Good evening,

Welcome to the best way to stay up-to-date on India’s financial markets. Here’s what’s in today’s newsletter:

India’s headline inflation cooled to 3.16 percent,

India's nine-year experiment with the Insolvency and Bankruptcy Code (IBC) has shown mixed results, and a recent Court ruling now threatens to undermine its foundation,

and India has proposed retaliatory tariffs on U.S. goods for the first time since trade negotiations began.

Then, we close with Gupshup, a round-up of the most important headlines.

Have a question you want us to answer? Fill out this form, and you could be featured in our newsletter.

—Shreyas, [email protected]

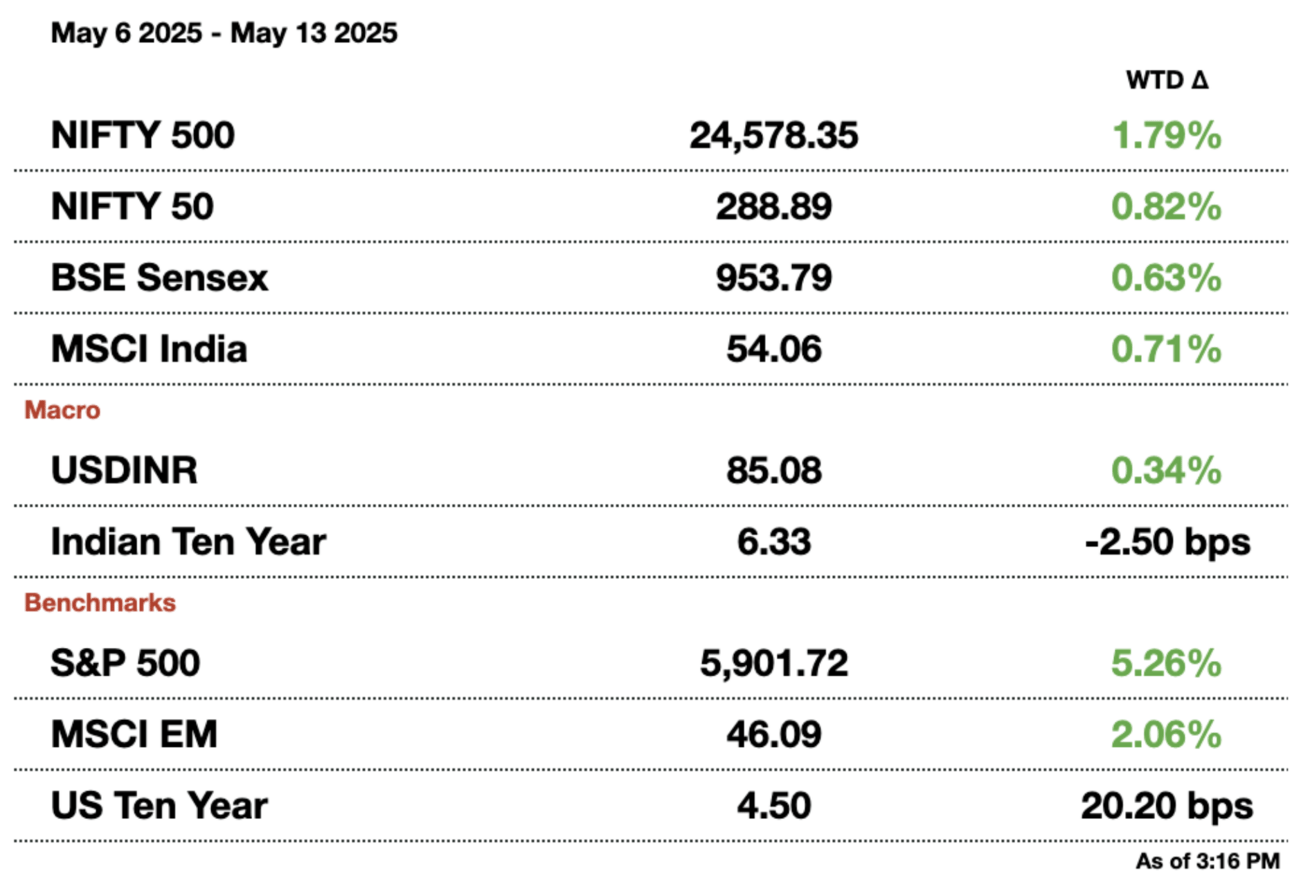

Market Update.

India’s Inflation Print Opens the Door to Further Cuts.

India’s headline inflation cooled to 3.16 percent in April, underscoring the RBI’s growing scope to ease monetary policy and reignite growth. CPI has now undershot the RBI’s 4 percent target for a third consecutive month, buoyed largely by a marked softening in food prices. Pulses, cereals, and vegetables, which together account for roughly half of the consumption basket, all saw outright price declines, with vegetable costs contracting nearly 11 percent y-o-y. Such a broad-based moderation in food inflation has helped anchor overall consumer prices in addition to falling energy prices and above-average monsoon forecasts.

Street market in Delhi, India

Great timing: With domestic growth indicators flagging and recent activity surveys pointing to slowing factory output and sluggish bank credit off-take, the RBI has both the mandate and the policy space to lean decisively towards growth support. Governor Malhotra’s decision in April to cut the repo rate by 25 basis points to 6 percent marked the second rate reduction in this easing cycle and opened expectations of at least another 50–75 basis points of cuts by early 2026. A sub-4 percent inflation regime, coupled with structural improvements in supply-side buffers (courtesy of bumper harvests and logistical reforms), strengthens the RBI’s hand to lower borrowing costs further without igniting price pressures.

Dovish bias: The 10-year yield has fallen about 25 basis points since March, and foreign inflows into sovereign bonds have resumed. Similarly, the equity market has repriced higher, reflecting confidence that easier financing will underpin corporate investment and consumer spending. Importantly, the RBI’s open market operations have successfully maintained systemic liquidity in a 1 percent surplus of net demand & time liabilities, ensuring transmission of policy rate cuts to lending rates.

A few upside risks: Core inflation (sans food and fuel) remains sticky at around 4.2 percent, suggesting underlying price pressures in housing and services that could flout the RBI’s comfort zone if demand recovers sharply. Heat waves and localized rainfall deficits also threaten to disrupt agricultural supplies, potentially triggering volatile vegetable price swings in the coming months. Finally, imported inflation must be monitored through trade tensions.

In balancing these considerations, India’s central bank appears to place a higher weight on growth impulses using the breathing room granted by benign headline inflation to deliver another 50–75 basis points of relief. Such a pivot would not only support domestic demand but also signal to global investors that India remains committed to a growth-friendly stance even amid external uncertainties.

India’s Bankruptcy Law Is Making Creditors Go Bald.

India's nine-year experiment with the Insolvency and Bankruptcy Code (IBC) has shown mixed results, and a recent Court ruling now threatens to undermine its foundation. The IBC was meant to streamline the process distressed and bankrupt companies go through, but as of December 2024, it has achieved only a 31 percent recovery rate on approximately $133 billion (₹11.3 trillion) of bad debt. More than one in three cases ended in liquidation, and three-quarters of cases took longer than the mandated 270-day resolution period.

Until recently, these underwhelming results at least provided a predictable framework for asset transfers. However, that predictability was upended when the Court ordered the liquidation of Bhushan Power & Steel. The company had a $2.7 billion (₹200 billion) resolution plan with JSW Steel, which closed in March 2021. Now, creditors' claims have been reopened, and JSW's position is in jeopardy.

At stake is the credibility of an entire legal regime. Under Section 31 of the IBC, once a resolution plan is sanctioned by the National Company Law Tribunal (NCLT) and cleared by creditors holding at least 66 percent of voting rights, it acquires binding force and extinguishes all prior claims and liabilities. By unsettling that principle, the Court’s decision casts doubt on whether any resolution plan can be conclusively relied upon. That, in turn, risks lowering participation in the insolvency process altogether: prospective bad debt bidders may now demand even steeper haircuts to buffer against judicial reversal, or withdraw from auctions entirely, worsening already-low recoveries and saddling banks with mounting non-performing assets.

Why did this happen? A combination of judicial activism and India’s peculiar insiders must be blamed. Unlike in jurisdictions where governance is entrusted to independent boards and fiduciary managers, Indian firms remain tightly controlled by founding families whose political clout often trumps minority interests. In Bhushan Power’s case, creditor banks alleged that the JSW-led plan failed to satisfy certain IBC safeguards and favored the promoter at the expense of operational creditors. The Court’s intervention to protect the statutory objectives of creditor rehabilitation and value maximization was also a reflection of deep-seated concerns over insider-driven restructurings.

Yet remedying these ills requires more than sporadic judicial reversals. The IBC must be recalibrated to strengthen due process up front, rather than teeing up endless back-and-forth litigation. Enhanced pre-bid scrutiny should be transparent so all bidders are exposed to other creditors. Streamlining appeals to fit within the 270-day limit would boost recoveries. Operational creditors should also have more power over whether a stalled process moves into liquidation or not, unlike the current system, where insiders rule.

Fixing the “promoter raj”: This entails toughening the Companies Act to reduce the stranglehold of dominant shareholders by bolstering independent directors, tightening related-party transaction rules, and mandating greater transparency. Minority investors and creditors should be empowered through collective action mechanisms to make bankruptcy resolution votes binding. Only by dismantling the legal and cultural scaffolding that places family control above corporate accountability can India ensure its bankruptcy regime operates as an engine of genuine value recovery, rather than a revolving door for politically connected insiders.

India Turns Hostile in US FTA Negotiations.

India has proposed retaliatory levies on a range of US goods, marking a hostile shift in its trade posture toward Washington, even as both capitals work toward a landmark bilateral trade agreement. By formally notifying the WTO that Trump’s new 25 percent steel and aluminum tariffs constitute “safeguard measures” injurious to India’s exports, New Delhi has reserved the right to suspend an equivalent amount of concessions on US products. This will likely place another $1.9 billion (₹161.5 billion) worth of levies on US exports to India.

Trading port in Gujarat, India

This is India’s first tit-for-tat response under Trump’s second term, contrasting sharply with its earlier restraint. In recent months, New Delhi slashed import duties on some 8,500 industrial items to placate US demands and facilitate ongoing trade talks. Now, by invoking WTO rules and threatening reciprocal tariffs on US goods worth $7.6 billion (₹646 billion), India signals that it will not shy away from defensive measures if its vital export sectors in steel and aluminum are put in danger by either the US or China.

India’s notification to the WTO set the stage for consultations with Washington, which had rebuffed India’s earlier request by asserting that its metal levies were justified on national-security grounds and therefore non-actionable. By reframing those levies as “safeguards,” India both amplifies its negotiating leverage and underlines its willingness to invoke formal dispute-settlement mechanisms. Importantly, Commerce Minister Piyush Goyal is slated to visit Washington in mid-May, and the specter of upcoming Indian counter-tariffs could become a powerful bargaining chip in those high-stakes discussions.

A few risks: Any rollback of US duties on steel and aluminum may now require Washington to make further concessions elsewhere, complicating efforts to finalize a broader free-trade agreement by fall. Commercial exporters in industries like engineering goods, which have lobbied for relief from US levies, will watch closely to see whether New Delhi secures exemptions or must instead proceed with its threatened suspensions of tariff concessions. The US could also see this move as hostile and believe that India will enact a similar game plan for its agricultural industry.

More broadly, India’s move illustrates a maturing trade strategy: the country is choosing to combine market-opening gestures while not rolling over to foreign demands as it did in May. New Delhi is choosing to build stronger economic ties in the US for investment and tech transfers while maintaining India’s own industrial interests.

Message from our sponsor.

Trusted by 1,000,000+ readers across the world and political spectrum

Ground News lets you compare how left, center, and right-leaning outlets cover the same story, so you can easily analyze reporting and gain a well-rounded perspective on the issues that matter to you.

Built for the age of the algorithm, its Blindspot Feed shows stories underreported by the left or right, helping you break out of your bubble and challenge your worldview. Because the news you don’t see can shape your perception just as much as what you do see.

Find out why the Nobel Peace Center endorsed Ground News as “an excellent way to stay informed, avoid echo chambers, and expand your worldview.”

Email [email protected] to sponsor our next newsletter!

Gupshup.

Macro

India’s Trade Minister Piyush Goyal will visit the U.S. on May 16 to lead high-level talks aimed at securing a bilateral trade deal and easing American tariffs, sources told Reuters. The visit follows renewed efforts by both countries to finalize the first phase of an agreement before the U.S. tariff pause ends.

Equities

Bharti Airtel posted a $1.29 billion (₹110.22 billion) profit for the March quarter—well above estimates—driven by higher tariffs and a 4.4 percent rise in subscribers to 424 million. Its average revenue per user jumped 17.2 percent to ₹245, the highest among Indian telcos.

GlaxoSmithKline Pharmaceuticals India posted a 35 percent jump in Q4 profit to $30.9 million (₹2.63 billion), driven by strong demand for generics, vaccines like Shingrix, and key respiratory drugs. Revenue rose 5 percent to ₹9.74 billion, helping offset price caps on some essential medicines.

Honeywell Automation India reported a 5.6 percent drop in Q4 profit to ₹1.4 billion ($16.4 million) as a 22 percent surge in expenses—driven largely by higher material costs—outpaced its 17.2 percent revenue growth. The company cited slower government infrastructure spending post-elections, though ongoing project execution supported topline growth.

Tata Motors is reevaluating Jaguar Land Rover’s profit forecast; despite a 1.1 percent rise in quarterly sales, JLR has paused its 10 percent EBIT margin target for fiscal 2026. Analysts predict a decline in North American sales due to tariffs, particularly on models like the Defender SUV, due to President Trump’s tariffs.

Asian Paints' market share fell from 59 percent to 52 percent in the past year, as Birla Opus gained 6.8 percent share through aggressive strategies like discounts and factory setups. This has led to a 45 percent drop in Asian Paints' Q4 profit, with further competitive pressure expected.

Alts

India has approved three more Russian insurers—including a Sberbank unit—to provide marine insurance for ships docking at its ports, ensuring continued oil shipments from Moscow. The approvals, valid through February 2026, bring the total number of recognized Russian providers to eight.

First Abu Dhabi Bank is planning to open a branch in India’s GIFT City, a low-tax financial hub, to serve global clients. The bank is seeking approvals from the International Financial Services Centres Authority and consulting UAE regulators before applying for a license, following a trend of international banks taking advantage of GIFT City’s tax incentives.

Policy

India’s market regulator SEBI has proposed easing rules for foreign investors who only buy government bonds, aiming to simplify compliance and boost inflows. The plan includes scrapping investor group disclosures and allowing contributions from resident and overseas Indians.

See you Wednesday.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.