Volatility in the Indian equity markets is unusually low, forcing options traders that have treated the stock market as a cash cow to rethink their strategy.

If you have any questions about India, fill out this form or reach out to Shreyas at [email protected]

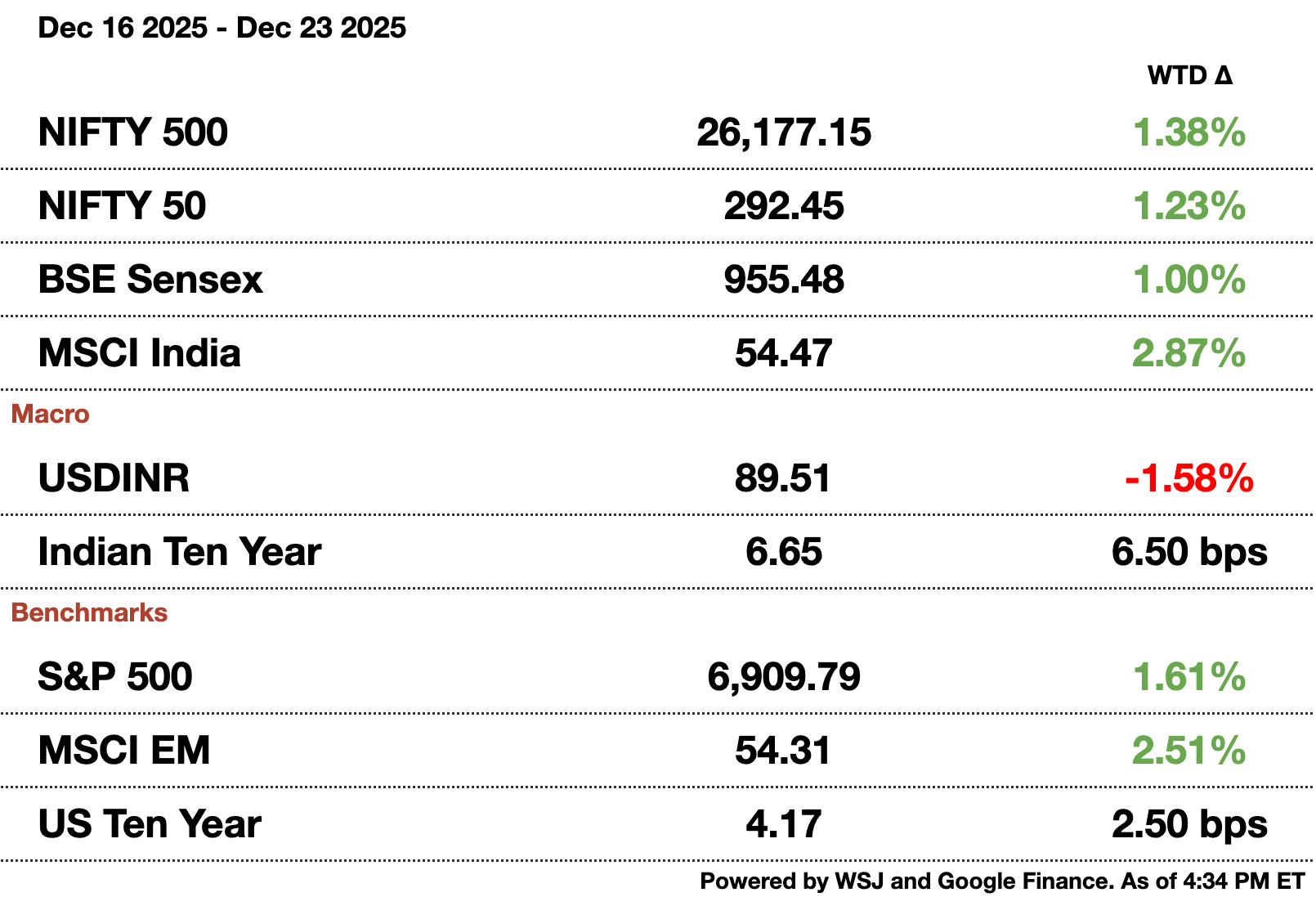

Macro

New Zealand Trade Minister McClay sees more opportunities for investment into India. He noted that food manufacturing, construction, and engineering firms in particular will have ample investment opportunities during the next 15 years, thanks to the recently signed India-NZ free trade agreement.

New Zealand dairy giant Fonterra was disappointed with Indian market access.The world’s largest dairy exporter was looking for more access to Indian markets, which was ultimately not granted to Kiwi dairy producers. The company noted that the outcome was “not a surprise,” given India’s protectionism over the industry.

Equities

JPMorgan takes the top spot in India's equity capital markets space for the first time since 2020. It was credited with $6 billion (₹537 billion) of equity raises and offerings after advising on huge block orders for Bharti Airtel and InterGlobe (IndiGo). Global banks are generally favored for large orders that foreign institutional buyers place.

Alts

Fairfax-backed IIFL is raising $446.2 million (₹40 billion) in private credit to fund mid-sized firms. IIFL is already raising its first $111.6 million (₹10 billion) fund which will close 1Q26. It seeks returns between 18 to 20 percent.

India's growing 'octopus class' of 1 million individuals has dire consequences for India's middle class.There is limited opportunity for social change since the octopi focus on wealth creation through passive income or overseas opportunities. 800 million adults now rely on government handouts.

Policy

Parliament's most active winter session with nuclear and insurance also saw a proposal to unify all market laws into one code. A new, modern framework could encourage more market participation from foreigners who are bogged down with regulation. The move would then entice investors who have shied away from India due to tariffs as well.

US Trade Negotiator Greer was critical of India as negotiations drag. He noted that a deal still hadn’t been signed though deals were signed with peers like Malaysia and European countries like Switzerland. His comments come after Trump and Modi’s 4th call last week.

The US Embassy in India posted that they want to engage with the newly-opened nuclear industry. An earlier 2008 deal reversed a decades-old freeze on nuclear supplies to the country and fresh investment from American firms should jumpstart nuclear facilities in the country.

Do red cars cost more to insure?

You may have heard the myth that red cars cost more to insure, often with varying reasons why. The truth is, the color of your car has nothing to do with your premium. Insurance companies are more interested in your vehicle’s make, model, age, safety features, and your driving history. What’s not a myth, though — is that people really can save a ton of money by switching insurers. Check out Money’s car insurance tool to see if you could, too.

Reach out to [email protected] to reach our audience and see your advertisement here.

Mumbai, India

Option Traders Are Rethinking Their Strategies

Volatility in the Indian equities market has been unusually flat, forcing professional and retail traders to rethink their strategies in the world’s largest derivative market by volume. Despite geopolitical flare ups and bouts of global risk aversion, the benchmark Nifty 50 Index has barely moved for months and the Nifty VIX is down to 9.5 implying just a 9.5 percent predicted move in the index over the next year. Domestic institutional buying has largely neutralized foreign selling, while tighter rules in the derivatives market have drained away much of the day to day volatility that once defined Indian trading.

The 9.5 reading for the VIX is at a record low affecting options traders massively. When prices swing, hedging demand rises and option premiums expand. When markets stagnate, premiums shrink, compressing returns and undermining strategies that depend on selling volatility.

India’s regulator played a decisive role. Last year, SEBI cracked down on speculative retail trading by removing several popular weekly options contracts. Those products had fueled sharp intraday moves and heavy volume. Their removal has reduced activity and dampened price fluctuations. Average daily notional turnover in derivatives has fallen about 35 percent this year compared with 2024, marking the first annual decline since at least 2017.

A slowing option market affects the cash market as well. Less options trades means less hedging with the use of equities. The Nifty 50 has moved less than 1.5 percent in each of the last 150 consecutive sessions, approaching a record stretch of calm. Consider the fact that these past 30 weeks have seen US tariffs, Russian oil issues, and record foreign investment.

While there is calm, the investor base has shifted from foreign to domestic. Foreign funds have withdrawn about $17 billion (₹1.5 trillion) amid trade tensions and limited exposure to AI compared to the US and Asian markets. Domestic institutions have invested over $80 billion (₹7.2 trillion) in the same time, overtaking foreign institutions as the market’s largest owner.

The calmness has not translated to outsized gains; the Nifty 50 is up about 10 percent which trails developed and emerging market peers while adjusting for currency makes the picture worse considering the poor rupee performance. For derivatives traders especially, familiar “vol-harvesting” strategies of selling options are working less and adapting to a different market regime will require more risk-taking.

How helpful was today's newsletter?

See you tomorrow.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Sponsor the next newsletter to reach tens of thousands of U.S.-based business-savvy professionals. Reach out to [email protected].

Could your business use expert insights to power growth in India? Reach out to [email protected] for a free introductory call.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.