Trump hits Indian exports to the U.S. with a 50 percent tariff, expected to cause India’s GDP to shrink up to 1 percent. New Delhi makes trade concessions. State-run refiners pause Russian oil purchases again.

If you have any questions about India, fill out this form or reach out to Shreyas at [email protected]

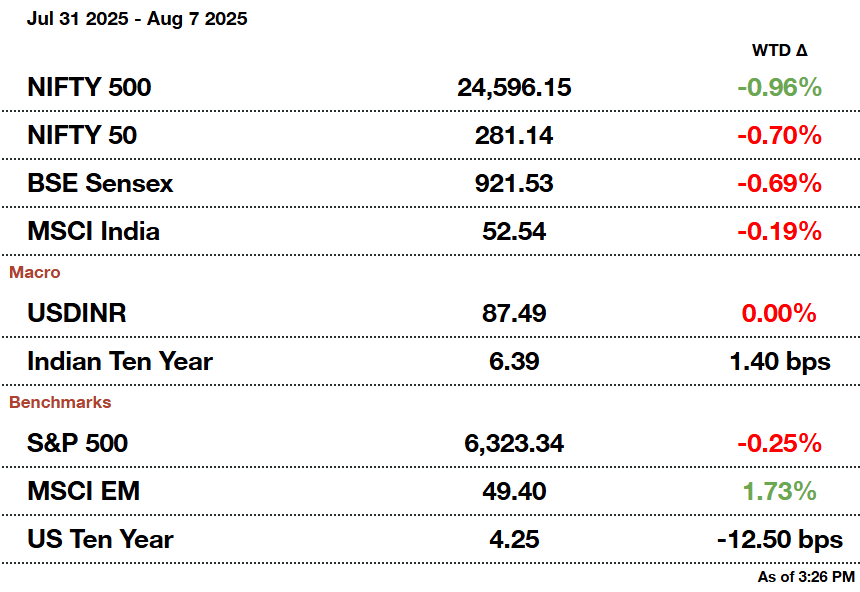

Macro

Indian exporters are restructuring operations to counter Trump’s 50 percent tariff hike, which they say is worse than COVID-19. Larger firms eye relocation and U.S. acquisitions, while smaller ones face severe losses, threatening Modi’s ‘Make in India’ and GDP growth.

Investor anxiety is mounting in India as Trump's steep tariffs fuel trade tensions and hammer pharma stocks, while the rupee and equity markets brace for volatility. Despite the uncertainty, NSDL’s strong debut shows selective optimism for market infrastructure plays.

Equities

Adani Power will invest $3 billion (₹262.3 billion) to build a 2,400 MW coal-fired plant in Bihar after winning a competitive bid, aiming to expand power supply and support regional industrial growth. The project comes amid rising electricity demand and pre-election infrastructure pushes.

TPG-backed SK Finance plans to launch a scaled-down IPO next week, targeting about $182 million (₹16 billion). Proceeds will support lending and corporate needs, with shares sold by TPG, Norwest, and others.

TCS will raise salaries for 80 percent of employees after a five-month delay, per an internal email. The hike follows recent layoffs and comes amid weak global demand and delayed client decisions in India’s IT sector.

Cummins India posted a 30.5 percent jump in quarterly profit, driven by strong demand for engines and power generators. Summer heat waves and rising electricity use supported growth despite early monsoons.

India’s Ramco Cements missed profit estimates as early monsoon rains hit demand and cut cement volumes by 7 percent. Despite a rebound in prices and lower costs, standalone revenue dipped 1 percent, and both revenue and profit lagged analyst forecasts.

Sunil Mittal-led Indian Continent Investment Ltd has launched a $1 billion (₹87 billion) block deal to sell about 0.8 percent of its stake in Bharti Airtel at a 3.15 percent discount to the last closing price, Moneycontrol reported.

India's AU Small Finance Bank received RBI’s in-principle approval to become a universal bank, the first such license granted in nearly a decade. This transition allows broader lending, customer reach, and business expansion beyond small finance limits.

Titan’s quarterly profit surged 52.5 percent as rising gold prices boosted margins, despite consumers opting for lower-carat, lightweight jewelry. The company saw strong revenue growth, driven by investment-grade gold sales amid global economic uncertainty.

Alts

Billionaire Irfan Razack warns of oversupply in Hyderabad's property market and rising housing costs pushing ownership out of reach. Despite record sales, he urges policymakers to address affordability as Prestige shifts focus to mid-market efficiency.

A US-sanctioned oil tanker sold to an Indian scrapyard included unusually long 180-day payment terms and a shell company seller, signaling desperation to offload blacklisted ships. The deal reflects growing pressure on the aging "dark fleet" as sanctions tighten.

Policy

India and Russia reaffirmed their "strategic partnership" during high-level security talks in Moscow, shortly after U.S. President Trump imposed higher tariffs on Indian goods over its Russian oil imports. India also confirmed it is expecting a visit from President Putin later this year.

PM Modi and Brazilian President Lula da Silva spoke shortly after Lula called for BRICS discussions on U.S. tariffs following President Trump’s 50 percent levy on Indian goods. Modi’s office said the leaders discussed regional and global issues of mutual interest, without directly mentioning the tariffs.

Missed the Market’s Big Moves?

The market moves fast - we make sure you don’t miss a thing.

Elite Trade Club delivers clear, no-fluff market intel straight to your inbox every morning.

From stocks to big-picture trends, we cover what actually matters.

Join 100,000+ readers who start their day with the edge.

Reach out to [email protected] to reach our audience and see your advertisement here.

1. Trump's Tariffs Could Shrink India’s GDP by 1 Percent

Kolkata

President Trump’s tariff hike, now expected to reach 50 percent on all Indian goods imported by the U.S, could cause India’s GDP to shrink 1 percent, according to Bloomberg Economics.

Economists warn this isn’t just a tariff hike, it resembles a partial embargo. Analysts at Nomura called it a “sudden stop” for labor-heavy exports like gems, textiles, and footwear. India’s current trade model, heavily reliant on slim-margin goods and low-value-added manufacturing, leaves smaller exporters especially exposed. With the U.S. accounting for nearly 20 percent of India’s exports, the 60 percent drop in shipments forecast by some would ripple across supply chains, jobs, and investment.

India’s central bank held rates steady at 5.50 percent this week, citing trade uncertainty. But the street expects at least two more cuts this year as policymakers scramble to support growth. The rupee, already flirting with record lows, may require intervention if outflows intensify.

New Delhi has called the move “unfair” and is already eyeing new markets in South Asia, Africa, and Latin America. However, it has tried to ensure confidence in markets by stating that it does not expect the economic damage to be as severe as some private-sector analysts predict. India’s central bank has not updated a forecast for 6.5 percent GDP growth through fiscal year 2026.

The 50 percent tariff rate comes from an initial 25 percent tariff Trump proposed on India (just slightly below the 26 percent tariff proposed on Liberation Day, calculated by half of (exports - imports) / imports, an arbitrary formula developed by the White House. The additional 25 percent tariff is put in place because of President Trump’s desire to pressure India to stop imports of Russian oil. India has imported $133.4 billion worth of Russian crude oil since January 2023, however, this is far less than China’s $213 billion imported in the same timeframe. The White House has punished India more than China because the U.S. and India have a stronger economic and security relationship to leverage; an ally’s hand can be forced more easily than an adversary’s.

The tariffs impact two-thirds of India’s exports to the U.S., about $58 billion (₹6.2 trillion) a year. With a 50 percent tariff, it is likely that many of these goods will simply be priced out of the American market.

2. Are Trade Concessions Worth Risking Agriculture Output?

With just weeks before President Trump’s 50 percent tariff hike on Indian goods takes effect, New Delhi is weighing limited trade concessions to preserve access to its top export market and its broader strategic autonomy.

Officials say India may consider easing some long-standing restrictions, including allowing controlled imports of genetically modified corn for non-human consumption. Talks are also focused on selective openings in the dairy sector, long a sticking point due to religious sensitivities and protectionist sentiment. For now, retaliation is off the table as India eyes the 21-day window to strike a deal and contain economic fallout.

But even as New Delhi engages Washington, the Modi government is walking a political tightrope. Agriculture is not just economically vital, it's politically sacred. India’s current rules prohibit dairy imports from cattle fed on animal-derived ingredients, in line with Hindu beliefs. Farmers, already squeezed by weak global prices and erratic weather, are a powerful voting bloc, and any perceived compromise on their livelihoods risks backlash. Internally, ministries are scrambling to evaluate options that signal goodwill to the U.S. without alienating domestic constituencies.

One possibility under review: narrowly tailored concessions with strict traceability rules, limited quotas, or phased-in access. But any movement will be cautious. As one official put it, “There’s zero appetite to throw our farmers under the bus just to get a deal through.”

3. India Pauses Russian Crude Imports

India’s state-run refiners have hit the brakes on Russian oil purchases once again, as New Delhi seeks to appease the White House after a 50 percent tariff on Indian exports was enacted today. Indian Oil, BPCL, and HPCL have skipped spot buys of Russian crude in the latest procurement cycle, according to insiders, opting instead for barrels from the US, Brazil, and Libya. The move follows President Trump’s decision to double tariffs on Indian goods to 50 percent as punishment for continued energy ties with Moscow.

While no official order has been issued to stop buying Russian oil, refiners are holding off until they receive guidance from the government. New Delhi views the next three weeks, before the latest round of tariffs kicks in, as a critical window for negotiations. The pause affects purchases for October-loading cargoes and signals a tactical recalibration as the government balances trade interests with energy security.

At its peak, India imported over 2 million barrels a day of discounted Russian oil. But narrowing discounts and diplomatic costs are shifting the equation. Industry players expect greater competition for Middle Eastern and African crude, especially from Iraq and Saudi Arabia.

This moment underscores the bind Modi’s government is in: preserving its strategic oil relationship with Russia risks jeopardizing $87 billion (₹7.6 trillion) in U.S. exports, a far bigger economic lever than the $4 billion (₹349.8 billion) in annual crude savings. The coming weeks will test India’s ability to hedge its energy policy without setting off a geopolitical firestorm.

How would you rate today's newsletter?

See you tomorrow.

Written by Eshaan Chanda & Yash Tibrewal. Edited by Shreyas Sinha.

Sponsor the next newsletter to reach tens of thousands of U.S.-based business-savvy professionals. Reach out to [email protected].

Could your business use expert insights to power growth in India? Reach out to [email protected] for a free introductory call.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.