Good evening,

Welcome to the best way to stay up-to-date on India’s financial markets. Here’s what’s in today’s newsletter:

Inflation in India eased to its lowest level in nearly six years last month,

India’s trade deficit widened sharply in March,

and a new RBI rule is poised to inject fresh momentum into the country’s junk debt market.

Then, we close with Gupshup, a round-up of the most important headlines.

Have a question you want us to answer? Fill out this form, and you could be featured in our newsletter.

—Shreyas, [email protected]

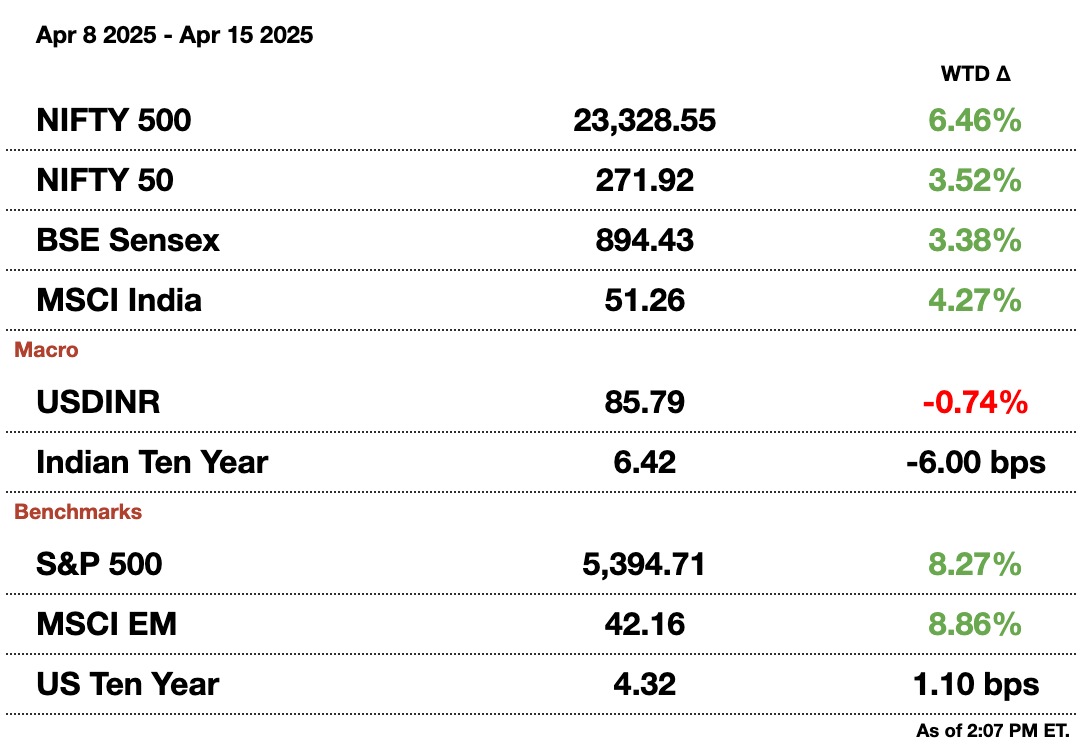

Market Update.

Inflation Falls to 3.3 Percent.

Inflation in India eased to its lowest level in nearly six years last month, bolstering calls for further interest rate cuts. Data released by the statistics ministry revealed that the consumer price index rose by 3.34 percent in March y-o-y, comfortably under the 3.6 percent mark forecasted by economists. This deceleration comes on the heels of a 3.61 percent increase in February and sits well below the RBI’s 4 percent target.

The RBI has already trimmed its benchmark interest rate by a quarter point in each of its two previous meetings, bringing the rate down to 6 percent. Last week, the central bank signaled that it could ease further by shifting its policy stance toward an even more accommodative framework. Market participants, including Morgan Stanley, Nomura Holdings, and Kotak Mahindra Bank, now forecast that the repo rate might drop as low as 5 percent during this easing cycle, suggesting up to 100 basis points of additional cuts may be on the horizon.

Causes for low inflation: A significant deceleration in food inflation, which comprises nearly half of the CPI basket, was a key contributor, as prices climbed just 2.69 percent compared with 3.75 percent previously. Notably, vegetable prices tumbled by over 7 percent after showing only a marginal decline in the prior month. Lower oil prices are also easing cost pressures, while the monsoon is projected to be stronger than usual, which should further reduce prices.

Core inflation, which strips out the volatile categories of food and fuel, edged up slightly to 4.2 percent from 4.08 percent earlier. Despite this modest uptick, the prevailing disinflationary trend is giving the RBI further latitude to prioritize growth.

Most economists believe that there is room for at least two more rate cuts this year. If global growth conditions continue to weaken, the possibility of a third rate cut cannot be ruled out. With global headwinds persisting, India’s monetary easing, combined with structural support from a robust domestic demand, could prove vital in sustaining economic momentum in the coming months.

The Trade Deficit Just Widened.

India’s trade deficit widened sharply in March as the nation grapples with the fallout from Trump’s aggressive tariff strategy. Last month, the gap between exports and imports reached $21.5 billion (₹1.9 trillion) — substantially above the $15.5 billion (₹1.3 trillion) anticipated by economists—indicating that imports surged while export growth remains tepid. Exports edged up by a marginal 0.7 percent y-o-y to $42 billion (₹3.6 trillion), whereas imports climbed briskly by 11.4 percent to $63.5 billion (₹5.5 trillion).

This widening deficit comes as policymakers and exporters alike race to insulate the economy from the escalating US trade war. With in-person trade negotiations scheduled to begin in the latter half of May, India is striving to finalize a bilateral deal that addresses both tariff and non-tariff barriers. Despite earlier assurances during Modi’s visit to Washington, the imposition of a 26 percent tariff on April 2 forced New Delhi to take swift remedial steps, including the establishment of a trade help-desk to provide real-time updates to exporters on tariff adjustments.

Leading causes: After recording a historic low trade deficit of $14.1 billion (₹1.2 trillion) in February, the recent spike is a stark reminder of the vulnerabilities in India’s external sector. Key components of the import bill have seen dramatic increases, with oil imports jumping to $19 billion (₹1.6 trillion) and gold imports almost doubling to $4.4 billion (₹378.4 billion). These factors, compounded by persistent geopolitical uncertainties, are casting a long shadow over future export performance. Commerce Secretary Sunil Barthwal noted that the last financial year was “difficult” given the rising tensions, even as overall exports exceeded $820 billion (₹70.5 trillion).

Currency risks: The rupee has gained 2 percent against the US dollar in March, but rising imports could cause this to fall. This fiscal imbalance has intensified discussions within New Delhi on the need to negotiate a broader network of free trade agreements. Beyond the protracted negotiations with Washington, India is also advancing talks with major trading partners in the EU and the UK, with the next India-EU round slated for mid-May and an anticipated free trade pact by year-end.

In parallel, New Delhi has set up a specialized monitoring panel comprising officials from the commerce and finance ministries to scrutinize dumping practices by regional rivals such as China, Vietnam, and Indonesia. There is also an expectation that Chinese duties on American goods could divert more US farm products into India, adding another layer of complexity to the trade dynamics.

New Securitized Products in India.

The RBI’s new rule change allowing banks to bundle stressed assets into tradable securities is poised to inject fresh momentum into the country’s junk debt market. Analysts and investors alike expect that this measure will attract a broader pool of foreign portfolio investors and private credit funds, deepening market liquidity while offering high-yield investment alternatives.

New guidelines: The RBI will permit market-determined securitization not only for loans with regular repayment schedules but also for distressed or stressed assets. Recent data highlights that the volume of securitized standard loans surged by 25 percent to $26.7 billion (₹2.3 trillion) in the 2024-25 period. This growth is indicative of a broader shift in strategy: rather than offloading bad loans to asset reconstruction companies at steep discounts, resulting in 90-95 percent haircuts, banks now have a viable pathway to lighten their balance sheets while offering attractive yields to investors.

Investor interest: By pooling stressed retail and personal loans, banks are not only expanding their capital relief options but also creating a market instrument that could generate returns comparable to those from distressed funds. This could be particularly appealing to US and European distressed debt funds, which have long been drawn to the high-yield opportunities emerging in India’s evolving debt landscape. The revamped securitization framework is expected to offer yields that surpass those typically found in the junk bond segment, aligning with what high-yield investors seek in distressed asset investments.

However, despite the promising outlook, several challenges remain. The pricing of these securities is inherently complex. Factors such as asset quality, recovery rates, historical default probabilities, and prevailing investor sentiments will be critical in determining deal values. Slow legal recovery processes and intricate regulatory frameworks could also temper the pace at which the market develops.

By allowing banks to securitise a wider array of assets, the RBI’s new policy aims to help institutions manage their balance sheets more effectively and ease the burden of bad loans—a chronic issue that once compelled banks to focus exclusively on the unsecured retail segment, thereby fueling higher delinquencies. As India’s overall bad loan ratio is projected to climb slightly — from 2.6 percent in September to an estimated 3 percent by 2026 — the move could be a timely intervention to stabilize the sector.

Message from our sponsor.

What Top Execs Read Before the Market Opens

The Daily Upside was founded by investment professionals to arm decision-makers with market intelligence that goes deeper than headlines. No filler. Just concise, trusted insights on business trends, deal flow, and economic shifts—read by leaders at top firms across finance, tech, and beyond.

Gupshup.

Macro

A stronger-than-expected monsoon should boost crops and reduce inflation. Rain will be 5 percent higher than the long-term average, which should aid farmers and reduce crop volatility. This rainfall is vital since the summer is expected to also be slightly hotter than average.

India is the first major market to erase all April 2nd stock losses. Asian equities are broadly still down 3 percent due to a rapidly approaching Sino-American trade war, which could push manufacturing into India as an FTA also nears.

Citi sees more room for a rally in Indian bonds during global selloff. Softening inflation and improved liquidity should result in more trading activity and bullish sentiment as well. These sentiments alone should drop the 10-year benchmark to 6.20 percent from the current 6.50 percent.

Equities

ICICI Prudential posts high quarterly profits from strong insurance demand. Standalone profit jumped to $45 million (₹3.9 billion) driven by a 30 percent jump in single premiums. Group insurance demand went up, but ICICI was actually dented by a lack of demand for market-linked insurance due to market corrections in Q4.

HDFC bank shares rose 4 percent with deposit rate cuts seen as a margin lift amid slow loan growth. The bank is now paying 25 basis points less on 23 percent of its total deposits. The cut targets accounts with less than $58,000 (₹5 million), which should boost margins by 5 basis points by FY26. Private banks are likely to follow suit, as interest rates around the economy come down.

Indian car makers' sales to dealerships grew by 2 percent y-o-y to 4.3 million. The rise was led by SUVs while sedan sales lagged. While demand continues to go up, growth has been logarithmic, with sales in 2023 being 27 percent. Part of the decrease is a reduction in savings glut as well.

Indian auto stocks jump 3 percent after Trump considers tariff exemptions. Trump, at a White House event, said that auto companies might need more time before 25 percent tariffs on auto parts kick in. This announcement led to the gain. The biggest winner was luxury car manufacturer Jaguar-Land Rover, which went up 5 percent.

Alts

Eli Lilly launches Mounjaro in India, leading to thousands of customer inquiries. In the past, Indians have relied on their non-resident families to attain weight loss drugs, but Mounjaro represents one of the first major legal intros. It will likely cost $200 (₹17,200) per month for the drug.

India is targeting 300 million new users for the UPI payments platform. They want to break “cash memory” by luring teenagers and house staff who may lack traditional bank accounts. India’s growth in digital payments is insane, with the country now responsible for 46 percent of global digital payments. This is the result of a 90-fold increase over the last 12 years.

Policy

India's government and sugar producers face off over jute bags, which cost $76 million (₹6.5 billion). Producers went to reduce reliance on jute bags and switch to plastic, recyclable ones to save money as mentioned above. The government, as per usual, is siding with farmers and other families that produce the jute bags over the green-friendly ones.

See you Wednesday.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.