Good evening,

Welcome to the best way to stay up-to-date on India’s financial markets. Today, we analyze how Indian banks need to meet the moment by improving liability management.

Then, we close with Gupshup, a round-up of the most important headlines.

Have a question you want us to answer? Fill out this form and you could be featured in our newsletter.

—Shreyas, [email protected]

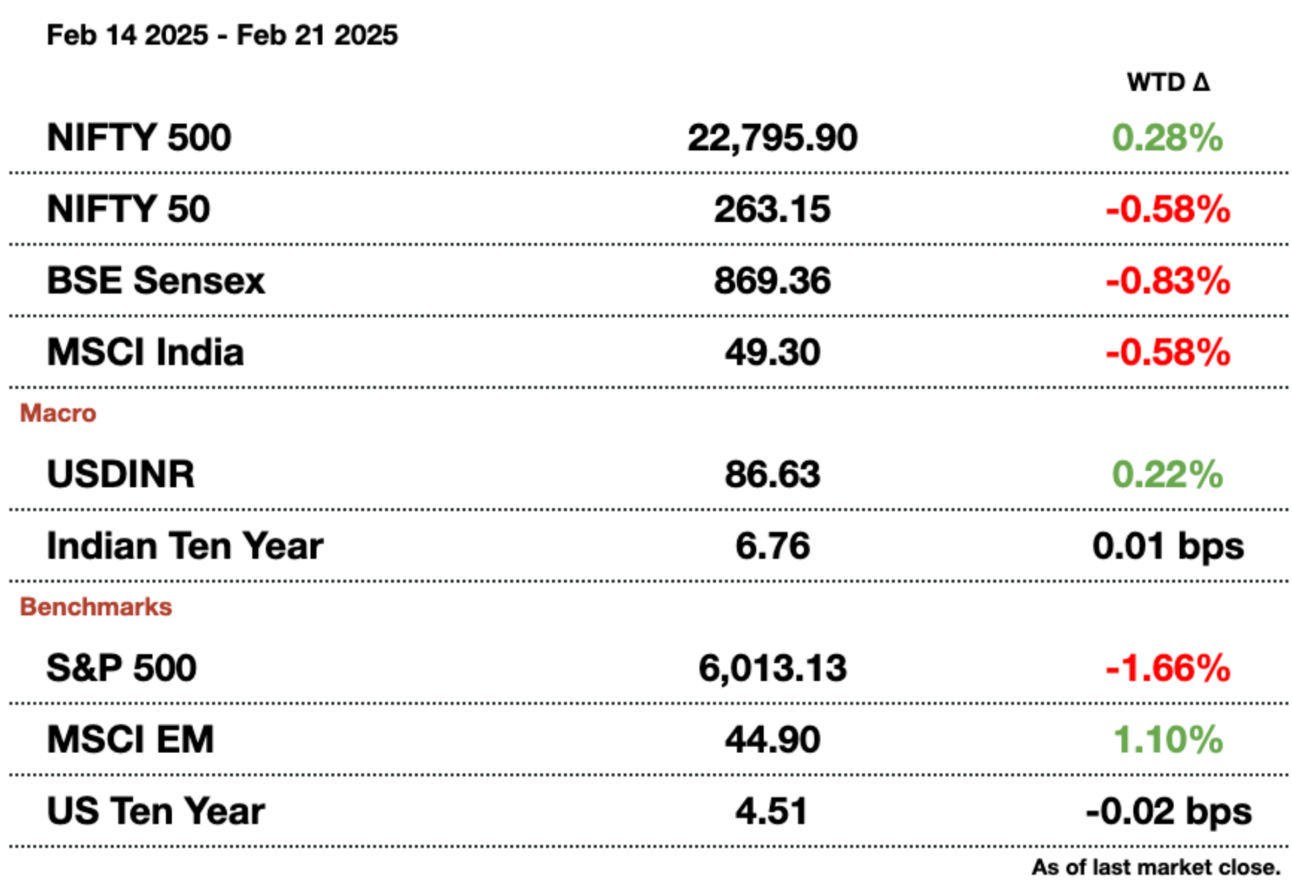

Market Update.

The RBI Thinks India’s Banks Need to Do Some Self-Reflection

Problem: India’s banks are struggling with a growing liability problem—essentially, they’re running out of good ways to fund their loans. RBI Deputy Governor Rajeshwar Rao just sounded the alarm, warning that poor liability management is leading to a rise in bad loans, choking profits, and making lending riskier.

Why this problem matters: When banks can’t lend, businesses can’t grow, jobs disappear, and the economy slows down.

How we got here: The core function of banking revolves around accepting short-term deposits and providing long-term loans, a process known as maturity transformation. While essential to financial intermediation, this also exposes banks to various risks. Historically, regulatory frameworks like Basel I and II focused primarily on the asset side of bank balance sheets, emphasizing credit risk management and capital adequacy. The assumption was that credit defaults and asset deterioration posed the greatest threats to solvency, while liquidity and funding risks—mainly tied to liabilities—were considered manageable without stringent oversight.

The ‘08 Global Financial Crisis changed this perception. It revealed that even well-capitalized banks could face insolvency due to liquidity shortfalls, highlighting the fragility of funding structures reliant on short-term liabilities. In response, global regulations incorporated liquidity-focused measures, such as the Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR), to enhance short- and medium-term liquidity resilience.

Liability management is critical for a bank’s solvency and profitability. The Net Interest Margin (NIM)—the spread between interest earned on loans and the cost of funds—is directly shaped by liability structures. Factors like the proportion of Current and Savings Account (CASA) deposits, the mix of retail versus wholesale funding, and liability durations significantly impact funding costs.

For instance, in India, deposits remain the primary funding source for Scheduled Commercial Banks (SCBs), making up 77 percent of total liabilities as of FY 2024. While term deposits have declined, the rise in CASA deposits has helped boost NIMs from 2.6 percent in FY 2015-16 to 3.3 percent in FY 2023-24. However, banks have also increased reliance on short-term funding instruments like Certificates of Deposit (CDs), raising concerns about potential risks if market conditions deteriorate.

Trends shaping liability management in India’s banking sector:

Household savings are shifting toward capital market assets like mutual funds and equities. This transition, driven by digital infrastructure, changing demographics, and higher equity market returns, may impact the composition and cost of bank deposits.

Banks are seeing a move from retail to institutional deposits, increasing funding costs. Retail deposits see far lower interest rates than the ones offered to large institutional accounts which increases liability costs. This could pressure banks to either raise loan interest rates — potentially slowing credit growth — or lower underwriting standards, increasing risk exposure.

Greater reliance on short-term funding instruments like CDs exposes banks to rollover risks (issues with refinancing or new borrowing when current debt, like CDs, mature), particularly during market stress.

Beyond banks, liability concerns extend to Non-Banking Financial Companies (NBFCs), which rely heavily on market-driven funding. Borrowings constitute 68 percent of their liabilities, making them more sensitive to interest rate fluctuations than banks. Over-reliance on short-term funding for long-duration assets can trigger liquidity crises, weaken investor confidence, and lead to credit rating downgrades.

RBI makes moves. To keep banks stable, the RBI has made it harder for NBFCs (non-bank lenders) to rely too much on bank funding. In response, NBFCs are turning to other ways to raise money, like Commercial Papers (CPs) and Non-Convertible Debentures (NCDs). Some are even borrowing from international markets, but that brings currency risks, which they have to hedge against.

The government is also tweaking its borrowing strategy. When banks buy government bonds, it can drain liquidity from the system, making lending harder. To ease this, the RBI uses open-market operations—buying and selling securities—to inject cash into the system and prevent bad loans from piling up.

Banks have their own tools to manage risk too. The Liquidity Adjustment Facility (LAF) lets them borrow short-term cash when needed, while the Standing Deposit Facility (SDF) helps them earn interest on extra money.

Effective liability management is no longer just about maintaining profitability—it is crucial for systemic stability. As the financial landscape evolves due to technological advancements, regulatory changes, and shifting consumer behavior, banks and NBFCs must adopt dynamic and comprehensive Asset-Liability Management strategies.

Message from our Sponsor

Hands Down Some Of The Best 0% Interest Credit Cards

Pay no interest until nearly 2027 with some of the best hand-picked credit cards this year. They are perfect for anyone looking to pay down their debt, and not add to it!

Click here to see what all of the hype is about.

Gupshup.

Macro

India's business activity surged to a six-month high in February, driven by a booming services sector and record job creation, according to HSBC’s PMI survey. While services growth offset a slight dip in manufacturing, businesses passed rising costs to consumers amid strong demand.

Indian insurers are considering raising health insurance premiums in New Delhi by 10-15 percent due to a surge in pollution-related claims in 2024. If approved by regulators, this would be the first time air pollution directly influences premiums and could set a precedent for other polluted cities.

Indian stock markets posted weekly losses as concerns over U.S. tariffs weighed on auto and pharma stocks. The Nifty 50 and Sensex fell for a second straight week, with investor sentiment dampened by uncertainty over trade policy, weak earnings, and foreign outflows.

The Reserve Bank of India will inject $10 billion into the banking system through a three-year dollar/rupee swap auction on February 28 to ease cash shortages. This move follows a $5.1 billion swap earlier this year, with analysts viewing the longer-term liquidity boost as a signal for potential rate cuts.

India's central bank must inject at least 1 trillion rupees into the banking system by March to address a persistent liquidity deficit, analysts say. Despite recent cash infusions and an interest rate cut, liquidity remains tight, prompting calls for additional bond purchases or measures to attract foreign deposits.

Equities

Indian pharmaceutical companies are expected to maintain their strong U.S. market share in generics despite potential tariffs, thanks to their competitiveness, according to a government-backed trade body. While Trump has proposed steep tariffs on pharmaceutical imports, India’s industry hopes for exemptions through bilateral talks.

Swiggy will invest $115 million in its supply chain unit to support the rapid expansion of its quick-commerce arm, Instamart. This follows a $192 million investment in December, as Swiggy and rival Zomato compete to dominate the fast-growing 10-minute delivery market.

Google is finalizing locations in Mumbai and New Delhi for its first retail stores outside the U.S., aiming to expand its physical presence in India. The stores, expected to open within six months, will showcase Pixel devices and other Google products, following a retail strategy similar to Apple.

Vedanta’s shareholders and creditors have approved the company’s plan to split into five independent entities, a move aimed at streamlining operations and managing debt. The restructuring, led by Chairman Anil Agarwal, follows a failed 2020 privatization attempt and will keep the base metals business under the parent company for now.

India’s Nifty 50 index will see major changes on March 28, with Zomato Ltd. and Jio Financial Services Ltd. replacing Britannia Industries Ltd. and Bharat Petroleum Corporation Ltd., according to the National Stock Exchange. The move highlights the growing influence of tech-driven companies in India’s stock market, though both new entrants have faced market volatility and competitive pressures.

Alts

Gold prices dipped as investors took profits after hitting a record high, but the metal remains on track for its eighth consecutive weekly gain. Safe-haven demand, fueled by economic uncertainty and concerns over U.S. tariffs, has driven gold up 11.5 percent this year.

Walmart-backed fintech firm PhonePe is preparing for an Indian stock market debut after posting its first annual profit in 2024. The company reported a 74 percent revenue surge to over 50 billion rupees and a profit of 1.97 billion rupees before employee stock option costs but has not yet set a timeline for its IPO.

Policy

India is investigating "deeply troubling" information about USAID activities after President Trump claimed the agency spent $21 million on Indian voter turnout, though reports suggest the funds were for Bangladesh. The Indian foreign ministry expressed concerns over potential foreign interference and said relevant agencies are looking into the matter.

India's EV policy will cap investment in charging infrastructure at 5 percent for automakers seeking import tax cuts, prioritizing manufacturing instead, a government document reveals. The move comes as Tesla prepares to enter India, securing showroom spaces in Mumbai and Delhi.

India is set to increase import taxes on vegetable oils for the second time in six months to support farmers struggling with low oilseed prices, according to government sources. The hike, which follows inter-ministerial approval, could raise domestic prices but may also dampen demand and cut imports of palm, soy, and sunflower oils.

India’s Foreign Minister Subrahmanyam Jaishankar met with his Chinese counterpart Wang Yi at the G-20 summit in Johannesburg, discussing border stability, travel facilitation, and diplomatic ties. The 30-minute meeting marked progress in restoring relations strained since 2020, with both nations recently resuming direct flights and easing visa restrictions.

See you Monday.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.