Good evening,

Welcome to the best way to stay up-to-date on India’s financial markets. Here’s what’s in today’s newsletter:

U.S. Vice President Vance puts U.S.-India relations in a strong light,

As the U.S. tariffs Chinese solar panels, Indian producers see opportunity,

and Indian bank stocks hit fresh highs on Tuesday as liquidity eased.

Then, we close with Gupshup, a round-up of the most important headlines.

Have a question you want us to answer? Fill out this form, and you could be featured in our newsletter.

—Shreyas, [email protected]

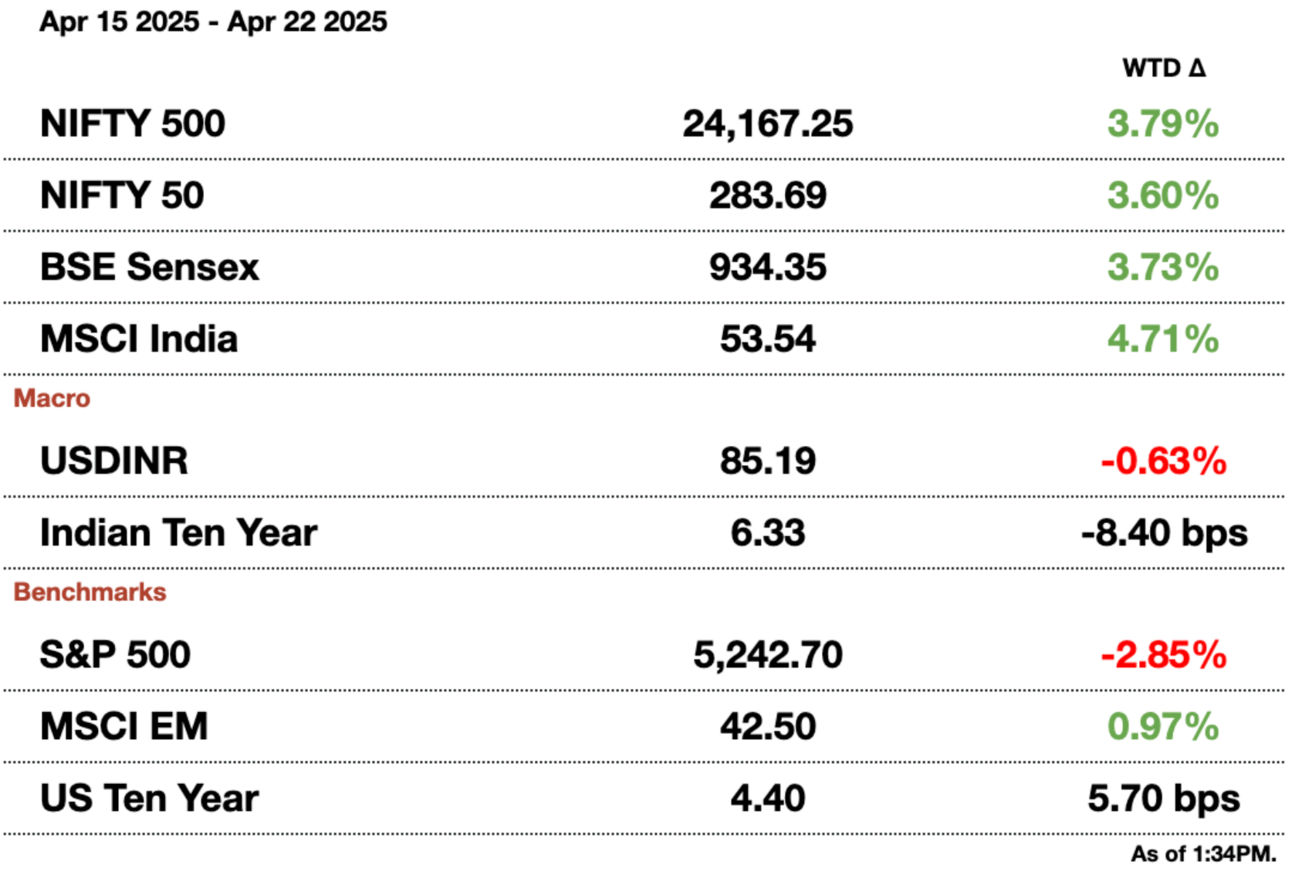

Market Update.

JD Vance is Very Positive on India.

VP Vance used his four‑day tour of India to cast the US‑India relationship as the defining partnership of the 21st century, grounded in mutual ambition. Speaking in Jaipur, Vance lavished praise on Modi’s vision and urged New Delhi to lower remaining trade barriers, buy more American energy and defense equipment, and help finalize a bilateral trade pact by autumn. He called it a “win-win partnership” and said that “the future of the 21st century is going to be determined by the strength of the United States and India partnership.”

That message marks a stark departure from past American attitudes toward India, which often cast it as a source of cheap labor. Vance, whose reputation as an America‑First firebrand preceded him, instead adopted a decidedly softer diplomatic tone, touring Hindu temples with his Indian‑American wife.

A few pointed economic imperatives. Trump’s reciprocal tariffs loom large: without a deal, levies on Indian exports could leap from 10 percent to 26 percent once the 90‑day pause ends. Vance reminded his audience that American businesses “want further access to Indian markets,” and he signaled that advanced US weaponry like the F-35 could deepen defense ties. In exchange, India stands to benefit from lower energy costs and closer technological collaboration.

Vance’s visit dovetails with a reciprocal trip by Sitharaman to Washington, where she’ll press Treasury Secretary Scott Bessent on the same deal. The synchronized shuttle diplomacy underscores how high the stakes have become: a successful pact would not only avert punitive tariffs but also cement a strategic alignment that many in New Delhi see as essential in an era of global uncertainty. Vance does not want to treat India with condescension but rather create a genuinely equal partnership.

India’s Solar Industry Hits An Inflection Point.

As punitive US tariffs (3,521 percent!) squeeze Chinese solar giants out of America’s market, India’s fledgling solar industry finds itself at a historic inflection point. With levies now targeting panels made in four Southeast Asian nations where Chinese factories dominate, the door has swung wide for alternative suppliers such as India. Local manufacturers, led by the Indian Solar Manufacturers Association, are already touting their ability to deliver high-quality, domestically manufactured solar cells that comply fully with US traceability and content rules.

The reality: Yet beneath the optimism lies a critical vulnerability: India’s upstream dependency on Chinese inputs. Nearly all of the raw wafers, polysilicon and specialized machinery that feed India’s module lines still come from Beijing’s world‑class suppliers. Should the trade war escalate further — or should China decide to withhold those key components — India’s nascent export push could stall. Escalating trade wars could always risk China snapping the supply chain, forcing India to scramble for lower‑tier vendors at the expense of quality and reliability.

Indian firms are still racing to expand capacity. By the end of March, the country’s solar‑cell manufacturing footprint had tripled in just one year to 25 gigawatts, propelled by a looming non‑tariff barrier that kicks in next year. Industry leaders now speak openly of doubling that figure, not merely to satisfy the domestic pipeline but to build a surplus destined for export markets, including the United States, which is desperate for cells to feed its burgeoning module assembly hubs. If realized, that scale-up would mark a seismic shift: from importer of panels to net solar exporter.

For now, the moment belongs to those who can marry India’s manufacturing ambition with strategic foresight. The trade war has cracked open the US market, but India’s clean‑energy hopes hinge on securing a resilient supply of upstream materials and machinery, ideally through onshore partnerships or insulated foreign trade agreements. Either option would protect the industry from further geopolitical issues. Like pharma and a few other industries, solar power could hit hockey stick growth with proper navigation.

Bank Stocks Are Rising as Liquidity Eases.

Indian bank stocks hit fresh highs on Tuesday, propelling the Nifty Bank Index even further from its nine‑month low in early March and adding nearly $100 billion (₹8.5 trillion) in market value. Led by heavyweight private lenders like HDFC Bank, Kotak Mahindra Bank, and ICICI Ban,k the sector rose 0.6 percent, reflecting a surge in investor confidence that credit growth is finally rebounding from last year’s slowdown.

A new catalyst: The RBI came up with a late-Monday decision to ease liquidity requirements, allowing banks to hold a smaller share of retail deposits in sovereign bonds. By freeing up the equivalent of roughly 600 basis points in the liquidity coverage ratio [liquidity coverage is if a bank’s assets can cover liabilities], the move unleashes fresh capital for lending at a time when mobile banking has fundamentally altered deposit dynamics. This relaxation, coupled with Governor Malhotra’s string of lending‑rule reforms and record liquidity injections since taking office in December, has positioned India’s banks to outpace their Asian peers by the widest margin seen since 2022.

Yet challenges remain. Retail credit growth is still expected to lag, and corporates continue to tread carefully on new capital‑expenditure plans. Moreover, the RBI’s 50 basis points of rate cuts since February may squeeze loan yields in the near term, given the prevalence of external benchmark lending rates. Banks will have to reduce their existing deposit rates, though this could cause customers to also pull money from those banks. Even so, this week’s robust results from ICICI Bank and HDFC Bank have reinforced the rally, with Axis Bank’s earnings due on Thursday set to be the next key test of the sector’s momentum.

For now, various investing portfolio managers see a clear play: foreigners and domestic investors will have to add more weight to India’s banks, given there is quality and the weight they have in the index. Similar to how tech moves the S&P, bank stocks have the same effect in India. With fresh liquidity on hand and stronger earnings visibility, India’s banking sector appears poised to convert regulatory tailwinds into sustained growth.

Gupshup.

Macro

A stronger-than-expected monsoon should boost crops and reduce inflation. Rain will be 5 percent higher than the long-term average, which should aid farmers and reduce crop volatility. This rainfall is vital since the summer is expected to also be slightly hotter than average.

India is the first major market to erase all April 2nd stock losses. Asian equities are broadly still down 3 percent due to a rapidly approaching Sino-American trade war, which could push manufacturing into India as an FTA also nears.

Citi sees more room for a rally in Indian bonds during global selloff. Softening inflation and improved liquidity should result in more trading activity and bullish sentiment as well. These sentiments alone should drop the 10-year benchmark to 6.20 percent from the current 6.50 percent.

Equities

ICICI Prudential posts high quarterly profits from strong insurance demand. Standalone profit jumped to $45 million (₹3.9 billion) driven by a 30 percent jump in single premiums. Group insurance demand went up, but ICICI was actually dented by a lack of demand for market-linked insurance due to market corrections in Q4.

HDFC bank shares rose 4 percent with deposit rate cuts seen as a margin lift amid slow loan growth. The bank is now paying 25 basis points less on 23 percent of its total deposits. The cut targets accounts with less than $58,000 (₹5 million), which should boost margins by 5 basis points by FY26. Private banks are likely to follow suit, as interest rates around the economy come down.

Indian car makers' sales to dealerships grew by 2 percent y-o-y to 4.3 million. The rise was led by SUVs while sedan sales lagged. While demand continues to go up, growth has been logarithmic, with sales in 2023 being 27 percent. Part of the decrease is a reduction in savings glut as well.

Indian auto stocks jump 3 percent after Trump considers tariff exemptions. Trump, at a White House event, said that auto companies might need more time before 25 percent tariffs on auto parts kick in. This announcement led to the gain. The biggest winner was luxury car manufacturer Jaguar-Land Rover, which went up 5 percent.

Alts

Eli Lilly launches Mounjaro in India, leading to thousands of customer inquiries. In the past, Indians have relied on their non-resident families to attain weight loss drugs, but Mounjaro represents one of the first major legal intros. It will likely cost $200 (₹17,200) per month for the drug.

India is targeting 300 million new users for the UPI payments platform. They want to break “cash memory” by luring teenagers and house staff who may lack traditional bank accounts. India’s growth in digital payments is insane, with the country now responsible for 46 percent of global digital payments. This is the result of a 90-fold increase over the last 12 years.

Policy

India's government and sugar producers face off over jute bags, which cost $76 million (₹6.5 billion). Producers went to reduce reliance on jute bags and switch to plastic, recyclable ones to save money as mentioned above. The government, as per usual, is siding with farmers and other families that produce the jute bags over the green-friendly ones.

See you Wednesday.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.