India’s economy shows mixed results in July so far. Abroad, climate regulation threatens demand for Indian exports. PayPal announced a landmark global payments system built on top of India’s Unified Payments Interface.

If you have any questions about India, fill out this form or reach out to Shreyas at [email protected]

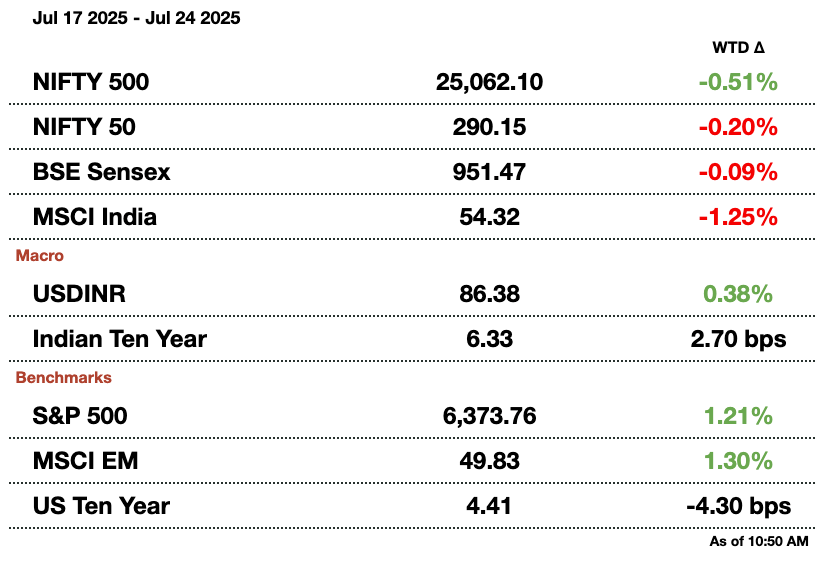

Macro

After a recent cash crunch led to costly overnight borrowing, Indian banks are expected to tread cautiously in the RBI's upcoming reverse repo auction. Many lenders now plan to reduce participation in the seven-day VRRR, wary of liquidity risks and rate volatility.

Indian shares declined on Thursday, led by losses in IT and consumer stocks following weak earnings. The broader market also slipped as investors booked profits and awaited cues from U.S. and UK trade talks.

Equities

SoftBank-backed InMobi plans to raise up to $1 billion (₹86.4 billion) through an IPO in India, aiming for a valuation between $5-$6 billion (₹432-518 billion). The mobile advertising firm joins a wave of Indian tech startups choosing local listings amid a booming IPO market.

Shares of Indian Energy Exchange (IEX) plunged nearly 30 percent after the power regulator ordered unified pricing across exchanges starting January 2026, a move that could slash IEX’s market share and revenues.

Trident reported a nearly 90 percent rise in Q1 profit to $16.21 million (₹1.4 billion) as lower raw material and employee costs offset a 2 percent dip in revenue. The textile firm benefited from a 7 percent reduction in overall expenses despite softer sales.

Nestle India reported a 12 percent drop in quarterly profit due to higher raw material and expansion costs, causing its shares to fall by over 5 percent. Rising prices also hurt demand in its key milk and nutrition product segment.

Bajaj Finance posted a 20 percent rise in quarterly profit, beating estimates, as strong loan growth, particularly in SME lending, offset concerns over elevated credit costs and asset quality. Its assets under management surged 25 percent, while net interest income grew 22 percent.

SBI Life reported a 14 percent rise in Q1 profit to $68.8 million (₹5.9 billion), driven by strong policy renewals and improved margins. Growth in the value of new business and lower demand for less-profitable policies helped offset weaker new policy sales.

ACC reported a 5 percent rise in first-quarter profit to $44.6 million (₹3.9 billion), driven by strong cement volumes and higher prices. The company’s revenue grew 18 percent year-on-year, supported by Adani Group’s strategic deals and price recovery.

Alts

Torrent Power is in talks to acquire L&T’s thermal power unit for about $1 billion (₹86.4 billion), including debt. The deal would help L&T cut debt as it refocuses on its core construction business.

IndusInd Bank plans to raise up to $3.5 billion (₹302 billion) through a mix of debt and equity as it deals with fallout from a suspected fraud and executive exits. The fundraising follows regulatory action and a $234 million (₹20 billion) accounting discrepancy.

An Indian company exported $1.4 million (₹117 billion) worth of military-grade explosive HMX to Russia in December, despite U.S. warnings against aiding Moscow’s war effort. One recipient, Russian firm Promsintez, is linked to the military and was targeted by a Ukrainian drone strike in April.

Three Indian infrastructure investment trusts, including NHIT, plan to raise nearly $500 million (₹43.2 billion) through bonds in the coming weeks. The move comes as InvITs seek to capitalize on lower yields and growing investor interest in debt markets.

Policy

India has issued new cybersecurity guidelines to protect its power grid from potential threats linked to Chinese-made solar inverters. The rules require rooftop solar inverters to connect to a national software platform and use secure SIM cards, aiming to prevent unauthorized data access and safeguard national energy sovereignty.

India's financial crime agency is investigating Anil Ambani's Reliance Group for allegedly siphoning $350 million (₹30 billion) in loans from YES Bank via shell companies. The probe includes accusations of bribery and violations of bank lending norms, triggering a drop in the group's share prices.

India has appointed former Finance Secretary Ajay Seth as chairman of the Insurance Regulatory and Development Authority of India for a three-year term. The move places a senior economic policymaker at the helm of the insurance regulator.

India has rejected an EU proposal for joint oversight on capital flows in free trade talks, citing concerns over national sovereignty and crisis-time policy flexibility. The disagreement comes as both sides aim to finalize the FTA by the end of 2025.

Wall Street’s Morning Edge.

Investing isn’t about chasing headlines — it’s about clarity. In a world of hype and hot takes, The Daily Upside delivers real value: sharp, trustworthy insights on markets, business, and the economy, written by former bankers and seasoned financial journalists.

That’s why over 1 million investors — from Wall Street pros to Main Street portfolio managers — start their day with The Daily Upside.

Invest better. Read The Daily Upside.

1. India’s Exports May be at Risk due to Tightening Global Carbon Rules.

India’s export sector, valued at nearly $825 billion (₹71.3 trillion) in FY2024-25, is facing growing pressure from climate-related regulations in key markets, according to a study released by Net Zero Tracker, a coalition of climate research groups linked to the University of Oxford.

The report warns that over two-thirds of India’s outbound shipments are exposed to tightening net-zero policies, particularly in the European Union and the UK, where carbon border adjustment mechanisms are set to impose tariffs on carbon-intensive imports starting in 2026. These mechanisms aim to level the playing field by charging for greenhouse gas emissions embedded in imported goods, essentially penalizing high-emission production methods.

India, which still derives around 75 percent of its electricity from coal, faces a structural disadvantage in this regard. The study highlights that India's high carbon footprint extends beyond heavy industry to include services like IT and professional services, sectors traditionally seen as low-emission. In contrast, competitor nations are delivering exports to global markets with carbon footprints up to 20 times lower, aided by cleaner energy grids.

The challenge for India is clear: boost export competitiveness while aggressively cutting emissions. The country has committed to achieving net-zero by 2070 and has introduced a sustainable finance taxonomy to guide green investment. A revised emissions reduction target is also expected before COP30 in Brazil.

As India negotiates trade deals with the UK, U.S., and others, aligning with global carbon standards may prove critical to securing long-term market access and maintaining export momentum.

2. India’s Economy Shows Mixed Momentum in July

Mumbai

India's economy showed a mixed performance in July thus far, with robust manufacturing growth offset by a slight slowdown in services activity, according to preliminary data from HSBC's flash Purchasing Managers' Index (PMI) surveys.

The manufacturing PMI climbed to 59.2 in July, up from 58.4 in June, marking its highest level in over 17 years, signaling strong factory output, rising new orders, and solid export demand. In contrast, the services PMI dipped to 59.8 from 60.4, indicating the sector is still expanding, albeit at a slower pace. As a result, the composite PMI, which blends manufacturing and services data, edged lower to 60.7 from 61.0 in June.

Despite the overall healthy reading above the expansion threshold of 50, underlying indicators suggested caution. HSBC’s Chief India Economist Pranjul Bhandari noted that while output and sales remain strong, business confidence has fallen to its lowest level since March 2023. Additionally, both input costs and output prices rose further in July, indicating mounting inflationary pressures.

Employment growth also weakened to a 15-month low, highlighting concerns about the labor market’s recovery. The data arrives amid recent economic shifts, including a surprise 50-basis-point rate cut by the Reserve Bank of India in June.

India’s private sector continued to grow strongly in July, driven by a surge in manufacturing and overseas demand, according to the HSBC Flash India Composite PMI. The index registered 60.7—slightly down from June’s 61.0—but still well above the 50 mark that signals expansion. Manufacturing hit a 17-year high at 59.2, while services dipped to 59.8. New orders rose at the fastest pace in a year, particularly from Asia, Europe, and the U.S. However, business confidence dropped to its lowest since March 2023, job creation slowed, and inflation intensified, with firms reporting rising input costs and passing them on to customers.

Although agriculture prospects have brightened with a good monsoon, global trade uncertainty, especially the stalled India-U.S. trade talks, continues to cloud the export outlook, adding complexity to India's growth narrative for the second half of 2025.

3. PayPal Taps into India’s UPI to Build Global Payments Infrastructure

PayPal announced plans to launch a new global payments platform, PayPal World, that will link with India’s Unified Payments Interface (UPI), aiming to create a seamless cross-border digital payments network. The initiative is expected to significantly expand UPI's global footprint and could mark a major step toward internationalizing India’s homegrown digital payments architecture.

The platform, slated to go live later this year, will allow interoperability between PayPal and domestic payment systems across multiple countries. PayPal’s launch partners include India’s National Payments Corporation, Brazil’s Mercado Pago, Tencent’s Tenpay Global, and Venmo. These partnerships suggest a strategic effort to link key emerging markets into a shared payments ecosystem.

UPI currently accounts for around 85 percent of India’s retail digital transaction volume and is increasingly being promoted by Indian authorities as a model for financial inclusion and digital transformation globally. “The integration of UPI on PayPal World’s platform will mark a significant step in expanding UPI’s global footprint,” said Ritesh Shukla, CEO of NPCI International.

India has been actively exploring bilateral partnerships with countries in Africa and South America to export its UPI-based model. By aligning with PayPal, a global payments giant, India’s vision of becoming a key player in shaping the future of digital finance gains credibility and scale.

This move also signals growing momentum in global efforts to create interoperable payment systems that reduce frictions in cross-border commerce, particularly for small businesses and emerging markets.

How would you rate today's newsletter?

See you tomorrow.

Written by Eshaan Chanda & Yash Tibrewal. Edited by Shreyas Sinha.

Sponsor the next newsletter to reach tens of thousands of U.S.-based business-savvy professionals. Reach out to [email protected].

Could your business use expert insights to power growth in India? Reach out to [email protected] for a free introductory call.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.