’s Commerce Ministry and the Office of the U.S. Trade Representative declined to comment on the talks, which have not been publicly detailed. However, local Indian media outlets have reported the extension of the delegation's stay.

India’s Commerce Minister Piyush Goyal

What this means: India has long sought a comprehensive trade pact with the U.S., one of its largest trading partners. The latest round of negotiations reflects renewed urgency and cooperation under the Biden administration, even as legal and political obstacles persist in Washington.

During a visit to the U.S. in May, Indian Commerce Minister Piyush Goyal described his meeting with U.S. Trade Representative Howard Lutnick as “constructive.” Earlier this month, Lutnick expressed optimism, saying he was “very optimistic” about the chances of a trade deal materializing “in the not-too-distant future.”

With the clock ticking toward the July deadline, both governments are looking to finalize a workable framework that would avert punitive tariffs and boost bilateral trade cooperation.

India’s Coal Power Output Sees Sharpest Drop in Five Years as Renewables Surge.

India’s coal-fired electricity generation plummeted by 9.5 percent in May, the steepest year-on-year decline in five years, as overall power demand softened and renewable energy reached record highs.

This marks the sharpest fall in coal use for power generation since June 2020, when the COVID-19 lockdowns brought the economy to a standstill. Total electricity output in May decreased 5.3 percent from the same period a year earlier to 160.4 billion kilowatt-hours (kWh), primarily due to a cooler summer and sluggish industrial demand.

Renewables, meanwhile, are on a rapid ascent. Solar and wind energy generation surged 17.2 percent year-on-year to 24.7 billion kWh, pushing renewables’ share in India’s power mix to a record 15.4 percent—the highest since data tracking began in 2018.

The changing energy mix is also affecting natural gas-fired power, which fell 46.5 percent to 2.78 billion kWh, the steepest decline since October 2022. Hydropower generation climbed 8.3 percent to 14.5 billion kWh, accounting for 9 percent of total generation, up from 7.9 percent a year ago.

What this means: These shifts are taking place at a time when global coal and LNG prices are under pressure due to weak demand from top importers China and India. Asian spot LNG prices have fallen over 15 percent in 2025, while thermal coal prices have hit four-year lows.

“Demand from the power sector - typically strong during peak season - remained limited. Additionally, economic headwinds have weighed on non-power industries,” Indian coal trader I-Energy noted in a market commentary.

In May, India’s peak power demand reached 231 gigawatts (GW), down 8 percent from a record 250 GW during a heatwave in May 2024. Milder temperatures this year, alongside growing renewable output, have reduced pressure on fossil fuel-based generation.

Decreasing dependence: India’s dependence on coal continues to shrink. The share of coal in the power mix dropped to 70.7 percent in May, down from 74 percent a year earlier, the lowest level since June 2022. While India has historically defended its coal use by citing its lower per capita emissions compared to developed nations, the recent trend reflects a slow but steady pivot toward cleaner energy.

Utilities are now expected to scale back purchases of expensive gas-fired power as solar and wind become more cost-competitive, said Prashant Vashisth, vice president at ICRA, a Moody’s affiliate.

The decline in fossil fuel usage could significantly aid India’s emissions goals, especially after its coal-heavy approach to post-pandemic recovery. With renewable momentum building and demand easing, India may finally be seeing the early signs of a long-term energy transition.

Message from our sponsor.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

Gupshup.

Macro

Julius Baer expects Indian stocks to hit record highs in the second half of the fiscal year, driven by a revival in domestic consumption. Slowing inflation, monsoon rains, and tax cuts are set to boost spending among lower- and middle-income groups, fueling corporate profits despite near-term valuation concerns.

Wall Street banks are bullish on India’s stock market, viewing it as a safe haven amid rising global trade tensions. They’re recommending bullish options strategies and low-cost hedges. Optimism has surged after the RBI’s surprise rate cut, with strong foreign and domestic inflows expected to drive the Nifty 50 Index to a new high this quarter.

India’s consumer inflation likely cooled to 3 percent in May, marking a more than six-year low, helped by easing food prices and a favorable base, according to a Reuters poll. This supports the Reserve Bank of India’s recent surprise 50 basis point rate cut aimed at boosting growth, with inflation staying below the RBI’s 4 percent medium-term target for the fourth consecutive month.

India’s $80 billion (₹6.85 trillion) coal-power expansion faces a major challenge as many new projects are planned in water-scarce regions, intensifying competition for limited water resources and sparking conflicts between power plants and local communities. This situation highlights India’s broader struggle with water scarcity, given its large population but limited freshwater availability toward Trump’s policies, which were previously more deferential.

Equities

Tata Motors plans to invest up to $4.1 billion (₹351.2 billion) over the next five years to expand its electric vehicle lineup and technology, aiming to solidify its position as India’s leading EV maker amid increasing competition and stricter emission norms. The company will nearly double its model offerings and introduce more EVs and compressed natural gas vehicles to meet India’s goal of 30 percent EV sales by 2030.

U.S. pizza chain Little Caesars plans to open dozens of stores in India, starting with its first outlet in the Delhi NCR region this month, aiming to tap into India’s fast-growing economy despite a highly competitive pizza market.

Indian ride-hailing company Rapido is entering food delivery with a new platform that charges restaurants a fixed fee per order, aiming to compete with Swiggy and Zomato by offering lower fees and keeping menu prices consistent with in-store rates.

Titan-owned CaratLane plans to expand its store network and exceed last year’s revenue growth, as demand for affordable, lower-carat jewellery rises among younger Indian consumers. The brand, which already has over 320 outlets, sees strong potential in smaller cities and recently launched 9-carat gold products to capture this shifting trend.

Alts

Bank of America has hired JPMorgan banker Satish Arcot to lead its India equity capital markets business as part of its effort to rebuild its investment banking team. Arcot will join as a managing director in Mumbai later this year, following recent leadership changes at BofA amid efforts to recover from a scandal involving senior dealmakers.

Veteran fund manager Lakshmi Iyer has resigned from Kotak Mahindra Group after more than two decades and is set to join Bajaj Finserv, according to sources. Iyer, who previously led investments and strategy at Kotak Alternate Asset Managers, will join the financial conglomerate as it expands its asset management business.

Shein and Reliance Retail plan to ramp up Indian suppliers from 150 to 1,000 and begin exporting India-made Shein clothing to markets like the U.S. and UK within a year, amid growing pressure to diversify away from China.

India is expected to have a sugar surplus for at least the next two years as heavy rainfall boosts sugarcane yields and encourages farmers to expand cultivation. This rebound will enable the world’s second-largest sugar producer to increase exports in the 2025/26 season after previous export restrictions caused by poor rainfall.

A Singapore-flagged cargo ship en route to Mumbai caught fire and suffered multiple explosions off the coast of Kerala, causing 40 containers to fall into the sea and prompting 18 crew members to jump overboard. Rescue efforts are underway, and the ship remains on fire and adrift, though it is not sinking.

Policy

Shashi Tharoor said India won’t hold talks with Pakistan until it dismantles terrorist camps, rejecting external mediation and emphasizing the conflict is with terrorism, not Pakistan. He backed Modi’s hardline stance and urged international pressure on Islamabad.

India’s market regulator SEBI is investigating Jane Street’s derivatives trades over the past three years to determine if the quant trading firm attempted to manipulate the country’s key stock indexes, marking one of the largest probes into a global trading firm.

The UK and India are deepening counter-terrorism cooperation following last month’s ceasefire between India and Pakistan after deadly clashes in Kashmir. British Foreign Secretary David Lammy also confirmed UK PM Keir Starmer will soon visit India to finalize a free trade deal.

India’s central bank deputy governor flagged persistent issues in the microfinance sector, calling for urgent reforms. The issues include high interest rates, borrower over-indebtedness, and harsh recovery practices. He noted that even well-funded lenders are charging excessive margins despite some recent rate moderation.

See you Tuesday.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.