Hello. India’s inflation print came in at 6.21 percent. Corporate earnings remain sluggish. We’ll investigate, and then close with Gupshup, a round-up of the most important headlines.

Seats are running out for our upcoming “Future of India” expert panel and networking event on Wednesday, February 12, 2025, in New York City. Buy now here, or earn a free ticket by sharing Samosa Capital with three friends.

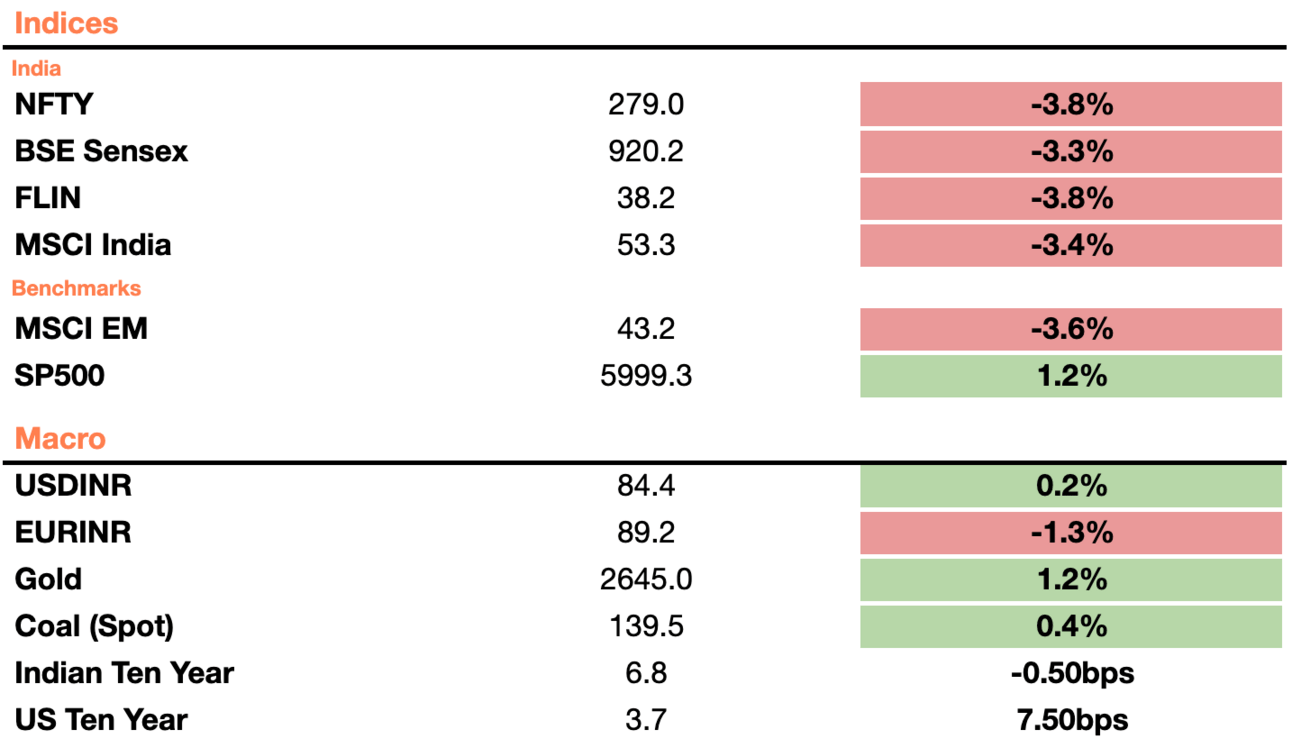

Markets

Read here for an appendix on the above.

Analysis

Is India Heading For Winter Freeze?

India's inflation rose to 6.21 percent year-over-year in October, marking a 14-month high and surpassing the Reserve Bank of India’s comfort range of 2-6 percent. This spike, largely fueled by surging food and vegetable prices, saw price growth reach double digits, effectively ruling out any immediate prospects for rate cuts.

This inflation shock also dampens near-term GDP growth expectations, meaning industrial companies may have to wait longer for the easing that a rate cut would bring. Among the Nifty50 companies that have reported earnings this quarter (all but six), 50 percent have fallen short of analyst estimates. Equity research firm Motilal Oswal also noted an 8 percent drop in earnings growth across 166 companies it tracks.

This disappointing performance breaks with a recent trend. Since early 2020, Indian companies have largely exceeded analyst expectations quarter after quarter, buoyed by pandemic-era global stimulus that promoted risk-on investing and directed capital flows into Indian markets. High corporate performance during that period may have set an unrealistic benchmark, with some companies now struggling to meet revised growth forecasts.

Despite these pressures, industrial output rose 3.1 percent year-over-year, with manufacturing output up 3.9 percent year-over-year in October, rebounding from a previous -0.1 percent contraction. Still, some sectors have felt the strain: 3M, a supplier of industrial machinery, reported an 8.4 percent profit drop, and Ultratech Cement, India’s largest cement producer, saw Q2 losses of 35 percent.

Equity analysts also point to additional headwinds, including reduced government capex and unpredictable weather. Companies have benefited from strong government spending in recent quarters, but this trend softened in the June quarter, which saw a 7.7 percent year-over-year decrease—partly due to national election spending priorities. This is in contrast to a 10 percent spending increase the year before. Looking ahead, there’s a risk of prolonged spending cuts as the government seeks to meet FY25 budget targets, which could impact sectors reliant on public investment, especially infrastructure and emerging industries.

Weather has been another challenge, with inconsistent rainfall patterns affecting crop yields and supply chains. Earlier this year, low rainfall drove up food inflation, while excessive rain in October harmed the kharif harvest through waterlogging. Higher food costs continue to strain household budgets, reducing discretionary spending—a trend that impacted the consumer retail sector this past quarter.

Macro

India proves to have low correlation to U.S. politics, providing much-needed diversification for international asset managers. Firms like Pictet Asset Management are concentrating on economies with idiosyncratic economic development and expectations of lower interest rates in the future. India also has fast economic growth and inclusion in various bond indices makes the country appealing as well. The global inclusion has led to India’s generally restrictive foreign investor rules being relaxed giving asset managers more opportunities as well. (BBG)

Equities

Swiggy's $1.3 billion IPO saw 2-3x oversubscription, driven mainly by strong institutional demand, though retail interest was lower than Hyundai's IPO. This positions Swiggy to compete better with rivals like Zomato and private firm Zepto. However, analysts remain cautious, citing Swiggy's weaker margins compared to Zomato, which could limit initial stock performance. (Livemint)

Indian state-backed firm seeks $12 billion valuation (₹1 trillion) for a green energy IPO. NTPC Green Energy is seeking to be one of the largest renewable IPOs in India. The company is looking for a $1.2 billion (₹101.3 billion) equity raise to continue increasing its output capacity. India as a whole has added 100 gigawatts in the last 10 years. (BBG)

Alts

Byju’s US units were wrongly stripped of the education app, courts found. Courts found that a “rogue officer” misled Apple into diverting ownership and revenue streams of two American SubCos of Byju. This continues a trend of unknown agents grabbing cash by hacking source code from Byju as the bankruptcy continues. Byju is also in bankruptcy in India and there is also a legal fight between countries since Indian and American creditors are splitting hairs. (Economic Times)

State Bank of India looks to raise $237 million (₹19.9 billion) for a climate fund. The fund is raised from multilateral institutions in order to invest in SMID companies focused on recycling and curbing carbon emissions. Green finance is booming in India with an estimated $12.4 trillion (₹1.04 quadrillion) in investment required to become net zero by 2070. (Economic Times)

Policy

Finance Minister Sitharaman signaled it may lower India’s tariffs if India’s economy isn’t harmed, following President-elect Trump’s comment labeling India the “biggest charger.” Trump may impose his own tariffs on India in response. Sitharaman aims to balance domestic needs with international pressure and consumer costs. The U.S., India’s largest trade partner, accounts for $119.7 billion (Rs. 10.1 trillion) in trade, up 33 percent over five years. (Business Standard)

Indian borrowing will likely rise in the next few years. Bond sales are likely to rise in order to cover higher debt repayments from past government spending. Current expectations based on the budget call for $168 billion (₹14 trillion) in borrowing but this could easily surprise to the upside. The government still does not see any shortfall in the budget and is encouraging departments and states to speed up spending, likely to inject the economy with growth stimulus. (Moneycontrol)

See you Friday.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

1 USD = 84.4 Indian Rupee