India’s trade deficit shrank in November as exports picked up, helped by a surprise jump in shipments to the U.S. despite the 50 percent tariff. Here’s what this means for India’s economy.

If you have any questions about India, fill out this form or reach out to Shreyas at [email protected]

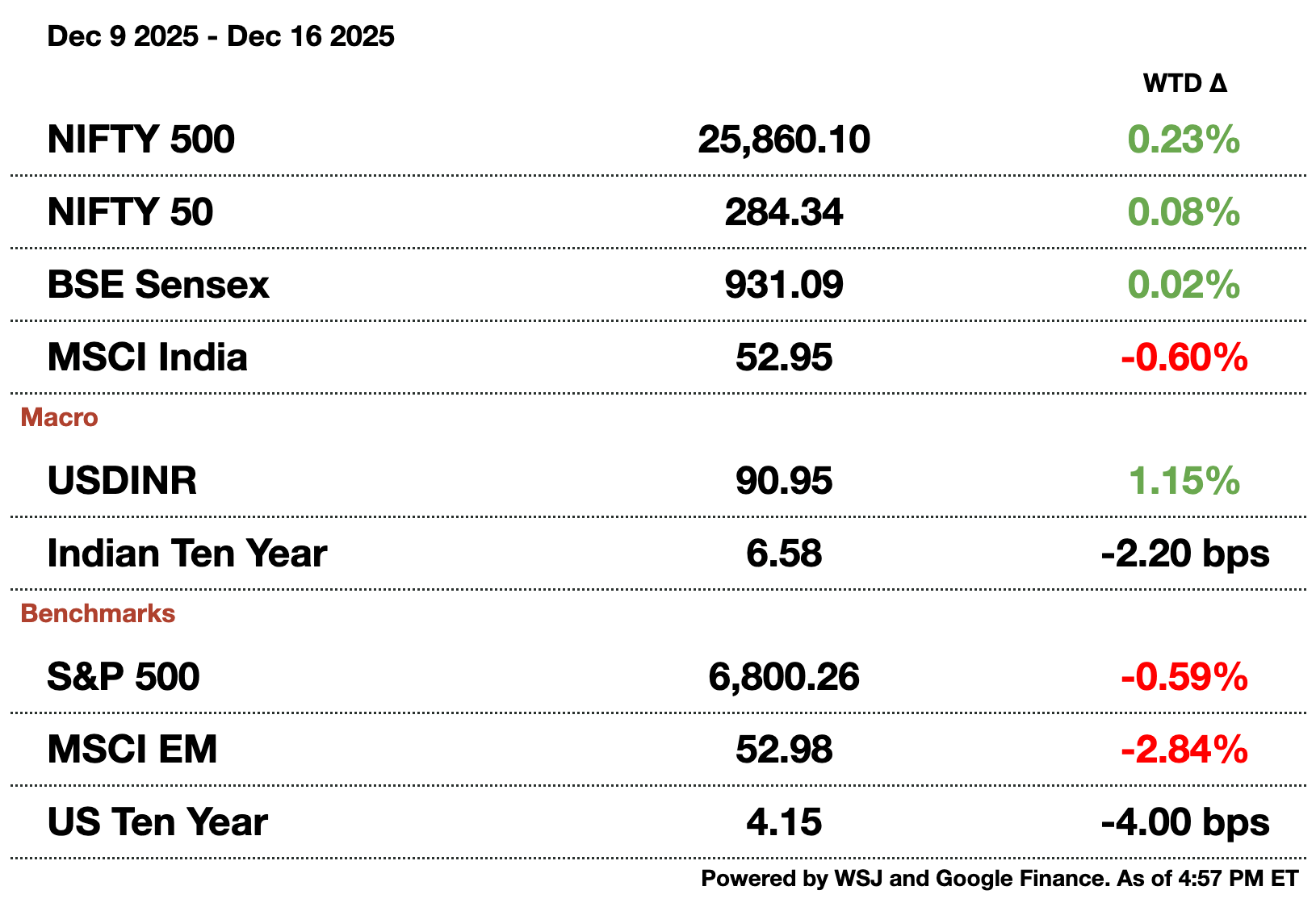

Macro

Tighter ship checks will cause Russian oil imports to drop. Shipments will go from 1.3 million barrels per day to 800,000 this month. Four out of seven large importers are still shopping for non-sanctioned Russian oil.

Buoyant electronics exports, with iPhones a large focus, led exports up in November.Both electronics and pharma are exempt from US tariffs from now; electronics and engineered goods saw the highest rise while jewelry and apparel were the hardest hit.

Equities

The e-commerce competition is a win for customers in the short term. Rapid capital raises and foreign entrants are dropping prices but will likely cause bankruptcies in the medium term as companies drop cash flow to gain market share.

Zepto is filing for a $500 million (₹45.3 billion) IPO valuing it at $7 billion (₹633.5 billion). The 10-minute delivery platform is doing a primary and secondary raise to focus on expansion.

Insiders are selling company stock due to constrained returns from high margins and lofty valuations. Reinvesting risks a supply glut, holding on to margins limits growth, and returning capital is hardly attractive.

Realty continues its weak growth due to a flattening of residential volumes.There is still a 5-year-upcycle though analysts are more bullish on the mid-premium segment with low mortgage rates.

Alts

MUFG is nearing a deal to buy a 20 percent stake in Shriram Finance for $3.2 billion (₹289.6 billion). Talks are advanced and expectations that a deal will be announced this week. Shriram focuses on loans for commercial vehicles to small and medium enterprises in rural India. Japan’s banks are investing in deals to get access to India’s whole financial landscape.

Kenya signed a $311 million (₹28.2 billion) deal with AfDB and state-owned Power Grid Corp. of India. The two firms are building universal electricity lines starting with a 202 kilometer line by 2030. This comes after Kenya canceled a deal with Adani.

Dense fog in north India disrupted over 100 flights.250 flights, 35 percent of those scheduled, were delayed out of Delhi.

Policy

India's new nuclear energy bill will spare suppliers from unlimited liability. Liability will be confined to just plant operators. Nuclear liability law has been a stumbling block with only 9 GW of nuclear power making up 2 percent of India’s energy mix, though the country wants 100 GW by 2047.

Trump's new $100,000 (₹9.1 million) fee for new H1-B workers will hit Tata and Infosys the hardest.The impact is largest on multinational staffing firms acting as middlemen for companies seeking foreign workers, like Tata and Infosys.

7 Ways to Take Control of Your Legacy

Planning your estate might not sound like the most exciting thing on your to-do list, but trust us, it’s worth it. And with The Investor’s Guide to Estate Planning, preparing isn’t as daunting as it may seem.

Inside, you’ll find {straightforward advice} on tackling key documents to clearly spell out your wishes.

Plus, there’s help for having those all-important family conversations about your financial legacy to make sure everyone’s on the same page (and avoid negative future surprises).

Why leave things to chance when you can take control? Explore ways to start, review or refine your estate plan today with The Investor’s Guide to Estate Planning.

Reach out to [email protected] to reach our audience and see your advertisement here.

Port of Mumbai

India’s Trade Deficit Narrows, Beating Estimates

India’s trade deficit shrank in November as exports picked up, helped by a surprise jump in shipments to the U.S. despite 50 percent tariffs on most goods. The gap between exports and imports shrank to $24.5 billion (₹2.2 trillion), well below all estimates and down from a record $41.7 billion (₹3.8 trillion) in October. The improvement was driven by outbound shipments but also a modest pullback in imports.

Exports rose 19.4 percent y-o-y to $38.1 billion (₹3.4 trillion), the fastest pace of growth in more than three years. The rebound reflected India’s broader push into alternative markets such as China, but it was also supported by a sharp recovery in exports to the US, still India’s largest single destination. Shipments to the US jumped 23 percent y-o-y after contracting in October. Commerce Secretary Agarwal added that the impact varied sector-by-sector, with losses in some areas offset by gains in others.

Imports fell 1.9 percent y-o-y to $62.7 billion (₹5.7 trillion). A key driver was gold, where imports plunged to $4 billion (₹362 billion) from $14.7 billion (₹1.3 trillion) in October following the end of the Diwali festival season, when demand typically peaks.

The data comes as trade negotiations between New Delhi and Washington continue to drag on. Trump and Modi spoke again last week, their fourth conversation since the tariffs took effect in August, but a comprehensive deal remains elusive. Agrawal said India is very close to signing a framework agreement, without offering a timeline. India is still one of the few major economies that has yet to secure a trade pact with the US, a delay that has weighed on investor sentiment and the currency.

Monthly trade data can be volatile, shaped by shipment timing and customs clearances. Still, November’s figures suggest that India’s exporters are finding ways to adapt, even as tariffs, currency weakness and uncertain trade diplomacy continue to cloud the outlook.

How helpful was today's newsletter?

See you tomorrow.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Sponsor the next newsletter to reach tens of thousands of U.S.-based business-savvy professionals. Reach out to [email protected].

Could your business use expert insights to power growth in India? Reach out to [email protected] for a free introductory call.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.