Good evening,

Yesterday, we hosted our first live speaker event in New York: Dr. Viral Acharya addressed ~70 professionals interested in the U.S.-India space, speaking about India’s macroeconomic picture, banking system, and structural issues and opportunities. Tomorrow, we’ll discuss the most important takeaways.

To those who came, thank you very much for sharing your time with us! To those who couldn’t, we hope to see you next time! Email us your city so we can put it on our list.

Here’s what’s in today’s newsletter:

Modi and Trump meet at the White House,

Karnataka announces a new Infra asset to entice investors,

and, Why SMID caps are going to continue sliding downward in 2025.

Finally, we’ll close with Gupshup, a round-up of the most important headlines.

Have a question you want us to answer? Fill out this form and you could be featured in our newsletter.

—Shreyas, [email protected]

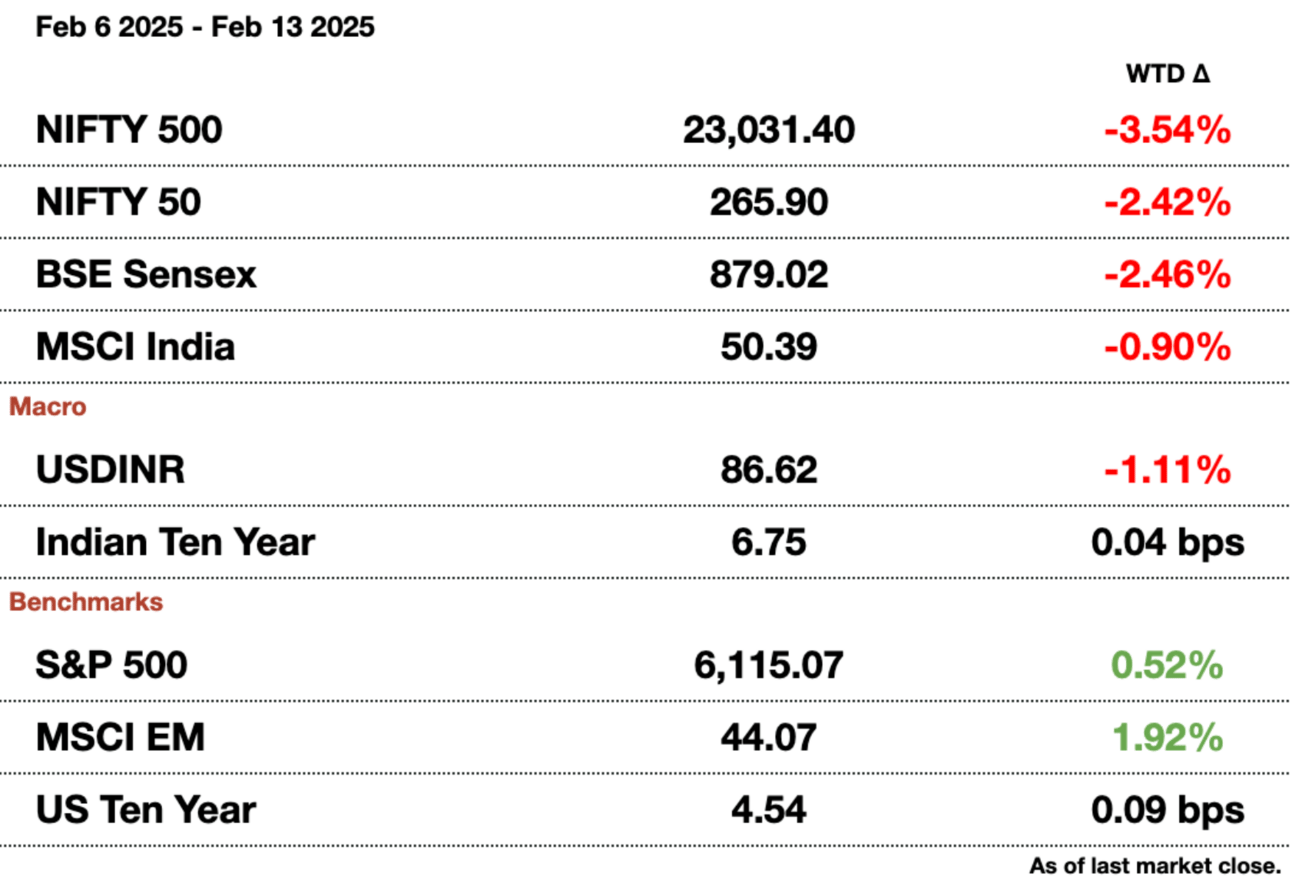

Market Update.

Modi Meets with Trump, Musk.

US President Donald Trump and Indian Prime Minister Narendra Modi met just a few hours ago to discuss a potential bilateral trade agreement, defense cooperation, and energy trade, amid rising tensions over tariffs and trade imbalances. Trump has called India a “tariff king” and a “very big abuser” of trade, setting the scene for tumultous trade negotiations.

Anonymous sources told Reuters that Modi intended to arrive at the meeting with a “tariff gift” for Trump, which could entail agreements to buy more liquefied natural gas and defense supplies. Details from the meeting are yet to be confirmed, and will be discussed in Monday’s briefing.

Earlier today, Trump announced “reciprocal tariffs” on any country that tried to limit and impose duties on U.S. exports—India has the highest tariffs of any major economy, a reflection if his protectionist bent.

Modi has already reduced tariffs on textiles, motorcycles, Jaguar/Land Rovers, and textiles, but there are still duties on many other goods like agriculture. Some expect India will switch from Russia to the US for major defense technology imports.

Modi also held talks with Elon Musk, a “special White House employee” who also heads Tesla, SpaceX, X, among other ventures. Musk & Co. relies on tariff exceptions and expedited permitting in India to access the world’s fastest-growing consumer economy.

A New Infra Asset to Get Investors

Karnataka, a southern Indian state home to the tech hub Bangalore, is looking to close a $4 billion (₹350 billion) budget gap to expand its power transmission network by introducing a novel investment vehicle to attract private capital. The state is exploring Infrastructure Investment Trusts (InVITs), which would use existing public infrastructure as collateral.

Similar to mutual funds, InVITs allow investors to pool equity and debt to generate returns from aging power assets. While group investing in infrastructure is not new, using old assets as collateral until new projects become operational is an innovative approach.

The structure is similar to private equity, where a lead sponsor invests pooled capital into various targets—in this case, cash-flow-generating infrastructure projects. The key difference is that the old assets serve as collateral, providing interim cash flow, while the launch of the new asset functions like a private equity exit.

InVITs could set a precedent for other Indian states to tap private capital for critical infrastructure needs, offering investors greater flexibility and optionality.

Message from our Sponsor

There’s a reason 400,000 professionals read this daily.

Join The AI Report, trusted by 400,000+ professionals at Google, Microsoft, and OpenAI. Get daily insights, tools, and strategies to master practical AI skills that drive results.

Expect SMID Caps to Continue Sliding in 2025

India’s small and mid-cap stocks are poised for a downturn in 2025 as the government shifts from infrastructure spending to tax breaks aimed at boosting consumption. The small-to-mid cap index has already fallen 13% this year, compared to just 2.5% for the broader market. While private investment has picked up to drive consumption, this primarily benefits large, established brands, whereas smaller companies have historically relied on government support to grow.

It gets worse: Adding to the pressure, earnings growth has slowed due to shrinking margins and rising debt burdens. Liquidity has flowed into consumption-linked stocks, creating a significant valuation gap between them and the rest of the market. These stocks—including select state-run enterprises—have emerged as a dominant investment theme in 2025. Meanwhile, smaller firms struggle with weaker, less diversified business models, making them more vulnerable to inflation, high interest rates, and slow economic growth. Many also face investor skepticism due to opaque tax accounting and frequent one-time adjustments in their earnings.

One likely outcome of this trend is further consolidation in the mid-cap space. As valuations decline, acquisitions become more attractive—a pattern seen in developed markets like the U.S., where industries such as consumer retail and banking have consolidated to a handful of dominant players.

Gupshup.

Macro

Russia courts Indian buyers for sanctioned Arctic Liquified Natural Gas (LNG) amid global restrictions. No agreements have been made as buyers remain cautious of U.S. restrictions.

Indonesia’s government is negotiating new trade agreements with countries like India, Canada, Peru, and the EU to expand exports and reduce reliance on the U.S. market.

Despite stock market declines, India’s retail investors continue to invest heavily in mutual funds. Monthly inflows reached a record $3 billion (₹260.5 billion) in January which has helped stabilize liquidity and cushion market downturns.

India's inflation eased to 4.31 percent in January, resulting from a decline in food and vegetables, approaching the central bank's 4 percent target, sparking hopes for further interest rate cuts.

India's oil minister urges commodity traders to focus on India's growing economy, predicting a surge in gas demand. Tax reforms and new suppliers are expected to lower gas prices with rising energy consumption driving new market opportunities.

Over 40 percent of Indians are optimistic about Trump, believing that his policies will be favorable to India. Only 16 percent believe that Trump will be disastrous to India; the rest reported feeling indifferent, moderate, or other.

Equities

The RBI has lifted restrictions on Kotak Mahindra Bank after nearly 10 months. Kotak has resolved its non-compliance issues, and can now resume digital customer onboarding and credit card issuance.

Tata Steel plans to re-enter the Indian corporate bond market after a 1-year hiatus. Tata Steel is likely to raise around $345.6 million (₹30 billion) through this bond issue and will likely complete the issue before the end of this month.

Coinbase plans to re-enter the Indian market after ceasing operations over a year ago due to regulatory concerns. Coinbase hopes to secure the necessary approvals from the FIU required to re-enter the market.

Prudential Plc has hired Citigroup Inc. to work on a potential $1 billion (Rs.86.6 billion) initial public offering of its Indian unit. The preparations are in the early stages, with other banks likely to join the process for the potential share sale of the jointly owned asset management business.

Adani Green Energy Ltd. has decided to withdraw from two wind power projects in Sri Lanka valued at around $1 billion (Rs.86.6 billion). The decision comes after the new Sri Lankan government sought lower tariffs for the proposed wind projects.

Alts

Carlyle Group acquired a controlling stake in Highway Industries and Roop Automotives. Carlyle hopes that the deal will help the companies leverage operating synergies. This deal also highlights Carlyle’s increasing investment in India’s advanced manufacturing sector.

Adani Group signed a $330 million (₹28.6 billion) private credit loan for its Australian coal port. The loan, provided by King Street and Sona Asset Management, will refinance existing debt and support Adani’s Australian operations.

India and France plan to engage in joint development of mini nuclear plants, strengthening their nuclear relationship. The collaboration aims to boost India’s nuclear power capacity and aligns with its push for cleaner energy and regulatory reforms.

India’s ONGC plans to invest $11.5 billion (₹998.4 billion) to expand its renewable energy capacity to 10 gigawatts by 2030. The state-owned firm is prioritizing solar, wind, biogas, and green hydrogen projects to meet India’s growing energy needs.

India anticipates a greater than-anticipated sugar crop harvest in the 2025-26 season. Favorable weather and improved cane varieties are expected to boost production, potentially lowering global sugar prices.

Shapoorji Pallonji Group is in advanced talks with global private credit funds to raise up to $3.3 billion (Rs.285.8 billion) in India's largest-ever local currency private debt deal. The deal, arranged by Deutsche Bank, aims to refinance existing debt and involves other investors.

Policy

India's federal government took direct control of Manipur after the chief minister resigned amid ongoing ethnic violence that has killed 250 people and displaced thousands since 2023. Under "president's rule," the state will be governed by a federally appointed governor, Ajay Kumar Bhalla, a former interior ministry official.

See you Friday.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.