Today, we breakdown Mumbai’s ultra wealthy real estate market.

If you have any questions about India, fill out this form or reach out to Shreyas at [email protected]

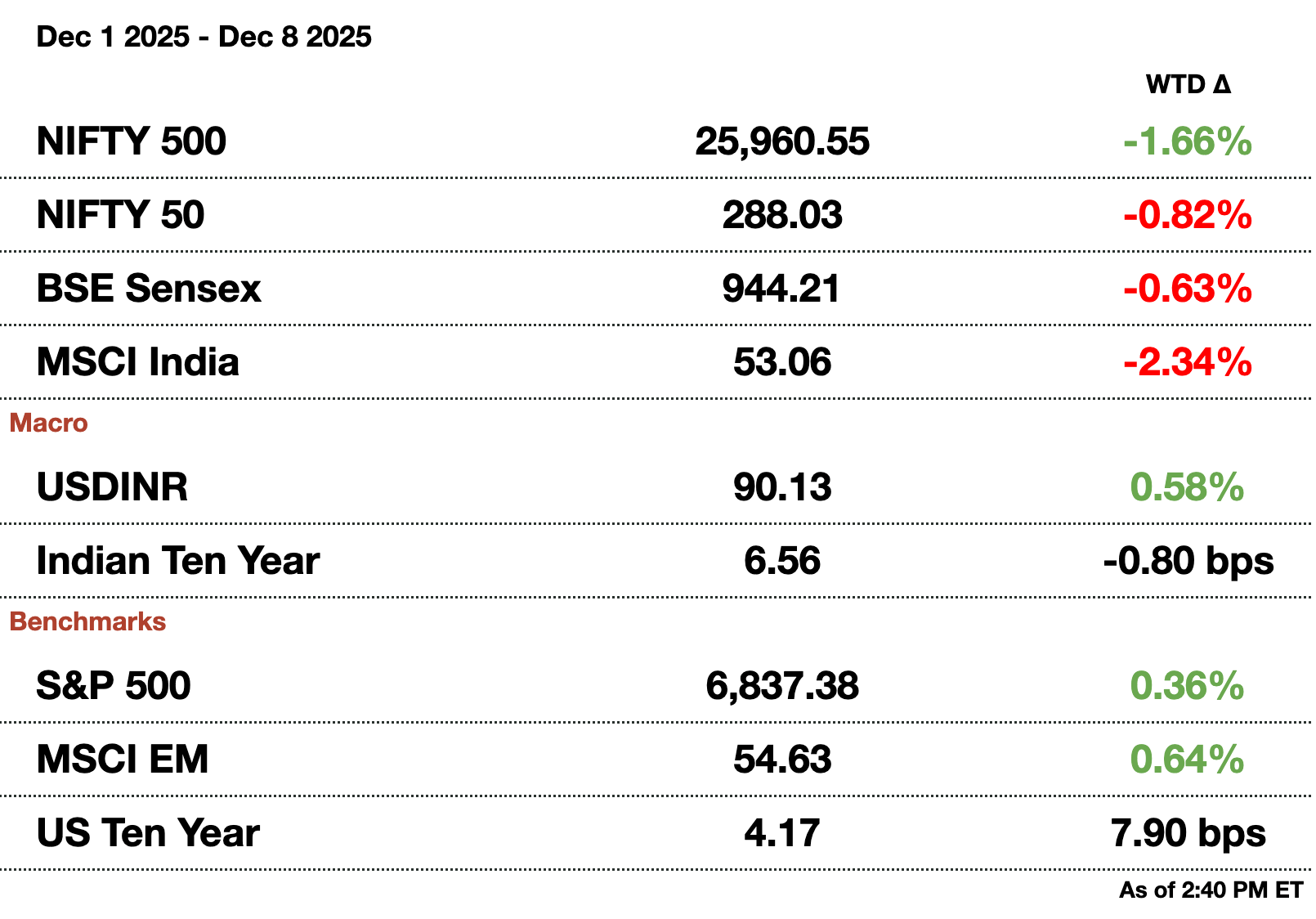

Macro

While the rupee looks undervalued now, foreign selling continues to add pressure. An indicator of currency flows is how investors treat equities. Foreigners have been net sellers while Indians have been buyers.

Foreign lenders are trying to do more corporate rupee lending.Indian companies are raising more domestically due to geopolitical tensions with the US and tariff-related currency swings. Rupee bond sales are hitting $140 billion (₹12.6 trillion) y-t-d.

Equities

Companies are targeting the 1 billion potential AI users in India through free access. Satya Nadella of Microsoft just reaffirmed his $3 billion (₹270 billion) investment into AI development in the country. To follow it up, his company and its competitors continue offering free AI access to pro models to entice more users. The vast engineering talent pool, data training ability, and scaling digital economy of India have made this a stomachable bet.

IndiGo shares dropped 8.7 percent, shedding $4.5 billion (₹405 billion) in market cap. The sale follows the week-long flight issues that resulted in 3,000 flights being canceled. Regulators are planning on being strict to the airline for the mass failures, something which is causing further selling.

Kaynes Technology, an electronics components manufacturer, lost $1 billion (₹90 billion) in market cap due to accounting inconsistencies.JP Morgan and Kotak saw massive deterioration in cash flow, causing the 13 percent share selloff. Kaynes responded by saying there are no inconsistencies, though a transcript of the response call to both banks has not been released.

Alts

Indian hotels are now offering niche experiences to allure wealthy customers. Curated, luxury stays with a twist such as dolphin watching or mud cottages are now a huge driver of revenue. The travel industry is expected to hit $45 billion (₹4.1 trillion) by 2027 in India.

SoftBank is selling part of its InMobi stake back to the company.The ~20 percent of the company being exchanged is valued at $250 million (₹22.5 billion); InMobi, an advertising firm, was India’s first unicorn back in 2011. InMobi is currently struggling due to the AI shift and is looking to restructure operations.

Policy

The government denied foreign ownership limits on state-owned banks going up. The Modi administration is reducing its stakes in certain banks like Bank of Maharashtra, but denied that foreigners can own larger pieces of the companies. The Nifty Bank Index fell 3 percent.

7 Actionable Ways to Achieve a Comfortable Retirement

Your dream retirement isn’t going to fund itself—that’s what your portfolio is for.

When generating income for a comfortable retirement, there are countless options to weigh. Muni bonds, dividends, REITs, Master Limited Partnerships—each comes with risk and oppor-tunity.

The Definitive Guide to Retirement Income from Fisher investments shows you ways you can position your portfolio to help you maintain or improve your lifestyle in retirement.

It also highlights common mistakes, such as tax mistakes, that can make a substantial differ-ence as you plan your well-deserved future.

Reach out to [email protected] to reach our audience and see your advertisement here.

Luxury residential high-rise in Worli, Mumbai

Mumbai’s Homes Reach Manhattan Prices

Premium apartments in Mumbai cost as much as one in Manhattan as the city’s Worli neighborhood receives more demand from India’s growing wealthy. The new going rate is $1,109 (₹100,000) per square foot, equal to Lower Manhattan. The prices are a growing indicator of the rapid rise of wealth in the country which is pushing prices up in India’s international gate to the world.

Worli is now home to 40 percent of India’s luxury apartment segment; a luxury apartment is defined as worth more than $4.5 million (₹400 million). In fact, there have been 20 deals priced above $11.1 million (₹1 billion) since 2022. There have been a total of $843.6 million (₹76 billion) worth of land deals closed around the area bringing in revenue estimated at $4 billion (₹360 billion) for the region. The district also has 4 to 5 million square feet of premium residential and retail space under construction with the total valuation of the construction worth $2.1 billion (₹190 billion).

While the top-end of Mumbai is getting closer to New York, India’s markets remain far more heterogeneous compared to the US. The Manhattan condo price per square foot is about $2,000 (₹180,000) while Mumbai is $150 (₹13,500). While a few micro-markets like Worli and South Bombay might have high prices, there is still a two-tier market due to the concentration of domestic wealth.

Real estate also continues to be a favored store of wealth for those in India, alongside precious metals. Capital flowing into luxury projects (the most favored real estate projects in India right now) is at a high right now. Add stringent zoning regulation in most major cities and there are then sustained premiums for top locations in Indian cities, while less in-demand zones remain relatively affordable.

There are short-term gains with the luxury boom, though medium-term risks with inequality rise as well. Construction and sales will boost adjacent industries like concrete and services while the government will also continue to collect higher revenue from taxes and land parcel sales. The risk of course is a lack of affordable supply while raising inflation within cities and pushing workers to the periphery, increasing commute times.

While the rise in housing prices shows increasing wealth and demand, mitigating the risks to the poverty seen in India remains important, something that comes up during exit polls during elections. Though there are few concrete solutions, some are to promote REITs (reducing the cost of capital by introducing more of it), introduce progressive taxation on expensive properties, and incentivize building affordable housing.

How helpful was today's newsletter?

See you tomorrow.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Sponsor the next newsletter to reach tens of thousands of U.S.-based business-savvy professionals. Reach out to [email protected].

Could your business use expert insights to power growth in India? Reach out to [email protected] for a free introductory call.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.