Indian bonds are heading for their worst foreign selling streak since India opened a subset of its debt to global investors back in 2020. Today, we explain what this means for India’s economy.

If you have any questions about India, fill out this form or reach out to Shreyas at [email protected]

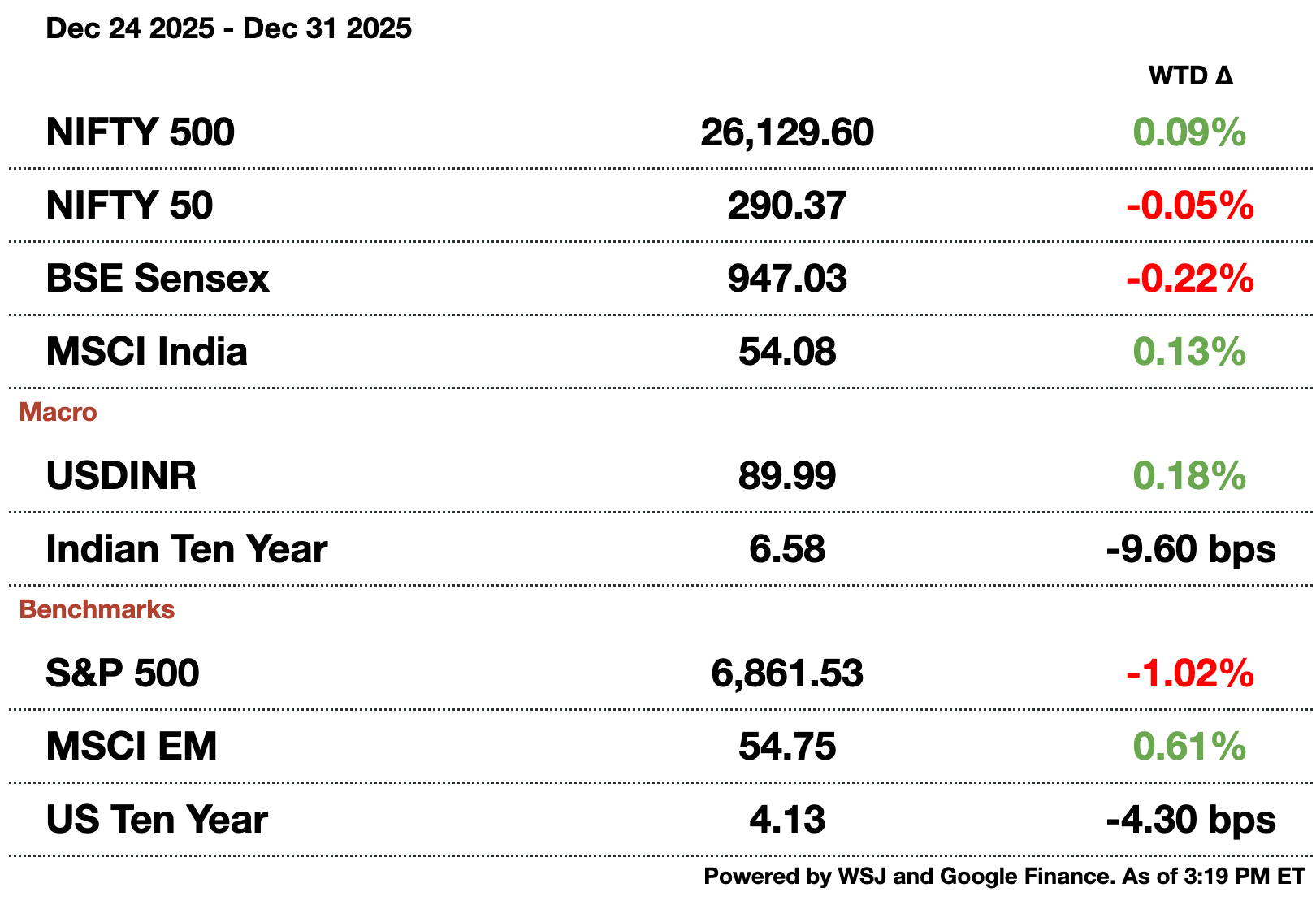

Macro

The RBI's bi-annual report says that the economy is robust and policy will shield from global volatility. Strong domestic demand, benign inflation, and healthy balance sheets will all continue to drive growth in 2026 and strong foreign reserves allow for intervention if needed. Stress tests on banks also came back positively in terms of asset quality.

The rupee is the biggest roadblock to high growth and low inflation, or the 'goldilocks zone'. A weak rupee increases the price of imports and makes relative growth weaker but intervention raises interest rates and removes local liquidity. The RBI has to either maintain a balancing act or see US intervention.

India is extending its 11 to 12 percent steel tariff for 3 more years to support local industries.Elevated exports from China have led to large producers like JSW to suffer and smaller mills to close entirely. Producers are still betting on accelerating urbanization and industrial growth.

Equities

India had its worst performance relative to Asia in 30 years, lagging by more than 10 percent. Annual foreign outflows were $17.9 billion (₹1.6 trillion), a record level. That being said, Kotak and Citi predict a return to norm next year assuming geopolitical tension subsides. Kotak and Goldman also predict over $25 billion (₹2.2 trillion) in IPO proceeds in 2026.

Zepto, a major quick-commerce player, files for a $1.2 billion (₹107.6 billion) IPO. The 2026 listing is one of the most anticipated of next year. Zepto is opting for a confidential filing.

IndiGo is boosting pilot pay after strikes causing mass delays and cancellations.Layover allowances are now $33.37 (₹3,000), 50 percent higher than earlier, while deadheading is worth $44.49 (₹4,000) at a 33 percent increase.

Alts

Indian sovereign bonds have seen $1.6 billion (₹143.5 billion) in global outflows this month. The record monthly outflow is due to rupee underperformance, it being down 10 percent this year. There is also some year-end profit taking and entrance into swaps rather than bonds.

The defense acquisition council approved $8.8 billion (₹790 billion) worth of proposals to buy radars, radios, and landing recording systems.The equipment is for the army, navy, and air force.

Policy

The BJP has drawn the ire of the public and opposition parties after Delhi AQI was above 300 the past two months. Despite campaign promises, Parliament never discussed the topic before ending two weeks ago and local city officials have also lamented the lack of action.

Winning “Brewery of the Year” Was Just Step One

It’s one thing to covet the crown. It’s another to know exactly how to use it to build an empire.

So when Westbound & Down took home Brewery of the Year honors at the 2025 Great American Beer Festival, they didn’t blink. They began the next phase of their expansion.

Already Colorado’s most-awarded brewery, they’ve grown distribution 2,800% since 2019 and earned a retail partnership with Whole Foods. And after this latest title, they’re scaling toward 4X distribution growth by 2028.

That’s step one of what Forbes recently called an “ambitious expansion plan that aims to eventually make Westbound & Down a national brand.”

This is a paid advertisement for Westbound & Down’s Regulation CF Offering. Please read the offering circular at https://invest.westboundanddown.com/

Reach out to [email protected] to reach our audience and see your advertisement here.

India’s Debt Also Turns into a Short Term Sell

Indian bonds are heading for their worst foreign selling streak since India opened a subset of its debt to global investors back in 2020. December has already seen about $1.6 billion (₹143.5 billion) of outflows from index-eligible government bonds. Multiple pressures have now turned India from a consensus EM long to becoming a source of funding for other emerging market peers.

The most immediate drag is the rupee. Its slide to record lows earlier this month to 91 wiped out all carry returns (the difference between local and other interest rates) and turned Indian local debt into one of the worst performers in emerging markets on a relative basis. Foreign investors (particularly in Europe with the strong euro) have left since the modest yield gain over other markets turned into losses quickly. With other global funds rebalancing toward markets offering both higher real yields and the prospect of currency appreciation, India has found itself on the wrong side of that trade.

At the same time, expectations around domestic monetary policy have shifted. Hopes for aggressive rate cuts have faded after the RBI signaled higher concern about inflation next year, just as state-level borrowing ramps up and adds to supply pressure. The result is a bond market facing rising yields without the compensating boost of easing financial conditions.

The longer term picture is still positive. India is under-owned compared to other EMs in global fixed income and index inclusions is already starting to pull in reluctant capital. Further index eligibility would bring in both discretionary and forced investment. Of course, an easing with US trade tensions would relieve rupee and bond pressure.

How helpful was today's newsletter?

See you tomorrow.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Sponsor the next newsletter to reach tens of thousands of U.S.-based business-savvy professionals. Reach out to [email protected].

Could your business use expert insights to power growth in India? Reach out to [email protected] for a free introductory call.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.