Today’s deep dives: UK PM Keir Starmer visits Mumbai to discuss trade. While the EU is fast-tracking relations with India, they’re not seeing eye-to-eye on a lot (cough Russia cough). Modi inaugurated two Mumbai infrastructure projects today.

We want to talk to you! Just respond to this email and we’ll set up a time to learn more about how Samosa Capital can be more helpful in your work.

If you have any questions about India, fill out this form or reach out to Shreyas at [email protected]

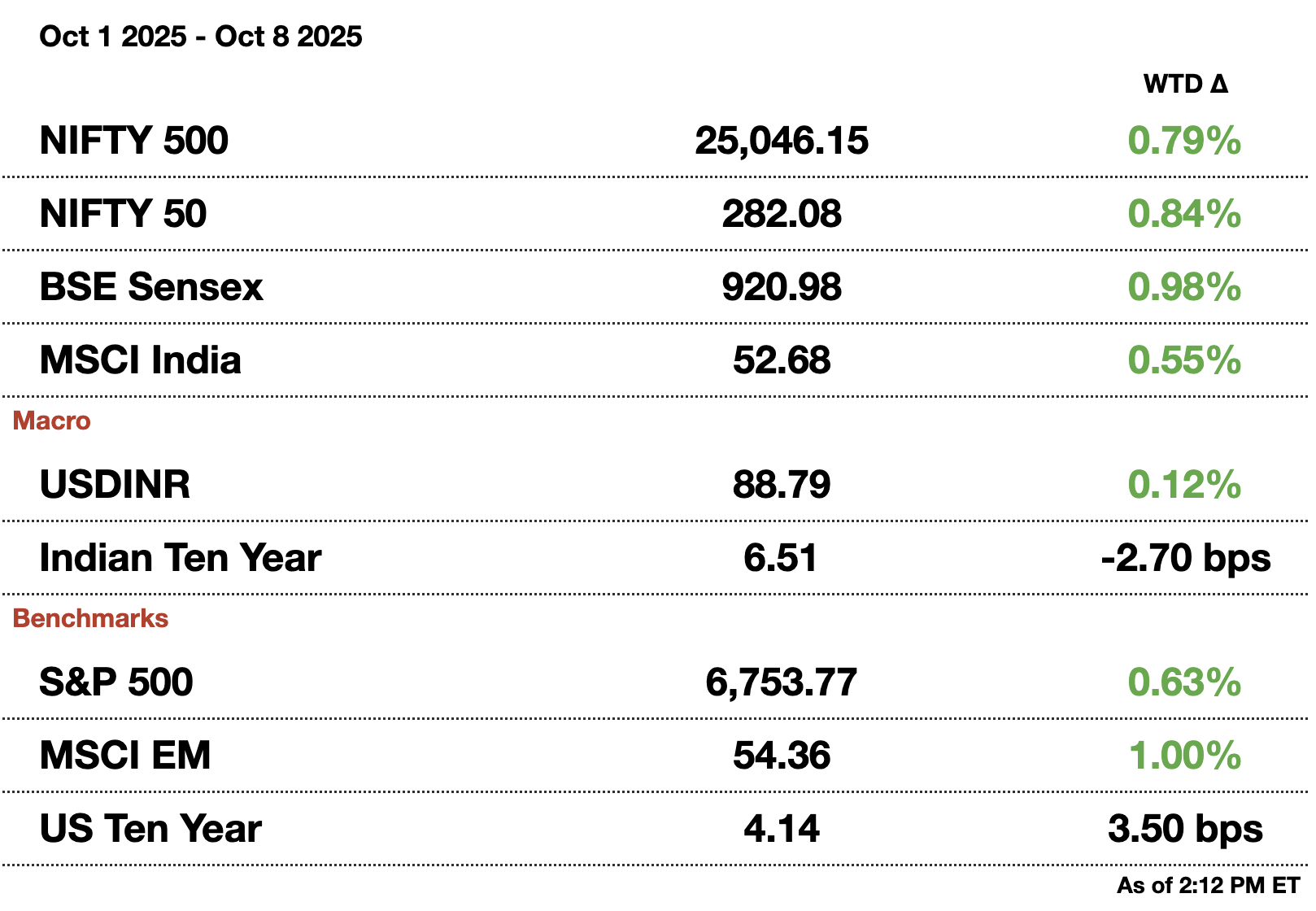

Macro

Indian refiners are expected to buy 1.7 million barrels per day from Russia. Current Russian shipments are $2-3 cheaper than equivalent Brent barrels making it even cheaper than summer. India is still talking to Middle Eastern processors due to punitive US tariffs, but Russia discounts could hold higher weight.

The housing market is showing signs of slowing, especially in the luxury segments.Unsold inventory has inched higher across the board but particularly in the $220,000-550,000 range (₹20-50 million).

Equities

Tata Capital was two times over subscribed, even on $1.7 billion (₹149.6 billion) worth of shares. Institutions bid 3.4 times over, retail investors bid 1.1 times over, while high net worth individuals bid 2 times over. Its strong shadow bank balance sheet accompanied with the Tata name made it a strong name.

Consumer discretionary stocks are expected to outperform staples due to festivals, GST cuts, and higher income. Although the restaurant industry faces some remnant inflation headwinds, segments like value retail and fashion will continue to grow in the holiday season.

Equity derivatives turnover in India is finally improving even with RBI/SEBI curbs.The increase in daily expiries has led to volume rebounding, although trading houses remain cautious on retail flows. Derivatives turnover is at its highest, $3.7 trillion (₹325.6 trillion), since Nov. 2024.

Alts

Blackstone is increasing hiring for its private credit and insurance business in India. The PE giant tapped Apurva Shah from Deutsche Bank who is the first hire for Indian credit. Shah has spent the last 26 years in the space; his hire will allow Blackstone to continue tapping into the $9 billion (₹792 billion) market that continues to grow in India.

EQT-backed Credila Financial is rethinking IPO plans due to H1-B rules. Credila is one of India’s largest student loan providers and wanted to raise $560 million (₹49.3 billion) but due to the uncertainty surrounding Indian students in the US, has backed off. Competitor Avanse is also debating delaying their IPO.

Anthropic is opening its first Indian office in Bangalore in 2026.CEO Amodei is visiting India to speak with potential partner companies. It produces Claude AI and was valued at $183 billion (₹16.1 trillion) recently; over 80 percent of use comes from outside the US and Chinese companies were recently banned from using the AI, reflecting India’s opportunity with the company.

Policy

Modi reaffirms ties with Russia by wishing Putin a happy birthday. Modi praised Putin for deepening ties as well which led to an awkward opening with Keir Starmer and his British envoy. Trade between the UK and India is expanding which was already at $22 billion (₹1.9 trillion) last year.

Where to Invest $100,000 According to Experts

Investors face a dilemma. Headlines everywhere say tariffs and AI hype are distorting public markets.

Now, the S&P is trading at over 30x earnings—a level historically linked to crashes.

And the Fed is lowering rates, potentially adding fuel to the fire.

Bloomberg asked where experts would personally invest $100,000 for their September edition. One surprising answer? Art.

It’s what billionaires like Bezos, Gates, and the Rockefellers have used to diversify for decades.

Why?

Contemporary art prices have appreciated 11.2% annually on average

…And with one of the lowest correlations to stocks of any major asset class (Masterworks data, 1995-2024).

Ultra-high net worth collectors (>$50M) allocated 25% of their portfolios to art on average. (UBS, 2024)

Thanks to the world’s premiere art investing platform, now anyone can access works by legends like Banksy, Basquiat, and Picasso—without needing millions. Want in? Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

Reach out to [email protected] to reach our audience and see your advertisement here.

1. Modi Meets UK’s Starmer

UK Prime Minister Starmer called for the rapid implementation of the UK-India FTA, urging businesses to capitalize on deepening economic ties between the two nations during his first official visit to India since taking office.

Speaking from the Taj Mahal Palace hotel in Mumbai, Starmer said he had instructed his team to move as fast as possible on the FTA, finalized in July after three years of negotiations. His remarks came before an audience of more than 100 British business, academic, and cultural leaders accompanying him on the visit aimed at expanding trade and investment links.

The visit, which has been marked by an unusually warm reception in Mumbai (over 5,700 billboards welcomed the British leader) underscores a renewed effort to anchor the UK’s post-Brexit trade strategy in Asia’s fastest-growing major economy. Starmer said the FTA is already driving an uptick in trade and symbolized the future partnership being brought together.

Starmer also announced that India’s Yash Raj Films will begin shooting in the UK next year, adding that such partnerships will bring “jobs, investment, and opportunity.” Meanwhile, British Airways revealed plans to launch a third daily flight between Heathrow and New Delhi, signaling rising business connectivity.

India’s Trade Minister Piyush Goyal and UK Business Secretary Peter Kyle reaffirmed a joint commitment to swiftly operationalize the trade deal, with discussions focused on removing non-tariff barriers, boosting regulatory cooperation, and integrating supply chains.

The otherwise upbeat visit carried a few awkward moments. Just hours before Starmer’s arrival, Modi publicly wished Putin a happy birthday, calling him “my friend.” Starmer then distanced himself, telling reporters he was not doing the same. Another sensitive issue was migration. Starmer said he would resist calls to expand visas for Indian workers, noting that the FTA is focused on trade and investment, not labor mobility.

Despite these tensions, the visit represents a major diplomatic milestone, signaling the UK’s intent to cement India as a cornerstone of its global economic strategy, even as both sides navigate diverging geopolitical and migration priorities.

2. The EU and India Still Have a Gap to Bridge

When EU leaders unveiled a new engagement strategy with India last month, they expected goodwill headlines about the growing partnership. Instead, Europe woke up to news of Indian troops participating in military drills with Russia and Belarus, a symbolic setback that exposed how deeply Brussels and New Delhi misunderstand each other.

The EU has largely stopped criticizing India’s purchases of Russian oil, tolerated its continued defense ties with Moscow, and even looked past images of Modi standing with Putin and Xi Jinping at a recent summit. Earlier this year, Modi and EU President Ursula von der Leyen committed to concluding an FTA by year-end which was a surprisingly ambitious timeline given unresolved issues over agricultural access, auto tariffs, alcohol duties, and India’s unpredictable quality control rules.

That makes it vital for India to lock in Europe’s goodwill quickly, before Trump’s coercive diplomacy derails negotiations. Europe needs India’s market and geopolitical weight to diversify away from China. India, meanwhile, needs European investment and access to advanced technologies. Yet both sides continue to talk past one another.

India tends to underestimate Europe’s sensitivity about Russia and its security anxieties on NATO’s eastern flank. Just as India insists that its Quad cooperation with the US isn’t anti-China, it should signal the same neutrality when working with Moscow to reassure Brussels. Europe, on the other hand, must loosen its rigid trade standards. India’s recent deals with partners like the UAE and Australia were struck under far lighter regulatory expectations. Brussels’ demands on environmental and labor standards risk making the agreement politically unviable in New Delhi.

3. Mumbai’s New Infrastructure Jewels

Navi Mumbai International Airport, Interior

Modi inaugurated two major transit projects in Mumbai today, signaling a major step forward in his government’s infrastructure modernization agenda. The projects—Navi Mumbai International Airport and the final phase of Mumbai Metro-3— together represent nearly $4 billion (₹351.6 billion) in investment.

At the airport, Modi toured the new greenfield facility, developed by the Adani Group. The airport is projected to eventually handle 90 million passengers per year and become India’s first airport with water taxi connectivity. Commercial flights are slated to begin in December, initially accommodating 20 million passengers annually, with a further $3.6 billion (₹300 billion) planned for phase two. The project aims to relieve capacity constraints at Mumbai’s existing airport, which is hemmed in by urban settlements, while catalyzing real estate and commercial development in Navi Mumbai.

Modi also inaugurated Metro-3’s Aqua Line, Mumbai’s first underground metro corridor, linking the southern peninsula to northern suburbs. The line connects key areas, including the Bandra Kurla Complex business district, and offers access to the existing airport. It is expected to reduce severe rail congestion and alleviate road traffic. It also complements the Mumbai–Ahmedabad high-speed rail project, whose terminus is under construction in the business district. Financing for the metro project comes from ADB, JICA, and AIIB.

The inaugurations underscore India’s broader effort to attract investment into logistics and urban infrastructure, including via infrastructure investment trusts targeting long-term investors such as pension funds and insurance companies. With urban populations swelling and public systems strained, these projects aim to expand capacity, improve mobility, and support growth in the financial capital.

The airport is structured as a special purpose vehicle (Navi Mumbai International Airport Pvt) with Adani Airport Holdings holding 74 percent and the state-owned City and Industrial Development Corporation of Maharashtra owning 26 percent.

How helpful was today's newsletter?

See you tomorrow.

Written by Eshaan Chanda & Yash Tibrewal. Edited by Shreyas Sinha.

Sponsor the next newsletter to reach tens of thousands of U.S.-based business-savvy professionals. Reach out to [email protected].

Could your business use expert insights to power growth in India? Reach out to [email protected] for a free introductory call.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.