Indian exporters urge RBI for relief. U.S. Commerce Secretary confident trade frictions with India will be worked out. Indian government plans a major carbon capture initiative.

If you have any questions about India, fill out this form or reach out to Shreyas at [email protected]

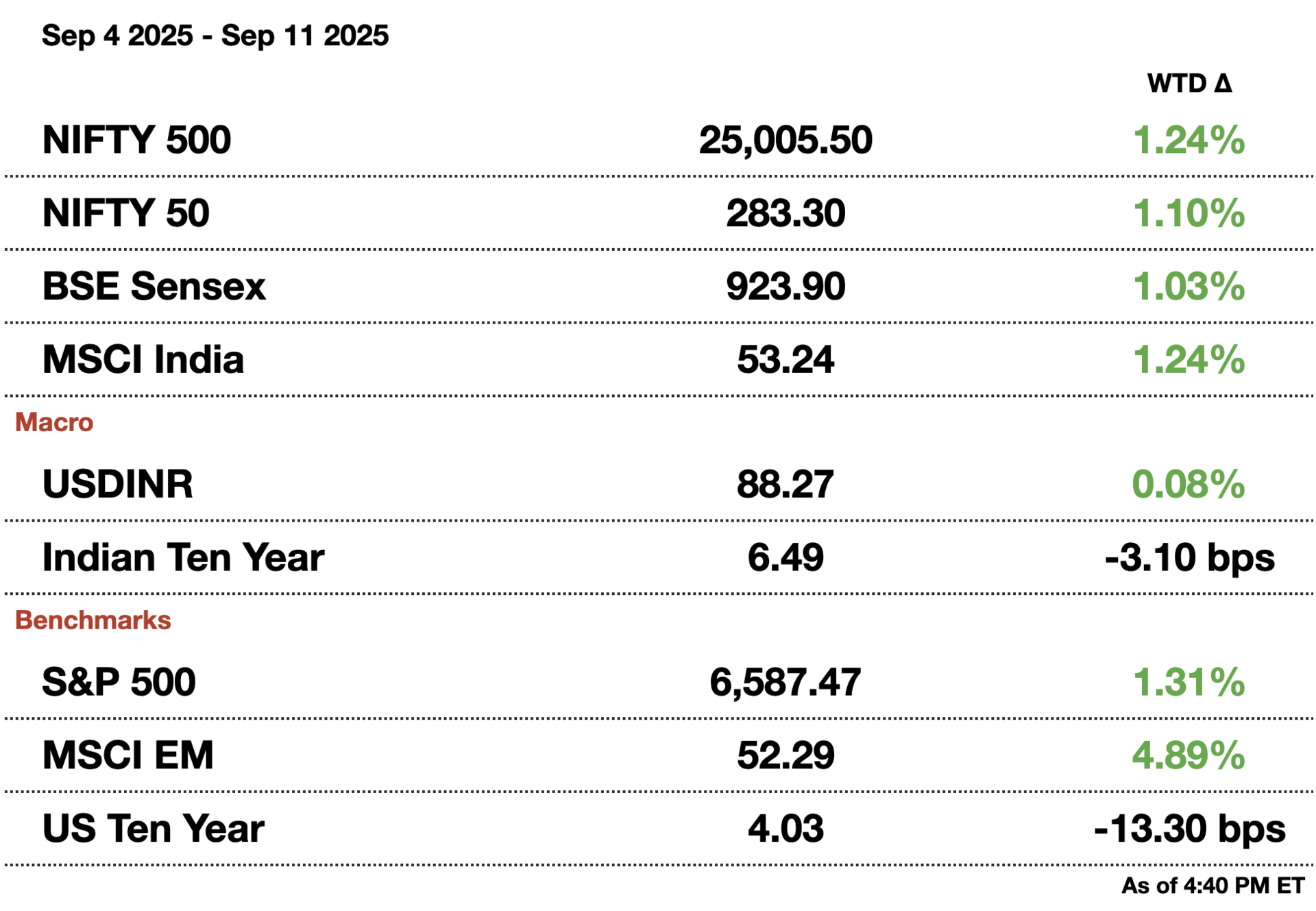

Macro

India writes Mauritius a $680M check, healthcare, infra, and maritime security on the menu, as Modi angles for Indian Ocean clout in Beijing’s backyard. Sweetener: cash for Chagos archipelago surveillance, near Diego Garcia’s U.S.-UK air base.

A policy rift between the U.S. and EU over Russian oil price caps is set to reduce India-bound crude flows in October. While the EU and UK lowered the cap, Washington withheld support, complicating sanctions coordination and trade planning.

Equities

Infosys will repurchase $2 billion (₹176.6 billion) worth of shares at a premium over its current price. The first buyback in nearly three years reflects confidence in digital and AI-driven growth despite a 20 percent stock slump.

Tata Capital is preparing a $2 billion (₹176.6 billion) IPO, likely launching in early October after receiving a short extension from India’s central bank. This is the country’s biggest IPO since Hyundai Motor India.

India’s Gujarat Fluorochemicals reported a temporary gas leak at its Ranjitnagar plant, killing one worker and injuring several others. The leak, caused by a pipeline rupture, briefly disrupted operations, though losses and equipment damage are insured and under investigation.

Forum Malls is going big, 14 new malls by 2029 to nearly double its portfolio, betting on India’s urban retail boom. With festive footfalls rising, Prestige Group’s retail arm eyes Delhi, Mumbai, Bengaluru, Chennai, and Hyderabad for growth.

Alts

India’s Tega Industries will acquire control of Omaha-based mining equipment maker Molycop at a $1.5 billion (₹132.4 billion) valuation, taking a 77 percent stake alongside Apollo Global Management. The cash-and-debt funded deal strengthens Tega’s global footprint but raises concerns over Molycop’s high leverage and equity dilution risks.

Billionaire Gautam Adani’s push to resolve US fraud and bribery charges has stalled amid strained Washington–New Delhi ties over trade and Russian oil. US officials have signaled no settlement is likely soon, leaving Adani unable to travel to America and facing a regulatory overhang that hampers financing and global deals.

Kashmir’s prized apples rot as floods and landslides block the main highway, leaving $68–79M (₹6-7 billion) in losses and truckers stranded. Railways rush in with extra services Sept 13, but growers face soaring packaging costs and shattered harvest season hopes.

Policy

India plans to keep its borrowing program unchanged in the second half of FY2025–26 despite tax cuts that may cause a big drop in revenue. The government will maintain capital spending, stick to a 4.4 percent fiscal deficit target, and proceed with 6.8 trillion rupees of October–March borrowing, within a total 14.82 trillion rupees plan for the year.

India’s IT sector faces uncertainty as the U.S. considers a proposed 25 percent tax on companies outsourcing jobs abroad. The move could delay contracts, prompt renegotiations, and force Indian firms to prepare for lobbying and possible legal challenges.

An Indian court has dismissed Asian Paints’ plea to halt an antitrust probe into alleged abuse of its dominant market position. The inquiry, triggered by rival Birla Opus’ complaint, will continue as regulators examine discount and dealer incentive practices.

Become the go-to AI expert in 30 days

AI keeps coming up at work, but you still don't get it?

That's exactly why 1M+ professionals working at Google, Meta, and OpenAI read Superhuman AI daily.

Here's what you get:

Daily AI news that matters for your career - Filtered from 1000s of sources so you know what affects your industry.

Step-by-step tutorials you can use immediately - Real prompts and workflows that solve actual business problems.

New AI tools tested and reviewed - We try everything to deliver tools that drive real results.

All in just 3 minutes a day

Reach out to [email protected] to reach our audience and see your advertisement here.

1. Indian Exporters Urge RBI for Relief

Indian exporters are urging the RBI to step in with loan relief and a favorable exchange rate after U.S. President Donald Trump’s 50 percent tariffs left them reeling, two people familiar with the matter said Thursday.

In a closed-door meeting, industry representatives asked the RBI for a 12-month moratorium on principal and interest payments, according to a request submitted by the Federation of Indian Export Organisations (FIEO). They also pushed for a collateral-free credit guarantee scheme modeled on measures used during the COVID-19 crisis, which would shift part of the lending risk to the government.

“This breathing space will allow exporters to recalibrate operations,” FIEO wrote in the note, warning of job losses in sectors like textiles, gems and jewelry, chemicals and fisheries. These industries face sliding U.S. orders while scrambling to diversify into Europe, Africa and Asia.

Export groups also asked for access to the rupee’s real effective exchange rate, which is about 15 percent higher than the current spot rate, to help them extract more value from dollar holdings.

The FIEO was set up by the Indian government, but is not an official public body.

2. U.S. Commerce Secretary Confident India Trade Frictions Will be Resolved

U.S. Commerce Secretary Howard Lutnick (left)

U.S. Commerce Secretary Howard Lutnick said Thursday he was confident Washington would resolve trade frictions with India once New Delhi halts purchases of Russian oil, underscoring the White House’s twin priorities of economic and geopolitical alignment.

“We’re going to sort out India,” Lutnick told CNBC, adding that a deal could follow swiftly after India reduces its reliance on Russian crude. He also flagged progress on trade discussions with Taiwan and Switzerland, while cautioning that South Korea still needed to complete paperwork on a separate agreement.

The remarks came as officials confirmed that a U.S. Defense Department delegation and Boeing executives will travel to India next week to negotiate the stalled $4 billion (₹353.2 billion) sale of six P-8I maritime patrol aircraft. New Delhi has already purchased 12 of the U.S.-made planes since 2009, which are used to monitor the Indian Ocean and key shipping lanes.

The parallel tracks highlight how Washington and New Delhi are keeping lines open on defense and trade despite a recent escalation of tensions. President Donald Trump doubled tariffs on Indian goods to 50 percent last month, half of it as punishment for Russian oil imports.

India has sharply reduced arms imports from Moscow, with Russia’s share falling to 36 percent last year from 76 percent in 2009. Analysts say closer defense cooperation with the U.S. could help narrow Washington’s trade deficit with India while reinforcing security ties.

3. India Plans Major Carbon Capture Push

India is preparing to launch a national carbon capture initiative, offering generous government incentives to industries as it seeks to balance surging energy demand with climate commitments, a senior official said Thursday.

The initiative will promote carbon capture, utilization and storage (CCUS) technologies, with funding support ranging from 50 percent to 100 percent for select projects, according to Rajnath Ram, energy adviser at policy think tank NITI Aayog. CCUS removes carbon dioxide from the atmosphere or traps it at the point of emission for underground storage, a technology increasingly viewed as critical for achieving global climate goals.

“These incentives will help industries adopt carbon capture technologies and integrate them with coal-based energy systems,” Ram told a coal summit organized by the Indian Chamber of Commerce.

Despite India’s pledge to expand non-fossil fuel capacity to 500 GW by 2030, coal will remain a key part of the country’s energy mix for decades. The government expects to increase coal-based power capacity by 97 GW to 307 GW by 2035, ensuring reliable power supply.

Officials are also studying how CCUS can be paired with coal gasification projects, which could halve India’s reliance on imported natural gas. Still, commercializing the technology remains a challenge.

Globally, several nations are piloting CCUS projects, with the International Energy Agency highlighting its importance for sustainable transitions. For India, success could ease its reliance on coal while keeping its energy security intact.

How helpful was today's newsletter?

See you tomorrow.

Written by Eshaan Chanda & Yash Tibrewal. Edited by Shreyas Sinha.

Sponsor the next newsletter to reach tens of thousands of U.S.-based business-savvy professionals. Reach out to [email protected].

Could your business use expert insights to power growth in India? Reach out to [email protected] for a free introductory call.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.