In partnership with

Quick-commerce, an e-commerce model focused on ultra-fast delivery, typically within 10 to 60 minutes, is starting to slow down as the human cost of delivering anything and everything starts to rise. Today, we explain what this means for one of India’s fastest growing industries.

If you have any questions about India, fill out this form or reach out to Shreyas at [email protected]

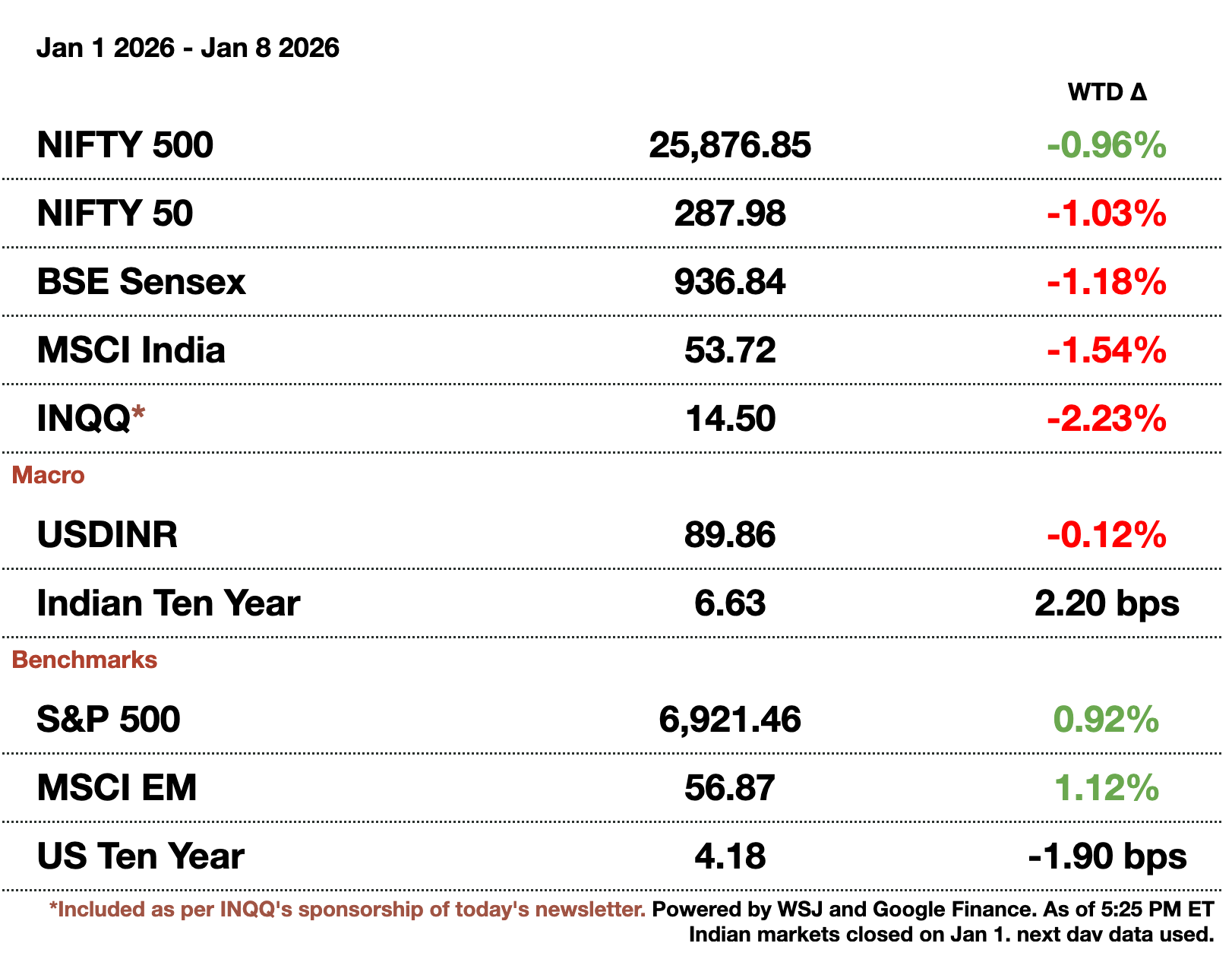

Macro

The government projects GDP for FY26, ending in March, will show a 7.4 percent growth y-o-y. The economy would be valued at around $4 trillion (₹357.1 trillion). A new GDP calculation revision in February could alter growth estimates since the base year changes.

The 7.4 percent GDP growth still hides a slowing second half at 6.9 percent compared to 1H at 8 percent. Nominal growth is only at 8 percent which lowers tax collection estimates and hurts government expenditure requirements. Shopping trips will be an important measure starting the year off to see if growth can continue.

Corporate investment rose by $33.3 billion (₹3 trillion) from 2024, making cost of capital important for 2026 investment. Higher borrowing from central and state governments on top of a broken monetary-transmission mechanism pushes up the cost of business for governments and companies.

Equities

BMW is rolling out 3 new EVs for India, with electric sales up 21 percent y-o-y making up 23 percent of the company’s Indian sales. BMW accounts for 60 percent of luxury car sales and is installing more charging infrastructure with $44.45 million (₹4 billion) to upgrade dealerships and charging networks.

Alts

Deutsche Bank had the most deals done for companies borrowing dollar bonds. Sales of foreign-denominated debt dipped by 37 percent to $8.3 billion (₹747.8 billion) while local debt grew to $151 billion (₹13.6 trillion).

De Beers plans on opening 25 stores in India betting on wealthy demand. By the end of the decade, De Beers wants to operate 100 stores targeting top metros but smaller tier 2 and 3 cities. Some stores could be franchised.

Policy

India started an excise tax on tobacco due to the $26.7 billion (₹2.4 trillion) cost of diseases due to tobacco use in the country. Over 250 million people use tobacco in some form but the tax should lower demand for cigs by 3 million users.

State-run power producer NTPC is searching across 30 sites for nuclear expansion in 5-6 states. NTPC wants to build 30 percent of the 100 GW goal by 2047 that India has for nuclear power. NTPC is also talking to various global suppliers for construction.

Invest in India's Tech Wave — The India Internet ETF (INQQ)

Eternal. NYKAA. Groww. Lenskart. Swiggy. Gain exposure to the “new age” technology leaders driving India's rise on the global stage -- all in a single trade. The India Internet ETF (NYSE: INQQ) allows investors to access a basket of innovative companies contributing to the future of the world’s most populous country.

From e-commerce to fintech to travel, the INQQ ETF taps into India’s rapidly expanding digital landscape and seeks to deliver a targeted way to participate in potential long-term growth. Invest with the INQQ ETF.

Reach out to [email protected] to reach our audience and see your advertisement here.

A Swiggy delivery rider in India

Quick-commerce’s Hype Starts to Slow Down

Quick-commerce, an e-commerce model focused on ultra-fast delivery, typically within 10 to 60 minutes, is starting to slow down as the human cost of delivering anything and everything starts to rise. Just a week ago, more than 200,000 drivers staged a flash strike to demand fair pay, safer working conditions, and an end to 10-minute delivery targets. While global peers like Buyk, Joker, and Getir all failed in the US, Blinkit, Swiggy, and Zepto are still growing in India through dark stores. Traditional retailers and e-commerce giants like Reliance, Amazon, and Flipkart are now rushing to build similar networks; the total number of dark stores will likely triple to 7,500 by 2030.

Platforms currently push riders to engage in risky behavior on unsafe roads while workers complain about the hazardous pollution in megacities like Delhi. Investors have also been thrown off since mid-October when new labor codes brought up the issue of social security and benefits provided to quick-commerce workers. Swiggy and Eternal shares have fallen around 20 percent while the Nifty 50 has remained stable. The flash strike helps show the problems employees have faced and the one that investors and boards are now seeing.

The response from executives has been to downplay the disruptions. Blinkit CEO Goyal claimed that riders average just a 2 kilometer drive at 16 kilometers per hour. Insurance premiums are also covered with average earnings reaching $233 (₹21,000) per month for someone working ten hours a day for 26 days. More investigation reveals that the average worker does not achieve these hours with typical annual participation equivalent to just 38 working days and only 2.3 percent of riders doing more than 250 days.

While the consumer-facing side of quick commerce has embraced capitalism, the delivery workforce remains precarious, bearing costs for vehicles, fuel, and maintenance without guarantees of consistent income or job security. By 2030, India’s gig economy is projected to reach 23.5 million people, tripling over a decade. Comparisons with China suggest that the pressures of balancing earnings targets and worker welfare are not unique but global, and the ultimate solution rests with government intervention. Without regulatory safeguards, the promise of convenience for consumers comes at the risk of perpetuating insecure conditions for the very workers who make the system function.

How helpful was today's newsletter?

See you tomorrow.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Sponsor the next newsletter to reach tens of thousands of U.S.-based business-savvy professionals. Reach out to [email protected].

Could your business use expert insights to power growth in India? Reach out to [email protected] for a free introductory call.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.