Good afternoon,

Welcome to the best way to stay up-to-date on India’s financial markets. Here’s what’s in today’s newsletter:

India is the most favorable place to invest in Asia, as per a BofA survey of 109 portfolio managers,

The National Stock Exchange quietly closed its inquiry into Jane Street,

and Shapoorji Pallonji is on the verge of closing the country’s largest-ever private credit transaction.

Then, we close with Gupshup, a round-up of the most important headlines.

Have a question you want us to answer? Fill out this form, and you could be featured in our newsletter.

—Shreyas, [email protected]

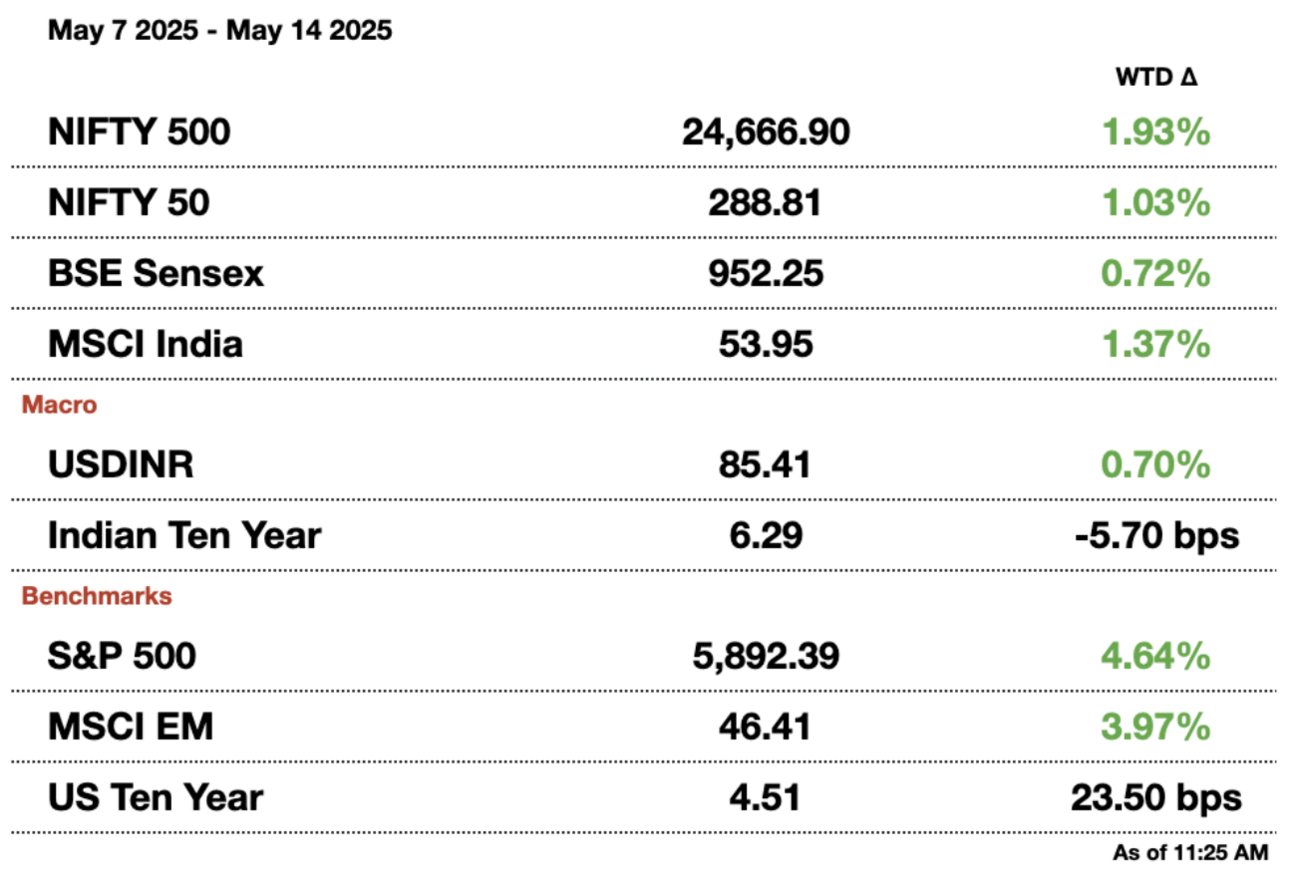

Market Update.

India Rises to BofA’s Favorite Asian Equity Market.

India is the top-most favored Asian market, as per BofA’s latest fund‐manager survey of 109 portfolio managers overseeing $234 billion (₹19.9 trillion) in assets, 42 percent reported being overweight on India, overtaking Japan’s 39 percent for the first time. This redistribution of preference reflects India’s dual appeal as both a relative safe haven amid escalating US trade tariffs plus a direct beneficiary of ongoing supply‐chain realignments away from China.

National Stock Exchange in Mumbai, India

The Nifty 50 has outpaced most Asian peers since Liberation Day, with only Japan and Indonesia outperforming it. The country’s large, domestically driven economy (consumption accounts for 60 percent of GDP) has insulated it from export shocks and provided an anchor of stability. Within India, two structural themes have come to the fore: a sustained public and private investment boom in infrastructure and a gradual resurgence in consumer demand, buttressed by rural income gains following a strong monsoon and targeted tax incentives.

Measurable gains: Infrastructure spending, which has been earmarked for a record budget allocation this fiscal year, is expected to lift sectors ranging from construction materials to heavy engineering, while consumption stocks stand to benefit from measures such as income‐tax cuts for the middle class and record agricultural stimulus. Recent macro data support this upbeat view: retail volumes rose 3.5 percent y-o-y in March, and Services PMI is expansionary at 54.

Corporate earnings are also reinforcing confidence. After a muted start, Q1 results from banking and non-banking sectors have surprised on the upside, prompting banks to raise guidance on asset quality and loan growth. At this rate, Nifty earnings could climb another 7.6 percent by year-end, driven by improved liquidity conditions and renewed rural demand. Importantly, analysts’ downward revisions to consensus earnings estimates have plateaued, signaling a potential end to the profit‐cut cycle.

Small risks: India’s exposure to geopolitical flare-ups with Pakistan temporarily pressured stocks and widened credit spreads. Moreover, lofty valuations (India trades at 19.5x forward earnings) will need to be justified by sustained growth acceleration. Finally, while supply-chain diversification away from China offers a windfall for Indian manufacturing, attracting significant foreign direct investment will hinge on continuous improvements in land, labor, and logistics reforms.

The NSE Quietly Ends Its Jane Street Investigation.

The NSE has quietly brought to a close its inquiry into a series of unusually rapid trades executed by Jane Street, one of the most prolific foreign market-making firms in India’s booming futures and options segment. Earlier this year, NSE compliance teams flagged a pattern of “wash-style” transactions: swift reversals executed at strikingly wide price differentials from prevailing market levels, mostly executed by Jane Street’s SubCo Nuvama Wealth Management. Such activity risked distorting price discovery and undermining confidence at a time when India’s derivatives turnover had surged to record highs.

Behind the scenes, the exchange’s real-time risk-monitoring arm had kept a close watch on position limits and intraday exposures across the futures and options book. In January, it issued show-cause notices to several active HFT firms after identifying clusters of trades that appeared engineered to eke out fleeting arbitrage gains or test liquidity thresholds. Although the volume involved in any single reversal was modest relative to overall market size, the sheer velocity and frequency of these executions triggered concerns that algorithmic strategies could be used to skew benchmarks or trigger unwarranted margin calls.

Jane Street, already under scrutiny after it earned $1 billion (₹85 billion) in Indian equity derivatives in 2024, responded promptly to NSE’s notices. In a letter dated April 30, the exchange informed the firm’s that it was satisfied that no deliberate market manipulation occurred and was therefore closing the case. Neither Jane Street nor Nuvama has commented on the outcome, but the swift resolution suggests that the anomalies stemmed from aggressive automated trading logic rather than intent to distort markets.

The deep securities market has forced SEBI, the RBI, and other parties to tread carefully while creating innovation. The derivatives market has ballooned in recent years — average daily notional turnover on the NSE topped $2.7 trillion (₹229 trillion) in April — driven by foreign portfolio flows, attractive carry differentials, and a growing base of retail and institutional participants. That explosive growth has forced both the NSE and SEBI to accelerate enhancements to their surveillance infrastructure, from position monitoring to real-time alerts for abnormal trade patterns.

India’s Largest Private Credit Deal is Closing.

Shapoorji Pallonji is on the verge of closing the country’s largest-ever private credit transaction. According to insiders, the group is set to sign a roughly $3.4 billion (₹289 billion), 3-year, zero-coupon rupee bond deal as early as Wednesday evening. The offering would eclipse previous benchmarks for privately placed debt and underscore India’s rapidly maturing non-bank lending markets.

Global participation: Among the reported participants are Ares, Cerberus, Davidson Kempner, and Farallon Capital. Deutsche Bank is stepping in both as sole arranger and trustee. Pricing involves a yield of 19.75 percent, which is a substantial pickup over conventional bank financing, catering to funds seeking enhanced returns in a low-rate environment. The proposed loan-to-value ratio of about 16 percent further signals lenders’ confidence in the Group’s strong asset base and the security package underpinning the bonds.

Watershed moment: Fundraising has risen dramatically now. Domestic banks, constrained by capital requirements and risk-weighting rules, have often been unable or unwilling to meet large-ticket financing needs for infrastructure, real estate, and energy, which Modi favors. As a result, non-bank lenders and overseas credit funds have moved in to fill the gap, offering flexible structures and a willingness to underwrite higher risks in exchange for premium yields. Shapoorji’s deal exemplifies this shift toward a parallel debt market outside the traditional banking system.

From the borrower’s perspective, the timing and size of the financing are highly strategic. Shapoorji has diversified interests spanning construction, real estate, engineering, and financial services, all sectors that stand to benefit from India’s infrastructure push. Locking in rupee funding at near-20 percent yields for three years allows the conglomerate to refinance existing liabilities, front-load capex plans, or pursue new growth initiatives without immediate cash-flow strain. Meanwhile, the zero-coupon structure where interest is essentially paid at maturity, modestly eases near-term liquidity demands for the borrower.

For the investors, the deal offers scale, security, and yield. A number of the funds participating have previously shown interest in India’s nascent loan space but struggled to find sufficiently large transactions to deploy their dry powder. Deutsche Bank’s role as arranger and trustee lends additional credibility and ensures robust documentation and oversight. This deal would likely catalyze further private credit activity, signaling that India’s regulatory and deal frameworks can accommodate transactions of this magnitude.

Message from our sponsor.

What Top Execs Read Before the Market Opens

The Daily Upside was founded by investment professionals to arm decision-makers with market intelligence that goes deeper than headlines. No filler. Just concise, trusted insights on business trends, deal flow, and economic shifts—read by leaders at top firms across finance, tech, and beyond.

Gupshup.

Macro

India is signaling a tougher US trade stance, which may be based on China. Indian officials said trade negotiations are proceeding smoothly, even after India imposed steel and aluminum import duties. The first tranche of the deal is expected in the fall, though likely after the July tariff reprieve rolls off. So far, India has rolled over to the US’s demands, but witnessing China play hardball and succeed is likely emboldening the steel duties.

Equities

Expect company margins to improve the rest of 2025. Energy and other commodity prices have been steadily declining, which would immediately boost gross and operating margins. Companies have been beating analyst estimates at the highest clip in 2 years, and the percentage of firms missing estimates is at its lowest in 4 years.

Swiggy's shares were the most traded on Tuesday when the IPO lock-up ended. The stock is currently at a 20 percent discount to its IPO due to the severe cash burn required to maintain operations. The main food ordering business remains firm, and some analysts believe that losses have peaked, which could signal profit growth moving forward.

Monday's post-ceasefire rally boosted the billionaire's wealth by $16 billion (₹1.4 trillion) and the market by $239 billion (₹20.3 trillion). The rally was the biggest in 4 years since pandemic subsidies went into effect.

Bullish bets on Hindustan Aeronautics are very high pre-earnings. The company’s results are coming right as the Pakistan conflict ends, which could result in defense spending skyrocketing. The company is going to report one-time expenses from delays in jet engines from GE, but this is a short-term issue. Shares have risen 8 percent since conflict broke out in April.

Bharti Airtel beats profits due to a one-time tax gain. The quarterly profit was $1.3 billion (₹110.2 billion) from a tax gain and a rise in subscribers. The estimate beat was practically only the deferred tax gain after revenue fell and costs rose 14 percent.

Alts

The RBI is reviewing e-wallets after EV apps go bust. Taxi companies are using digital wallets for ride-hailing, but BluMart’s collapse is worrying regulators after users were unable to access their wallets. The RBI is talking with various ride-hailing apps and EV charging points to assess similar risks with digital wallets across the economy.

Carlyle seeks a $1.2 billion (₹102 billion) loan for Hexaware M&A refinancing. The syndicated loan would come as rates start to come off and 8 global banks have already signed on. The spread would be 333 basis points over the benchmark rate.

Scotiabank is targeting affluent South Asians by partnering with ICICI in Canada. Scotiabank wants to sell fee-based services like financial planning by getting customer lists of ICICI’s subsidiaries in Canada.

First Abu Dhabi Bank plans to open a branch in GIFT City. The bank will become the second Middle-Eastern lender to have a presence in the city. Moving to GIFT City gives access to tax benefits, but also a global clientele that is investing in India through the region. Banking assets in GIFT have surged by 48 percent y-o-y to $88.5 billion (₹7.5 trillion).

Policy

Chinese weapons gain credibility after Pakistan's use during the border conflict. Pakistan hailed the use of Chinese fighter jets, and the jet manufacturer’s market cap rose by $7.6 billion (₹646 billion) or a 25 percent rise after the fighting. Such success could cause China's weapons exports to rise globally. India said it shot down several jets, which Pakistan has denied, and also did not confirm if any of its fighters were shot down by Chinese jets.

Trade Minister Goyal is visiting the US later this week to discuss tariffs. Goyal will meet with Howard Lutnick to discuss the first deal tranche and retaliatory tariffs on steel. India’s chief trade negotiator Rajesh Agarwal will travel next week to discuss market access, rules of origin, and non-tariff measures.

See you Thursday.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.