- Samosa Capital

- Posts

- 📰Metal Stocks Have Risen Dramatically, But Could Fall as Fast | Daily India Briefing

📰Metal Stocks Have Risen Dramatically, But Could Fall as Fast | Daily India Briefing

Everything you need to know about Indian markets.

In partnership with

India’s metal stocks are soaring on record commodity prices — but history suggests this is exactly when investors should start worrying. Today, we explain more.

If you have any questions about India, fill out this form or reach out to Shreyas at [email protected]

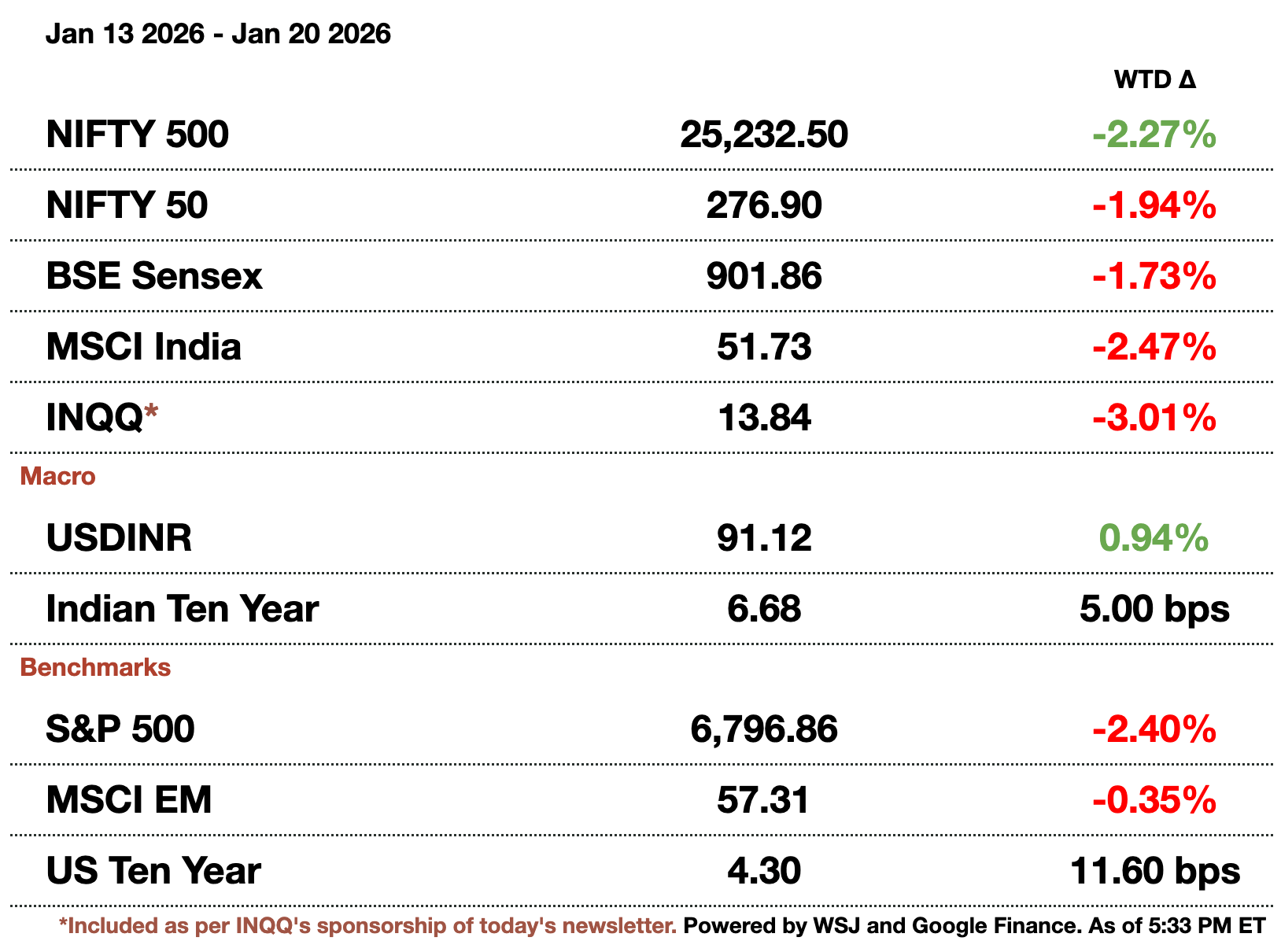

Macro

The rupee fell to 90.8 amid muted RBI support and foreign equity outflows. Foreign investors have already pulled $1.6 billion (₹144.3 billion) in January.

Maximum demand for power hit 245.4 GW this month, surpassing the summer season.The variation shows the weather but also rising income since more people are using space heaters in the frigid winter instead of burning wood which used to be common practice. The all-time power record was 250 GW in the summer of 2024.

Equities

ECM markets show no signs of slowing down with IPOs oversubscribed 147x. State-owned Bharat Coking Coal was subscribed nearly 147 times. This continues 2025’s bids where 16 of 103 main IPOs were subscribed over 100 times.

ICICI bank is reappointing old CEO Bakshi for 2 years after profits fell 4 percent y-o-y to $1.3 billion (₹113.2 billion) last quarter.A large difference was because provisions doubled to $283.4 million (₹25.6 billion) from agricultural priority sector credit facilities after the terms were not compliant with regulatory requirements.

Alts

Standard Chartered is reviewing its retail card strategy to focus on repeat customers. Selling its card unit will help deepen and focus on relationships only in wealth management since value per customer is higher there.

Mobius Emerging Opportunities Fund finds gold as a more unattractive asset. He would only consider metals if they were 20 percent lower than today’s. Mobius is instead investing in EM countries like India, China, Korea, and Taiwan.

Investec India is partnering with smaller firms to provide greater financial advisory. It started up in 2011 and closed 51 advisory and capital market transactions worth $13 billion (₹1.2 trillion).

Tiger Global's tax ruling impacts many ongoing cases in the buyout sector related to $50 billion (₹4.5 trillion) of PE capital injected just in 2025.India has become ground-zero for PE investment but firms have to look at capital structures and investment risk differently with policymakers cracking down on Mauritius-tax rules. Tiger now owes $1.6 billion (₹144.3 billion) in back taxes.

Policy

India's Directorate of General Aviation fined IndiGo just $2.4 million (₹216.5 million) over their December cancellations. The airline also has to pledge $5.5 million (₹500 million) in bank guarantees which will be released in phases spanning areas like governance, rostering, and manpower planning.

India’s Tech Boom Is Here. Now, You Can Invest in Minutes.

Samosa Capital is excited to partner with The India Internet ETF (NYSE: INQQ), a U.S.-listed ETF that lets you invest in the tech companies driving India’s future in minutes: from Swiggy and Lenskart to Eternal and Nykaa.

In a single trade, you'll get access to a basket of innovative companies contributing to the future of the world’s most populous country, and gain exposure to India's long-term investment potential.

INQQ is available through most major online brokerages, giving you direct access to rigorously researched Indian tech giants.

Reach out to [email protected] to reach our audience and see your advertisement here.

Metal Stocks Have Risen Dramatically, But Could Fall as Fast

History argues for caution as India’s metal stocks continue their blistering run. The sector is surfing a powerful global commodities rally that has taken gold, silver, and copper to record highs, lifting mining and metal producers along with them. The Nifty Metal Index is off to its strongest start to a year since 2018, reviving memories of past boom cycles and raising a familiar question for investors.

From a technical standpoint, warning signs are beginning to flash. The ratio of the Nifty Metal Index to the broader Nifty has moved beyond two standard deviations above its long term mean, a threshold breached only twice in the last 11 years. On both occasions, according to Bloomberg data, the metal index went on to fall more than 7 percent over the subsequent three months.

The rally has nonetheless created clear winners. Vedanta Group has been among the biggest beneficiaries, with its shares rising about 56 percent over the past year and its market value overtaking traditional heavyweights such as Tata Steel and Hindalco. The surge has also delivered windfall gains for the Indian government through its stake in Hindustan Zinc, whose valuation has climbed close to $31 billion (₹2.8 trillion), and in Hindustan Copper, whose shares have risen by 150 percent to $6 billion (₹541.2 billion). Together, these moves underscore how sharply investor sentiment has shifted toward the sector.

The exuberance is not confined to institutional portfolios. Retail traders are increasingly chasing momentum in commodity markets, drawn by record prices and the lack of excitement in equities. Groww now sees commodity trading accounting for 4.6 percent of all orders, up from just 0.3 percent from the September quarter. Online brokers report a sharp jump in commodity derivatives trading, particularly among mobile-first users, as gold, silver and base metals become the new vehicles for speculation. That influx of retail activity may add fuel in the short term, but it also tends to amplify reversals when sentiment turns. After such a rapid ascent, metal stocks may be entering a phase where discipline matters more than enthusiasm.

How helpful was today's newsletter? |

See you tomorrow.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Sponsor the next newsletter to reach tens of thousands of U.S.-based business-savvy professionals. Reach out to [email protected].

Could your business use expert insights to power growth in India? Reach out to [email protected] for a free introductory call.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.