Good afternoon,

Welcome to the best way to stay up-to-date on India’s financial markets. Here’s what’s in today’s newsletter:

India just saw its largest-ever local currency private debt deal,

India’s government launched anti-trust investigations into global advertising agencies,

and India and New Zealand are finalizing a free-trade agreement.

Then, we close with Gupshup, a round-up of the most important headlines.

Have a question you want us to answer? Fill out this form and you could be featured in our newsletter.

—Shreyas, [email protected]

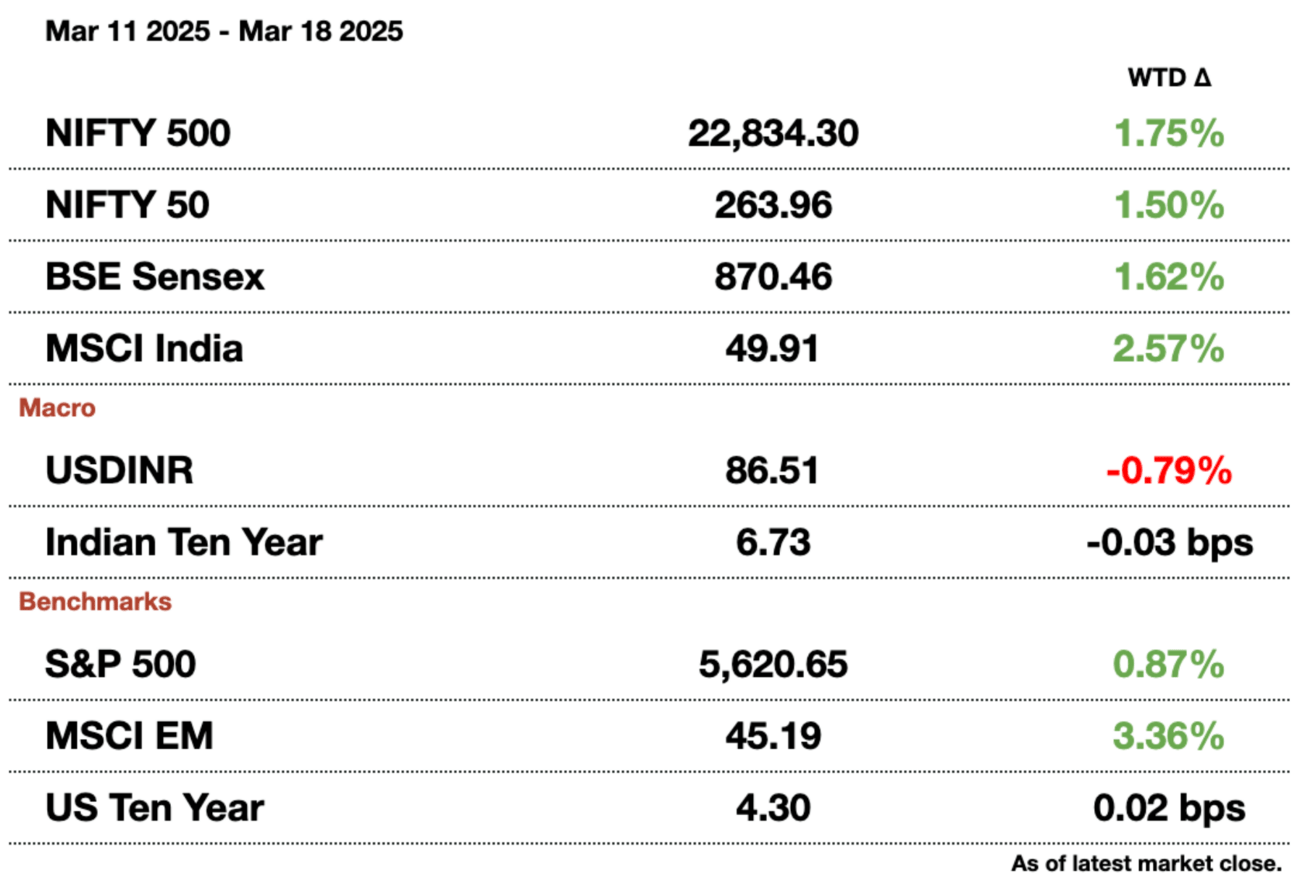

Market Update.

India’s Largest Ever Rupee-Based Private Debt Deal.

India’s Shapoorji Pallonji Group, a leading Mumbai-based construction and real estate conglomerate, is in advanced discussions with top global private credit funds to raise $3.3 billion (₹287.1 billion), marking India’s largest-ever local currency private debt deal. This deal signals a deepening of India's private credit market, which is expanding in response to Modi’s infrastructure push, increasing the demand for alternative financing in sectors like renewable energy and transportation.

Global players: Major global investors in the deal include Cerberus Capital Management, Davidson Kempner Capital Management, Farallon Capital Management, Varde Partners, and Ares Management Corp. Deutsche Bank is acting as the sole arranger for the transaction, which is structured around rupee-denominated bonds with a three-year tenor. The final coupon rate is still under negotiation, but yields are expected to be in the high teens.

The proceeds from this fundraising will primarily be used to refinance existing debt, with real estate assets and other holdings serving as collateral. Negotiations are progressing rapidly, with at least a dozen funds already submitting binding commitments as of last week. The deal is expected to close within the next three to four weeks, making it a significant milestone for Indian borrowers.

The larger trend: India’s private credit market has been expanding, with $9.2 billion (₹800.4 billion) raised across 163 deals in 2023, according to E&Y. However, increased competition has made deal execution and lending standards more challenging. The successful completion of this transaction could pave the way for larger private credit deals in the country, as more companies seek alternative financing outside traditional bank lending. Traditional bank financing in India has also become harder to come by, given the liquidity constraints.

This is not Shapoorji Pallonji’s first foray into high-yield debt. In 2023, its unit Goswami Infratech raised $1.6 billion (₹139.2 billion) through India’s largest-ever low-grade local currency bond at the time. The current deal, at more than double that size, underscores global investors' confidence in India's infrastructure-driven growth and an increasing ability to manage high-yield debt instruments.

Ad Giants are Being Raided for Antitrust.

India’s Competition Commission (CCI) has launched an extensive antitrust investigation, conducting raids across Mumbai, New Delhi, and Gurugram at the offices of major global advertising agencies, including GroupM, Publicis, Dentsu, and Interpublic Group, as well as the Indian Broadcasting and Digital Foundation. The core allegation is that these firms colluded with top broadcasters to manipulate advertising rates and discount structures, effectively limiting competition and keeping ad prices artificially high. These raids are part of a broader effort to ensure fair competition in India's rapidly growing media and advertising industry.

High stakes: India’s advertising market, valued at $18.5 billion (₹1.6 trillion), is expected to grow by 9.4 percent in 2025, making it one of the world's fastest-expanding ad markets. Digital advertising, now accounting for 60 percent of ad spend, is increasingly dominated by streaming platforms like JioHotstar, Netflix, Amazon Prime, and YouTube, reflecting the shift in consumer behavior. The investigation takes place at a time when the Indian media landscape is undergoing significant consolidation, most notably with the $8.5 billion (₹739.5 billion) merger between Walt Disney and Reliance’s media assets, which is set to control 40 percent of India’s TV and streaming ad market.

Additionally, the $13.3 billion (₹1.2 trillion) Omnicom-Interpublic merger has reshaped the global ad agency landscape, further raising concerns about market concentration and price-fixing tactics. The CCI’s focus on potential collusive behavior suggests a proactive approach to prevent monopolistic practices in a sector that is crucial to businesses and media companies alike.

The larger impact. If proven, the alleged collusion could have far-reaching consequences for advertisers, broadcasters, and the broader Indian economy. Advertisers could have been forced to pay inflated prices, limiting their ability to reach audiences effectively, while smaller media companies and independent broadcasters may have faced an uneven playing field due to restricted access to fair pricing models.

For global agencies like GroupM, Dentsu, and Publicis, the investigation threatens financial and reputational damage, with potential penalties reaching up to three times their annual profits or 10 percent of their turnover per year of wrongdoing. Given the size and influence of these firms in the Indian ad market, the case could set a precedent for regulatory interventions in other sectors where pricing collusion might exist.

Growing antitrust enforcement: This raid follows a pattern of increased antitrust enforcement in India. In December, the CCI conducted raids on alcohol giants Pernod Ricard and Anheuser-Busch InBev over similar price-fixing allegations, signaling a more aggressive regulatory stance. That being said, there are still huge conglomerates—see Adani/Ambani/Birla—that have gone unscathed for years.

An India-New Zealand Trade Deal is Coming Up.

India and New Zealand are aiming to finalize a free trade agreement within the next two months, according to New Zealand Prime Minister Christopher Luxon, who announced the initiative during his visit to India. This marks a revival of trade negotiations after a decade-long pause, following discussions with Modi. The deal could significantly enhance bilateral trade in agriculture, aerospace, renewable energy, and critical minerals, potentially boosting trade tenfold within a decade, according to Trade Minister Goyal.

Modi and Luxon

Bilateral trade between India and New Zealand surged by 30 percent year-over-year, reaching $1.2 billion (₹104.4 billion) in 2024, according to India’s trade ministry. Goyal emphasized that India’s manufacturing capabilities combined with New Zealand’s strengths in innovation and technology could allow both nations to leverage global markets more effectively.

Strategic importance: India's push to finalize trade agreements comes amid mounting global trade tensions, particularly after the US decision to impose reciprocal tariffs on imports, including those from India. As a result, India is actively pursuing trade deals with key partners such as the EU and the UK to offset potential losses from US policies.

Early challenges and opportunities. Despite the optimism, the agreement faces hurdles, particularly regarding tariffs on agricultural products. India has long resisted lowering import duties on dairy and other farm goods, with tariffs ranging between 30 percent and 60 percent, to protect its millions of small farmers from foreign competition. Similar concerns have complicated India’s trade negotiations with the EU and other partners. Goyal assured that while both sides would work toward an expedited deal, negotiations would proceed while respecting individual sensitivities.

Luxon expressed New Zealand’s eagerness to strengthen cooperation in aerospace, renewable energy, and advanced manufacturing, positioning the agreement as a strategic economic partnership rather than just a trade pact. However, analysts caution that while political will is strong, differences over tariffs and non-trade issues could delay or modify the final agreement.

Want to sponsor our next newsletter?

Email [email protected] for the best way to reach U.S.-based professionals interested in India.

Gupshup.

Macro

New Zealand is pushing for dairy in the Indian FTA. PM Luxon admitted that negotiations will have to be “brutal” in order for both sides to reach an agreement. He and Minister Goyal want to close the deal in two months, with a potential for trade to rise from $1.2 billion (₹104.4 billion) to $12 billion (₹1 trillion) by the end of Modi’s term.

Fitch expects Indian steel prices to fall due to Chinese imports and tariff pressure on exports. The agency downgraded both JSW and Tata as local mills have been hit with cheap imports.

Equities

Regulators approved LG's potential $1.5 billion (₹130.5 billion) IPO. The approval lets LG start marketing its share sale and schedule a potential listing date. The Korean parent company will sell up to 102 million shares in its Indian SubCo with all proceeds going to the HoldCo. LG is the largest seller of appliances and consumer electronics in India with sales of $2.5 billion (₹216 billion) last year. Morgan Stanley, JPM, BofA, Axis, and Citi will manage the IPO.

IPO stars are losing their luster while blue-chip companies have seen more flows. Newly listed firms are down 25 percent from their peaks, but blue-chips have been a safe pick. New IPOs like LG and HDB Financial are still going on with excitement, however.

Air India sees a global aircraft shortage for the next four years. Wilson sees supply shortages at Boeing and Airbus forcing higher maintenance as airliners continue to operate older planes. He also warned that airlines cannot necessarily expand routes due to constraints. The comments come after Air India ordered hundreds of new planes last year.

Fintech firm Pine Labs is targeting an Indian IPO in 2H25.Pine offers full-stack payment services from point-of-sale card machines to online paying systems similar to PhonePe. Pine is planning a $1 billion (₹87 billion) raise at near a $5 billion (₹435 billion) valuation. It also is waiting for regulatory approval to domicile in India.

Alts

Allianz is to sell their India JV stake to Bajaj for $2.8 billion (₹243.6 billion) following a dispute over partnership. Allianz is a German insurer that partnered with Bajaj to enter India. Directional issues in their partnership are causing the tear. Allianz is committed to redeploying the funds elsewhere in the country. Insurance is likely to be a growing segment, given that insurance penetration rate — premiums over GDP — is half that of similar EM South Africa.

LIC is looking to buy a health insurance stake by the end of March. LIC provides life insurance services and wants to get a minority stake in a health insurance company to diversify. They are also looking to raise debt financing, a move that could be the source of funds.

GMR — the Delhi airport operator — is suing the government over allowing commercial flights from a defense aerodrome.GMR alleges that the airport will become financially unviable. They might be onto something given that they lost $21 million (₹1.8 billion) last year after servicing 73.6 million passengers. They also cited a rule that, unless there was huge passenger demand, there could not be another airport within 90 miles of Delhi’s Indira Gandhi Airport.

Policy

India's telecom minister is bullish about the Bharti-Starlink-Ambani internet plan. He emphasized that satellite connectivity is needed in regions without fiber or mobile connectivity access. He also brought up natural disasters as something that could be mitigated with satellites. Scindia refused to bring up specific firm names, approval timelines, or potential pricing.

Tulsi Gabbard says India and the US are boosting work in intel and security. The National Intelligence Director said she had a fruitful visit to India while discussing the Quad as well. Gabbard says Trump and Modi were both still committed to the Japan-Australia-India-US alliance to limit China’s influence.

See you Wednesday.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.