Good morning,

Welcome to the best way to stay up-to-date on India’s financial markets. Here’s what’s in today’s newsletter:

Inflation drops (and what this means for India’s markets),

India deepens its trade relations with Russia,

and, India announces strategic partnership with France to build nuclear plans.

Finally, we’ll close with Gupshup, a round-up of the most important headlines.

Have a question you want us to answer? Fill out this form and you could be featured in our newsletter.

—Shreyas, [email protected]

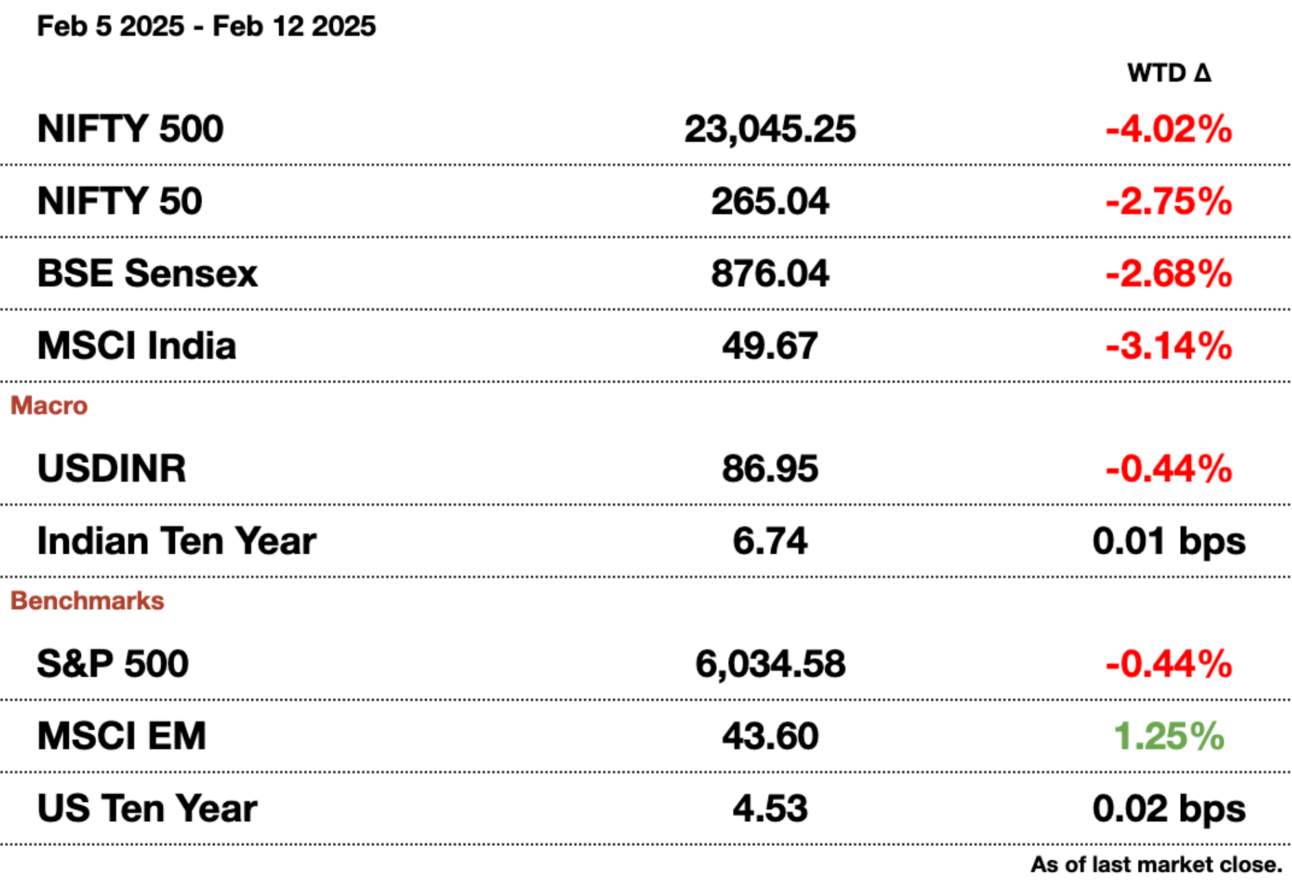

Market Update.

SOLD OUT: Expert Panel & Networking Event in New York City.

Our upcoming “Future of India” speaker and networking event on tonight, in New York City, has been sold out! Thank you to all who plan to be there. If you didn’t get a chance to buy a ticket, we’ll be hosting another event later this year.

See you soon!

Inflation Drops, Vindicating RBI.

India’s inflation cooled to 4.31 percent in January y-o-y, a five-month low, edging closer to the central bank’s 4 percent target and raising expectations for further interest rate cuts. The CPI is lower than the 4.50 percent forecast by economists and a significant drop from 5.22 percent in December. The decline was primarily driven by a drop in food prices, which account for nearly half of the CPI basket.

Food inflation slowed to 6.02 percent, compared to 8.39 percent in December.

Vegetable prices dropped 11.35 percent, reversing the 26.56 percent surge from the previous month. 475

Predictions for cuts: Governor Malhotra cut rates in his first policy meeting last week and reaffirmed the 4 percent inflation target. The central bank expects inflation to average 4.2% next fiscal year but remains wary of global trade risks and adverse weather. Economists anticipate another quarter-point cut soon, though the rupee’s depreciation threatens to raise import costs and inflation.

Further reasoning for another cut: Separate data showed India’s industrial production grew 3.2 percent in December, slowing from a revised 5 percent in November, further evidence of deteriorating economic growth.

Russian Oil Supply Chains are Being Developed.

India is deepening its economic relationship with Russia, as Indian refiners are reconfiguring supply chains to continue importing discounted Russian crude, despite tighter US sanctions that have disrupted shipping and payment networks. To bypass restrictions, refiners are partnering with new and existing middlemen who are not blacklisted. Some of these entities, such as L-Oil and Sccton, have emerged in Dubai to replace sanctioned firms like Black Pearl, Guron Trading, and Demex Trading.

State refiners and Reliance Industries face a shortfall of 18-20 Russian cargoes for March—equal to 20 million barrels or 14 percent of India’s monthly imports. Government and corporate officials insist that the disruption is temporary but logistical and financial hurdles remain to import from the Middle East.

Key Challenges: US sanctions blacklisted 160 vessels in January which has a ripple effect. New insurance policies have to be restructured in addition to changing payment processing. To sidestep restrictions, some shipments may be discharged into onshore storage tanks in Fujairah, UAE, then reloaded and rebranded as UAE-origin crude. Ship-to-ship transfers have already been used by Chinese buyers to mask Iranian crude origins.

Oil Minister Hardeep Singh Puri emphasized that India has multiple crude sources but remains in talks with Moscow for deeper discounts. At the same time, Modi is set to meet Trump this week, potentially discussing energy security and geopolitical pressures.

Message from our Sponsor

Billionaires wanted it, but 66,737 everyday investors got it first… and profited

When incredibly rare and valuable assets come up for sale, it's typically the wealthiest people that end up taking home an amazing investment. But not always…

One platform is taking on the billionaires at their own game, buying up and offering shares of some of history’s most prized blue-chip artworks for its investors. In just the last few years, those investors realized representative annualized net returns like +17.6%, +17.8% and +21.5% (among assets held 1+ year).

It's called Masterworks. Their nearly $1 billion collection includes works by greats like Banksy, Picasso, and Warhol, all of which are collectively invested in by everyday investors. When Masterworks sells a painting – like the 23 it's already sold – investors reap their portion of any profits.

It's easy to get started, but offerings can sell out in minutes.

Past performance not indicative of future returns. Investing Involves Risk. See Important Disclosures at masterworks.com/cd.

France and India Plan to Build Joint Nuclear Plants.

India has announced a strategic partnership with France to jointly develop advanced modular reactors (AMRs) and small modular reactors (SMRs), underscoring New Delhi’s intent to collaborate on cutting-edge nuclear technology amid global trade uncertainties.

The partnership stems from a meeting between Modi and French President Macron in Paris. The agreement also includes nuclear research cooperation to streamline regulations and attract private investments. India is also planning on developing five locally-made SMRs by 2033 to offer grid adaptability and reduced emissions. The Indian government has now allocated $2 billion (₹173.6 billion) to R&D in nuclear energy.

In regard to regulation, India has pledged to ease regulations for nuclear suppliers by amending its civil liability law to facilitate private capital and technology transfer. The thought process stems from delays on the world’s largest nuclear power plant in Maharashtra due to strict liability regulations.

The big picture: The deal with France comes as Modi prepares to meet US President Donald Trump in Washington. While India and the US have collaborated on AI, defense, and semiconductor technology, delays in key agreements, such as jet engine deliveries, highlight growing uncertainties in their partnership. This new development signals a broader strategy to diversify technological alliances and maintain energy security.

Gupshup.

Macro

India’s liquefied natural gas imports are expected to more than double to 64 billion cubic meters by 2030. Overall gas consumption is projected to grow by 60 percent, driven by rising demand from transport, industry, and refineries.

Indian stocks fell to their lowest level since June as global investors pulled out amid economic slowdown concerns. Small-cap stocks lead the decline with foreign outflows nearing $10 billion (₹868.9 billion) this year.

The SBI sees loan woes easing due to new credit reporting rules requiring updates every 2 weeks. This change helps lenders better assess borrowers' financial capacity and avoid overextending credit.

Indian investors pivot to mutual funds, large-cap stocks, and gold after a volatile January. Investing in large-cap stocks jumped 52.3 percent to $35 million (₹30.6 billion) in January, the second-highest monthly inflow on record.

Equities

Indian Oil and Bharat Petroleum plans to sign a multibillion-dollar liquefied natural gas deal with Adnoc. The contract is expected to be valued at $7 billion (₹608.2 billion) over 14 years, and it is targeted to align with India’s goal to increase gas usage.

LanzaTech sees major growth opportunities in India as Trump's climate policy rollback creates uncertainty in the US. The company aims to expand its carbon recycling technology amid India's push to cut emissions.

US-based chip toolmaker, Lam Research, plans to invest $1.2 billion (₹100 billion) to boost India's semiconductor ecosystem. Lam has signed a memorandum of understanding (MoU) with the Karnataka Industrial Area Development Board (KIADB) for the investment.

Alts

Russia offered to make India a fifth-gen fighter jet for the Indian Air Force. Limited by the war in Ukraine, Russia seeks to ramp up military exports starting with Indian contracts.

Peak XV Partners, previously Sequoia India, is losing two partners, Shailesh Lakhani and Abheek Anand. This news follows a reduction in its latest growth fund and fee cuts, highlighting challenges in investing in India.

The National Investment & Infrastructure Fund plans to raise $2 billion for a private credit fund. The fund is focused on performing credit, capitalizing on the growing demand for middle-market funding in India’s expanding infrastructure sector.

Policy

The Reserve Bank of India increased its overnight fund infusion to $28.85 billion (₹2.50 trillion) after heavy foreign exchange market intervention. This marks the central bank’s largest single-day liquidity injection in over a year.

India's central bank has approved allowing bad debt managers (ARCs) to list equity shares on the local market. This move is intended to help bring in capital, increase transparency, and improve disclosures for these companies.

See you Thursday.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.