Hello. While I am not entirely sure why, one of the biggest internet memes in India is of potential romance rumors between Indian Prime Minister Narendra Modi and Italian Prime Minister Giorgia Meloni, trending under the hashtag #Melodi. And Meloni and Modi’s selfies at the G7 summit did not help squash those rumors.

We’ll talk about Modi at the G-7, if foreign investors are putting money back into India, and close with Gupshup, a round-up of the most relevant headlines from the week.

BTW: Today, India is the fifth largest economy by GDP, and the 136th wealthiest by GDP-per-capita. However, at one point, India was considered the most affluent economy in the world. When was that? (Answer at bottom).

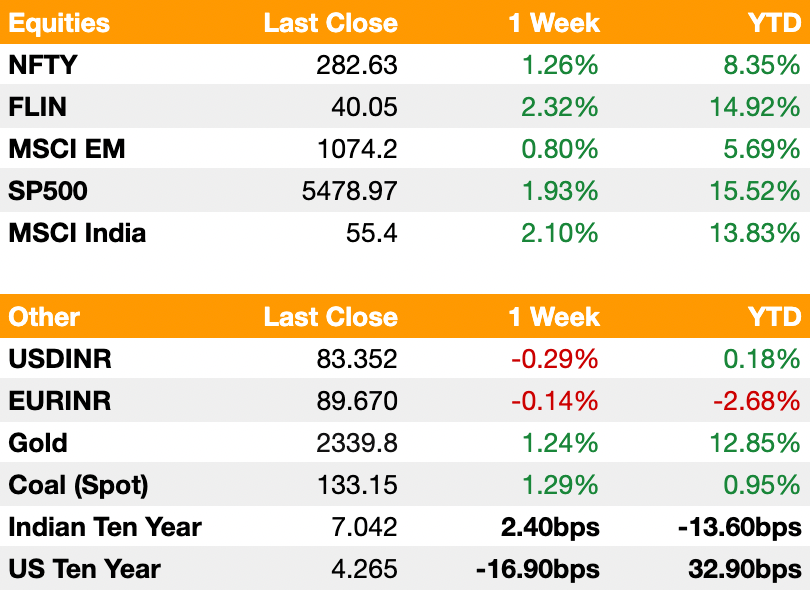

Markets

Quick Appendix: NFTY is a weighted average of the largest 50 companies listed in the National Stock Exchange of India by market capitalization. FLIN, or Franklin TSE India ETF, tracks large and mid-cap companies, weighted by market cap, to give international investors exposure to Indian markets. MSCI EM is an index that captures large and mid-cap companies across 24 emerging market countries and covers 85% of the free float-adjusted market capitalization in each country. SP500 is the index of the 500 largest companies listed in U.S. stock exchanges by market cap. MSCI India is an index that covers 85% of the Indian equity universe.

G-7: Modi’s Unusual Leverage

Thirty years ago, the G-7 countries, a coalition of the largest democratic economies, represented 70 percent of the global economy. Today, Canada, the US, France, Germany, Italy, Japan, and the UK, represent just 43 percent.

To make matters worse, most of the leaders are unprecedentedly weakened at home. Pollsters expect U.S. President Biden and U.K. Prime Minister Sunak to lose their upcoming elections, Canada’s Trudeau to be replaced next fall, while France’s Macron, Germany’s Scholz, and Japan’s Kishida have the lowest approval ratings at home of any leader in recent history. Only Italy’s Meloni stands on firm ground, enjoying the highest domestic approval ratings of any G-7 leader, and her party beating expectations in recent European Union elections.

In this environment, Modi has unusual leverage. While Modi is often described as breaking from previous Indian leaders, his foreign policy has been remarkably consistent with the country’s history. During the G-7 summit, Modi showcased his "multi-aligned diplomacy," while also striving to revive India's historical role as a leader of the Non-Aligned Movement from the Cold War era. Notably, India relies on Russia as its largest weapons supplier and a major energy source, and in return has been a huge buyer of Russian commodity exports, while growing its trade with all Western economies.

Modi also carved time to meet with Ukraine’s Zelenskyy, reaffirming India’s hope to see a diplomatic end to the war. India has not condemned Russia’s invasion of Ukraine and has abstained in UN resolution votes condemning the aggressor.

Modi’s diplomatic balancing act is not hard to maintain; as Western leaders suffer political losses and tensions rise with China, Modi has been a source of stability and continuity for Western countries looking to access cheap labor while building a counterweight to China.

Foreign Investors Showing Signs of Returning

Investors poured in $329.1 million of fresh capital back into India as of Friday. While a good sign, June’s foreign net investment is still negative.

Last week we discussed how foreign and domestic investors’ views on Indian markets diverge; retail investors were pouring money into equity mutual funds at unprecedented rates, while foreign money spent April and May pulling out of Indian stocks.

Some analysts predicted that foreign investors were avoiding the volatility of Indian stocks during an election, which saw huge swings between exit polls predicting a BJP landslide and election results that saw the party lose its 10 years of single-party majority. In the first week of June, foreign investors took $2.1 billion out of Indian markets.

Policies from Modi’s third term are still unclear: the Union Budget is yet to be announced, but is expected to show a pathway to the administration’s promise to make India the third-largest economy by 2027. The budget’s proposals for strengthening financial markets, reforming property and labor, and specific spending plans, will give investors insight into the government’s capital allocation into various industries for the next five years.

Macro

Indian inflation eases only slightly to 4.75%, above target of 4%, due to sticky food inflation (BBG)

A severe heat wave this past month casts fear that food prices may continue to rise even as the monsoon season comes; food inflation remains above 8.5% YoY

The US Fed’s reluctance to fully pivot also puts pressure on the RBI to stay hawkish at least until the end of 2024

Pakistan shows growing rice exports due to Indian trade restrictions (FT)

Rice exports in Pakistan surged to 5.6 million tonnes up 60% YoY in May

The boom follows India imposing export restrictions in an effort to curb rising food inflation before the Lok Sabha elections

India’s monsoon season delivered 20% less rainfall than normal, raising concerns for agriculture (The Economic Times)

The India Meteorological Department (IMD) reports deficits, especially in the northwest which also faces heatwaves

Food prices are expected to climb even more in the coming months considering half of all farmland relies on monsoons due to a lack of irrigation

India’s Energy Minister looks to cut coal dependency in favor of Green Energy (BBG)

Minister Pralhad Joshi has worked for the last 5 years to reduce coal imports due to rising commodity costs post-pandemic and is aiming for 500 gigawatts of renewable energy by 2030

This comes as electricity demand continues to surge while state miners and private companies are investing to expand mine capacity

Windfall taxes on crude fall from Rs. 5,200 ($62.23) per metric ton to Rs. 3,250 ($38.90) (Economic Times)

Windfall taxes existed to make Indian producers disincentivized to export crude

Taxes on diesel and aviation turbine fuel remain at zero

India is pursuing targeted trade deals to open complementary sectors in the economy (The Economist)

India has signed deals with UAE, and Australia, plus a bloc of Liechtenstein, Norway, Iceland, and Switzerland

Equities

Hyundai is planning their Indian IPO for June and listing by end of the year (BBG)

The automaker is looking to raise $2.5B (Rs. 207.5B) for a valuation of $25B (Rs. 2.08T)

A draft prospectus will likely to be filled to a market regulator over the next 2 weeks with their advisers being Citi, HSBC, JP Morgan, Kotak Mahindra, and Morgan Stanley

PwC’s Indian chair is aggressively looking to join the firm’s leadership team (FT)

PwC runs as a network of partnerships across 151 countries ran by chairs from the US, the UK, China/Asia-Pacific, and Europe

India was PwC’s fastest growing business, expecting to surpass $1B (Rs. 84B) in sales in 2024, however the growth comes from a low base similar to Canada, the Middle East, and France

Adani Enterprises’s Ambuja Group purchase Penna Cement for Rs. 104.2B ($1.2B) (BBG)

Penna has strong holdings in south India and Sri Lanka giving Ambuja entrance into those markets

Ambuja can also boost production by 10 million tons adding to its current 80 million tons annually

Growing cement production is in line with Adani and Modi’s goal of heavy infrastructure spending over the next decade or so

India’s non-banking financial sector grew by 10%; the sector fell 3% globally (Malaysia Sun)

Non-banking financial firms do not accept public deposits but rather focus on financing, a field that has strengthened in India due to the RBI’s substantial capital and liquidity buffers

India’s growing digital banking landscape has also led to an explosion in lending and financing

Indian domestic investors helped recoup the Nifty50’s 6% loss in just 3 days (BBG)

Domestic investors used the $400B selloff to buy the dip with $4.2B pouring into markets in May even though foreign investors pulled back $5B throughout last quarter

Strong liquidity has led to a rise in lower quality SMID caps as non-institutional players chase high returns

The stock market is now worth over $5T joining just the US, China, Japan, and Hong Kong

Paytm’s Owner One97 is looking to sell its movie and ticketing business to Zomato (BBG)

One97 filled a stock exchange filing late on Sunday and Zomato filed a separate disclosure related to the potential acquisition

Zomato, primarily a food delivery business, sees an opportunity to build its fintech business with ticketing assets valued at Rs. 20B or $240M

Amazon and Microsoft plan to spend billions on computing infrastructure in India (FT)

Microsoft plans on investing $3.6B (Rs. 300B) in the southern state of Telangana to construct data centers to add 660 megawatts of IT capacity

Amazon plans to invest $12.7B (Rs. 1.05T) by 2030 to boost cloud infrastructure

Modi’s new coalition partners see their key allies’ stocks rising (BBG)

N. Chandrababu Naidu, Modi’s new biggest ally, saw his dairy company, Heritage Foods, jump 20%

Andhra Pradesh companies where Modi needed allies have benefitted across every industry from food to technology

Alts

Singaporean Cube Highways plans to sell stakes worth $240 million for 7 Indian toll-road assets (BBG)

The fund’s structure allows for a pooling of assets that will allow Cube to raise capital by diluting its position by 20%

Indian infrastructure continues booming with an estimated Rs. 143 trillion ($1.7T) from now to 2030

India expected to see Grade A warehousing space hit 300 million square feet by end of 2024 (MoneyControl)

Boman Irani, president of CREDAI, sees e-commerce, retail expansion, and global companies demanding logistics space

Homebuilders plan for a huge decade with expectations of 100 million new homes (MoneyControl)

About 70 million new households will turn eligible for home ownership, which along with current homeowners looking for an upgrade, should drive huge expansion

Knight Frank, a real estate consulting firm, sees the demand for homes translating into $906B (Rs. 7.6 million crores) of economic output (not the cumulative value of the homes themselves)

Mumbai-based private credit fund, Neo Asset Management, raised $308M (BBG)

All investments in the fund are backed by collateral by lending to profitable companies to target a 22-24% IRR

The Fund has seen 12 investments and had 2 successful exits; there were 108 total deals in 2023 amounting to $7.8B compared to 77 deals totaling $5.3B in 2022

Market Trailblazers Vijay Kedia and the Jhunjhunwalas are increasingly focusing on pure-play themes with startups (Business Today)

Startups provide investors an opportunity to find first movers, especially in a developing market

One draw is of course the opportunity for outsized returns; the other is the chance to support innovative ventures that could help these investors influence India’s growing economy

Politics

The BJP’s Parliament faces several upcoming issues beyond just fracturing (The Economist)

The Agnipath scheme, recruiting officers in the armed services for 4 years rather than the BJP’s lifetime appointment schedule, represents a growing initiative to develop jobs for new generations

The BJP’s most important allies, Janata Dal in Bihar and Telugu Desam in the south, both are demanding more money for their states eating into fiscal maneuverability

Union minister for steel and heavy industries, HD Kumaraswamy, brings concerns over central government subsidies to large US firms (LiveMint)

Micron, a semiconductor manufacturer, received $2 bn (16,000 crores INR) for 5,000 new jobs in Modi’s home state of Gujarat equating to $380,000 (Rs. 3.2 crores INR per head)

Opposition leader Priyanka Chaturvedi agreed with the issues, though Kumaraswamy later says he was misquoted and that he needs to be “very cautious in the future”

Modi makes no changes to top cabinet positions (BBG)

A lack of change puts to rest speculation that Modi would be forced to share power and radically shift his top portfolios

The BJP will likely be able to keep most of their original agenda and retain policy continuity

Finance Minister Nirmala Sitharaman plans to meet with farmer associations and economists this week (Zee News)

This is a run-up to prepare for the 2024-25 budget which is expected to be revealed in late July

The budget is expected to give priority to the development of agriculture and rural areas

The G7 Summit saw Modi call for an end to tech monopolies, prioritize Africa’s development, stress international governance on AI, and reaffirm India’s Net Zero goal by 2070 (Economic Times)

Following last year’s G20 summit in New Delhi, India has become a larger global player with the GDP soon to overtake Japan to become the 4th largest on the planet

India is attempting to become a leader in South Asia while also serving as the G7’s wall to China

Modi’s opposition gained due to lower caste votes on the campaign trail (The Economist)

Rahul Gandhi focused on a national census of all castes and an expansion of quotas, something the BJP has previously looked at reviewing and potentially scrapping, though Modi denies this

In Uttar Pradesh, 37 out of 80 seats went to the Samajwadi Party which represents Muslims and lower to mid tier castes (Modi won 62 out of the 80 in 2019)

We need your feedback to make this newsletter more useful to people like you. Please let us know what you think here.

And, consider sharing with three friends.

Oh, and many historians believe India was the wealthiest region in the world during the Gupta Empire, approximately 320-550 CE. Called the “Golden Age of India,” the subcontinent saw advances in science, literature, and astronomy that still inform our understanding of the world today.

An ancient relic of the Gupta Empire

See you next week.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

1 USD = 83.35 Indian Rupee