In partnership with

India is industrializing faster than China did—and somehow using less coal and oil. That wasn’t supposed to be possible. Today, we explain more.

If you have any questions about India, fill out this form or reach out to Shreyas at [email protected]

Macro

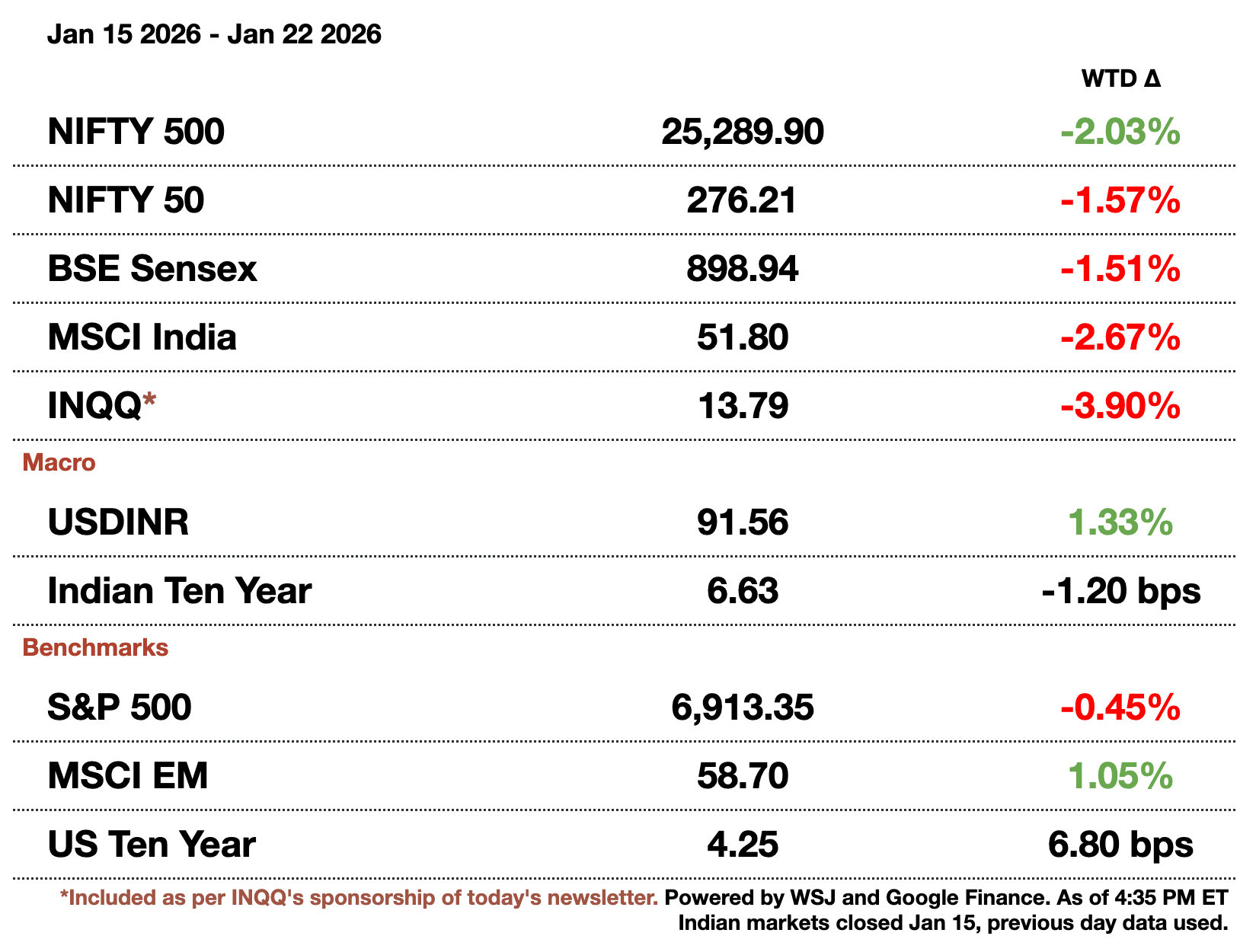

The rupee hits a fresh low at 91.745 after weakening for a 6th straight session. Global uncertainties and idiosyncratic factors have made the rupee the worst performer against all Asian peers. Foreign investors have pulled $2.7 billion (₹247.1 billion) in local equities this month already.

Aditya Birla Asset Management and Axis are doubling holdings of risky short-term company debt to 25 percent in their bond funds. The yield between 3-year corporate securities and government debt expanded to 192 basis points.

The EU sees a potential India FTA as historic given the 2 billion people it would serve.Trade would account for 25 percent of global GDP when tariffs on 90 percent of bilateral traded goods are eliminated. The trade deal has been in the works for 2 decades.

Equities

The Nifty slipped below its 200 day moving average for the first time since May. Currency moves and foreign selling have initiated a vicious cycle of further equity selling.

Blackstone is weighing a $500 million (₹45.8 billion) IPO for its PGP Glass PortCo. PGP makes glass packaging for industries including cosmetics and perfumery, food and specialty spirits, and pharmaceuticals. The company has a total capacity of 1,720 metric tons per day valued at $4 billion (₹366 billion).

Reliance shares have fallen 11 percent erasing $29 billion (₹2.7 trillion) from its market cap. This is the most sold shares since the pandemic due to its slowing retail business and concerns over Russian oil imports.

Housing prices have climbed but real estate stocks fell 17 percent last year and 5 percent this year already.2026 will likely mirror 2025 with housing sales sluggish due to affordability and the office segment also struggling.

Alts

India's CEOs are more optimistic about their companies' growth than foreign counterparts despite a lack of AI use. The results are from a Davos survey finding that 77 percent of Indian CEOs believe economic growth will improve vs 55 percent globally. 57 percent of Indian CEOs are positive on revenue appreciation compared to 30 percent globally.

Elevated pollution levels in north India impacted consumer demand according to Shoppers Stop.Sales were flat in the 3 months ending December, breaking the norm where holiday sales power yearly earnings. The winter season saw 90 percent of days having an AQI higher than 300.

Policy

India is adding 50 surveillance satellites due to its May border conflict with Pakistan. The BJP is also planning ground stations overseas to relay information in Scandinavia, Southeast Asia, and the Middle East, though government approval is required.

India’s Tech Boom Is Here. Now, You Can Invest in Minutes.

Samosa Capital is excited to partner with The India Internet ETF (NYSE: INQQ), a U.S.-listed ETF that lets you invest in the tech companies driving India’s future in minutes: from Swiggy and Lenskart to Eternal and Nykaa.

In a single trade, you'll get access to a basket of innovative companies contributing to the future of the world’s most populous country, and gain exposure to India's long-term investment potential.

INQQ is available through most major online brokerages, giving you direct access to rigorously researched Indian tech giants.

Reach out to [email protected] to reach our audience and see your advertisement here.

India’s Electrification is Moving Faster Than China’s Ever Did

While China’s rapid electrification was jawdropping, India is arguably moving faster at an earlier stage of economic development. A new report from the energy think tank Ember suggests that India is electrifying its economy more quickly and relying less on fossil fuels per person than China did when the two countries were at comparable income levels. That finding challenges the long-held assumption that emerging economies must first pass through a prolonged phase of fossil-fuel dependence before they can go green.

To make the comparison meaningful, Ember adjusted incomes for purchasing power. On that basis, India’s adjusted current per-capita income of about $11,000 (₹1 million) matches China’s level in 2012. Yet India today consumes far less coal and oil per person than China did back then; India uses 78.3 liters of gasoline compared to China’s 175 liters. Even as its economy grows, India’s fossil-fuel use is rising more slowly in absolute terms than China’s did during its rapid industrialization phase.

The explanation lies largely in timing. India is benefiting from a dramatic fall in the cost of clean-energy technologies that simply were not available a decade ago. Solar panels, batteries and electric vehicles are far cheaper today thanks in large part to China’s own earlier investments, which drove learning-by-doing and economies of scale. Those gains have spilled over globally. As a result, India has reached meaningful levels of solar penetration in its power mix at much lower income levels than China ever could.

The same dynamic is visible on the roads. About 5 percent of new cars sold in India last year were electric. When China reached a similar adoption rate, its per-capita oil consumption for road transport was roughly 60 percent higher than India’s is today. India also has 5 percent solar use in its grid but China didn’t hit that until $23,000 (₹2.1 million) in per-capita GDP. That gap suggests India’s oil demand per person could peak well below Chinese levels, a remarkable shift for a country of its size.

None of this means India is abandoning fossil fuels. Coal still dominates its power system, and the government is considering plans that could significantly expand coal capacity by the middle of the century. Oil demand is also still rising. But relative to its income level, India is charting a different path, one that leans more heavily on electricity and less on combustion.

Ember’s broader argument is that countries without large domestic fossil-fuel reserves may increasingly become “electrostates,” meeting most of their energy needs through electricity generated from clean sources. No country fits that description yet. But as the cost of solar, batteries and electric vehicles continues to fall, India’s experience suggests that latecomers to development may be able to grow faster while burning far less fuel than their predecessors ever did.

How helpful was today's newsletter?

See you tomorrow.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Sponsor the next newsletter to reach tens of thousands of U.S.-based business-savvy professionals. Reach out to [email protected].

Could your business use expert insights to power growth in India? Reach out to [email protected] for a free introductory call.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.