Welcome to Samosa Capital’s evening briefing — the best way to stay up-to-date on India’s financial markets. Here’s what’s in today’s newsletter:

India and Afghanistan warm relations,

Gold imports were revised down,

India loves subsidies, but now it has to pay up.

Finally, we’ll close with Gupshup, a round-up of the most important headlines.

Have a question you want us to answer? Fill out this form and you could be featured in our newsletter.

—Shreyas, [email protected]

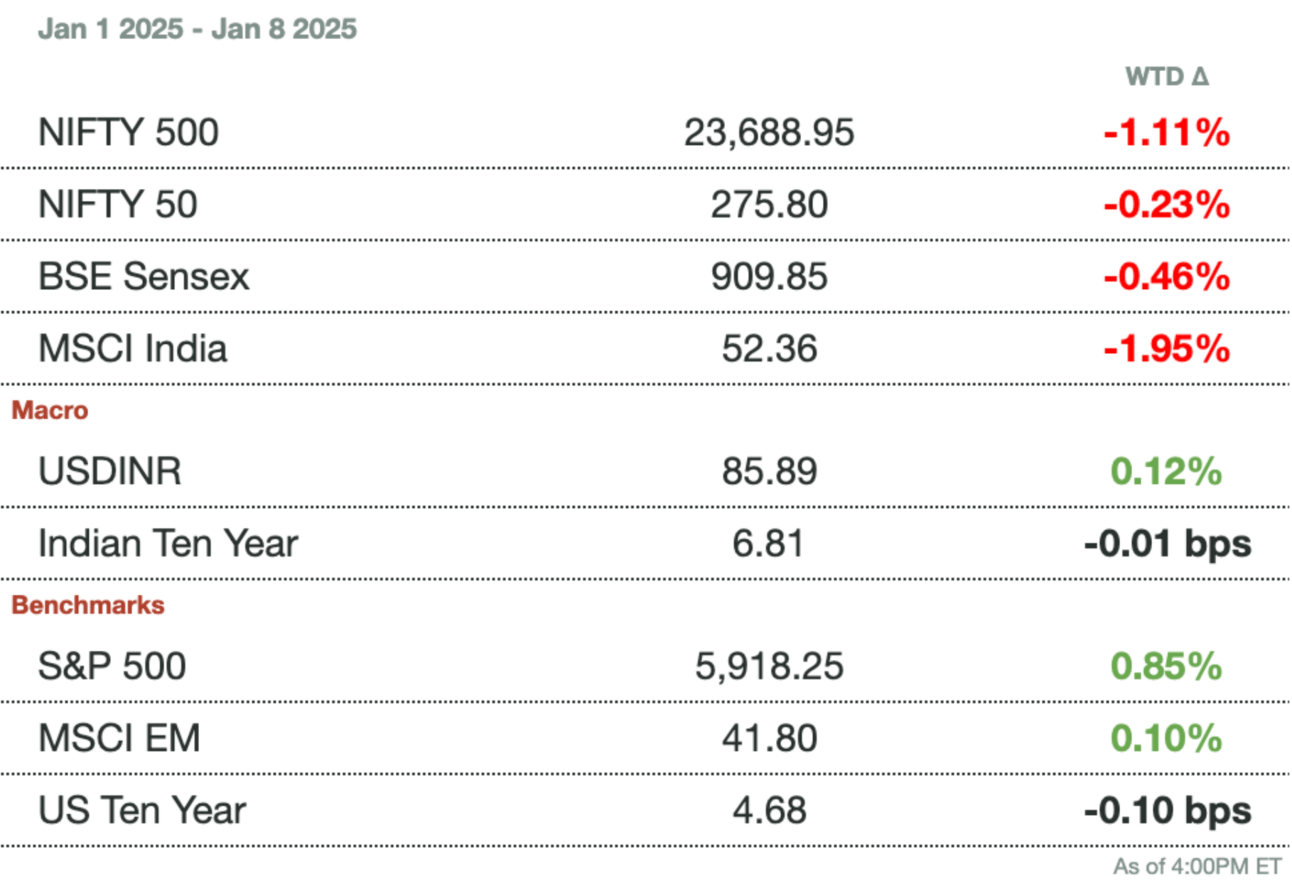

Market Update

India’s stock indices were flat today, a trend seen across global markets.

Live Event

Seats are running out for our upcoming “Future of India” expert panel and networking event on Wednesday, February 12, 2025, in New York City. Buy now here, or earn a free ticket by sharing Samosa Capital with three friends.

India and Afghanistan Warm Relations

Iran’s Chabahar Port

India and Afghanistan’s Taliban-led government have agreed to use Iran’s Chabahar port to revive bilateral trade and strengthen economic ties. This marks a significant step in normalizing relations between the two nations, four years after the Taliban seized power in Afghanistan.

Meeting in Dubai: Indian diplomat Vikram Misri and Afghanistan’s acting foreign minister Mawlawi Amir Khan Muttaqi met in Dubai to finalize the agreement, aiming to facilitate trade and commercial activities via the Iranian port.

Improving Relations: The meeting reflects India’s growing engagement with Afghanistan, with New Delhi sending a diplomat to Kabul last November to meet the defense minister.

Why now? The decision comes amid strained relations between Afghanistan and its neighbor, Pakistan, which recently bombed parts of Afghan territory over allegations of harboring terrorists. As Islamabad-Kabul ties sour, India appears to be leveraging the opportunity to improve its influence in the region.

India’s outreach also counters the growing presence of China and Russia in the region, who have both formally recognized Taliban diplomats. The U.S. does not formally recognize Afghanistan’s Taliban-led government.

Gold Imports Were Revised Down

India’s government is revising its gold import and trade data after discovering discrepancies, with November gold imports now estimated at $9.8 billion (₹844.3 billion), about $5 billion (₹429 billion) lower than the earlier reported figure of $14.9 billion (₹1.3 trillion). This revision reduces the country’s trade deficit for the month from $37.8 billion (₹3.2 trillion) to $31.8 billion (₹2.7 trillion), offering some relief amid mounting economic pressures.

Double counting was identified by The Directorate General of Commercial Intelligence and Statistics (DGCIS), leading to inflated figures in previous reports. April-November gold imports were revised downward to $37.4 billion (₹3.2 trillion) from $49.1 billion (₹4.2 trillion).

India's trade deficit eased in November, but persistent external imbalances continue to pressure the rupee, which hit another record low of 85.87 per dollar.

India Loves Subsidies, But Now It Has to Pay Up

Apple and Dixon want the money Modi promised: Foxconn and Dixon Technologies are lobbying for subsidies under India’s ₹410 billion production-linked incentive (PLI) scheme (a government policy, as you can guess, intended to boost domestic production). Because both Foxconn and Dixon beat production targets, they believe they should receive funds intended to go to companies that missed their production targets.

Bringing in the dough: India’s PLI scheme has attracted significant investments, including $14 billion (₹1.2 trillion) in local iPhone production last year, as global manufacturers diversify beyond China. The success of this initiative is critical as India seeks to lure chipmakers and tech giants like Microsoft, which recently announced a $3 billion (₹257.4 billion) investment in AI and cloud computing infrastructure.

Gupshup

Macro

India's slowdown dashes hopes of an 8 percent growth era. Slowing private investment has given doubt that the Indian economy will be able to sustain the long-term 8 percent growth required to make it a developed nation.

Goldman Sachs expects India’s GDP growth to pick up only if monetary policy becomes less restrictive and if India creates ties with Trump. The bank believes that the lower growth numbers and projections of 6.4 percent are underselling the country given the restrictive rates regime.

RBI Governor Malhotra is hearing pleas to unshackle the rupee foregoing predictability. One of the hallmarks of former Governor Das’s RBI tenureship was to fix the rupee to the dollar to currency risk for international companies. Critics say that the policy hurt export competitiveness due to the crawling peg method, causing the rupee to be overvalued, thus limiting investment in the country. Some economic advisors are calling for a more free-floating currency.

RBI Governor Malhotra faces calls to unshackle the rupee from the dollar, shifting from former Governor Das's policy of pegging it to the dollar. Critics argue the crawling peg overvalued the rupee, hurting exports and deterring investment, prompting demands for a freer-floating currency.

Equities

Heineken is blocking beer sales to the state of Telangana, causing a 7.5 percent drop in stock prices. The company reports state agencies owe $105 million (₹9 billion) in unpaid dues and cites unprofitable pricing. With the state accounting for 15-20 percent of Heineken’s volume and 10-12 percent of earnings, the NSE-traded stock has declined.

Citigroup predicts 10 percent upswing for Indian equities based on robust earnings growth. In particular, analysts predict that EPS growth will continue and expectations are low risk given the growing universe of industries and companies to follow. Citi and Morgan Stanley also cite the ability for fiscal/monetary changes to occur and the fervor domestic investors have shown at buying dips.

SEBI warned Ola Electric for sharing updates on social media before notifying investors, citing a CEO post about store openings on X. The regulator criticized the firm for failing to ensure equal and timely information access. Ola has also faced controversies over vehicle fires, regulatory scrutiny, and social media backlash in the past two years.

Alts

India is considering lifting a three-year ban on trading futures for seven farm goods. Initially imposed to curb prices, the ban has hindered price discovery, while improved harvests have stabilized prices. A ministerial panel will present findings to SEBI, likely favoring removal, aligning with last year’s lifting of bans on non-exportable goods.

JSW Steel is stuck in a deal to buy a Mozambique coal concession.JSW was attempting to buy rights from MdR to mine coal — a right valued at $50 billion (₹4.3 trillion). The loss of rights has left JSW on the sidelines and eagerly waiting for the swearing-in of President Chapo on January 15th. Chapo has prioritized international investors which could give JSW leeway.

Policy

India is revising income tax regulations to address $120 billion (₹10.3 trillion) tied up in legal disputes. The changes aim to simplify language, use charts for clarity, and reduce required form submissions, with no changes to tax rates or policies expected.

See you Thursday.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.