Good evening,

Welcome to the best way to stay up-to-date on India’s financial markets. This week, we were flooded with questions (and we love it!) about India’s path forward after the White House announced a blanket 26 percent tariff on the country. So, we took the most common questions and answered them below!

Then, we close with Gupshup, a round-up of the most important headlines.

Have a question you want us to answer? Fill out this form and you could be featured in our newsletter.

—Shreyas, [email protected]

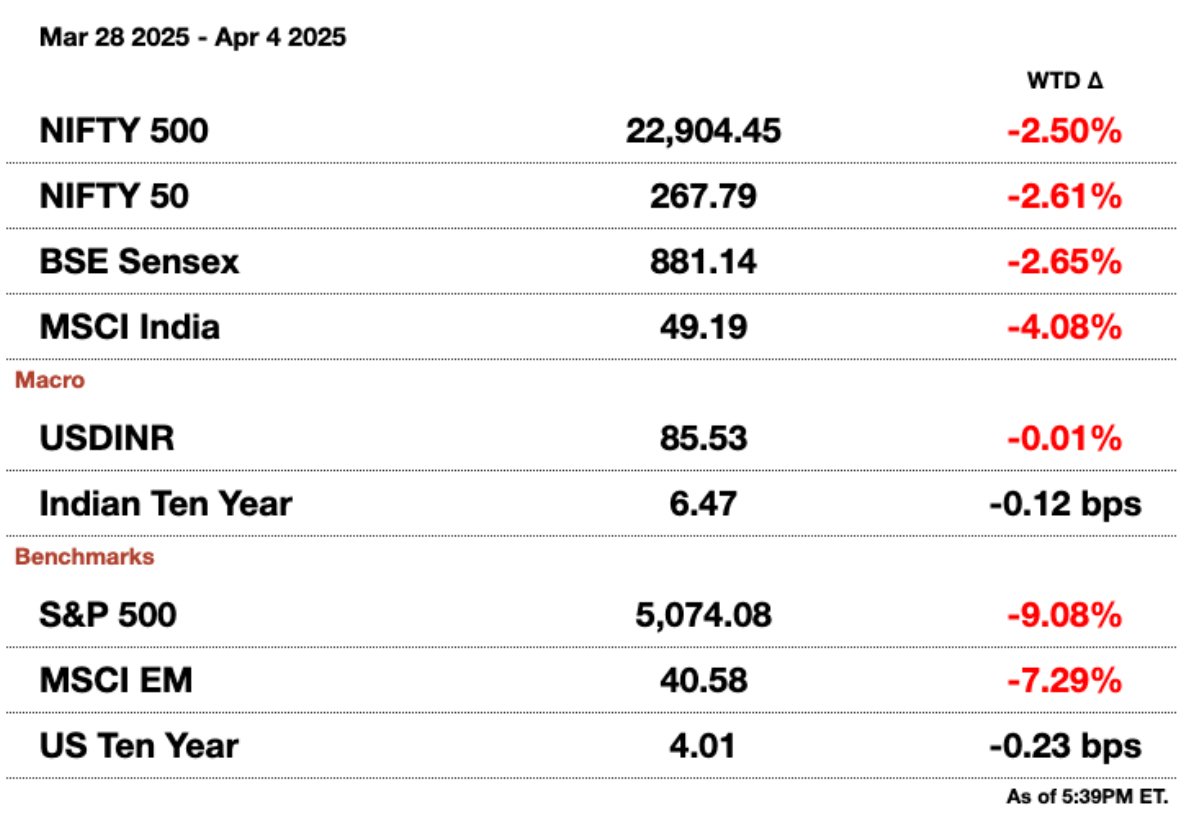

Market Update.

Q&A: Tariffs on India.

How will U.S. tariffs impact India’s economy?

India’s economy may take a hit from new U.S. tariffs, with analysts projecting a 20-40 basis point reduction in GDP growth this fiscal year. The new tariff threatens to shrink Indian exports to the US by up to $33 billion (₹2.8 trillion). Trump’s decision to impose a steep 26 percent tariff on Indian goods has now prompted major financial institutions to revise their forecasts. Goldman Sachs cut its growth estimate to 6.1 percent, down from 6.3 percent, while Citi expects a 40 bps drag on growth. Keep in mind that the government is aiming for 8 percent growth annually.

This economic jolt comes as inflation remains stable at around 4.2 percent, near the RBI target. The RBI had already cut interest rates in February for the first time in five years and is widely expected to cut another 25 bps at its April meeting.

Before the tariffs, economists anticipated just one more rate cut this year. Now, they foresee up to 75 bps in cuts, potentially bringing the repo rate to 5.5 percent—the lowest since 2022. Indian central bankers are focused on jumpstarting the economy from low growth, with inflation concerns taking the backseat.

How should U.S. professionals invest in India post-tariffs?

Firstly, this is not financial advice and is for informational purposes only.

American investors should show caution but understand that there are still many opportunities present. Most investors think India is well-insulated compared to other economies from tariffs. Just looking at index returns, the Nifty has fallen around 3 percent since they were announced, compared to American indices going down 7 percent. This is due to the domestic-centric nature of these companies, where most Indian companies already focus on internal revenue growth as compared to relying on exports.

Certain industries like pharmaceuticals will also outperform, as they are largely granted exceptions from tariffs; pharma is rapidly growing in terms of molecule exports to the EU and the US. Additionally, accredited investors should be prepared to invest in a bond rally in India since rates are expected to fall more than expected.

Samosa Capital maintains a long-term bullish view on India, as the world’s largest free trade zone by population, home to one of the youngest working age populations of any major economy, a state-of-the-art digital payments infrastructure, and enormous potential for scale and growth in every industry. Thus, short-term declines in Indian markets are viewed as an exciting opportunity to buy in, rather than as a rebuke of our founding thesis.

Can India hit 8 percent growth?

If Modi’s government takes the opportunity to reduce tariffs, remove outdated regulations, and enable deeper competition, Indian firms could thrive globally. Numerous economists have argued for India to lift tariffs so that it can be more easily integrated into global supply chains, especially with China; India’s concessions during tariff negotiations with the U.S. are a huge step in the right direction. Analysts predict that removing trade barriers could add an additional 1.5 to 2 percent that Modi is looking for in annual growth.

Why is India not putting reciprocal tariffs on the U.S. while the rest of the world is?

Because India already had the highest tariffs of any major economy (Trump often called the country, and not incorrectly, the “tariff king,”) it realized it had a strategic advantage over countries: it could front-run tariffs by giving concessions in exchange for more favorable negotiating terms. The European Union, on the other hand, averaged a 1 percent tariff (about a seventh of India’s tariffs) on the United States, and did not have any major industries protected by tariffs like India does; therefore, the EU had nothing to give to the U.S. in exchange for lower tariffs. India made several offers to lower tariffs to the U.S. and reduced tariffs on electric vehicles, facilitating business for Elon Musk’s Tesla before "Liberation Day." Still, these concessions did not amount to anything, the country was still slapped with a blanket tariff from the U.S. in the same way others were. Modi’s administration has not announced how it will move forward, though it will be in an aligned effort with other trading partners, including the EU, UK, and China, who also saw major tariff hikes on their exports to the U.S.

Message from our sponsor.

Email [email protected] to sponsor the next newsletter.

Apple’s Starlink Update Sparks Huge Earning Opportunity

Apple just secretly added Starlink satellite support to iPhones through iOS 18.3.

One of the biggest potential winners? Mode Mobile.

Mode’s EarnPhone already reaches +45M users that have earned over $325M, and that’s before global satellite coverage. With SpaceX eliminating "dead zones" worldwide, Mode's earning technology can now reach billions more.

Mode is now gearing up for a possible Nasdaq listing (ticker: MODE) but you can still invest in their pre-IPO offering at $0.30/share before their share price changes.

*An intent to IPO is no guarantee that an actual IPO will occur. Please read the offering circular and related risks at invest.modemobile.com.

*The Deloitte rankings are based on submitted applications and public company database research.

Gupshup.

Macro

India’s services PMI dipped to 58.5 in March from 59.0 in February, as growth eased and inflation hit a 3.5-year low, according to HSBC and S&P Global. Slower hiring, weaker global demand, and subdued business confidence may push the RBI to cut rates on April 9.

New U.S. tariffs on Indian goods could slow India’s GDP growth by 20–40 basis points this year, prompting economists to predict up to 75 basis points in interest rate cuts—triple earlier expectations—to cushion the blow. With inflation near target and growth risks rising, the Reserve Bank of India may bring rates down to 5.5 percent, the lowest since 2022.

India’s $283 billion (₹24.2 trillion) IT sector faces mounting pressure as new U.S. tariffs spark recession fears, leading major clients to cut tech budgets and causing the Nifty IT index to plunge 9.2 percent this week—its worst drop in over five years. With more than half of Indian software exports reliant on the U.S., analysts warn that deal delays and reduced discretionary spending could make 2026 a near washout.

Equities

IndusInd Bank hid $175 million (₹14.9 billion) in losses by not marking internal derivative trades to market, exposing a balance-sheet hole after a rupee slump and triggering its worst crisis in 30 years. The RBI has called for leadership changes as investigations widen into the bank’s accounting practices.

India’s commerce minister Piyush Goyal sparked backlash after urging startups to build like China—focusing on EVs and robotics instead of "fancy ice cream" and food delivery for the rich. Founders hit back, blaming the government for poor infrastructure and lack of support for deep tech.

Alts

A 27 percent U.S. tariff on Indian gems and jewellery—America’s third-largest import from India, worth nearly $10 billion (₹855 billion) — has brought Surat’s diamond industry to a standstill, threatening millions of jobs and over 30 percent of India’s export earnings from the sector. With global demand already weakening, analysts warn the shock could be worse than the 2008 crisis, forcing smaller firms to shut down and sparking urgent searches for new markets.

Policy

An Indian court has ordered Wikimedia to remove parts of a Wikipedia page calling news agency ANI a government "propaganda tool," ruling the statements defamatory and harmful to its reputation. The case, which includes a $233,000 (₹20 million) damages claim, has sparked renewed concerns over free speech and censorship in India.

India will send a delegation to Chile next week to negotiate stakes of up to 20 percent in SQM’s Mount Holland and Andover lithium projects, as it races to secure critical minerals for EVs, a source said. The talks, involving four state-backed firms, come amid broader efforts to expand resource access in Chile, Australia, and Argentina.

India's parliament passed a landmark aviation bill on April 3, easing the repossession of jets and engines for global aircraft lessors when airlines default on payments. This move, aligning with the Cape Town Convention, is expected to lower leasing costs, benefiting both airlines and passengers.

See you Monday.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.