Hello. Federal Reserve Chair Jerome Powell promised “the time has come” for rate cuts in September. We’ll analyze how this impacts Indian markets and how the Reserve Bank of India may respond. Then, we’ll dive into Modi’s new pension scheme for government employees and why it matters. Finally, we’ll close with Gupshup, a roundup of the most important headlines.

BTW: Do you know what the largest gathering of people on Earth happens in India; do you know what it is? (Answer at bottom)

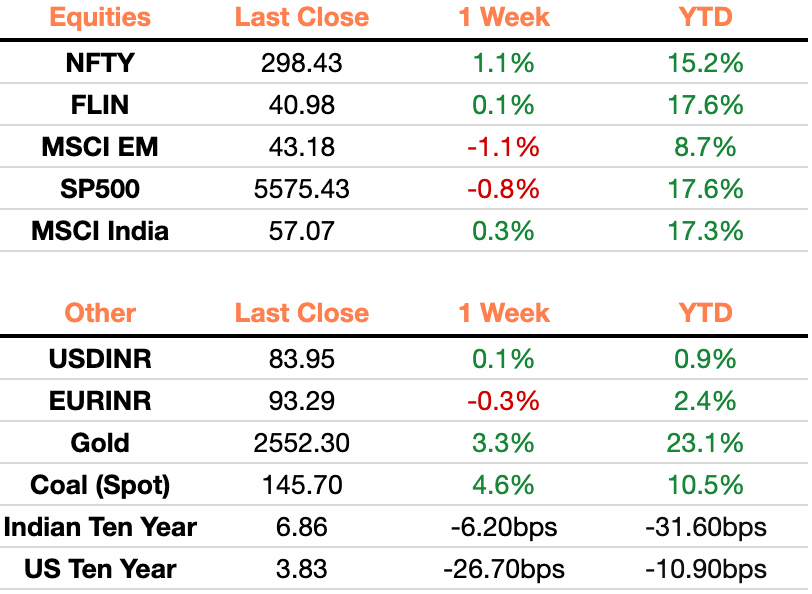

Markets

Read here for an appendix on the above.

How Do Federal Reserve Rate Cuts Impact India?

Powell at Jackson Hole, 2024

At the Jackson Hole Economic Symposium last week (Aug 22 to Aug 24) in Jackson Hole, Wyoming, the world’s top journalists, economists, and central bankers met to share research and align strategies. Powell strongly indicated the U.S. will cut rates from their 23-year high in September. As central banks worldwide, including the European Central Bank's Governing Council, the Bank of Canada, and the Bank of England, begin to signal the end of their high-interest-rate policies, the global economy is transitioning away from the aggressive measures used to combat post-pandemic inflation. Markets are pricing in a 61 percent chance of a 25 bps cut in the Federal Reserve target interest rate in September, and a 39 percent chance of a 50 bps cut.

Federal Reserve rate cuts typically free up capital seeking higher return opportunities elsewhere, often in the U.S. equities market and abroad, often a positive for emerging markets. Here are a few potential impacts on Indian markets:

RBI has more room to cut rates: Since U.S. financial markets and the dollar are deeply entrenched in global markets, central bankers often wait for the Federal Reserve’s forward guidance before solidifying their strategies in order to avoid divergences. Because the Federal Reserve has kept interest rates high since July 2023, the Reserve Bank of India has limited flexibility to lower rates without risking a depreciation of the rupee against the U.S. dollar. Such a move could make imports more expensive for Indians and prompt investors to abandon the rupee in favor of higher-yielding currencies. Now, the RBI has more room to cut rates (for the first time in 4 years) from the 6.5 percent benchmark, though RBI Governor Das has indicated he will wait for food and core inflation to cool off further. Retail inflation is now at 3.54%, within the 4% target band. Food inflation continues to drive the inflation rate up, but Governor Das signaled that the board expects food inflation to taper off with growing monsoons.

Loan volume will likely increase: The National Bureau of Research found that between 1980 to 2015, a 4 percentage point cut in Federal Reserve rates was met with a 32 percent increase in loan volumes in emerging markets. This is because banks skew to riskier assets as the spread between the Fed target interest rate and the 10-year Treasury yield narrows. Consumer loans are already skyrocketing in India, with personal and retail loans growing at double-digit rates through 2023 and 2024, and security issuance rising to an all-time high of $11.9 billion. RBI has stepped in to limit the risk of faulty loan formations, which will cut loan growth expectations; for example, in May 2024, it asked all non-banking financial companies to cap personal loans to $240 a month.

State Bank of India representatives advertise home loans at booth

Indian equities could see stronger fundamentals: While growth stocks would benefit the most, other export-driven industries like automobiles, industrials, and IT could benefit from growing sales and a weakening dollar. A strengthening rupee would lead to greater profits when converting revenue back and a weaker dollar would increase exports to parts of Asia and Europe. Additionally, company import costs would fall as the rupee strengthened relative to the dollar. Investors seeking higher returns can be expected to move capital to India, which will increase FII flows that have been relatively slow this year. RBI rate cuts would further bolster the domestic equities market. The Nifty50 and BSE Sensex both rose last Friday after Powell’s speech indicating rate cuts.

Modi Approves New “Unified Pension Scheme”

Modi with a delegation representing Central government employees, 2024

Last Friday (August 24), the Modi government approved a new “unified pension scheme (UPS),” which will offer a defined-benefit pension to 2.3 million government employees beginning April 1, 2025. The new scheme will function under the existing pension system, the National Pension System (NPS), a defined-contribution pension system that manages $110 billion to serve 63.5 million government employees.

BTW: Defined-benefit pensions are employer-funded and promise a fixed payment amount to retirees; this was the typical corporate pension system in the 20th-century United States. Defined-contribution pensions accumulate a fixed contribution from the employee that will be paid back out in fluctuation amounts upon retirement. Defined-contribution plans have become more common since they are less likely to risk insolvency because they do not promise a specific payout.

UPS is opt-in for government employees and is likely to see high amounts of switching since it promises a payout of 50% of last year's salary for any employee with a tenure of 25 years or more. The plan will cover all retirees retroactively since 2004 costing an additional $750M in the first year of implementation compared to the NPS system. Pensions are expected to cost the government $27.9B out of the total budget at $575B for the 2024-25 FY.

Looking at NPS first, employees contribute 10% of their base salary with the government matching 14%; the eventual payout is market returns on the contributions that are put into government debt usually. Currently, NPS is managed heavily by the Indian government with asset managers needing licenses and being strictly regulated by EPFO: 45-65% in government securities, 20-45% in other fixed income, 5% in short-term debt, and the rest in equities. NPS was fully funded however had no guaranteed payout due to market performance, a demand of many federal employees and groups arguing for worker rights.

UPS sees government contribution being 18.5% compared to 14% which is leading to part of the higher government cost and the assured 50% payout. In terms of the additional $750M cost, part of the increase comes from arrears of already retired employees since 2004 who would benefit from UPS. UPS has similar fiscal management to NPS with government debt and other fixed income making up the majority of funding, and experts see both as well-funded with low chances of failing. This takes the best parts of the Old Pension System before 2004 with the NPS since employees get the assured payout of OPS plus being fully funded similar to NPS.

India is one of the only major economies in the world to switch back to a direct benefit plan after going with a direct-contribution system for 2 decades.

Macro

Recent IPOs show the overbought nature of India’s stock market (BBG)

A $1.4M offering for a 2 store motorcycle dealer with 8 employees has been overbought 400x

The short term and retail driven market continues to ignore global conflicts and rate/inflation uncertainty

MPC official Jayanth Varma predicts India will have a soft landing going into 2025 (Business Line)

Varma pointed at geopolitical shocks (Russia-Ukraine, Hamas-Israel, rising oil prices, inflation) that India has withstood and sees them as indications that inflation will stabilize with continued growth

Equities

Zee Entertainment Enterprises shares rally after settling messy, failed merger with Sony India (BBG)

Zee Entertainment pulled the curtain on the merger, causing shares to rally 15%

Both sought break-up fees from each other and ended up in arbitration court in Singapore

This comes at a time when there has been consolidation in Indian media (Disney and Viacom)

IndiGo continues booming with largest plane order in history for any airline (Economist)

IndiGo just ordered 500 aircraft, the largest order ever, as profitability continues to soar post-2020

The simplistic, low-cost approach has led to the airline controlling 60% of all domestic air travel

LG Electronics looks to an Indian IPO to help reach $75B in revenue by 2030 (BBG)

LG wants to earn more from enterprise clients while timing the Indian stock market boom occuring

Alts

US-based PE firm Chatterjee Group looks for Indian oil firm partnerships (BBG)

TCG wants partners for a $10B oil-to-chemicals project in the southern state of Tamil Nadu and has reached out to Hindustan Petroleum and others to cumulatively hold a 49% stake

Ports continue to be an important investment for exporters and infra companies (Economic Times)

Adani and other infra giants continue to buy ports, specifically through distressed companies

Politics

Indian regulators allow Siemens to manufacture mpox detection kits in Gujarat (BBG)

The output of all Siemens kits will be used in India with none marked for exporting

Countries around the world have been screening for mpox after it broke out in Congo and recently spread to Thailand

India’s health ministry has been proactive, with 32 labs and a vaccine being developed

Modi government plans to intervene in news media industry (Economic Times)

There have been declining revenues and rising costs leading to the sector wanting government protection

The government withdraws a broadcasting services bill that was heavily criticized (FT)

The bill proposed giving the government expansive powers featuring vague language that left all forms of media and content creators liable to an untested regulatory framework

The opposition argues government can use the policy to censor free speech

We need your feedback to make this newsletter more useful to people like you. Please let us know what you think here.

And, consider sharing with three friends.

Oh, and the world’s largest gathering is the Kumbh Mela - a Hindu pilgrimage and festival that saw 120 million people travel to Prayagraj, Uttar Pradesh in 2019. It is celebrated only once every 12 years.

Kumbh Mela, 2019

See you next week.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

1 USD = 83.92 Indian Rupee